Andre Botha, Senior Dealer at TreasuryONE, delves into the MPC meeting later this week and related considerations.

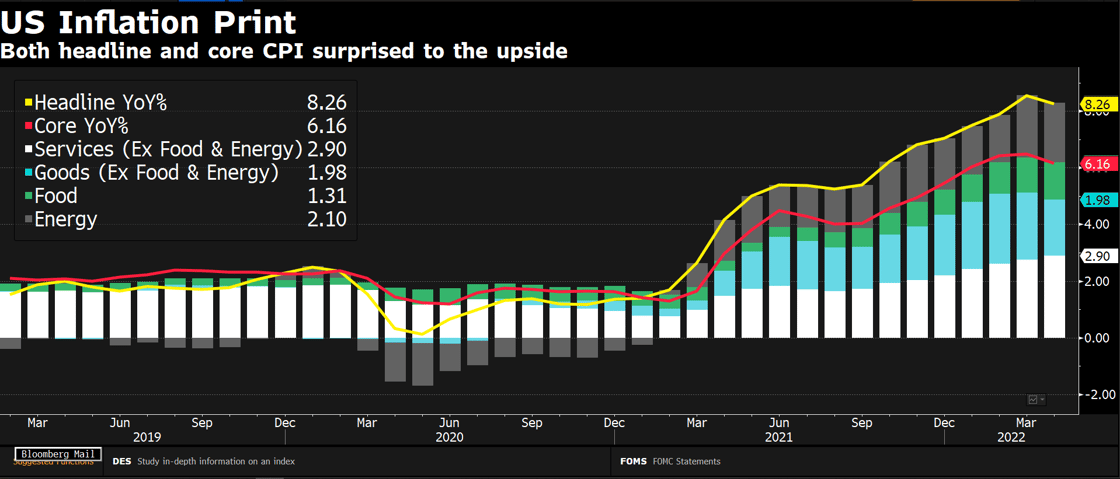

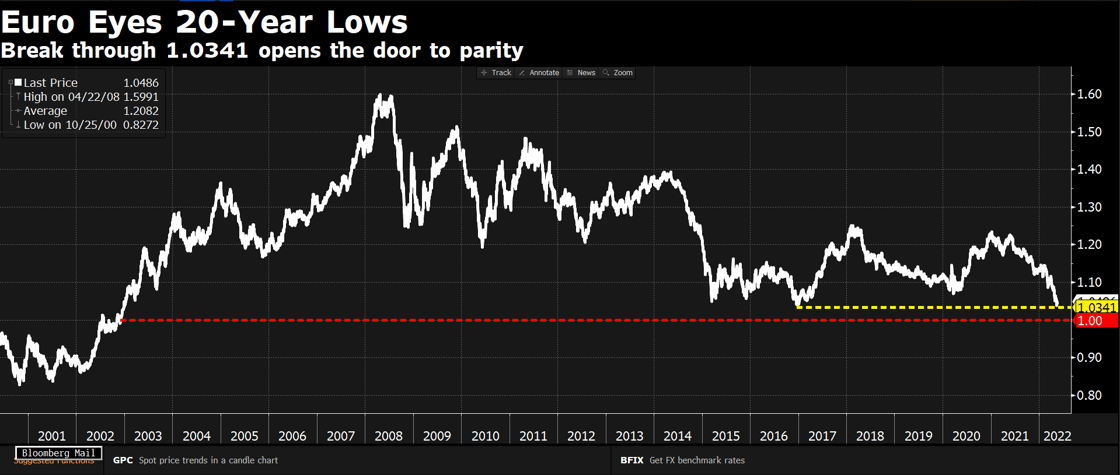

Last week was just the latest in a long line of data that only affirmed the scale of inflation currently in the market. US inflation numbers printed higher (8.5%) than the expected 8.3% number. From the numbers alone, it was easy to gauge the market reaction as the US dollar went on another rally, stronger all the way down to 1.04 against the euro.

The reason the US dollar went on another run is simple: with no signs of inflation being transitory as initially thought, the US Fed will have to act to curb inflation and bring it back to adequate levels. This will force the Fed’s hand to continue to hike rates in the immediate future, and this has caused the market to run toward the US dollar in anticipation of further hikes. It is also a possibility that with Central Banks in hiking cycles, we are in for a more challenging economic climate, and with the real possibility of recessions across the world, the US dollar is also seen as a safe bet.

The question is, what does this do to risky assets like the rand and its kin? We have seen a sell-off in the equity space worldwide as major indices recorded significant negative days in the past week.

This leads into the rand, where we have seen it bump its head at the R16.30 level numerous times over the past week. The level has held for now, but if the sentiment stays negative, it will only be a matter of when rather than if for the rand to break above R16.30, which could open the dollar for a swift run higher.

Another factor impacting the movement in the rand is the loss of ground in the commodity space and bad data out of China. With the rand being a commodity currency, it is influenced by drops in prices, as we have seen currently with Gold dropping all the way from $2,000 per ounce all the way to $1,800 in the wake of the Fed rate hike and inflation numbers coming out.

Brent Crude Oil is trading above $110 per barrel as there is optimism in the market, with China relaxing some of their COVID lockdown restrictions, which could see a surge in demand for oil. However, Oil is stuck in a hard place as some countries in the EU are vetoing the vote by the EU to ban Russian oil imports, which could relieve some of the pressure on supply should the ban fail to pass.

Looking to this week, the biggest event is the speech by Fed Chair Powell later on today, which will shed some light on the Fed’s thinking, especially after the inflation numbers out last week. Some other inflation numbers are out as well, with the most notable being those from the UK and Japan. We expect markets to follow the US dollar this week for the most part.

We also have CPI data out later this week on the South African side, and we have the MPC meeting on Thursday. While an interest rate hike has been penciled in, the real question is whether the hike will be 25 or 50 basis points.

If growth was not a concern in South Africa, a 50 basis point hike would have been a dead certainty. Instead, the MPC has to balance the growth of South Africa versus hiking rates too quickly. A lot of emphasis will be placed on the tone being struck by the MPC in their statement. We can see the rand trading stronger if there is a hawkish tone, but the opposite is also true.

Visit the TreasuryONE website for more information on market risk management, corporate treasury and other services.