With some sparkling alliteration, Chris Gilmour digs into credit demand by South African consumers.

Just when you thought South African consumers had become so debt-averse that this trend would carry on ad infinitum, lo and behold Lewis Stores made abundantly clear that their customers have a preference for credit over cash once more.

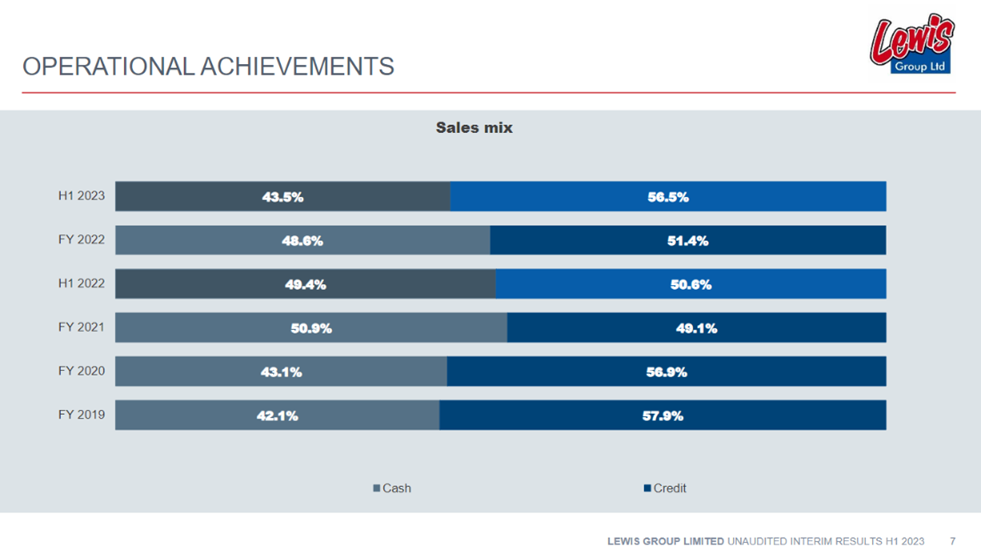

In the latest interim results from Lewis to end September 2022, there was a distinct change in the composition of cash:credit sales. From being nearer 50:50 cash:credit, the interim 2023 figures saw a big jump in credit sales to 56.5%:

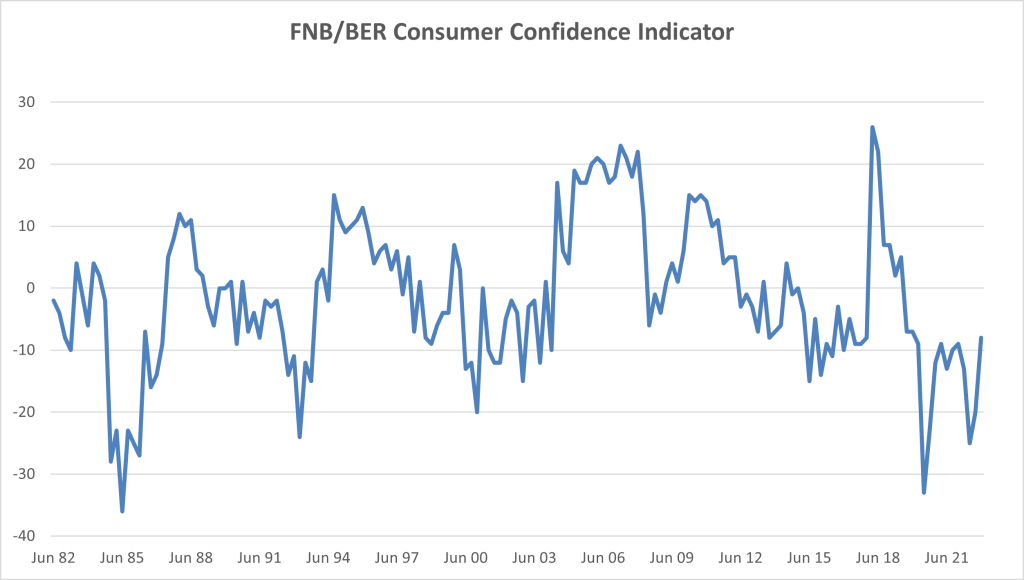

And the latest consumer confidence indicator from the Bureau for Economic Research in Stellenbosch also suggests that consumers became more confident in the final quarter of 2022:

“The FNB/BER Consumer Confidence Index (CCI) recovered from -20 to -8 index points during the fourth quarter of 2022. Although the index remains in weak terrain relative to its long-term average, it has regained all the ground lost during the first half of 2022. The rebound in consumer sentiment shows an improved willingness to spend among consumers, but consumers’ ability to spend would also need to improve in order to translate into a significant increase in consumption.”

In other words, what the BER is suggesting is that, provided consumers have the wherewithal to spend, they will now be more inclined to do so.

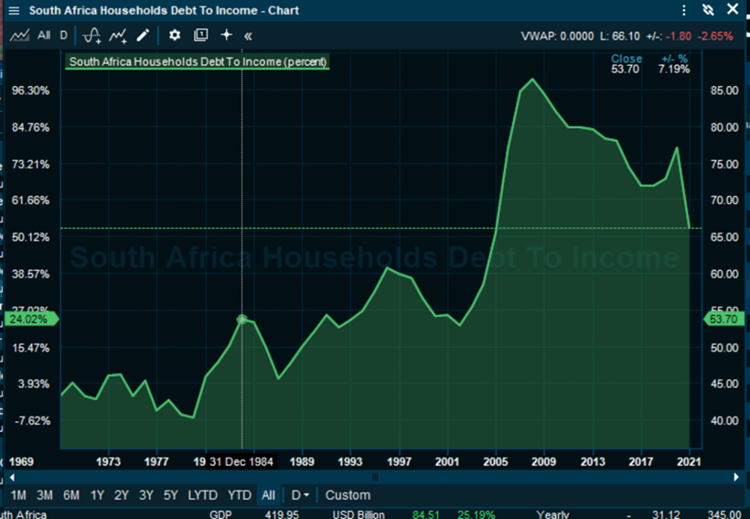

This is not to suggest for a moment that Lewis or any other credit retailer for that matter is about to embark on a program of reckless credit-granting. Far from it, in fact. The credit application decline rate at Lewis improved to 35.8% (previous year 39.1%). Over the years, Lewis and others have learned a lot more about their customers’ spending patterns and have adopted very conservative credit-granting procedures. And for quite some time, South African consumers generally have expressed a preference for cash purchases over credit, as household debt to disposable income has declined progressively. Over the past thirteen years, household debt to disposable income has declined from 85% to nearer 65%.

Thus there is probably some capacity for consumers to take on extra debt, provided they are comfortable in their ability to repay it.

The statistics from the National Credit Regulator (NCR) are seriously lagged – the Q3 figures will only be available by early January – and so it’s not possible to draw any high-level conclusions about consumers’ willingness and/or ability to take on more credit at this point in time.

This comes as South African GDP growth surprised on the upside last week, with Q3 growth beating all estimates, coming in at 4.1% year-on-year and 1.6% quarter on quarter. Admittedly, the figures were helped by a bumper agricultural harvest coupled with a low base of comparison in Q2 . But nevertheless it’s a good outcome and suggests that SA won’t enter recession next year like many of its developed economy trading partners. Obviously the high incidence of rotational power cuts (loadshedding in Eskom-speak) may well dull GP growth in Q4 but across the spectrum, consumers and industry are making plans to combat loadshedding.

But we have to be realistic about the impact of higher credit sales. There can be no doubt that in a “normal” economy, furniture & appliance retailers much prefer credit sales to cash sales. It reminds me of a comment that JD Group CFO Gerard Volkl made at a presentation to the effect that “if we could just find a way of offering consumer finance without having to worry about this pesky furniture, it would be so much easier.”

Lewis CEO Johan Enslin pointed out at the results presentation that a credit sale is, on average, four times more profitable than a cash sale, even allowing for the fact that the group has to wait many months for the proceeds to arrive. This is not surprising, considering that the maximum interest rate allowed under the National Credit Act is the repo rate plus 21%.

Up until now, consumers have been wary of taking on more debt and understandably so at these kind of interest rates.

So, provided the retailer is happy that the consumer can afford to take on more debt and the consumer is happy to assume more debt, there does appear to be a bit of capacity for improving retail sales growth, even in a rising interest rate environment.