Andre Botha of TreasuryONE reminds us that even if some people are already on the beach, our currency certainly isn’t.

Economic news and events that could affect the rand and the market are continuing as we approach the end of the year. But, before we delve into the events of the week, it is probably an opportune time to take a look back at some of the early-year events that are still affecting the market.

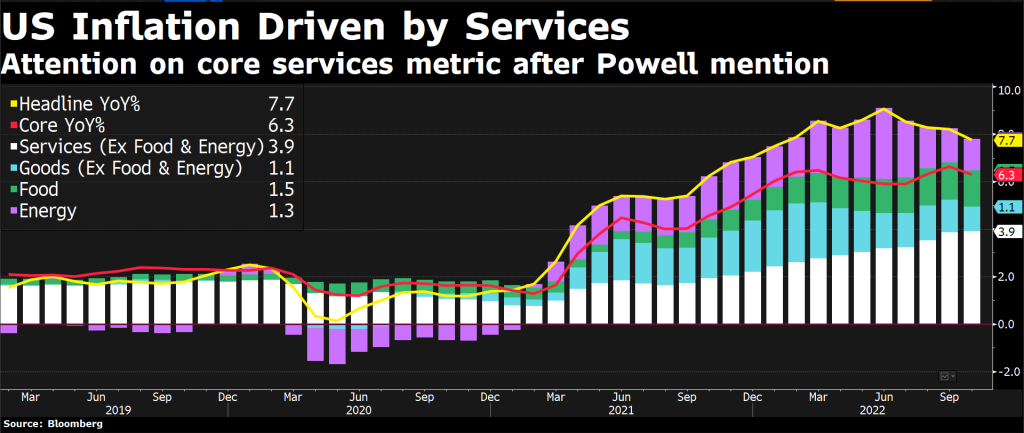

First, there is inflation, which has been on the rise all across the world as central banks struggle to combat the scourge. We have seen unprecedented hikes, with many countries on the verge of hiking themselves into a recession. Given that the majority of the world is anticipated to enter a recession, this is what we anticipate will be the base play of 2023. With the Fed leading the way in the initial part of hiking rates, we saw a rampant US dollar, and risky currencies like the rand were under pressure in the back half of the year.

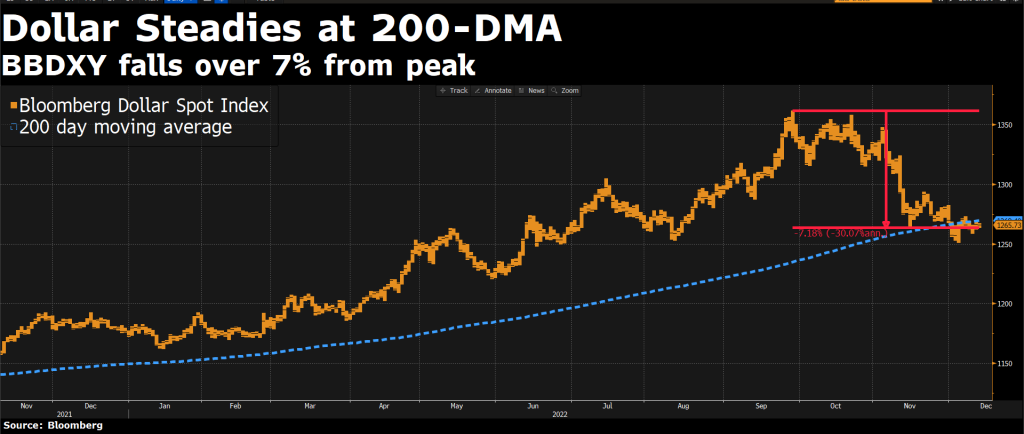

US dollar rollercoaster for the year:

Second, the aftermath of the conflict between Russia and Ukraine continues to affect the Eurozone, where there have been – and will certainly be – further energy crises because of the reliance on Russian gas. Recent months have seen an increase in gas costs in the UK and the Eurozone due to the anticipated colder winter. This could fuel the inflation monster further in those countries that are most affected by the energy crisis.

Locally, there is the Phala Phala scandal and the possibility of a presidential resignation. Even though the President did not resign, the news surrounding the Presidency has caused the market to experience some volatility. We have the ANC elective conference at the end of the week, but we do not anticipate any significant deviations from the norm. However, stranger things have happened, and any deviation from the narrative could send the markets into a frenzy.

This brings us to this week, where a lot will happen in a very short amount of time. First, we have the US CPI number on Tuesday, where last week’s higher-than-expected PPI number caused some market participants to anticipate a higher-than-expected CPI number following several months of lower-than-expected inflation. Should the number print higher, we can expect the rand and other risky assets to run with it, but with the risk premium already built in, should the number print lower, we can expect a swift reverse in risky assets.

Inflation spike in the US:

On Wednesday, we have the FOMC meeting, where we expect the Fed to hike by 50 basis points. Looking at the US dollar and its performance of late, we expect that lower rate hikes have been priced in, and thus the rally in the US dollar has run out of steam a little. The key will be the press conference after the announcement where the thinking of the Fed will be revealed as well as what the new CPI number will have changed their thinking.

On Thursday we have the ECB interest rate decision and we also expect that the ECB will hike rates by 50 basis points. The ECB are in a bit of a tight spot as they are behind the curve and also hiking into an anaemic economy across the board. It will also be insightful as to where the thinking of the ECB is and how they propose to tackle inflation and interest rates going forward.

We are in for a busy week in the market, before the calm of the December holidays hits us.