Ringing the Bell

A rally of over 6% in the share price tells you what the market thought of this update

After a great deal of distraction around whether the controlling family will or won’t take the company private at a suitable price, things eventually settled down at Bell Equipment.

Focusing on the operations would’ve paid off for investors, as the share price has climbed nearly 26% this year.

In a trading statement for the year ended December, the company goes a long way towards justifying that share price performance. HEPS is expected to be at least 43% higher at 420 cents, a tasty number on a closing share price of R15.40.

The performance has come from stronger market conditions, which is exactly what shareholders want to see.

To learn more about Bell, take this opportunity to catch up on the Unlock the Stock event with the Bell CEO that we hosted back in March. In this case, it really paid to pay attention:

Equites’ deal with Lidl goes back to the drawing board

The local council has not approved the proposed development

Back in October, Equites Property Fund announced the sale of land in Basingstoke, England to iconic retail group Lidl. The deal was conditional on approval being obtained from the local council for the proposed warehouse developments on the site.

After an initial refusal, Equites’ UK business (Equites Newlands Group) was also unsuccessful in its appeal process. The local council ruled that although demand justifies the development, the visual and landscape impact wasn’t going to work.

Equities Newlands is not going to continue with this transaction, recognising that it needs to go back to the drawing board and come up with a new plan for the site. As the site is carried at cost and doesn’t currently generate any income, there is no change to the distribution per share guidance.

If you want to learn more about Equites, a very recent appearance on our Unlock the Stock platform may be of interest:

Jubilee is going from strength to strength

The CEO calls it a “truly remarkable year” for Jubilee

At operational level, there’s good news from exciting metals group Jubilee. At the Roan copper operations, a water infrastructure upgrade has taken the project back to “nameplate capacity” – the level it was built to operate at. There is also technical progress being made at the Sable Refinery, with solutions being found to improve recovery of copper and cobalt from historical waste and to reduce operating costs.

The new approach at Sable is referred to by the CEO as a “game changer” and allows multiple ores to be produced at once, which is similar to what the company achieved at the Inyoni PGM plant in South Africa.

Having made huge progress in the Southern Copper Strategy in Zambia this year, the focus next year is on what the company calls the Northern Refining Strategy in that country.

I must also note that there are outstanding warrants on the company’s shares. This has nothing to do with traffic fines and everything to do with instruments that give holders the right to subscribe for new shares at a price way below the current traded price. This is dilutive for shareholders.

KAP operational update

The five months to November weren’t easy

KAP operates in tricky conditions, with a difficult South African macroeconomic environment and volatility in input costs. With diverse operations, the group generally wins some and loses some, with a net outcome that hasn’t been enough to get the share price out of a stubborn recent trend.

Here’s an overview of how the businesses are doing:

- PG Bison is enjoying “robust demand” and all plants operated at capacity

- Restonic suffered far-less-appealing “subdued demand” and struggled with operating profit margin pressure as well, which is typical when revenue isn’t doing as well as hoped

- Feltex saw an improved revenue performance as new vehicle assembly volumes picked up, which in turn improved the operating margin

- Safripol’s profitability declined vs. the prior period due to lower raw material margins and production volumes

- Unitrans lost a major food contract but still put in a “stable performance” and posted margins that remain below the long-term guided range of 8% – 10%

- Newly-acquired DriveRisk is running below expectations because of the dollar strength, with related pricing adjustments to customers still to take place

The group is putting in a big effort to mitigate the impact of load shedding and to reduce reliance on Eskom, with construction of a 10 MW PV plant at Safripol Sasolburg completed in November and a 4 MW PV plant approved during this period for PG Bison Boksburg.

Woolworths closes a painful chapter

The sale of David Jones has been announced after much speculation

After exceptional destruction of shareholder value under previous CEO Ian Moir, current CEO Roy Bagattini and his team have been doing their utmost to steady the ship at Woolworths.

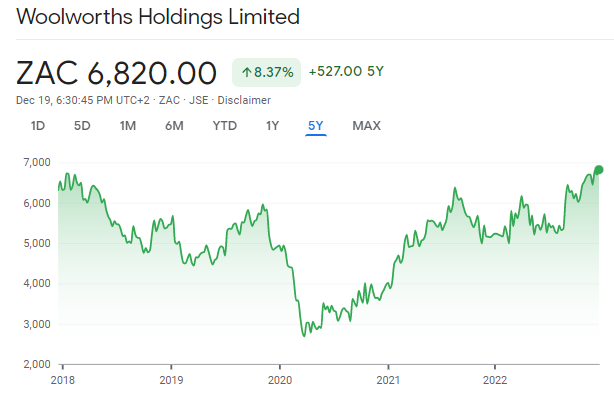

Having joined the group in February 2020 – displaying an uncanny ability to start under the worst possible circumstances – Bagattini has taken Woolworths back to basics and back to a share price level not seen since 2018:

The latest step in fixing the group is to offload David Jones, the horrendous investment that tarnished Moir’s career. The buyer is Anchorage Capital Partners, an Australian private equity fund. The fact that this is a voluntary announcement tells you how tiny it has become in the Woolworths context. It wasn’t always this way, so a huge amount of value has been lost forever.

The deal excludes the flagship property in Bourke Street, which Woolworths will retain and lease to David Jones on a long-term basis.

The important thing is that around R17 billion worth of liabilities relating to David Jones will be removed, which will allow the balance sheet to be tilted towards the right activities. Of course, this also gets rid of a distraction for the management team.

The Country Road business in Australia remains core to the group, so this isn’t a complete retreat from the land of kangaroos and broken shareholder dreams.

Little Bites:

- Director dealings:

- The family trust of David Hurwitz, CEO of Transaction Capital, has disposed of shares worth R36.4 million to reduce debt to an institutional lender – he could’ve sold them a LOT higher earlier this year

- Dr Christo Wiese isn’t one to do things in half-measures, buying single stock futures on Shoprite shares with a strike price of R242.14 and a value of R726 million

- The investment entity of the management team of Ninety One has bought shares worth £92.5k

- A director of Argent Industrial has sold shares worth R675k

- The company secretary of Afrocentric has disposed of shares worth R126k

- Des de Beer bought more shares in Lighthouse, this time worth R125k

- The interim CEO of Hulamin has acquired shares worth R15.4k

- An associate of Piet Viljoen has acquired shares in Astoria worth R12.3k

- Those of you who are particularly interested in climate change and associated Net-Zero targets will find it interesting to learn that Mondi is among the first packaging and paper companies with validated Net-Zero targets. The Science Based Targets Initiative (SBTi) has assessed and approved the targets.

- In another sad reminder that mining remains a dangerous industry, Harmony reported a loss of life following a seismic incident at the Kusasalethu mine in Carletonville.