ArcelorMittal: cyclical stocks are risky

Profitability has been hammered as conditions turned against the company

For the year ended December 2022, ArcelorMittal’s headline earnings per share (HEPS) is expected to nosedive by between 60% and 65%, coming in at between R2.15 and R2.45 per share. To be fair, this still puts the company on a Price/Earnings multiple of under 2x!

Despite that low multiple, the share price fell 11.6% on this news.

There are various reasons for this, ranging from declines in steel prices through to the global energy crunch and the impact on the company’s operating costs. With destocking by local customers, demand also came under pressure. To make everything even worse, there was a shortage of road trucks for domestic and African overland deliveries in the final quarter of the year.

As the company points out, these results were actually much stronger than in previous times of crisis. Despite obvious operating challenges, there was still a profit on the table for shareholders.

Clicks posts solid growth

The share price was flat, showing just how much is priced in

Clicks is famous in the local market for (1) exceptionally long queues at the dispensary and (2) a share price that trades at very high multiples. Investors have a soft spot for Clicks because of its defensive characteristics. The company is especially popular among global investors.

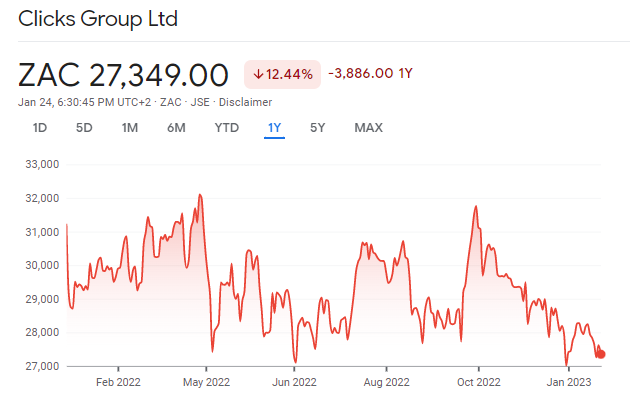

Still, the share price has been under pressure over the past year:

Credit where credit is due: the sales performance for the 20 weeks to 15 January 2023 is more than decent. Excluding vaccinations (which were huge in the base period), group turnover is up 7.8%.

Retail sales excluding vaccinations were up 12.2%, so the wholesale growth is significantly lower. Wholesale turnover in UPD fell by 0.6%, so it was turnover managed on behalf of bulk distribution clients that helped that side of the business.

Volumes were up, with like-for-like sales of 8.9% vs. selling price inflation of 6.8%.

Interim results are due in April. I’ll be interested to see why the wholesale side of the business is under pressure when things are clearly doing well on the retail side.

Datatec wants you to get to know Westcon International

The company has released a detailed investor presentation

The release of an investor presentation is always worth paying attention to. Generally, these are proper learning opportunities and the latest example from Datatec is no different.

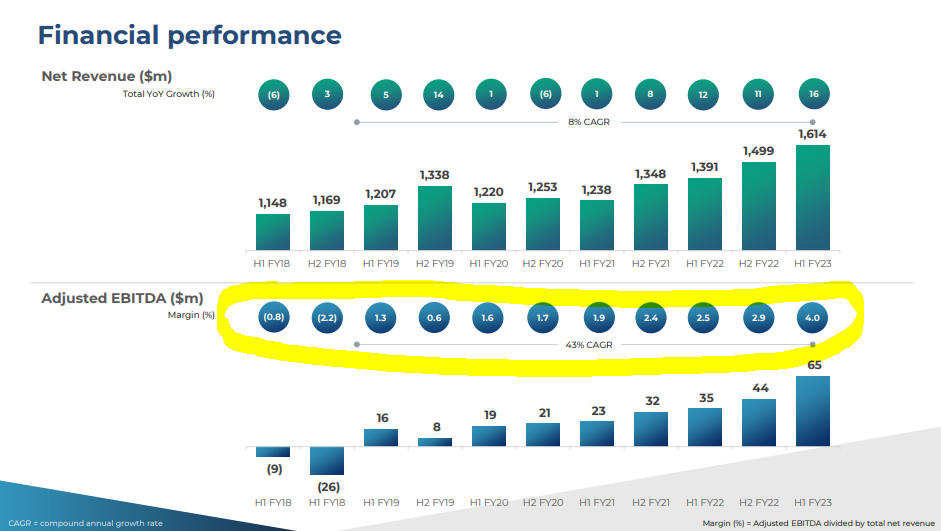

For example, here’s an interesting chart showing how skinny the EBITDA margins are in the IT distribution game:

The yellow highlight is obviously my handiwork, drawing your attention to the EBITDA margin history. As you can see, there isn’t much room to make a mistake in this business!

If you’re keen to learn more, you’ll find the full presentation here>>>

Grindrod keeps smiling in Mozambique

The Port of Maputo is growing beautifully

Grindrod has alerted shareholders to a press release by the Port of Maputo that highlights a new handling record in 2022, having grown a whopping 20% compared to 2021. Volume handled was 26.7 million tons, up from 22.2 million tons in 2021.

The growth is attributed to infrastructure investment and the decision of the Government of Mozambique to establish a 24-hour border operation.

To depress you further about the trajectory of our infrastructure in South Africa vs. other countries, rail volumes for chrome and ferro-chrome jumped by 73% vs. the prior year. The press release notes that 26% of cargo is now carried by rail, with links into South Africa helping with this. It’s just a pity that other parts of our country aren’t working nearly as well as the Mozambique corridor.

Sasol jumps 4.7% after releasing a production update

The market also liked the news about renewable energy procurement

Eskom is doing a wonderful job of helping companies move towards meeting emissions targets. Not only does it make the ESG section of the report look better, but having alternative sources of power has become a business imperative thanks to the state of our national grid.

Sasol has announced three power purchase agreements, including 69MW of wind power for Sasolburg and 220MW of wind power for Secunda under two separate agreements. There’s a long way still to go, with Sasol aiming to procure 1,200MW of renewable energy by 2030.

Looking to the detailed numbers, external sales revenue for the half year was down 2% vs. the prior year.

Productivity in the mining business was lower in this period. The coal stockpile remains above the minimum level, helped by growth in external purchases. This is important to ensure continuous coal supply. Export sales fell by 25% in this part of the business, attributed to challenges at Transnet Freight Rail and the diversion of export coal to the stockpile.

In the Gas business, production fell by 2% due to reduced demand from Sasol itself and its external customer, attributed to load shedding and the impact it has on our industrial companies.

The Fuels business reported a 2% drop in production, hurt by various factors ranging from coal quality to rainfall incidents. Although Sasol hopes to achieved the original full year guidance, there are challenges in sourcing hydrofluoric acid and this is a risk to the numbers being achieved.

The Chemicals business experienced a 5% decrease in external sales volume and a 2% decrease in external sales revenue. The major pressure was in the Eurasia business, where volumes fell by 19% due to economic challenges in Europe and the war in Ukraine. The African and American businesses were positive.

Little Bites:

- Director dealings:

- The former CEO of Famous Brands has executed a collar structure over R12.28 million worth of shares, with a put strike price of R55.26 and a call strike price of R86.33. This is a way to protect the value of a stake within a certain range (the latest closing price is R61.96).

- A director of CMH has acquired shares worth nearly R53k.

- A director of Barloworld has acquired shares worth R77.5k

- Reinet has released its net asset value per share update for the quarter ended December 2022. The net asset value per share is up 6.5% vs. September 2022 and the company has achieved a compound annual growth rate of 9.1% in euro terms since March 2009, including dividends paid.

- Kore Potash has announced further drilling results form the DX extension in the Republic of Congo. Note that this is different to the Kola project that is usually in the headlines. The management team seems to be pleased with the results. If you want to learn about geology, you’re welcome to go read the complicated announcement!

- In further junior mining news, Southern Palladium is pleased with the results of an internal scoping study for the Bengwenyama PGM project. It confirms that UG2 has the best development potential, with the company now believing that a mining rights application should be submitted earlier than first envisaged. The board has decided to initiate the Prefeasibility Study this quarter.