Chris Gilmour digs into the Stats SA November release and finds some surprising numbers.

StatsSA never fails to surprise me with its monthly releases and November 2022 was no exception. The rational person in me was expecting to see a really dull November, given the rising interest rate background. I was expecting to see another big yawnfest of a Black Friday/Cyber Monday at month end. I was completely wrong!

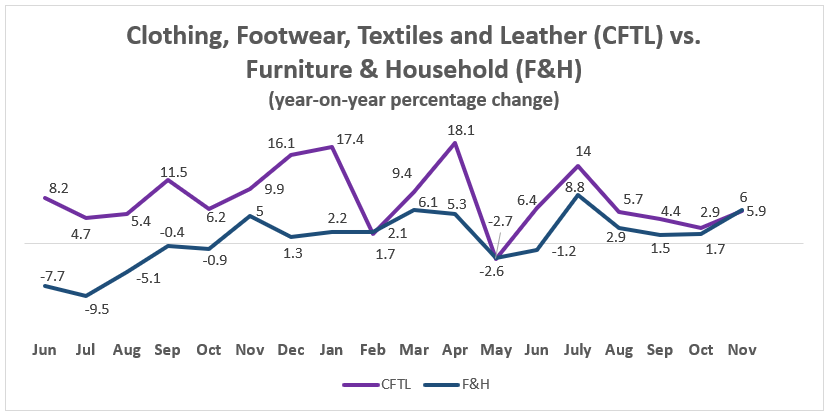

Discretionary retailers in the clothing, footwear, textiles and leather (CFTL) and household furniture and appliances (F&H) had an exceptionally strong month. It will be instructive to observe how December retail sales pan out, given the strength of November’s sales.

The best performing category in November was F&H at 6% year-on-year, closely followed by CFTL on 5.9%. We must bear in mind that November 2022’s figures are being compared against November 2021’s figures, which would also have a relatively strong “Black Friday” component built into them, so it’s not as if there some sort of weak base effect at play.

Far from it, in fact, which makes the November 2022 figures all the more interesting, especially as they arise during a period of sustained rising interest rates.

Both of these discretionary categories are depicted in the above graph, which shows that they are both quite volatile, though rarely do they dip into negative territory.

Some of the JSE-listed alternatives

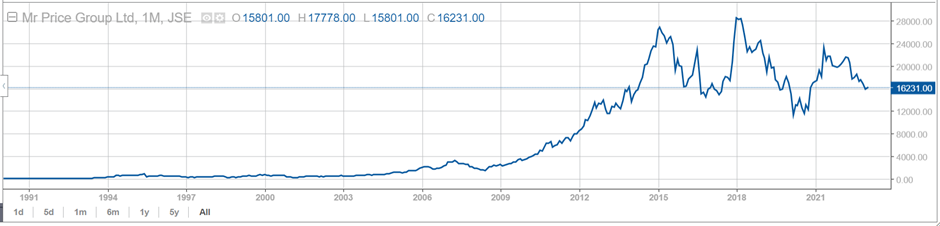

From a JSE perspective, it’s difficult to draw any meaningful conclusions. There is only effectively one furniture retailer left on the JSE – Lewis Group – and its share price languishes at somewhat less than half of its 2018 peak.

The CFTL retailers have had a very mixed picture, with Truworths enjoying a very belated surge after years of doing nothing, while Mr Price and The Foschini Group are demonstrating the benefits of investing through the cycle. But even here, there doesn’t appear to be an appetite for either of them.

Perhaps Truworths is worth having a look at, as its trading pattern is not only the best of the listed CFTL retailers but TRU is also the cheapest share of this universe, on a P/E ratio of only 8.5 vs 10 for TFG and 12.2 for MRP.

What is happening in credit sales?

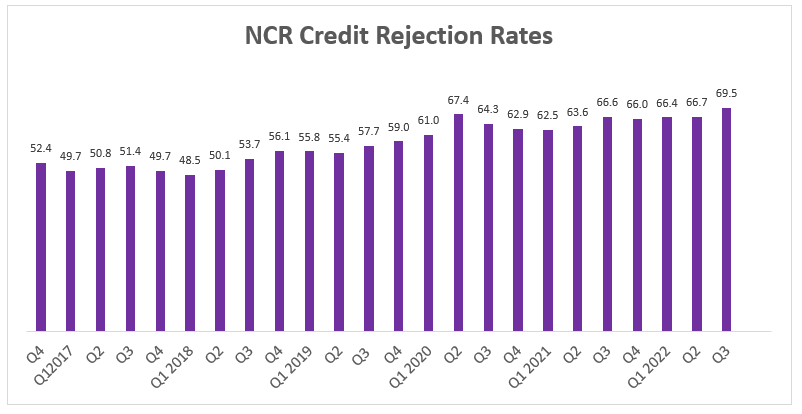

At the most recent Monetary Policy Meeting of the SARB held on 26 January 2023, an interest rate hike of 25 basis points was announced. This is a lot lower than the string of 75 basis point hikes that have preceded this and probably signals a peak in the repo rate.

While this is a glimmer of good news for the embattled South African consumer, we must bear in mind that rates can stay at these elevated levels for quite some time, so any real relief may be some way off yet. In recent trading updates from discretionary retailers such as Lewis and Mr Price, it is noticeable that credit sales have increased faster than cash sales, suggesting that consumers are losing their fear of credit.

This is fascinating, as rejection rates for new credit applications have actually increased, according to the National Credit Regulator. This seems counter-intuitive as far as the rational person is concerned and yet the figures do suggest that this is indeed the case:

The wooden spoon goes to…

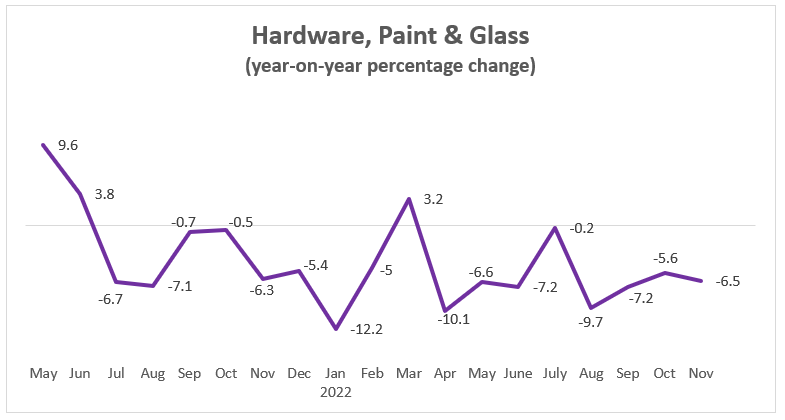

The worst performing sector in November continued to be hardware, paint and glass, a DIY home improvement proxy. There are no signs of a turnaround in this dismal sector, even after many months of secular decline. So, no respite for Cashbuild shareholders: