There’s “cautious” optimism for diamond demand at De Beers

Anglo American shareholders continue to benefit from the rock that everyone wants

Diamonds. Sparkly things that have been the downfall of many. These rocks benefit from a wonderful marketing campaign by De Beers over the years, positioning them as the best way to show how much you love someone (and to what extent your credit card is part of your life).

For Anglo American shareholders, that’s just fine thank you very much. De Beers gives a solid underpin to the Anglo business, with totally different fundamentals to the other commodities in the group.

Based on the latest sales cycle, the management team was happy with consumer demand over December. Bulk diamond purchasers (or “sightholders” as De Beers calls them) have been careful with their planning for this year given the broader macroeconomic conditions. In a recession, even love gets cheaper.

Given the reopening of China, there is “cautious optimism” for diamond demand this year.

Bidcorp stuns the market – in a good way

A share price jump of over 6% was the reward for punters

Bidcorp is in the food service game, with a wide range of customers in the restaurant and hospitality industry. It’s a wonderful business model, with Sysco as a great example in the US of a similar business.

Despite all the ingredients for a disaster, ranging from consumer pressure through to high energy costs causing margin compression for restaurants, Bidcorp has been riding a wave of consumer demand in the aftermath of the pandemic. Financial pressure or not, people just cannot handle being stuck at home anymore.

After releasing a positive update in November, the momentum continued over the festive season and even into January. Europe has been having a far better winter than anyone expected, so that certainly helped. The lifting of lockdowns in China will be a major boost as well.

For the six months ended December, headline earnings per share (HEPS) will be between 43% and 49% higher year-on-year, implying a range of between 960 and 980 cents. For context, the previous record interim performance was only 714 cents per share, achieved in 2019.

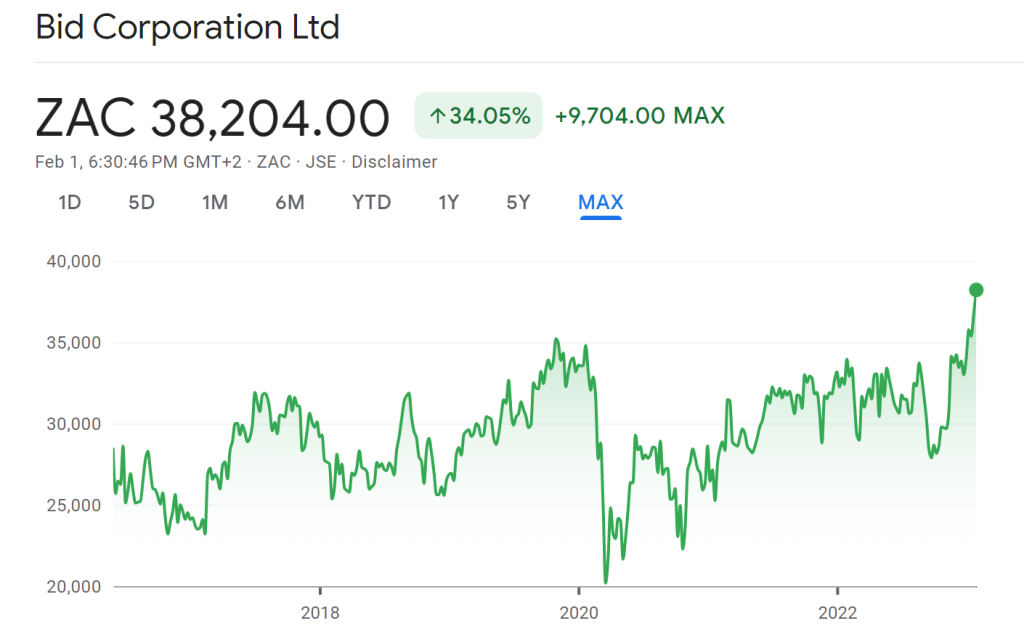

The share price is now at its highest levels since being unbundled from Bidvest. I think you would be quite brave to buy this chart, with a meteoric increase of over 35% since October when the worst was expected for a European winter:

Ellies is paying top dollar to stay relevant

Or is that top rand?

Ellies has a core business has that been dwindling. The company didn’t make it a secret that alternative energy is where its future lies, an industry that Eskom is doing its very best to support.

The problem is that Ellies needed to make an acquisition in this space. With these companies currently all the rage, the risk of overpaying for an asset was always there. With a deal now announced, we have confirmation that a significant multiple is being paid.

With most industrial companies on the JSE trading at mid-single digit Price/Earnings multiples, it’s worrying to see Ellies agree to pay a 10x multiple for Bundu Power, an alternative energy (i.e. generators / solar etc.) business that is expected to make profit after tax for the year ending February 2023 of R20.4 million.

The value of net assets in the business is R48.7 million and Ellies is paying R202.6 million, so there’s a very large goodwill payment here. This means that either Ellies loves the brand (unlikely I would think) or is desperate to get a foothold in this industry (bingo).

Don’t get me wrong: it just might work. Ellies brings a distribution network and Level 2 B-BBEE status, both of which are valuable in South Africa. Perhaps more importantly, there’s a deal structuring trick that has been used here to give Ellies shareholders some protection.

Of the purchase price, only R72.6 million is payable when the deal closes. The remaining R130 million has been structured as three earn-out payments over the next three years. There would typically be earnings targets attached to these payments, though the announcement doesn’t give those details at this stage.

This is a category 1 transaction for Ellies, so a detailed circular will be released and shareholders will need to vote on the deal. If I was an investor in Ellies, I would give the earn-out structure a careful read.

Glencore’s production is higher in Q4

The fourth quarter saw sequential improvement across most commodities

Full year production numbers for 2022 were in line with revised guidance issued in October, so there were no major shocks in the final weeks of the year. Although the fourth quarter was better than the third quarter (a “sequential improvement”), the full year was a mixed bag.

On a like-for-like basis, group production fell by 7% due to abnormally wet weather. Due to a number of disposals and acquisitions, the reported percentage differs significantly from the like-for-like number.

Production challenges aside, Glencore is up nearly 40% over the past 12 months as the commodity cycle played out in its favour.

Harmony reports better production numbers

With the substantial positive momentum in the gold price, this came at the right time

Thanks to improved underground recovered grades in the second quarter, production increased vs. the first quarter of the financial year. This means that Harmony is on track to achieve full-year production guidance, which is exactly what shareholders want to see when the gold price is finally doing the right things.

All-in sustaining costs for the first half of the year were in line with guidance at below R900,000/kg. The gold price per kilogram is currently nearly R1,080,000/kg.

Since the recent lows in September 2022, the share price has skyrocketed 85%. It is nearly 14% up over twelve months.

MTN Nigeria continues to grow

As the most important African subsidiary, this is material to MTN

Nigeria is a good country when you can operate at high margins and enjoy decent growth rates. It’s a terrible place to try and extract money from, as evidenced by the challenges that the likes of Nampak and MultiChoice have been having. MTN is no stranger to those challenges, though a great run during the pandemic means that MTN’s holding company debt has been brought under control and repatriation from Nigeria is less of a key dependency.

And unlike Nampak and MultiChoice, MTN operates at exceptional margins in Nigeria that make it worth the risk. In 2022, service revenue grew by 21.5% and EBITDA grew by 22%, so margins expanded even further to a whopping 53.2%.

The company is investing just as quickly as it is growing earnings, with capital expenditure up 23.5%. The useful thing about MTN Nigeria is that there’s a strong case to be made for in-country investment, rather than trying to get all the cash back to South Africa for other purposes. This helps mitigate some of the repatriation issues.

Capital intensity (capital expenditure as a percentage of revenue) increased from 24.7% to 25.1%. This is a key ratio for telcos, as high capital expenditure is part of the game and is obviously a drag on free cash flow available to shareholders.

MTN Nigeria is separately listed on the Nigerian Stock Exchange and is up more than 18% over the past year.

Vukile gives an update on festive trading

Vukile offers a unique combination of South African and Spanish exposure

In Vukile’s South African portfolio, footfall was higher than last year by 8%, with township and community malls outperforming the likes of regional malls. Despite the obvious issues around load shedding, trading density was up across the local portfolio by mid-to-high single digits. Trading density for grocery (+8.5%) was well ahead of clothing (+4.8%), which ties in with recent updates we’ve seen from retailers.

In Spain, the Castellana portfolio also showed improvement in all major metrics, with footfall running ahead of even pre-pandemic levels. It seems as though growth was strong across all major categories.

This bodes well for Vukile, with a share price chart that has lost momentum in its recovery:

Little Bites:

- Director dealings:

- A director of PSG Konsult has disposed of a sizable number of shares, worth R7.75m

- A director of Stefanutti Stocks has bought shares worth just over R160k.

- A director of Invicta has bought listed preference shares in the company worth R136k

- Those interested in Kibo Energy should refer to the detailed operational update released by the company, which gives extensive details on the various energy projects in the group. Overall, management seems happy and expects to see projects achieve revenue generating status in the next 12 to 24 months.