AngloGold Ashanti expects HEPS to drop

Gold really hasn’t behaved itself in these macroeconomic conditions

I got out of my gold positions after the rally in recent months and I’m glad I did, with the share price chart having rolled over severely as dollar strength came back into play.

At the mercy of the gold price, all that AngloGold can do is manage the things within its control, like production, capital expenditure and operating costs. For the year ended December, guidance was achieved on all three of those metrics.

Despite this, HEPS is down between 8% and 13%. With impairments in Brazil, the drop in EPS is far more severe, down between 49% and 55%.

Take a look at this 1-year share price chart:

Cashbuild flags a huge drop in earnings

This hasn’t come as a surprise if you’ve been paying attention

If you’ve been following the market updates in this sector or keeping even one eye on StatsSA data releases, you’ll know that the “DIY” sector has been in a tough space. After experiencing significant demand during the pandemic as people stayed home and improved their environments, the reality is that people are back at the office and spending money on petrol rather than DIY projects or major builds.

If you add load shedding into the mix (leading to prioritisation of energy solutions by consumers) and a general lack of consumer confidence, then it’s easy to understand why Cashbuild is suffering.

For the 26 weeks ended 25 December 2022, Cashbuild’s headline earnings per share (HEPS) will be between 35% and 40% lower. The share price barely moved, which is how you know this wasn’t a surprise. It has dropped 35% in the past year, so there’s further proof that share prices are forward looking and based on reasonable estimates of earnings.

DRDGOLD increases HEPS despite a drop in profit

You can thank the “Finance Income” line for this result

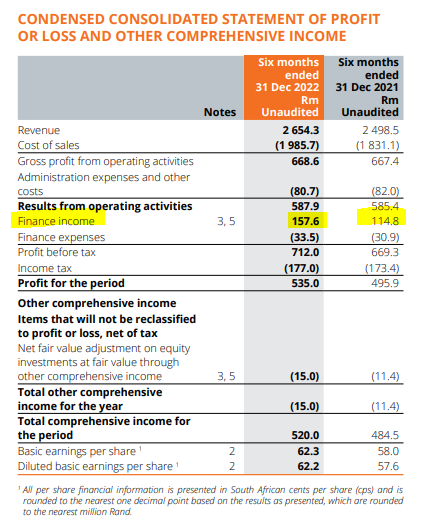

In the six months ended December, DRDGOLD’s gold production fell by 5% and cash operating costs were 17% higher. With the average gold price only up by 11%, you wouldn’t expect to see earnings going up.

Indeed, operating profit fell by 5% as operating margin fell from 33.3% to 29.9%. Despite this, headline earnings per share increased by 7%.

This wasn’t because of share buybacks, so we need to look more closely at the income statement where we can clearly see that finance income saved the day:

This was primarily driven by higher interest rates. In other words, DRDGOLD managed to increase earnings because they had more money in the bank earning interest. That’s not a good investment story.

Emira reports growth in distributable earnings of 15%

Industrial and retail property portfolios have performed well

In the six months to December 2022, Emira Property Fund’s distributable earnings increased by 15% and the directors are clearly feeling more confident than before, with a 17% increase in the interim dividend. This means the payout ratio has increased.

The retail and industrial portfolio is performing well generally and the office portfolio has improved off a terribly low base. It still remains depressed vs. pre-Covid levels. The company has invested further in residential property, increasing its stake in listed residential property fund Transcend via a general offer to shareholders.

The net asset value (NAV) has increased by 10% to R16.946 per share. The share price closed nearly 4% higher at R10.60 so there’s still a significant discount to NAV, as we see with nearly every property fund on the JSE.

With an interim dividend of 66.43 cents per share, that’s an annualised yield of 12.5%.

The “G-Factor” – will it ever take off?

I’ve only seen Gemfields report this number

In July 2021, Gemfields announced that it would be reporting a ratio called the G-Factor, which simply measures the percentage of revenue paid to the government of the country in which the natural resource is found.

The G stands for government, governance and good practice apparently. I’m sure the fact that Gemfields also starts with a G was no coincidence. The company has invited other mining groups to report this ratio but I’m not sure that many have done that.

Leaving this attempt at trying to turn a ratio into a brand building strategy aside, the G-Factor in Mozambique was 27% in 2022 and in Zambia was 17%.

If nothing else, this gives an indication of how valuable the asset is to the Mozambican government. This increases the likelihood of them providing proper support to protect the mine against the insurgency in the region.

I’m quite sure that this is exactly why Gemfields even reports this number in the first place.

Glencore looks back on a terrific year

The company was on the right side of the post-Covid commodity boom

There was much talk about how mining and resources companies would have a great 2022. This wasn’t true for all of them, with the likes of gold miners having a disappointing time. Glencore had the right commodities at the right time, benefitting from record coal prices among other energy price increases.

The cash is falling out of the sky, with net debt down to just $0.1 billion (from $6 billion) after allowing for $7.1 billion in shareholder returns. This took the form of a $5.1 billion cash distribution, a further $0.5 billion as a special dividend and a $1.5 billion share buyback.

This is what happens when revenue is up 26% and adjusted EBITDA increases by 60%. Funds from operations were a whopping 70% higher.

Although the economic outlook isn’t fantastic, the company thinks that China’s reopening will support continued demand for Glencore’s products. Supply constraints are likely to persist as the world isn’t investing in new fossil fuel projects.

Glencore is up more than 140% in three years. This has been an exceptional investment through the pandemic.

Gold Fields: the joy of a break fee

An increase in HEPS of 16% to 22% isn’t because of the gold operations

For the year ended December, Gold Fields managed to meet its production and cost guidance. All-in sustaining costs were $1,105/oz, which is only 4% higher than the prior year. This wasn’t enough to drive earnings growth, with normalised earnings per share down between 5% and 11% year-on-year.

Ironically, the failed attempt to merge with Yamana Gold was a very helpful boost to results, as Gold Fields was paid a break fee of $202 million. The was the major driver of the increase in HEPS!

Not much jubilation at Jubilee as it drops 14%

Zambian infrastructure challenges are hurting

Jubilee Metals operates in South Africa and Zambia. When Eskom wasn’t the biggest infrastructure challenge in a given period, you know things were tough.

In the six months to December, the PGM and chrome operations in South Africa put in a solid performance. In Zambia though, copper production fell by 10% and the company has invested $2.5 million in trying to address the infrastructure challenges at that operation. It sounds as though things will be better in Zambia going forward.

So why the big share price drop? On a bright red day that saw the Resource 10 Index drop by 3.25%, Jubilee was likely the victim of highly negative sentiment towards the sector, which will always be more exaggerated towards smaller mining houses. Of course, the challenges in Zambia don’t help.

Injecting some Life into your returns

A 13% rally was a lovely surprise for Life Healthcare investors on Wednesday

If you hold Life Healthcare, your day got off to an excellent start. An early morning SENS announcement gave an operating update for the company and (more importantly) some news on its strategic priorities.

In the four months ended January, there was a solid uptick in occupancies in the South African business from 55% in the prior year to 62% in this period. The double digit growth in paid patient days (PPDs) in this period won’t be repeated in February and March, as there was already strong growth in those months in 2022, so the base effect isn’t as pronounced.

Overall, this was a solid period for Life Healthcare. Revenue was up 10% and EBITDA 16%. In a very interesting comment in the release, the company notes that load shedding isn’t having a significant impact on overall costs. Although the company needs to run generators, prior investment in solar and the overall operating requirements of the hospitals means that load shedding is far less severe than for retailers.

There is still a fight underway with SARS worth R199 million. The company highlights that the structure being attacked resulted in no loss to the fiscus, so this sounds like SARS shaking the tree to see what falls out.

In the international business, revenue increased by 9.2%. This is where we find the “strategic” news that helped drive the share price jump, with Life Healthcare advising shareholders that it has received unsolicited proposals to acquire the AMG business. This has nothing to do with fast and noisy Mercs and everything to do with complex molecular and diagnostic imaging services.

Although the AMG business is core to Life Healthcare, anything is for sale at the right price. The indicative pricing must be interesting, as Life has appointed investment bankers to take a closer look.

This 5-year share price chart has more twists and turns than your favourite episode of Grey’s Anatomy:

Murray & Roberts confirms that Australia is a doughnut

Not the sweet kind, but rather the worthless kind – a big fat zero

I would make a joke about a Cloughnut but I have it on good authority that this isn’t the right pronunciation of Clough. Still, it’s too good to resist.

As things stand and based on the voluntary administration process underway in Australia, Murray & Roberts’ value in Clough and RUC Cementation will go to zero. There isn’t even enough to cover the creditors.

These businesses will be deconsolidated in the group accounts with effect from 5 December.

Although Murray & Roberts has made peace with the Cloughnut situation, the company still hopes to find a way to retain ownership of RUC Cementation which is a useful business.

There’s still much work to be done on this balance sheet, but the market seemed to like this news with an 8.7% increase in the share price.

Production decreases hurt Pan African Resources

With such a lacklustre gold price, there’s no margin for production error

Pan African Resources experienced a nasty drop in production in the six months to December, down 14.6% year-on-year. Despite this, full year production guidance has been maintained, so the company is putting big pressure on the second half of the year.

For the interim period at least, there isn’t much for investors to get excited about. HEPS dropped by 36.4% as the production issues drove an increase in all-in sustaining costs per ounce.

These are historically strong operators, so some investors may take a punt here on the better half coming to fruition. The share price is currently sitting on a strong support line if you look back over three years.

Little Bites:

- Anglo American Platinum is looking for a new CEO, as Natascha Viljoen will be leaving the group to join Newmont Corporation as its COO. This is a move onto the global stage for Viljoen, as Newmont is based in the US. Her notice period is 12 months, so Amplats will have time to find her successor. Whilst this is another great example of South Africa punching above our weight globally, I also can’t help but wonder whether emigration is part of the appeal here. Either way, that’s another highly experienced executive leaving our shores.

- Aside from the vacant CEO role, the independent board of Spar appears to be settled. The various committees have been formed and the King Code boxes have been ticked. We await to see who will take the most important job going forward.

- Santova has appointed James Robertson as Group Financial Director, as internal appointment which is usually a good sign.

- Capital Appreciation Limited will need to appoint a new chairman, as Motty Sacks (a co-founder of the group) is stepping down from that role.

- Another set of executive changes on the JSE can be seen at AYO Technology, where Amit Makan has come in as CEO and Pride Guzha has been appointed as CFO.

- Daniel Mminele, outgoing Chair of Alexander Forbes and former CEO of ABSA Bank, has been appointed as the incoming Chairperson of Nedbank Group. He actually resigned from the board of Alexander Forbes so that he could take up this rolee.

- Universal Partners has almost no liquidity on the JSE so it only gets a passing mention down here on an otherwise very busy day. As an investment holding company, net asset value (NAV) per share is the right metric, especially as no dividends are paid. The NAV per share increased by 3.9% year-on-year, measured in GBP.

- The legal wrangling at Tongaat Hulett continues, with the company in business rescue and trying to find a way forward. The latest news is that although the lenders are seeking to “perfect their general notarial bonds” in respect of the operating assets, the business rescue practitioners have negotiated access to the assets so that the company can continue operating. If you’ve learnt nothing else here, at least you know that “perfect” can be a verb in a legal context!

Always great reading Ghost Bites and love your play on common words that non-commercial people can identify with. It makes reading easy and fun. May you continue with many more fun editions

Thanks for the kind words!