AECI battles with the German business (JSE: AFE)

An operating loss of R228 million at AECI Schirm Germany isn’t pretty

In the year ended December, AECI’s group revenue was up 37% and EBITDA was up 16%. Once depreciation and amortisation is included though, EBIT was flat. That’s not what you want to see in your operating margin.

It does at least mean that cash profits grew solidly, supporting an increase in the dividend of 15%. This is despite an increase in group debt, with gearing up from 24% to 45%.

There was also no shortage of reinvestment in the business, with 61% of total capital expenditure of R1.55 billion going into growth opportunities (vs. maintaining existing assets).

The flat EBIT result was thanks entirely to the German business, which suffered an operating loss of R228 million and an impairment of R445 million. Shareholders are demanding Achtung, Baby!

(And in case that reference went over your head, today is a good day to discover the band U2…)

Aspen gives shareholders a shot in the arm (JSE: APN)

A rally of over 13% would’ve put a smile on many faces on Wednesday

For the six months ended December, Aspen’s group revenue fell by 1%. Within that, Commercial Pharmaceuticals grew by 2% and Manufacturing revenue fell 10% due to the loss of COVID vaccine sales.

The manufacturing margins on the vaccine are higher than in Commercial Pharmaceuticals, so gross profit fell by 5% as margin deteriorated.

Normalised EBITDA fell by 11% and normalised HEPS was 17% lower, with foreign exchange losses adding to a painful set of numbers.

If you found yourself wondering why on earth this sent the share price higher, you aren’t alone. You needed to keep reading the announcement to get to the better news.

The outlook for the second half of the year is a lot better, with earnings expected to exceed not just this interim period but also the second half of the prior year. A very useful driver of earnings over the next couple of years will be capacity utilisation in the sterile manufacturing facilities, which comes with great operating leverage as overhead absorption per unit improves. Remember, under-utilisation is the death knell for any manufacturing business.

Has the market gotten carried away here? I don’t chase gains like these as a rule, especially when they are based on a lot of promises rather than money that has already been banked. Each to their own.

Brikor shareholders may get a liquidity event (JSE: BIK)

A mandatory offer at 17 cents per share looks likely

With the bid in the market at 12 cents per share and the offer at 17 cents per share, I suspect that Brikor shareholders will be quite happy to accept a mandatory offer at 17 cents per share. It’s probably the only way to sell at this price!

Nikkel Trading has entered into agreements with major shareholders to buy 67.7% of the company. There are two tranches here, with the first one representing 34.1% of shares in issue. This does not trigger a mandatory offer, for which the threshold is 35% ownership.

The second tranche is for a further 33.6% in the company, which is subject to approval by regulators like the Competition Commission, JSE and TRP. If that gets approved and executed, it would trigger a mandatory offer to all other shareholders.

If I was a Brikor shareholder, I would consider this liquidity opportunity very carefully. Director Garnett Parkin didn’t waste any time, selling shares worth nearly R3 million.

Capital & Counties is still battling valuation pressures (JSE: CCO)

When rates are rising, property values tend to drop even if rentals increase

This is confusing, I know. The way a property is valued is based on a “cap rate” and the higher the rate, the lower the property value. Value and yield always have an inverse relationship.

Simply, investors demand a higher return from the properties when rates are higher. Even if rentals increase, the impact of higher yields is often severe enough to more than offset the benefit of net operating income from the properties.

At Capital & Counties for example, the valuation of Covent Garden is flat because yields widened by 19 basis points to 4.07%. Lillie Square’s valuation fell 6%. We won’t talk about the value of the investment in Shaftesbury, which is substantially lower.

Group net debt to assets is 28%, so the balance sheet is in decent shape.

Cashbuild releases its worst interim HEPS in years (JSE: CSB)

When will the pain end in this sector?

With a 32% drop in the share price over the past year, things really haven’t been enjoyable for Cashbuild. The riots hurt the business severely and consumer spending has shifted away from DIY and home improvement in the aftermath of the pandemic.

For the six months to December, revenue was down 4% and headline earnings fell by a rather hideous 39% to R156 million, comfortably the weakest result in recent years. The dividend has been slashed by 32%.

As we dig deeper, we find selling price inflation of 4.5%, which suggests that volumes were down approximately 8.5%. Gross profit margin also went the wrong way, dropping from 26.6% to 25.3%. With operating expenses up by 9%, profitability never stood a chance.

There’s no sign of improvement, either. In the first six weeks of the 2023 calendar year, revenue was down 8% year-on-year. Nobody is climbing off this pain train just yet.

Caxton and CTP reports a juicy jump in HEPS (JSE: CAT)

There’s impressive pricing power on show here

In the six months ended December, Caxton’s HEPS increased by between 32.3% and 39.8%. That’s a solid outcome under these circumstances, achieved through revenue growth of 25.8% as the company managed to recover raw material costs.

In the industrials game, pricing power is everything in an inflationary environment. If you can’t pass those costs on to customers, you die. Simple as that.

The group had also made the strategic decision to ramp up raw material stockholdings to avoid losing out on sales because of supply chain issues. As supply chains have eased, this creates the opportunity to reduce the overall stockholding and release working capital into cash.

I’m not surprised that the share price was 4.5% up on this news.

Cognition is profitable again (JSE: CGN)

Both EPS and HEPS are in the green

After the sale of Private Property and the rationalisation of costs, Cognition Holdings is profitable once more. For the six months ended December, HEPS is expected to be between 0.60 and 0.75 cents, a lovely turnaround from a loss of 0.70 cents in the comparable period.

Even Earnings Per Share (EPS), which is affected by asset impairments (unlike HEPS), is positive in this period.

The share price is up over 60% in the past year, a great example of a value unlock by a small, off-the-radar company.

Harmony: no dividend as the company invests in copper (JSE: HAR)

It seems that even Harmony Gold is scared of gold

I can’t blame Harmony Gold for wanting to diversify its exposure to the yellow stuff. After such a disappointing period for gold, the investment case took a knock.

In the six months to December, the year-on-year story looks good at least. Revenue was up by 6% and net profit jumped by 36%. There’s no dividend though, as the company has acquired Eva Copper in Australia as part of the diversification strategy referenced above. This also drove a substantial increase in net debt to EBITDA from 0.1x to 0.6x.

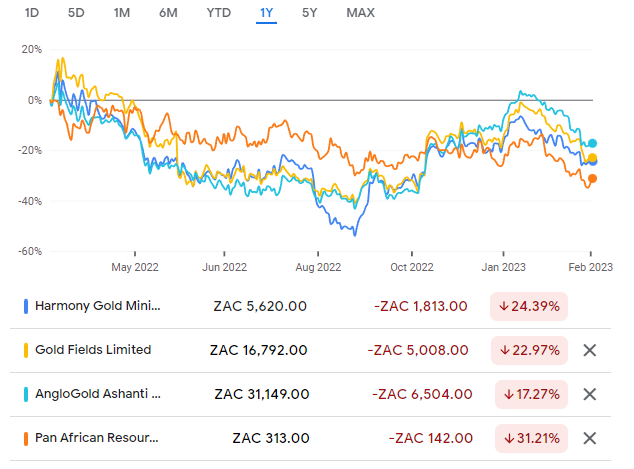

The charts over the past year in this sector don’t make for pleasant viewing:

Investec Property Fund has a lot to tell you (JSE: IPF)

There’s a ManCo internalisation and a couple of joint ventures

Allow me to begin by explaining why property fund asset management companies (or ManCos) were the biggest rip-off of ordinary shareholders that I’ve possibly ever seen on the JSE.

You see, instead of just paying salaries to property professionals, funds were put together by “asset managers” who then charge a fee based on the value of the properties, not a reasonable amount for the skills and time spent (like a normal management team).

With the greatest respect to property professionals, this isn’t “asset management” in the true sense. This isn’t a team of people putting together deals across various industries, building a portfolio of diversified assets and dealing with a huge variety of market dynamics. Property funds stick to properties, so there’s absolutely no reason why property professionals can’t just earn a salary and bonuses. Sorry, but it’s true. You don’t see the team at Bidvest or Barloworld trying to put together a ManCo.

Nevertheless, for years institutional investors were happy to let this happen. As people eventually realised how expensive this is for shareholders, funds were put under pressure to “internalise” the ManCo at great expense. Not only are management teams now being paid out a multiple of their earnings, but the base for that multiple is also inflated!

How do you rationally explain a scenario in which Investec (the ManCo) will get paid out a spectacular R975 million by Investec Property Fund to internalise the ManCo? The market cap of the fund is not even R7 billion, so this is around 14% of the fund’s market cap! The net management fee saving on an annual basis is R73.8 million, so they aren’t shy of putting a proper earnings multiple on it either.

Even worse, that management team will still need salaries going forward. It’s not like they work for free from here onwards.

Once ordinary shareholders have been fleeced of their capital, they can look forward to news like the acquisition of a 19% interest in the Pan European Logistics Platform for EUR96 million and a 50% joint venture agreement with Irongate Australia to acquire a stake in one of their property funds.

I just find it hard to focus on the “good” strategic news after seeing that incredible amount put forward for the ManCo.

In a separate trading update, the fund reported a decline in distributable income per share of between 2% and 3%. This was blamed on interest rate movements in Europe. Reversions (the percentage change in a renewed lease rental vs. the previous rental) are negative in South Africa and positive in Europe, showing how different the conditions in each region can be.

MTN’s HEPS is higher, but wait for the cash flow (JSE: MTN)

The issue for telecoms companies doesn’t lie in profitability

In a trading statement for the year ended December, MTN banked growth in HEPS of between 12% and 22%. The forex losses are huge, as the company needs to upstream cash from a country like Nigeria at pretty much whatever exchange rate it can get.

For reference, the HEPS range is R11.05 to R12.04 per share. The forex impact was -R1.81 per share, so this is material in the group context.

Full results are due on 13 March. When they are out, the first thing I’ll be looking at is the commentary around the costs of load shedding and the investment required in batteries and other backup solutions.

The share price barely moved after this trading statement came out, so I think the broader market is also waiting to see what the balance sheet looks like.

Murray & Roberts makes a small recovery (JSE: MUR)

I still don’t think the risks are being fully priced in

After releasing interim results for the six months ended December, Murray & Roberts closed 4.65% higher. This is despite being (1) loss-making and (2) in a net debt position of R2 billion with a market cap of R950 million. You need to be brave to be having a punt here.

The good news is that at least earnings before interest and taxes (EBIT) was positive this period, coming in at R80 million. This suggests that the core business is capable of making a profit, so the losses are due to the balance sheet.

This balance sheet isn’t going to be fixed overnight, with the company already warning that there will probably not be a full year dividend. More worryingly, the comment in the result about “options to de-lever the balance sheet to create a sustainable structure” gives a pretty strong clue that a painful rights offer could be coming down the line.

The only thing you can be guaranteed of with Murray & Roberts is that the share price will be volatile going forward.

Stefanutti Stocks buys more time (JSE: SSK)

Lenders have agreed to extend the capital repayments profile

When Stefanutti Stocks last updated the market on the restructuring plan in November 2022, the group was negotiating with the lenders to extend the capital repayment profile out to February 2024.

This has now been achieved, so the group has another 12 months to manage this loan.

Woolworths puts in a premium performance (JSE: WHL)

It’s not often that the dividend nearly doubles!

With an “under new management” sign firmly on the door, Woolworths is showing the market what the benefits are of focusing on the core business.

These numbers look quite incredible, really. In the 26 weeks to 25 December, turnover was up 15%, HEPS jumped 75.1% and the interim dividend per share nearly doubled (+96.9%) as management confidence in the operations increased.

Free cash flow per share was up 29.3%, a strong result but well off the profitability growth as some of the cash got sucked into the business.

To be fair of course, the comparable period included lockdowns in Australia. Woolworths gives us a very useful data point for the last six weeks of this period as a more sustainable view on the business, with revenue up by a still-impressive 8.8%.

With David Jones on its way out the door, management can give full focus to the local operations and Country Road in Australia. With load shedding having a huge impact of R15 million per month (not least of all because the average Woolworths Food is colder than Sutherland in winter), management will need to find a longer-term energy solution. The cold chain is everything at Woolworths, so this is a key business risk.

The share price actually fell by 3.2% on Wednesday after results were released, perhaps as the market digested the load shedding impact. The share price has been on a charge of note, so some consolidation is to be expected.

Little Bites:

- Director dealings:

- A prescribed officer of Gold Fields (JSE: GFI) has sold performance shares worth R11.3 million. There’s no indication that this was only the tax amount. Having recently given up on gold in my portfolio, I don’t blame this individual.

- RBFT Investments, an associate of a director of Salungano (JSE: SLG), has been buying shares in the open market at R1.40 per share. The latest purchases come to R4.7 million and there’s still plenty of ammo left to buy shares of those who want to sell.

- Peter Mountford (CEO of Super Group) sold enough of his share awards to cover the tax on them and chose to keep the rest. Although these are performance awards, choosing to keep 57% of them sends a message (JSE: SPG).

- The company secretary of Tiger Brands (JSE: TBS) has sold shares worth R1.05m that were acquired under an incentive programme. It looks like this was the full value of the award, not just the tax.

- An associate of a director of Fairvest (JSE: FTA) has acquired shares worth R980k.

- An associate of a director of Huge Group (JSE: HUG) has bought shares worth around R55k.

- The company secretary of Trematon (JSE: TMT) has sold shares worth R35.5k.

- Sanlam (JSE: SLM) and Alexander Forbes Group (JSE: AFH) have closed the deal in which Sanlam acquired Alexforbes’ individual client administration business. The effective date of the transaction is 1 March 2023. Sanlam’s Glacier business will take full responsibility for this newly acquired operation.

- Premier Fishing and Brands (JSE: PFB) has concluded the transaction to meaningfully increase its stake in Talhado Fishing Enterprises from 50.3% to 80.65%.

- I was slightly surprised to learn that Sygnia’s (JSE: SYG) offices in Green Point are owned by a family trust of founder Magda Wierzycka. For someone who has always beaten the drum about governance, that’s an unusual situation for a listed company. Still, this is why related party rules exist on the JSE, so an independent expert will need to opine on whether the lease terms are fair. I’m just not sure that the optics are great, especially after the company had moved towards having professional independent management and has now reverted to the old founder-led situation after David Hufton left the group.

- I’m keeping an eye on Clicks (JSE: CLS), a company whose share price has always been propped up by foreign investors. With greylisting and a souring of relations with the US, I’ve been wondering if US investors might start selling. Sure enough, JPMorgan Chase & Co has sold down its stake and now holds 7.98% in the company. The Clicks price is holding up for now.

- In a very strange situation, an update that supposedly related to Renergen (JSE: REN) was released on SENS. It caused a stir, as it was all about the late announcement of a share consolidation. The JSE seems to have made a mistake here, as Renergen and its Designated Advisor had no knowledge of this announcement and it clearly related to a completely different and suspended company called Resource Generation Limited (JSE: RSG). Renergen can’t get rid of it on its SENS feed, so an announcement was released asking shareholders to disregard the incorrect release. I’ve never seen this before!

- The CFO of Advanced Health Limited (JSE: AVL) has resigned and been replaced on an acting basis by an internal candidate.