AYO settles with the PIC (JSE: AYO)

Somehow, the terms haven’t been announced

You’ve gotta love AYO Technology and the rest of the companies in the broader Sekunjalo stable. This is a listed company that was in a material dispute with the PIC and Government Employees Pension Fund (GEPF) over capital that had been invested in AYO.

There is now an “amicable” conclusion of a settlement agreement, but the terms are confidential. This is surprising, because AYO shareholders now have no idea what the settlement looks like and what the financial impact will be.

Nonetheless, the company lifted its cautionary announcement and noted that caution is no longer required to be exercised when dealing in its shares. I would be cautious here regardless of whether there’s an official cautionary announcement or not.

Eastern Platinum launches a major rights offer (JSE: EPS)

The number of shares in issue will double

Eastern Platinum is raising capital for a number of purposes, ranging from the restart of operations at the Crocodile River Mine through to completion of phase 3 of the Zandfontein Concentrator Plant. There are other projects that need capital, like Mareesburg and Spitzkop. Junior mining is expensive!

With a market cap of roughly R343 million, Eastern Platinum is small. It’s about to get considerably larger, is the company plans to raise just over R200 million in this process. With a rights offer ratio of 1:1 (i.e. the number of shares will double) and armed with that knowledge of the market cap vs. the size of the raise, you can immediately tell that the offer price is a significant discount to the current traded price.

The offer price is R1.4564 per share and Eastern Platinum closed at R2.50 on Friday.

A little gem (JSE: GML)

Gemfields achieved record revenue in 2022 against a backdrop of major stress in Mozambique

Gemfields owns and operates the Kagem emerald mine in Zambia, the Montepuez ruby mine in Mozambique and luxury brand Fabergé. The latter is famous for eggs that make your local Lindt selection seem very reasonably priced in comparison. Of revenue of $13.8 million at Fabergé in the past financial year, a whopping $2.2 million came from the sale of the Fabergé x Game of Thrones objet egg.

In the aftermath of the pandemic, the coloured gemstone market has experienced strong demand. The company makes it clear that 2023 may not be as juicy as 2022, particularly against an inflationary and possibly recessionary environment.

In 2022 at least, Gemfields made the most of conditions. Revenue shot up by more than 32% to $341 million and EBITDA came in at nearly $166 million, up 24.5%.

The mix is important here: Montepuez is the largest revenue contributor at $166.7 million, with Kagem up next at $148.6 million. Fabergé contributes $17.6 million and other revenue sources come to $8.2 million.

There is clearly some margin pressure in the system, with the group highlighting fuel costs at the Zambian emerald mine as one example of inflationary cost pressure. In Mozambique, the stress has been more political in nature, with the insurgency in northern Mozambique coming dangerously close to the mine. This risk in Mozambique come with costs as well, as security certainly isn’t free. Group EBITDA margin decreased from 52% to 49%. Kagem came in at 49% and Montepuez at 50%.

As there has been solid support from government in Mozambique when it comes to security, Gemfields seems to feel confident enough to invest further in that region with a second processing plant. The payback period is less than 18 months, which tells you everything about mining in Africa: maximum risk, maximum rewards.

And despite the fancy eggs (and other jewellery) at Fabergé, the luxury brand still isn’t profitable. 2022 saw its lowest ever cash draw from Gemfields (i.e. the least assistance the group has ever needed from its shareholder), so perhaps there is hope. A loss of $3.1 million was reported by that business, which should be viewed in the context of Gemfields group operating profit of $116.5 million.

Despite the big jump in profits, free cash flow was actually slightly down vs. 2021 at $84.4 million. Capital expenditure was a meaty $34 million (vs. $11.7 million), most of which was replacement capex. Shareholders will want to keep a close eye on this, especially as the group expects capital expenditure to increase in 2023.

With worries about 2023, I would personally trim a position in this stock (if I had one) based on this chart and the earnings guidance:

Grand Parade is simpler and better (JSE: GPL)

You just need to look at the right metrics

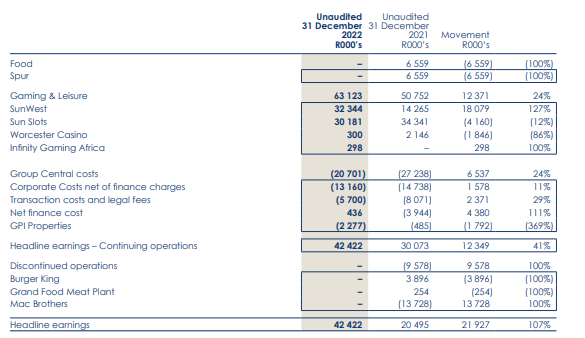

I really have no idea who writes the short-form announcement for Grand Parade, but I wouldn’t be proud of it if it was me. Inexplicably, it focuses on revenue as the first metric, which doesn’t make sense for a company that now derives its entire value from investments in gaming entities. Grand Parade is firmly an investment entity now, having gotten out of the foods business.

The key line is “profit from equity-accounted investments” at R63 million vs. the silly little revenue number of R3.8 million.

Anyway, moving on from the pointless short-form announcement, we find a really useful table in the results that shows exactly how much the group has changed in the past year:

This is a good lesson in creating cleaner, focused groups. Just take a look at how Mac Brothers was hammering profitability!

There is currently a mandatory offer on the table from GMB for R3.33 per share, a 27% premium to NAV. The last day to trade is 3 April and I’ll be interested to see what happens to the share price thereafter. I’m not sure it should be trading at a premium to NAV under normal circumstances.

Northam: a sharp rise in earnings but no dividend (JSE: NPH)

The group is at a “critical juncture” in its growth strategy

There aren’t many mining houses that managed to improve margins during 2022. With inflationary pressures on mining costs and commodity prices that in some cases went sideways, margins were squeezed for many mining groups.

Not so at Northam Platinum, where operating profit margin in the six months to December 2022 was 290 basis points higher at 45.1%. This means that a 44.9% increase in revenue drove a 55.0% increase in operating profit. At HEPS level, the jump was 67.3%. This is particularly impressive when you consider that the cash cost per equivalent refined ounce increased by 14%.

Of course, the major focus is on the offer to the shareholders of Royal Bafokeng Platinum. Based on the way in which the offer is structured, the split between cash and shares will change depending on whether Impala Platinum accepts the offer from Northam. This uncertainty is why the board has elected not to pay an interim dividend.

The Northam share price has lost nearly a third of its value in the last twelve months. It’s down 22% this year. The market isn’t a fan of risky acquisitions in this environment.

Little Bites:

- Director dealings:

- There’s some chunky buying underway at Sibanye Stillwater (JSE: SSW), with the CFO buying over R5.5 million worth of shares.

- An associate of a director of Transaction Capital (JSE: TCP) has bought shares worth just over R1 million. This is a different director to those who have been doing the buying in the past week.

- Directors of gold companies are cashing in on this latest rally, with the latest example being two directors of Harmony Gold (JSE: HAR) who sold shares worth nearly R5 million.

- Des de Beer has bought another R640k worth of shares in Lighthouse Properties (JSE: LTE)

- There’s yet more director buying at Invicta Holdings (JSE: IVT), with an associate of the CEO buying shares worth R320k.

- Montauk Renewables (JSE: MKR) has announced an investment of $25 million in the development off a new gas-to-RNG facility in South Carolina, the group’s first investment in that state.

- Accelerate Property Fund (JSE: APF) doesn’t have a great reputation for corporate governance. With the announcement of joint CEOs being appointed with effect from 1 April, we have yet another governance concern. From my perspective at least, a company appointing joint CEOs is a sign that they simply can’t make a decision and don’t trust either of them to fully do the job properly.

- As a reminder of how dangerous mining still is, an employee at Harmony’s (JSE: HAR) Kusasalethu Mine near Carletonville lost his life. Sadly, this is still a fairly regular occurrence in this industry.

- Telemasters Holdings (JSE: TLM) is one of the most obscure companies on the JSE, with a market cap of just R60 million. In a trading statement that is deserving of such an odd company (mainly because whoever wrote it didn’t bother to mention which period it covers), the headline loss per share will be 39.3% smaller than in the prior period. It’s still a loss, but a smaller one.

- Brikor (JSE: BIK) has been party to several legal proceedings for which a settlement has been reached. The announcement doesn’t mention any cash changing hands, but a lot of legal action is being withdrawn by all parties. It seems they have all decided to just go away. Meanwhile, a company called Nikkel Trading 392 now owns 23% in the company.

- If you are a shareholder in cash shell Trencor (JSE: TRE), be aware that the annual financial statements have been released.