Capital Appreciation announces a R131 million deal (JSE: CTA)

The acquisition target is Dariel Solutions

Dariel Solutions is the holding company of Dariel Software, an IT software services provider that was founded in 2001. As is so often the case, it takes two decades to build a business to the point where it can be sold for this sort of number. The focus on the FinTech sector is what caught the attention of Capital Appreciation.

The structure looks decent for Capital Appreciation. The R131.2 million purchase price is split nicely across a cash payment (R46.9 million), equity allotment out of treasury shares (R38.4 million) and potential earn-out payment (up to R45.9 million). The earn-out has cash and equity elements to it. In summary: Capital Appreciation is making good use of its listed platform here.

It’s rather interesting to note that the profit warranty is based on EBITDA over a 24-month period. This takes some volatility out of it, with the warranty being R62.2 million in total EBITDA from 1 April 2023 to 31 March 2025. This represents a compound annual growth rate (CAGR) of 20%.

The net asset value of Dariel was R47.8 million as at the end of March 2023. That’s not the way tech companies are valued, so I would suggest looking at EBITDA of R23.8 million and profit after tax of R16.2 million in assessing the purchase price. The trailing Price/Earnings multiple is 8.1x if the full purchase price is applicable, which would be the case if the earn-out is met.

This is a sensible price for what seems to be a fast-growing, established company. The Capital Appreciation share price increased by 1.3% on the day. With a market cap of R2 billion, this is a small but not insignificant transaction for the company.

Jubilee Metals has a good story to tell (JSE: JBL)

Production guidance should please shareholders

With recent upward momentum in PGM prices, it’s a good time to be delivering on production expectations. Jubilee Metals is doing precisely that in the PGM side of the business, with full year guidance reaffirmed.

Of course, mining is never simple. Jubilee has the ability to focus on either copper or cobalt at the Sable Refinery. With cobalt prices having dropped by around 76% from the year’s high, it wasn’t terribly difficult to choose copper as the winner. Copper guidance for the full year is unchanged, though.

In chrome, full-year production is expected to be ahead of guidance. As an additional benefit, chrome prices have also been stronger during this quarter.

There’s been no shortage of volatility in this share price in recent years:

KAL Group mopped up over R10m worth of odd-lots (JSE: KAL)

In case the name isn’t familiar, this is the renamed Kaap Agri Limited

Odd-lot offers have been popular on the JSE lately. It’s a bit sad I think, as companies don’t like having a long tail of retail shareholders because of the administrative costs. Although odd-lots aren’t forced to sell, many don’t notice and end up selling their shares by default.

If you aren’t familiar with how this works, an odd-lot is a holding of fewer than 100 shares. The company can make an offer to all such shareholders, buying back their shares and hoping to save on administrative costs in the process.

In the latest example, KAL Group has repurchased 0.3% of its total issued share capital for nearly R10.1 million.

The company is set to release results on Star Wars day – May the 4th!

Purple Group turns red (JSE: PPE)

The share price continues its correction as macroeconomic conditions bite

Twitter can be a nasty place. If ever you needed an example of how quickly a mob can turn against something, look no further than the general narrative on Twitter around Purple Group.

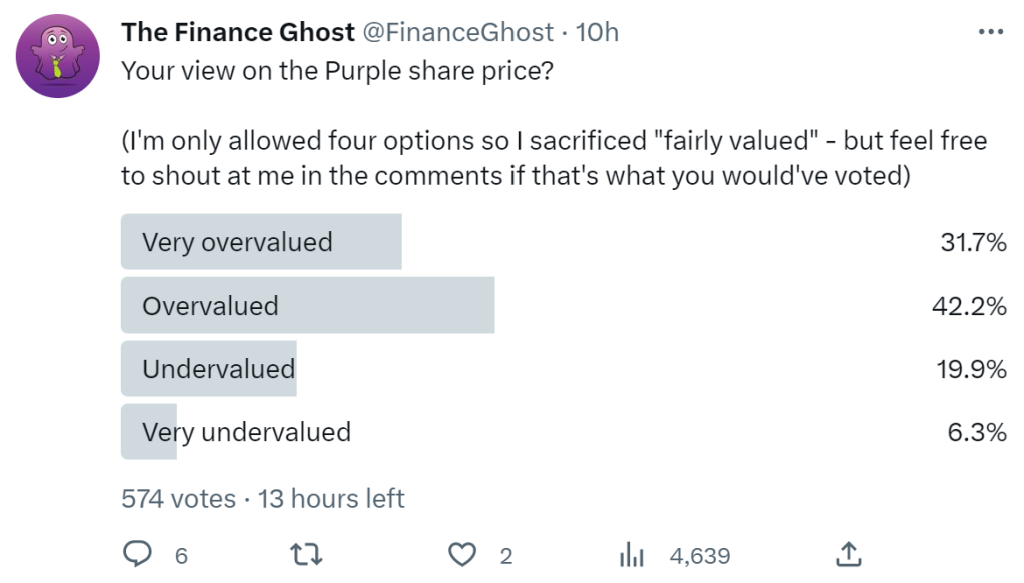

Also, if you ever needed further proof that the price drives that narrative, check out the results of this survey at roughly the halfway mark:

Suddenly everyone is bearish on Purple Group. I was pointing out how overvalued the company was long before the investors starting heading for the exit over the past year. For context, just take a look at this share price chart:

Where is this headed? The trend definitely isn’t your friend here if you are long, with little to suggest that the near-term pressure on South African consumers (and thus investors) will ease. We can see it coming through in significantly lower client inflows and thus average revenue per user (ARPU), a key metric for any growth company.

Although active client numbers have increased sharply, profitability isn’t driven by active accounts. It is driven by activity on those accounts and the level of deposits, as EasyEquities does have various sources of revenue these days.

With a loss-making period being digested by the market, Purple Group CEO Charles Savage joined me to discuss a wide range of topics related to these results and the company’s growth prospects. I can’t write anything that does this discussion justice, so rather just listen to it:

Something positive at Sibanye-Stillwater (JSE: SSW)

Good news has been hard to come by recently at Sibanye

This is a highly operational update, but it is at least good news for a mining group that has mostly been reporting unhappy things in recent times. Sibanye’s Stillwater West mine can now report a recommissioned vertical shaft, which means the damage suffered during March 2023 has been repaired.

Production from the deeper levels of the mine (below 50 level) has resumed and should reach normalised levels by the end of this month. Suspension of production at deep levels for even just a few weeks had a negative impact on production numbers of approximately 30,000 2Eoz.

Mining is hard.

South32 revises production downwards in several areas (JSE: S32)

The share price didn’t have a good day

In case you’re wondering how important production guidance is for mining groups, I decided to CTRL-F “guidance” in the South32 update. It appears a whopping 51 times! There’s your reminder for the day that valuations are firmly forward-looking in nature.

There was some good news in this South32 update, like copper equivalent production up by 7% year-to-date and Australia Manganese achieving record production. Commodity pricing was also higher across the general portfolio.

Weather and other temporary impacts affected production in several operations this quarter, with guidance revised lower for the full year as a result. Surprisingly, unit cost guidance is largely unchanged despite the production pressures. Capital expenditure guidance is unchanged.

The group is in a strong balance sheet position and regular followers of SENS will know that South32 has been busy with an extensive share buyback programme in addition to the payment of cash dividends to shareholders. There’s a question mark around the wisdom of this in a rising interest rate environment, with finance cost guidance for the year revised sharply upwards from $150 million to $190 million.

The growth strategy is focused on so-called transition metals like copper and battery-grade manganese.

Little Bites:

- Director dealings:

- Des de Beer has bought another R12.4 million worth of shares in Lighthouse Properties (JSE: LTE).

- A director of Old Mutual (JSE: OMU) has bought shares worth over R1.1 million in the company.

- Altron (JSE: AEL) is selling its ATM hardware and support business to American group NCR Corporation. The parties have agreed to extend the fulfillment date for outstanding conditions by one month to 31 May 2023. This is required for competition approval in Namibia and some tax admin with SARS.

- As I suspected, life after REIT may not be so bad for Fortress (JSE: FFA). GCR has improved the company’s credit rating outlook from Evolving to Positive and affirmed its existing credit ratings.

- Brimstone (JSE: BRT) is proposing the specific repurchase of forfeitable shares that may vest in February 2024. The price would be based on the 30-day VWAP at the time of vesting, with no premium or discount. As I see it, this is a liquidity event for the executives and managers who receive share-based awards, as there is a lack of liquidity in the Brimstone price. They are essentially turning an equity-settled scheme into a cash-settled scheme.