Grindrod Shipping reduces debt through ship sales (JSE: GSH)

In such a cyclical industry, timing is everything

With things having slowed down in the shipping industry and interest rates on the rise, it made sense for Grindrod Shipping to sell off some ships and reduce debt with the net proceeds.

There were four such sales in March and April, with total net proceeds of $26.6 million. The cash was used to reduce senior secured debt in the group.

Kibo Energy is a good example of dilution in action (JSE: KBO)

Always look out for convertible instruments

When a company has issued warrants or convertible debt, there is risk of dilution for ordinary shareholders.

A warrant is just a type of option, allowing the holder to exercise the right to receive shares directly from the company (i.e. new shares) for a pre-determined price. Warrants can be used as part of start-up capital raising to create an equity kicker for early-stage investors to get them across the line.

A convertible loan does what it says on the tin: this is a debt instrument that can be converted into equity (shares) at the option of the holder.

The latest announcement dealing with equity conversions is a reminder that Kibo has dilutive structures in place, something that investors should be aware of when investing.

Kore Potash quarterly review (JSE: KP2)

This is a useful summary of progress at the Kola Project

The focus is still on finalising the terms of the Engineering, Procurement and Construction (EPC) contract. Kore Potash’s counterparties to this contract are PowerChina and SEPCO, who are working on guarantees to support the EPC contract.

Importantly, Summit Consortium has confirmed that the financing proposal for Kola will be provided within six weeks of the EPC terms.

As at 31 March, the company had $3.8 million in cash.

Life Healthcare: enough volatility to send you to the ER (JSE: LHC)

Here’s a lesson in investing in “safe” assets, like hospital groups

Life Healthcare is currently weighing up its options to sell its offshore business, Alliance Medical Group. Unsolicited proposals were received that the board can’t ignore, driving a need to engage with the potential offerors.

The company has renewed its cautionary announcement in this regard. Caution indeed, as just a cursory glance at this share price chart will reveal:

Fully licensed and shovel ready (JSE: MCZ)

MC Mining updated the market on the Makhado project

In MC Mining’s case, the shovels would be building the project rather than taking hard coking coal out of the ground. The good news is that an estimated 650 permanent jobs are expected to be created at full production. A detailed execution plan for the next five years has been put together based on the bankable feasibility study for Makhado and a great deal of subsequent work.

Various tender processes for contractors are underway and are expected to be concluded in the third quarter. Funding arrangements are expected to be concluded at around the same time.

It’s a long process, even once a project is “fully licensed and shovel ready” as the company puts it.

Orion Minerals reflects on the past quarter (JSE: ORN)

Copper and zinc prices are volatile as always, but the outlook remains strong

So-called “junior” mining companies are risky things. While they are running around trying to piece together funding for projects, metal prices can change and so can sentiment. It helps when there is a solid long-term story, as is the case with a metal like copper.

The past quarter was critical for Orion, with Clover Alloys coming in as the cornerstone equity investor. Together with other equity investors, this puts the company in a position to access the Triple Flag Precious Metals ($87 million) and IDC facilities (R250 million).

Scalable dewatering of the underground operations is set to start this quarter.

Renergen’s trading statement isn’t important (JSE: REN)

The share price isn’t being driven by current financial results

With Renergen having been firmly in development phase, the current financial results don’t tell you much about the long-term prospects or what the share price should be doing.

Still, I should mention that a trading statement has indicated a headline loss per share of between -22.6 cents and -17.1 cents for the year ended February 2023. That’s an improvement on the prior year of between 18% and 38%.

The royal saga continues (JSE: RBP | JSE: IMP)

Although Northam Platinum pulled its offer, the TRP complaints are unresolved

I’m tired of reading about this deal, so I can only imagine how tired those involved are. The management team at Royal Bafokeng Platinum is particularly gatvol, with the company having been under offer for over 18 months. Operating in a tough environment with that level of uncertainty really isn’t easy, something we are starting to see in the numbers.

Northam Platinum is no longer interested in making an offer to shareholders. This doesn’t mean that the saga is over, as a Takeover Regulation Panel (TRP) Compliance Certificate cannot be issued until complaints are resolved. A couple of complaints are causing major headaches, with the company trying to resolve them.

For example, there is a fight underway around the accelerated vesting and issuance of shares to the CEO and COO who announced their retirements. They were then given contracts to stick around until the corporate action is concluded. Northam Platinum believes that this is a “frustrating action” under Takeover Law and the matter has gone as far as the High Court. The problem is that the High Court process has the potential to really drag on, which would then delay the issuance of a compliance certificate by the TRP. Royal Bafokeng is considering other steps that would resolve this matter.

There were other issues as well. Northam Platinum made a complaint about the independence of the Royal Bafokeng directors, with that complaint dismissed by the TRP and then the Takeover Special Committee (TSC) in the appeal process. There were also concerns around the level of disclosure by the valuation independent expert in terms of valuation ranges. This was subsequently resolved, although the ranges are now so out of date that they are actually pointless.

Meanwhile, Impala Platinum has extended the longstop date to 31 May. The language in that company’s announcement is starting to sound very frustrated and impatient.

Somehow, I don’t think that Northam Platinum is on the Christmas card list for either Implats or Royal Bafokeng.

Steinhoff: worthless, but willing to share (JSE: SNH)

The speculative punts on this share price continue

Steinhoff closed 20.8% higher on Wednesday. You may be mistaken for thinking that there’s a good reason for this.

Instead, there’s just the usual activity in this share price of speculators playing a game of musical chairs. When the music stops, those who didn’t get out with a profit will be left as the proud owners of unlisted instruments in a worthless company.

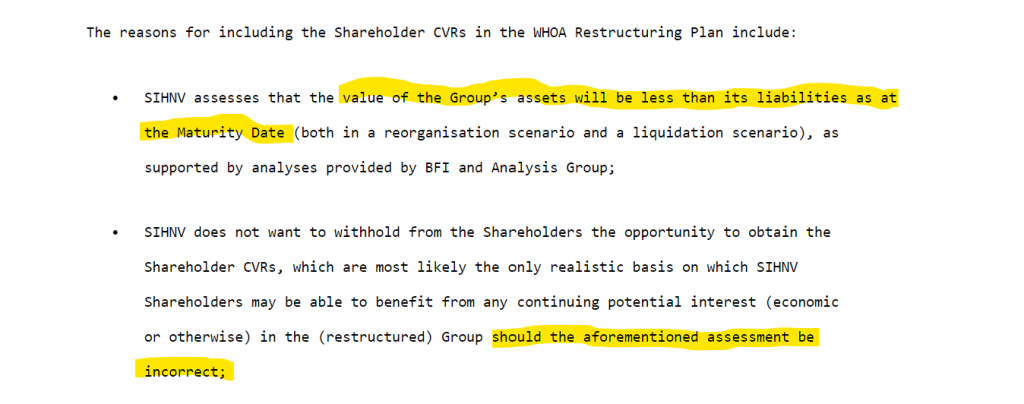

In case you think that this is just me being painful about Steinhoff, here’s the company literally telling you that there is no value:

In simple terms, the company is worthless and hence creditors didn’t mind making space for shareholders to receive 20% of nothing. Ask yourself this: if there was any value here at all, why would creditors give some of it up after shareholders voted against the restructuring plan?

Little Bites:

- As part of significant changes to its board, Grand Parade Investments (JSE: GPL) has also announced the appointment of a new chairman.

- Heriot Investments and related parties (including Heriot REIT – JSE: HET) now hold 56.8% of the shares in Safari Investments (JSE: SAR).

- The CFO of AECI (JSE: AFE) has resigned for personal reasons. An internal promotion has been made on an interim basis.

- The delisting of Jasco Electronics (JSE: JSC) was approved almost unanimously by shareholders at a general meeting.

- Oando PLC (JSE: OAO) looks set for an offer and delisting process. In case you’re interested, the company released a very long announcement about taking delivery of electric buses (a perfect example of SENS being used as a public relations platform) and also released financials for the year ended December 2021, so it has nearly caught up.

- Efora Energy (JSE: EEL) has been suspended for a long time. The company seems to be making some progress in addressing the backlog of financial reporting, but there’s still a long way to go in finishing audits etc.