A slowdown in economic activity hits Afrimat (JSE: AFT)

HEPS came under pressure from the industrial minerals and construction materials segments

Although Afrimat’s group revenue increased by 4.9%, operating profit fell by 13.3% and operating margin declined from 23.7% to 19.6%.

Some of this is due to increased operating activity and associated costs at Jenkins and Nkomati, with those mines expected to reach steady state in the coming year. With a drop in iron ore prices and those ramp-up pressures on margin, the Bulk Commodities segment reported a drop in operating profit of 15.6%.

There isn’t much that Afrimat can do about iron ore prices, or the reality of starting up new operations. Sadly, there also isn’t much that the company can do about broader South African economic activity. With electricity supply disruptions and a slowdown in economic activity, Industrial Minerals saw operating profit fall by 41.9% and Construction Materials dropped by 17.7%.

The Future Materials and Metals division is interesting but still very small, with revenue of R25.2 million and start-up losses of R11.4 million.

The total dividend for the year of 150 cents per share is 19.4% lower than the prior year. This is a larger drop than the decrease in HEPS of 15.7%.

Even Afrimat, with all its diversification and track record of excellent management, isn’t immune from the pressures out there.

Coronation flags a loss based on its key metric (JSE: CML)

The tax troubles are temporary, but painful

Some coronations are full of pomp, ceremony and old-fashioned traditions that surprisingly still manage to draw huge crowds in the UK. Others are full of tax troubles and disappointing numbers, at least for now.

Coronation’s internal metric used to measure performance is fund management earnings per share. It excludes mark-to-market impacts and forex effects on investment securities held. On that measure, Coronation expects a decrease of between 102% and 112% in the six months ended March. This is a loss of between 4.3 and 25.8 cents per share.

If the impact on investment securities is included, then HEPS will drop by between 89% and 99% to between 2.0 and 21.9 cents per share. In this case, the market moves went the right way. It’s just a real pity about the tax.

IFRS 2 charges take Datatec into the red (JSE: DTC)

The share-based remuneration costs have severely hurt the numbers

Datatec reported a headline loss of 9.3 US cents per share for the year ended February, a number that bears little resemblance to the story at operational level.

The performance of Westcon International has been very strong in recent years, leading to a significantly higher valuation for that division and a large IFRS 2 charge based on share-based remuneration plans. So large, in fact, that it is responsible for the group reporting a loss. Yes, this is highly unusual.

Looking at numbers that are perhaps a better reflection of underlying performance, revenue from continuing operations increased by 13% for the year in dollars. That’s more like it. This excludes Analysis Mason, which was sold during the year for a profit on sale of $109.9 million.

Aside from the performance at Westcon, Logicalis International also did well with a much better second half in the Latin America business.

If the IFRS 2 charge conveniently wasn’t there, underlying earnings per share would be 29.5 US cents per share. This is the metric that the board will use in considering a cash dividend for the year.

Grindrod Shipping’s vessel revenue halves year-on-year (JSE: GSH)

If you needed further proof that shipping is cyclical…

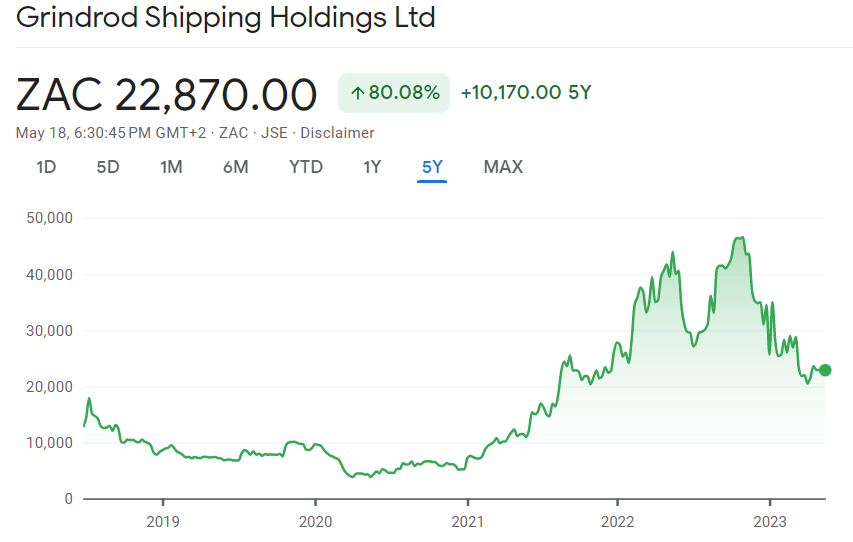

During the pandemic, shipping companies made more money than they could count. In the latest quarter, Grindrod Shipping just reported a loss. Here’s what that journey looks like on a share price chart:

If we dig into the details, we find that revenue fell year-on-year from $110.3 million to $76.8 million. That isn’t quite the entire story, as vessel revenue fell from $110.2 million to $52.8 million. This is because the sale of vessels is recognised as revenue, so you need to strip that out in my opinion to see what is really going on.

To give a better sense of just how significant the drop in shipping rates has been, Handysize TCE (the way of measuring daily rates in this industry) was $9,491 per day in this quarter vs. $22,201 per day in the comparable quarter. The trend is similar in other shipping sizes.

When you combine this with pressure on operating costs from the likes of lubricating oil, the profits disappear as quickly as they arrived. Gross profit fell from $40.7 million in Q1 2022 to $7 million in this quarter.

The company fell from a profit of $29 million to a loss of $4.3 million in this quarter.

Investec achieved a juicy increase in HEPS (JSE: INL)

This is a case study in the joy of positive JAWS

For some reason, I’ve not really seen the JAWS ratio make its way outside of banking. Even Investec doesn’t seem to use the term in the SENS announcement dealing with results for the year ended March 2023. Having spent time working in a different local bank, I can tell you that JAWS is a major focus area for the traditional South African banks.

It’s simple, really. JAWS measures the difference between the growth rates of income and expenses. If those JAWS are pointing the right way, then margins go up. If expense growth is outpacing income growth, margins go down.

At Investec, the latest period reflects revenue growth of 14.6% and operating cost growth of just 9.5%. The net result? A 28% increase in pre-provision adjusted operating profit. Although the credit loss ratio increased to 23 basis points (still below the through-the-cycle range of 25 basis points to 35 basis points), HEPS was 25.3% higher.

With a geographical lens, Southern Africa grew adjusted operating profit by 14.6% and the UK business grew by 30.5%.

Return on equity has increased from 11.4% to 13.7% and the net asset value has remained flat despite the distribution to shareholders of the 15% stake in Ninety One, along with other dividends and share buybacks.

Strategically, the group will hope that combining Investec Wealth & Investment UK with Rathbones plc will create a stronger franchise in the UK in the wealth management space.

The dividend payout ratio is largely consistent year-on-year, so the dividend per share is 24% higher.

The share price is up more than 18% in the past year.

Investec Property Fund is a lot less juicy than the bank (JSE: IPF)

The decline in distributable income per share is in line with guidance

These results are further proof of my irritation with property “ManCos” and how they are little more than a glorified way to rip off shareholders. The management teams of property companies obviously play a substantial role in results, but they are ultimately managing a stream of cash flows and they are beholden to macroeconomic challenges that are always blamed for tough results.

Do they deserve an asset management fee for this rather than a salary and bonuses? Do they really behave like fund managers with a broad mandate, or do they behave like operational managers in the same way as executives in other sectors do? I think my view on it is obvious.

For the year ended March, Investec Property Fund reported a drop in distributable income per share of 2.8%. The weighted average cost of funding in Europe was part of the problem, with rates now capped and limited further risk over the next 2.5 years. Those hedges don’t come for free, I might add.

The loan-to-value ratio of 43.4% looks high. The target is 35%, so capital will need to be recycled to lower debt.

The guidance for FY24 is low single digit growth in distributable income per share. It’s far more exciting to be in the ManCo than on the shareholder register, I’ll tell you that much.

Netcare reports a significant jump in earnings (JSE: NTC)

The post-COVID normalisation continues

For the six months to March 2023, Netcare expects to report HEPS that will be between 39.8% and 41.4% higher. The management team likes to use adjusted HEPS to measure performance, with that metric up by between 31.0% and 32.4% – a lower growth number but still substantial.

In absolute terms, adjusted HEPS will be between 46.1 cents and 46.6 cents.

The last interim results that had no COVID impact were for the six months to March 2019. Sadly, that was before the implementation of IFRS 16, which arguably had an even larger impact than the onset of COVID right at the end of the 2020 interim period.

To give you context, I’ll thus mention the interim 2020 HEPS of 79.0 cents. As you can see, we are still running well below those levels. This explains the share price:

Purple Group confirms the terms of the rights offer (JSE: PPE)

Sanlam is underwriting the offer at Purple level and following its rights in EasyEquities

As the management team has been saying for a while, Purple Group needs to raise capital for the growth ambitions of EasyEquities. The company wants to replicate its model in other markets where the metrics look appealing in terms of potential user numbers, like Kenya. Efforts in the Philippines have already been underway for a while now.

The pricing for the offer has been announced as 81 cents per share, a discount of 31.87% to the 7-day VWAP. This rights offer will increase the number of shares in issue by 9.25%.

With Sanlam willing to underwrite the offer at that price, it gives a good idea of where an institution on the inside sees value in the shares. It also gives final evidence of just how ridiculous things had gotten at nearly R3.50 per share at the start of 2022.

Aside from Sanlam’s underwriting, shareholders with 27.12% of shares in issue have provided irrevocable commitments to follow their rights in full.

Sanlam will earn a 2% underwriting fee for the pleasure. This is standard market practice, as the reward for Purple Group is that the capital raise has effectively been derisked. The money will be raised – it just depends from who.

PLEASE NOTE: if you are a Purple shareholder, you will receive letters of allocation in your brokerage account on 29 May. If you don’t want to follow your rights and put in more money, you would be very silly not to try and sell the letters, as they will be worth something on the open market (likely close to the prevailing market price less the rights offer price). In other words, if you do nothing at all, you are likely to suffer a loss in value.

Across almost the entire business, Sanlam is stronger (JSE: SLM)

It’s little wonder that they are being such a supportive partner to Purple Group

In the first quarter of 2023, Sanlam reported a 25% improvement in the net result from financial services and a 38% jump in operational earnings. New business volumes are up at group level and even where there are pressures on volumes (like in the life business), value of new business margin has improved.

It was only the Investment Management business that reported a year-on-year drop in profits, down 2% as reported and 8% in constant currency. Sanlam notes a substantial once-off in the base, without which the result would’ve been 11% higher. At the other end of the spectrum, we find the Credit and Structuring segment as the biggest winner, up 45% as reported and 37% in constant currency.

As noted in the Santam update earlier in the week, the Allianz transaction is expected to close in the second half of 2023. It’s been a busy period of corporate finance for Sanlam (including deals with Absa and AlexForbes in the past couple of years), underpinned by solid numbers.

Little Bites:

- Director dealings:

- A number of associates of Piet Mouton have bought shares in Curro (JSE: COH) worth nearly R6.6 million.

- A senior executive of Capitec (JSE: CPI) has sold shares worth R5.6 million. The share price has fallen 35% in the past year and I expect that to continue in this environment.

- Sabvest Capital (JSE: SBP), the investment entity of Chris Seabrooke who sits on the Transaction Capital (JSE: TCP) board, has bought another R700k worth of shares in the embattled company. The price paid was roughly R7.00, so this helps bring down the average in-price.

- GMB Liquidity (the entity related to the new CEO of Grand Parade Investments – JSE: GPL) bought another R147k worth of shares in the company.

- A director of Thungela (JSE: TGA) sold shares worth R106k. The share price has lost nearly half its value this year as coal prices have come off!

- An associate of a director of Ascendis Health (JSE: ASC) bought shares worth R49k.

- Newpark REIT (JSE: NRL) has almost no liquidity, so the results only earn a spot in Little Bites on an otherwise busy day. The numbers look fantastic, with this tiny REIT (it only owns four properties, including the JSE building) growing net asset value per share by 5.68% and HEPS by 26.5%, with the dividend up by 43%. The total dividend for the year was 67.12 cents per share, a trailing yield of 14.9% on the current price of R4.50 – if you can get shares at that price.

- Kibo Energy (JSE: KBO) seems to be trying quite hard to use SENS as a public relations machine rather than an investor information platform. One of the announcements on Thursday was about an agreement to establish a joint technical committee – exciting, isn’t it? The other was a lot more detailed, with a joint venture agreement between Mast Energy Developments and a new consortium regarding gas peaker plants. That consortium will inject £33.6 million into the joint venture and Mast Energy will contribute assets.

- At its AGM, ADvTECH (JSE: ADH) noted that the business has maintained positive momentum and is trading in line with expectations. Importantly, R245 million of tertiary debtors outstanding at year-end have been collected and system issues have been largely resolved.

- Industrials REIT (JSE: MLI) is hoping to avoid having to publish another set of annual results. The scheme to take the company private is planned to have an effective date of 21 June 2023. Results would’ve been published on 9 June, but the deadline is the end of June. In other words, the company may get away with being private before the deadline, so there may not be another set of annual results released publicly.

- AYO Technology (JSE: AYO) released further details on the repurchase and settlement agreement with the PIC. The repurchase of shares for R619.4 million was paid and settled at the end of March, reducing cash from R1.1 billion to R491 million. The company is also engaging with the JSE regarding how to implement the Government Employees Pension Fund’s option to sell another 5% in AYO back to the company at the higher of R20 per share or the prevailing 90-day VWAP. The option is valid for up to three years.

- The sale of a property by a subsidiary of Novus Holdings (JSE: NVS) for R125 million has met all conditions precedent and will now be implemented.

- Impala Platinum (JSE: IMP) picked up another 0.07% in Royal Bafokeng Platinum (JSE: RBP), taking the stake to 45.82%.

- Chrometco Limited (JSE: CMO) is suspended from trading and is in business rescue. The meeting of creditors scheduled for 16 May has been adjourned based on a court application issued by the Sail Minerals business rescue practitioner. These companies fighting is like one of those drunken bar fights between two blokes who both should’ve left to go home hours ago.

- Another JSE zombie is Union Atlantic Minerals (JSE: UAT), suspended from trading and needing to finalise audits going back to 2021. There are negotiations underway with a potential investor to try and rescue the thing, with loans being advanced to the company to get its house in order.