A rare update from farming group Crookes Brothers (JSE: CKS)

A substantial farming operation in Caledon is being sold for R200 million

Crookes Brothers isn’t a company that you’ll hear from very often on SENS. They tend to just get on with it, navigating the challenging world of primary agriculture. The group is in the process of selling certain farming properties that aren’t generating returns in line with targets. This will enable Crookes Brothers to reduce debt and invest in other diversification projects.

The big news is the sale of Vyeboom Fruit Farm for R200 million, consisting of 404 planted hectares and related infrastructure.

One of the conditions is the purchaser (a Western Cape fruit farming business) obtaining a loan from Standard Bank. There’s no guarantee of this sale going through until the conditions are met.

The profit after tax for the farming operation for the year ended March 2022 was just R9.8 million and the net asset value was R265.2 million.

This is a Category 1 transaction, which means a circular will be sent to shareholders to approve the deal. It will no doubt include many interesting details around farming!

Hudaco announces a significant R315 million deal (JSE: HDC)

The acquisition of Brigit is a big investment into the fire protection space

Hudaco is an industrials group that tends to do interesting deals. The latest example is the Brigit group of fire protection companies, clearly named after the founder Brigit van Zyl. This is a complementary acquisition for Hudaco as it bolsters the services already being sold into the security industry.

There are 65 employees in the business and revenue is R215 million per year. Profit for the year ended February 2023 was R36 million.

The maximum price is R315 million, based on average annual profits for the two years after the deal. The initial payment is R143 million and the rest is payable over two years.

Importantly, the current managing director of the business will enter into an employment contract for two years and has signed a restraint of trade covering a further three years.

Huge Group closed 14% higher, but watch the spread (JSE: HUG)

The net asset value per share is between 4.92% and 5.42% higher

The bid-offer spread on Huge Group is worthy of the company’s name, which is why you can see massive swings in a single day. The price action needs to always be interpreted very carefully.

After Huge Group decided to call itself an investment entity and change its accounting approach to rather reflect the fair value of underlying assets, the right metric to look at is technically net asset value (NAV) per share. This increased by between 4.92% and 5.42% in the year ended February 2022, implying a range of R9.41 to R9.45.

The share price of R2.74 is your best evidence of what the market thinks of the director valuations underpinning that NAV.

Invicta: focus on HEPS, not EPS (JSE: IVT)

Major asset disposals and fair value gains in the prior period are distorting things

There are very good reasons why investors tend to focus on HEPS rather than EPS. The H for “Headline” makes all the difference, as it splits out many of the accounting funnies and once-offs that tend to skew results.

For example, in the latest Invicta trading statement for the year ended March 2023, HEPS is up by between 43% and 53% whereas EPS is down between 32% and 42%.

To understand this properly, you need to take note of the profit on disposal of businesses in the comparable prior period and a large fair value gain on remeasurement of joint venture investments. This is included in the base period for the EPS calculation but not the HEPS calculation.

HEPS is thus the best measure of the performance in the core business and with a range of between R4.72 and R5.05, Invicta is trading on a Price/Earnings multiple of roughly 5.8x at the midpoint.

Momentum Metropolitan reports solid year-to-date growth (JSE: MTM)

For the nine months ended March, normalised HEPS grew strongly

There aren’t many local companies that provide quarterly updates. Momentum Metropolitan is one of them, with an operational update released for the nine months ended March 2023.

Normalised HEPS has increased by over 32%, with a major driver being an improved mortality experience in the life business thanks to a less severe impact of Covid in this period. Share buybacks helped here as well, as normalised headline earnings increased by 29%. The additional 300 basis points was thanks to the number of shares in issue.

As is usually the case in these groups, new business volumes were up in some areas and down in others.

Annualised return on equity for the period of 18% was within the target range of 18% to 20%.

It looks like Hillie Meyer will be leaving the group on a high, despite the challenging economic conditions in which the business is operating.

Even Pepkor can’t escape these retail pressures (JSE: PPH)

These are dark days in our economy – literally

Pepkor is seen as a relatively defensive retailer in this market, or at least as defensive as a clothing and homeware retailer can really get. With a firm focus on a value offering, Pepkor competes on a combination of price and quality rather than brand. The challenge is that “defensive” is a relative term in South Africa, as the core client base of lower income consumers is under immense pressure from food and transport inflation.

I think there’s an argument that retailers further up the pricing curve are perhaps more defensive in this environment, as their customer base isn’t part of the “working poor” group of South Africans whose plight is genuinely heartbreaking.

That plight is clearly visible in the numbers for the six months to March, with 4.3% growth in revenue and an 11.7% drop in HEPS (or 8.6% excluding non-recurring items). Diesel costs increased by 142% to R72 million, which isn’t a total disaster in an expense base of R7.8 billion but definitely doesn’t help in a low-growth environment.

Ackermans is really struggling in this environment with an 8.3% drop in like-for-like sales, driving a 2.0% drop in like-for-like sales in the clothing and general merchandise segment. Overall growth in that segment was 7.0% thanks to Avenida in Brazil performing ahead of expectations.

Amazing, isn’t it? Businesses can function when they have electricity.

The trouble with poor performance at a retailer is that the balance sheet deteriorates rather quickly, with inventory levels up by 11.7% thanks to slower sales in the core operations. So not only is profitability down, but more working capital is tied up on the shelves.

PEP Home grew by 18.8% as another desperately needed highlight in this story.

Furniture, appliances and electronics retailer JD Group was impacted by weak demand and a 3.7% drop in like-for-like sales. Online sales are now 10% of the tech division’s turnover.

The Building Company managed to maintain its sales levels, which frighteningly means that it outperformed its competitors.

On the FinTech side, Flash improved profitability by over 20% and the Capfin lending business expanded its loan business. A sad reality of tough times is that it isn’t difficult to find people to lend to.

On that note, group cash sales grew by 2.6% and credit sales grew by 36.7%.

In terms of outlook, Pepkor notes that April trading was weak but May was better. Overall, the operating consumer environment is not expected to “improve any time soon” – ouch.

Our economy is severely broken and I do not see any obvious way for that to change. You hold shares in local retail businesses at your own peril, with Pepkor down over 11% in afternoon trade.

And guess what? Steinhoff is also impacted by this. If the equity in Steinhoff was worthless before, what is it now?

We finally know who Primeserv is buying (JSE: PMV)

On a market cap of just R130 million, I guess a deal worth R11 million is material

This transaction isn’t going to blow your socks off in terms of deal value, but at least we now know that Primeserv is acquiring Pinnacle Outsource Solutions and AJR Enterprises for just under R11 million.

These businesses supply temporary employment services within the logistics industry.

The purchase price is payable over three years based on net profit after tax targets for each of 2024, 2025 and 2026. This is a sensible structure when acquiring such a small company.

The profit after tax for the group was R4.5 million in the 2022 financial year, so there’s a good example of how low the valuation multiples are for private companies in South Africa.

Sirius refinances debt at 4.25% (JSE: SRE)

Welcome to the yield curve

When assessing property funds, it is very important to consider the impact of refinancing of existing debt. In a steady rate environment, that’s not a big deal. In a rising rate environment, it absolutely is.

Sirius Real Estate has refinanced a €58.3 million 7-year facility approximately seven months in advance of expiry, which I suspect is just a sign of the company’s expectations for further rate increases.

The all-in fixed rate is 4.25%, which is enough to take the group’s weighted average cost of debt from 1.4% to 2.1%. The total weighted average debt expiry has increased from 3.3 years to 5.0 years.

Another €49.3 million worth of debt is expiring within the next three years.

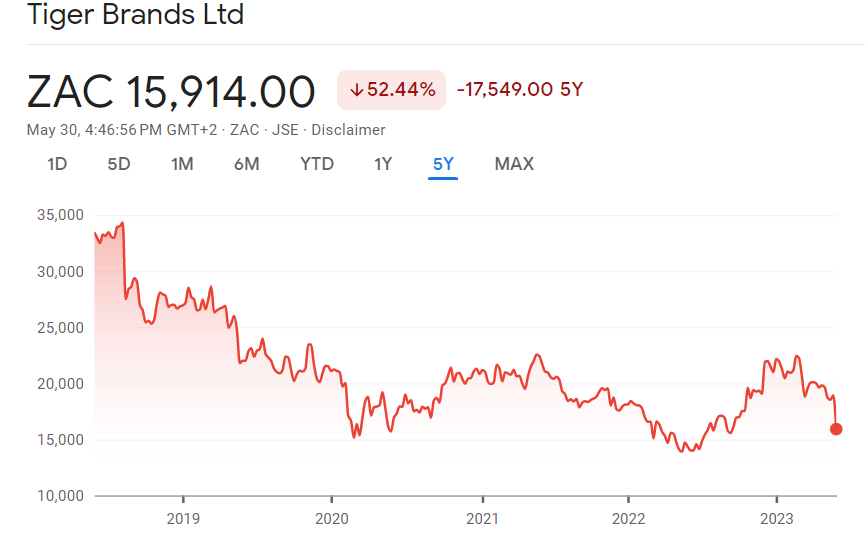

Tiger gets slashed down to March 2020 levels (JSE: TBS)

Food inflation is out of control

In case you’ve recovered from reading the Pepkor numbers, I’ll now hit you with the revenue growth of 16% at Tiger Brands.

But that’s great, isn’t it? It would be, if it wasn’t for the fact that 17% is from price increases and -1% is attributable to volumes.

Just let that food inflation story sink in and ask yourself: where does this end for the working poor of South Africa? Frankly, where does it end for the middle class?

Fascinatingly, Tiger Brand spent almost the exact same amount as Pepkor on diesel over the six months (in this case R76 million), which it reports as an incremental energy cost of R48 million. It’s good of Tiger to do that, as it gives us a reference point that running generators is costing roughly 60% more than using power from Eskom in those hours.

But here’s the difference in energy costs: while Pepkor only attributes 1% of operating costs to diesel, at Tiger the diesel spend is 1.9% of operating costs. Again that may not sound like a big difference, but these businesses are fighting for growth in an economy on life support and value is literally being transferred from shareholders to suppliers of diesel.

With gross margin down from 29.2% to 27.0% and pressure on expenses, group operating income fell by 9%. If you exclude the distortion of insurance payments in both periods, it was down 2%.

HEPS increased ever so slightly from 729 cents to 731 cents and an interim dividend of 320 cents was declared, which is bravely in line with the interim dividend last year.

The share price has retreated to March 2020 levels:

Trustco gives wide guidance for its NAV (JSE: TTO)

If you’re looking for precision, you won’t find it here

In the latest strange behaviour from Trustco, the company has released a trading statement that suggests its net asset value per share could be between 0.81% and 20.81% higher for the six months to February 2022. I think we can all agree that this isn’t exactly a tight range.

Results are due on 31 May, so I am sure they will be busy through the night to get that range tighter. Or perhaps they could’ve just released a trading statement timeously, rather than the day before results?

Little Bites:

- Director dealings:

- The CEO of MTN (JSE: MTN) has bought shares in the company worth $123.5k. You read that currency correctly – he bought American Depository Receipts. Fascinating.

- The CEO of Pan African Resources (JSE: PAN) has taken advantage of the share price sell-off to buy £26.4k worth of shares and a similar exposure in CFDs on the UK market where the company is also listed. The financial director followed suit but on the local market, buying shares worth R757k.

- Directors of Santova (JSE: SNV) have bought shares worth R1.27 million.

- A director and an associate of that director bought shares in Redefine (JSE: RDF) worth R470k.

- Old Mutual (JSE: OMU) has commenced its R1.5 billion share repurchase programme.

- Afine Investments (JSE: ANI) announced that its HEPS for the year ended February 2023 will be within 10% of the profit forecast at the time of listing and 20% of the prior period.

- Stefanutti Stocks (JSE SSK) has received R90.85 million under the project arbitration award and has made a capital repayment of R50.6 million towards the funding loan.

- Southern Palladium (JSE: SDL) announced a mineral resource update that shows a 39% increase from the resource presented in the prospectus last year. The management team also sounds pleased with the conversion of Inferred to Indicated. These are technical terms that make sense to geologists.

- Delta Property Fund (JSE: DLT) has agreed to sell 5 Walnut Road, Durban for R46 million. The proceeds will be used to reduce debt with the loan-to-value expected to decrease from 58.2% to 58%. Depressingly, a circular is needed for the deal which is costly and time consuming. This really is picking up pennies in front of a steamroller, but it’s not like the company has a choice.

- If you want to reinvest your dividend in Dipula Income Fund (JSE DIB), the reinvestment price is R3.52 per share which is a 3.00% discount to the 30-day VWAP.

- Mantengu Mining (JSE: MTU) announced the successful commissioning of the Langpan Mining Co chrome processing plant. First deliveries from the plant are expected imminently. There are another two processing plants that Langpan has invested in, both expected to be commissioned in August 2023. The company has also announced the appointment of a general manager of Langpan who comes with extensive experience, most recently within Northam Platinum.

- In other commissioning news, Wesizwe Platinum (JSE: WEZ) has announced the commissioning of the Bakubung Platinum Mine processing plant.

- The creditors of Tongaat Hulett Developments (the property subsidiary of Tongaat Hulett JSE: TON) have approved the business rescue plan.

- Sable Exploration and Mining (JSE: SXM) released results for the year ended February that reflect a 2% drop in EBITDA and a 24% drop in the NAV per share. This is a highly speculative mining group in a state of flux and the financials aren’t the major focus for exploration companies.

- With tough times at the company, it’s not ideal that the Company Secretary of Nampak (JSE: NPK) has resigned from the group after 19.5 years of service.

Ghost, I’m not bright but help me out here: Hudaco is buying Brigit Fire for R315 million.

Purchase price based on two years profit which is R72 million?

What am I missing?

Hey Julian – you’re missing the valuation multiple. Companies usually change hands on a multiple of revenue and this is no different. So the purchase price is calculated with reference to those profits, which doesn’t mean it is equal to those profits. Hope that helps!