Afine’s profits are in line with the pre-listing forecast (JSE: ANI)

Year-on-year comparability is limited due to restructuring activities

Afine Investments is a REIT that owns a portfolio of fuel filling stations. The numbers for the year ended February 2023 reflect some big year-on-year moves, but the company is reminding investors that comparability on that basis is limited.

Instead, the focus is on the results vs. the forecasts made in the pre-listing statement. On that basis, distributable profits are actually slightly higher (6.5%) than the forecast levels and HEPS is in line with the forecast.

The total dividend per share for the year was 43.83 cents. The current share price is R4.49 but the bid-offer spread is absolutely huge, so good luck getting a trade through.

At Capital Appreciation, growth comes at a cost (JSE: CTA)

Strong revenue growth has been offset by expense growth and a large credit loss provision

In a trading statement for the year ended March 2023, Capital Appreciation noted an impressive 19% growth rate in revenue. That’s largely where the good news ends for investors, as there has been a significant increase in expenses and there’s a nasty credit loss provision as well.

The expenses relate to the core business, so let’s start there. The rate of growth in expenses isn’t disclosed in this announcement but we know that HEPS is between -2% and -1% lower than the prior year, which means between 13.13 cents and 13.27 cents.

That HEPS number excludes the credit loss provision for the GovChat associate of R70.8 million. If we take that into account by looking at EPS, there’s a drop of between -45.5% and -44%.

The share price closed 6.3% lower at R1.48, which implies a Price/Earnings multiple of roughly 11.2x. Detailed results are expected on 6th June and I’m sure that investors will take a detailed look at the expense growth and how it supports future growth.

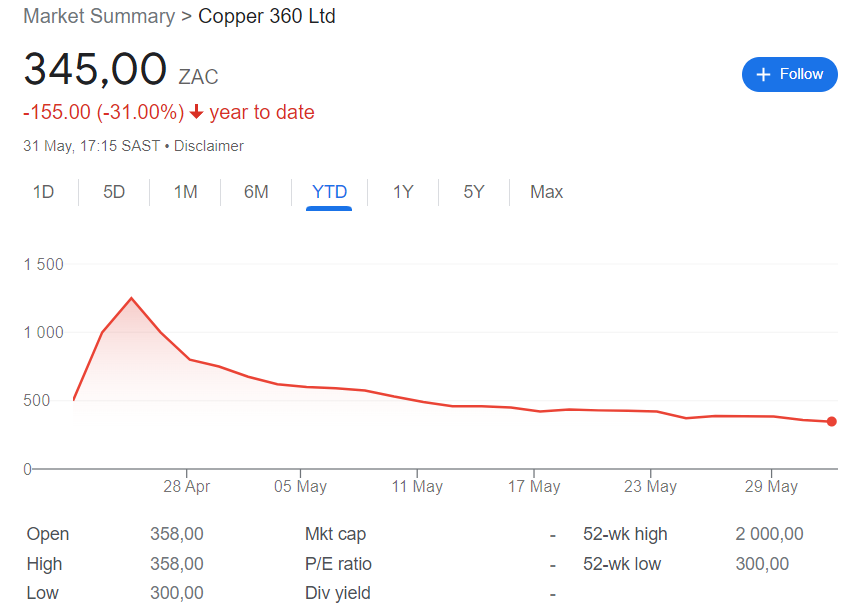

Copper 360 was classic IPO silliness by punters (JSE: CPR)

As I joked at the time of the listing, the ticker CPR might indicate what some people will need!

It certainly isn’t the company’s fault that investors love throwing money away shortly after an IPO. This is a story as old as time, which is precisely why I avoid IPOs as a rule (just look at Zeda as another example). Here’s the Copper 360 chart:

The company has released results for the year ended February 2023 and has also given an operational update.

Growth is rapid, with tons milled up by 296% and copper sales up by 191% The average copper price received fell by 5.4% measured in rand. I must highlight that there was only five months of focused trading in this period, so I’m not sure that the growth rates are all that useful.

With the group very much in the early stages of its life, the revenue increase of 175% was overpowered by a 279% increase in operating expenses. This drove a swing from an operating profit of R9.8 million to an operating loss of R78.5 million. That’s the number that I would keep in mind.

I would also take note of management’s commentary around a decrease of 36% in the delivered copper grade, a direct result of lower grade stockpiles of ore that necessitated the acquisition of a R30 million crushing plant. The company still believes that the forecast copper production for FY24 that was noted in the pre-listing statement can be achieved.

Fairvest: it matters which class of shares you own (JSE: FTA JSE: FTB)

The A shares are smiling – the B shares not so much

In property funds with two classes of shares, you really need to do your homework. These legacy structures were put in a place during a time when institutional investors demanded a mix of safer and riskier structures. The theory is that one class is more defensive than the other, but then offers less upside as well.

At Fairvest, the results for the six months to March 2023 reflect a drop in net asset value (NAV) per share for both share classes. The dividend for the A shares is 5% higher and for the B shares is 2% lower.

The loan-to-value sits at 38.4%.

In addition to its portfolio of 137 properties, Fairvest holds 60.9% in Indluplace and 5.1% in Dipula Income Fund. Remember, Indluplace is currently under offer from SA Corporate Real Estate.

The market is sending a Huge message about valuation (JSE: HUG)

Some of these investment assumptions are breathtaking

Despite the obvious economic pressure we find ourselves in, Huge Group somehow managed to increase the net asset value (NAV) per share by 5.3%. It now sits at R9.4385 per share, with the share price at R2.74. This discount to NAV is gigantic even by investment holding company standards, so something isn’t adding up.

I decided to go digging into the way in which the assets have been valued. It’s not hard to see why the market puts more faith in Eskom’s promises than this valuation.

Let’s start with the R571.9 million valuation on the Huge Connect preference shares. With the total unlisted portfolio apparently worth R1.46 billion, this is a very big contributor. I therefore find it remarkable that the valuation yield is 10.85% at a time when the South African 10-year bond yields are over 11%.

Is Huge less risky than the government of the country in which it operates? Do me a favour.

We then arrive at Huge TNS, valued at R641 million. The weighted average cost of capital applied here is 16.81%, with meaty revenue growth of 10.13% in the model. This division is the combination of Huge Networks and Huge Telecom, with the Telecom side of the business having historically struggled. Personally, that discount rate feels too low for me.

The share price is down 27% in the past year. Against that backdrop, I cannot see how any valuation increase of 5.3% in the NAV per share could hope to be taken seriously.

Impala withdraws allegedly misleading statements (JSE: IMP)

The bun fight between Northam Platinum and Impala Platinum is setting interesting precedent

If you have deal fatigue regarding the battle for control of Royal Bafokeng Platinum (JSE: RBP), can you imagine how the parties and advisors involved must feel?

Northam Platinum (JSE: NPH) eventually walked away from the deal, citing a drop in PGM prices. This left Impala Platinum as the only horse in the race to get control of Royal Bafokeng. This has finally happened thanks to the PIC selling its 9.26% stake in Royal Bafokeng Platinum to Impala Platinum.

After the latest trades, Impala Platinum holds 55.46% in Royal Bafokeng Platinum – a controlling stake. This triggers the public interest and related conditions of the approval by competition authorities, which inevitably means a requirement to execute B-BBEE ownership transactions. This will include community and staff trusts as well as the introduction of an empowerment consortium.

Black retail investors get shut out as usual, although Royal Bafokeng Platinum does have a history of being highly focused on regional empowerment rather than broader, national empowerment. This is a more reasonable outcome than when Absa didn’t do a retail B-BBEE deal, for example.

Although Northam Platinum pulled out of the deal, they remained a thorn in the side of Impala Platinum, as the offer requires a compliance certificate from the Takeover Regulation Panel (TRP). To get that certificate, certain complaints made by Northam Platinum needed to be resolved.

To this end, Impala Platinum has elected to formerly withdrawn certain statements made by executives to the media and in results presentations over the course of the offer. The comments vary, with references made to the market dynamics of the deal, the appetite for time extensions and comments on the Competition Commission approval.

The official line is that Impala Platinum has withdrawn the statements and advised the public to ignore them in consideration of the offer. This is not an admission that the statements were false or misleading. We will now wait and see how long the Compliance Certificate takes to come through. The longstop date for the offer has been extended once again to 28 June, so that’s the (very loose) deadline that Impala Platinum has set to meet this condition.

Mahube Infrastructure needs more wind, please (JSE: MHB)

A feel-good asset isn’t always a good asset

Mahube Infrastructure has investments in solar PV and wind farm projects. We would all love these to be slam-dunk winners, but sadly life is never so easy.

For the year ended February 2023, the revenue was actually negative R14.1 million. I don’t think I’ve ever seen negative revenue before and I didn’t have time to dig into the financials on this. They note positive dividend income of R18 million and then a negative change in the fair value of the assets, which decreased revenue by R33.1 million.

Perhaps someone who is more up to date than me on IFRS can explain why the change in fair value is recognised as revenue.

Either way, the worrying bit isn’t just the change in macroeconomic inputs that has affected the valuation. No, I would be more worried about the comment that the wind IPP industry across the country is experiencing lower winds than expected. This certainly highlights the risks inherent in such projects.

The tangible net asset value has dropped from R11.21 last year to R9.91 in this period. There is no final dividend after an interim dividend of 45 cents was declared earlier this year.

Nampak prepares for its rights offer (JSE: NPK)

A share consolidation is necessary to escape penny stock territory

After the monumental destruction of shareholder value at Nampak, the share is now trading at 73 cents (down another 4% for the day). This isn’t great for a rights offer that is clearly going to be priced at a discount, with Nampak worried about setting the rights offer price at a “practical level” – that says a lot about what is coming.

In preparation for the R1 billion capital raise that is desperately needed to save the balance sheet, Nampak is proposing a share consolidation that turns every 250 shares into 1 share. In other words, the price should be 250 times higher after this as there will be fewer actual shares in issue.

Some cash will change hands, as fractional entitlements (i.e. where you own fewer than 250 shares) will be cash settled at a 10% discount to the VWAP of the first day of trading.

The slide in Nampak’s value has been extraordinary and I wouldn’t be surprised to see more pain before this rights offer is concluded.

Sirius reports strong growth in its distribution (JSE: SRE)

The benefit of low funding costs was still in these numbers

Sirius Real Estate has given the market guidance on the total expected dividend for the year ended March 2023. The increase is between 26.2% and 31.4%, which is obviously a good outcome for shareholders.

After the recent announcement around the refinancing of debt and the increase in funding cost as rates have gone through the roof in the past year, I would caution that this growth probably isn’t sustainable.

Spar is the latest retail casualty, tanking 15% (JSE: SPP)

The South African retail apocalypse continues

The local retail industry is being smashed by load shedding. I was bearish on this sector coming into 2023 and had written on that view a few times. I wanted to be wrong, but sadly I wasn’t.

Spar has guided a decrease in HEPS of between -35% and -25% for the six months ended March 2023. This horrific outcome isn’t from a lack of turnover growth, but rather from huge jumps in operation expenses.

Spar is a wholesaler, so fuel and distribution cost pressures sit squarely in this group. There was also substantial investment in IT, so that didn’t help matters against this economic backdrop, as I don’t think I’ve ever seen a SAP implementation that hasn’t been accompanied by major inventory issues and implementation challenges. Even the European operations weren’t immune from the cost pressures.

And of course, the environment with higher interest rates is driving an increase in net finance costs.

If we dig deeper, Spar’s wholesale grocery business grew turnover by 7.9%. TOPS, usually a strong performer, suffered a 1.9% drop in sales vs. a high base period when South Africans were unleashed to behave wildly after lockdowns. Build it reported further declines, down 3.8%.

Looking abroad, BWG Group in Ireland and South West England reported 8.8% turnover growth measured in euros. SPAR Switzerland fell by 4.3% in local currency thanks to volume declines. Turnover in Poland was up 4.9% in local currency despite contracts being terminated with 58 retailers in July 2022.

The pharmacy business is tiny but was actually the highlight, with sales up 20%.

The group reckons that the retailers spent over R700 million on diesel in this period. At wholesale level, diesel costs “more than tripled” and pressure in the retail stores obviously flowed to the top, as Spar doesn’t have a business without its franchisees doing well.

Much like the entire sector right now, I continue to avoid this one.

Tongaat Hulett has published the business rescue plan (JSE: TON)

It looks like a JSE delisting is likely

If you would like to see what a business rescue plan looks like, you’ll find the plan for the group holding company at this link.

In summary, the business rescue practitioners are looking for strategic equity partners for the business and it looks likely that a delisting from the JSE will take place. The plan notes that if the company was liquidated, unsecured creditors would receive nothing. Shareholders would therefore also receive nothing.

In case you’re wondering how that happens, BDO has estimated the assets to have a gross realisable value of R5.1 billion. Secured creditors have claims of R7.3 billion and unsecured creditors had another R1.7 billion excluding inter-company loans.

With 2,500 direct employees and 23,000 indirect jobs depending on this group, the reality is that saving Tongaat Hulett is a social imperative. The effect on the local sugar industry would be horrific if this group was not able to continue in some form or another.

To achieve that, a strategic equity investors will need to buy the assets of the group out of business rescue, with the creditors being dealt with through this process. Expressions of interest have been requested from eight bidders, so there is interest in the asset. It just won’t help existing shareholders who have essentially been wiped out.

Little Bites:

- Director dealings:

- Two directors of Calgro M3 (JSE: CGR) bought shares worth R436k.

- An associate of a director of British American Tobacco (JSE: BTI) bought shares worth £21.9k

- MTN (JSE: MTN) is holding a capital markets day over two days this week (so the name is a bit odd, but it’s an industry standard). There are a large number of materials, including several podcasts, available at this link for those interested.

- In a very interesting move, Serialong Financial Investments is being required to deliver nil paid letters to Glen Anil Development Corporation even on the Purple Group (JSE: PPH) shares that Glen Anil only has the option to acquire. The argument is that the rights were attached to the shares at the time of the original option agreement, even though the rights offer hadn’t been announced at that stage. I really can’t see why Glen Anil would exercise the options then, as the rights offer lets them mop up a large number of shares at a vastly lower price than the strike price in the option agreement. This is painful for Serialong.

- Renergen (JSE: REN) has released its financials for the year ended February. With the group very much in the early stages of production, I don’t pay much attention to the headline loss per share of 19.89 cents. The current share price is being driven by a multitude of factors and I don’t think last year’s results feature highly on the list.

- RH Bophelo (JSE: RHB) is a healthcare investment entity that focuses on net asset value as its leading metric. In the year ended February 2023, this has decreased by 3.5% overall and 3.6% on a per share basis. Cash is up from R8 million to R152 million but borrowings have increased from nil to R102.5 million and I’m not sure this is the right environment for borrowing money. There was no dividend in this period, unlike in the last period.

- Metals business Insimbi Industrial Holdings (JSE: ISB) announced results for the year ended February 2023. A drop in revenue of 5% drove a decrease in operating profit of 3%. At net profit level, there was a 2% increase and at HEPS level, there was growth of 12%. The metric to keep an eye on is cash from operating activities, down 30%.

- Trustco (JSE: TTO) released results for the six months ended February 2023, reflecting a drop in NAV per share of 10.6% that the company largely attributes to the resources portfolio and associated dilution in underlying assets.

- Brikor (JSE: BIK) released results for the year ended February, showing a 14.3% increase in revenue but a collapse in HEPS to a loss-making position of -0.1 cents per share. The coal segment was loss-making for the year but showed improvement towards the end of the period, while the brick segment performed very well overall.

- The most useful thing about the release of financial results by Buka Investments (JSE: ILE) is that at least I now know how to find the corporate website. The company is a “suspended shell” on the JSE that had no assets at the end of February other than some cash. The initial plan was to acquire a shoes business, but that was stopped for various reasons (even though the website seems to imply otherwise). The idea is now to acquire fashion businesses. After burning through R1.9 million in FY23 just to be a listed company, they better get on with it.

- The scheme of arrangement to delist Industrials REIT (JSE: MLI) was approved by shareholders, with the delisting date on the JSE anticipated to be 27 June.

- In case you’re wondering, the acquisition of Bundu Power by Ellies Holdings (JSE: ELI) is still intended to go ahead. The publication date of the circular has been extended to no later than 31 July.

- Metair (JSE: MTA) has announced that the current interim CEO and interim CFO have both been appointed to the roles permanently, which is good news for investors in terms of stability.

- Lewis Group (JSE: LEW) has repurchased a further 4.8% of issued shares during May, with a value of R114 million. Another 2.2% of shares outstanding can be repurchased under the existing authority from shareholders, calculated with reference to the number of shares that were in issue at the time the authority was granted.

- Shareholders of Tradehold (JSE: TDH) have approved the change of name to Collins Property Group Limited. It will be made effective during June.

- In other renaming news, Tsogo Sun Gaming (JSE: TSG) shareholders have approved the change of name to Tsogo Sun Limited. It will be interesting to see how the strategy develops in this group.

- Delta Property Fund (JSE: DLT) has delayed the publishing of results from 31 May to 12 June.

- Acsion (JSE: ACS) is another company with delayed results, expected to be released on 15 June.