Aveng receives the last R210 million for Trident (JSE: AEG)

This further strengthens the Aveng balance sheet

As part of the disposal of Trident Steel for cash proceeds of R1.2 billion, Aveng provided a loan of R210 million to a separate company to subscribe for 30% in the new Trident Steel business. This was subject to a call option and related demand guarantee.

The option holder has exercised the call option on the 30% stake and Aveng has called the demand guarantee, being paid R210 million in the process plus interest.

This was only ever meant to be a temporary funding arrangement and it has worked out well. Aveng will use the capital to support the McConnell Dowell and Moolmans businesses.

AYO reports a much higher loss (JSE: AYO)

It didn’t take them long to blame bad publicity and the issues with banking facilities

I would probably invest in Eskom before buying shares in AYO Technology. Here’s one of the many, many reasons why:

At a time when corporates can finally earn really strong yields on cash thanks to higher rates, AYO has decided to speculate with shareholder money in the market by buying equities.

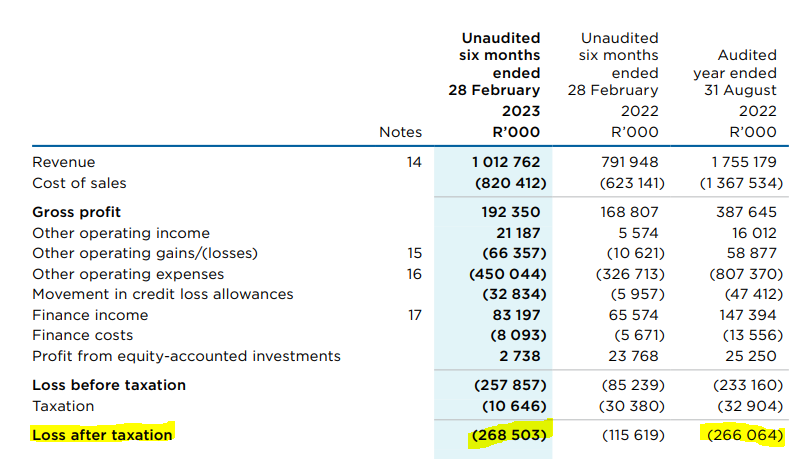

Another good reason why I wouldn’t touch this thing is that they’ve now lost more money in the six months to February than they managed to lose in the year ended August:

Impressive numbers. It’s just a great pity about the negative sign in front of them.

Bidcorp: record results in the four months to April (JSE: BID)

But the bounce isn’t coming from where you might have expected

Bidcorp has released an announcement covering the ten months to April, although much of the commentary relates to the four months ended April (i.e. trading conditions since the end of the interim period).

As you would expect, Australasia did well in this period. Europe has proven to be resilient, with the UK also doing well (with a 19% food inflation rate in the UK). Again in line with expectations, conditions in South Africa are difficult. For me, the bigger surprise was that the Chinese business hasn’t experienced the post-COVID bounce that many anticipated.

Outside of China, Bidcorp believes that most sectors of the industry (accommodation / business travel / conventions and conferences / cruise lines) are approaching normalised trading levels.

Interestingly, the margin defensiveness at Bidcorp has come from independent customers who obviously have less bargaining power. Large customers on long-term contracts have pushed back against price increases, putting Bidcorp under pressure.

The pressure on gross margin has been offset by operating costs as a percentage of revenue declining from 19.3% to 18.6%. EBITDA margin of 5.7% for the ten months to April is in line with FY19, a period before COVID.

Aside from investment in working capital, Bidcorp has allocated R1.4 billion in this financial year-to-date to bolt-on acquisitions in various geographies.

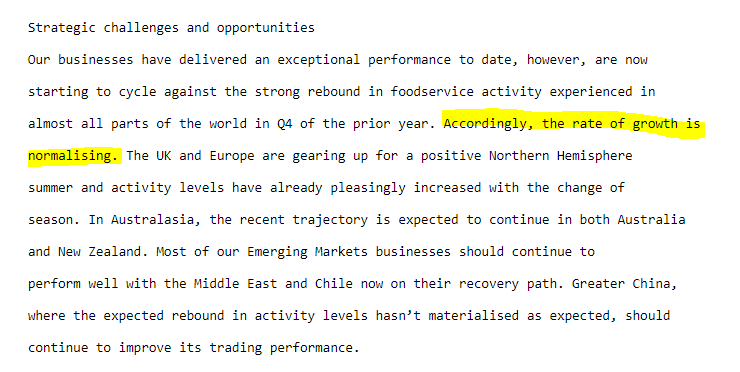

The share price dropped 4.6% on the day. Although it’s always difficult to attribute a move to something specific, I doubt this paragraph towards the end helped:

British American Tobacco on track for full year guidance (JSE: BTI)

The new CEO has delivered his maiden trading update

In the first quarter of this financial year, British American Tobacco increased the number of consumers of the ESG-friendly non-combustible products by 900,000. This side of the business is still making losses, with the dividends at the company paid firmly by the good ol’ fashioned cancer sticks.

I must highlight that even this group isn’t safe from the SAP implementation issues that always lead to havoc in inventory levels. The US had a disappointing quarter thanks to this problem.

The volume decline for the global tobacco industry is expected to be 3% for the full year. Thanks to pricing increases that make it increasingly expensive to smoke, the company expects 3% – 5% organic constant currency revenue growth. Earnings per share is expected to increase by mid-single figures.

So despite a start to the year that experienced some issues, the company hopes to still achieve full year guidance.

The market sees it as a defensive stock and a dependable dividend payer. Personally, I see it as being pretty vulnerable at these levels when it’s possible to get decent yields in many other places.

Capital Appreciation grows non-SA revenue sharply (JSE: CTA)

Aside from the GovChat issue, earnings came under pressure from headcount growth

The high level numbers for Capital Appreciation for the year ended March 2023 tell an interesting story, with revenue up by 19.7% and EBITDA down by 6.3%. This led to a 660 basis points deterioration in the EBITDA margin and an 8.9% decrease in operating profit. So even without the GovChat provision that was a major contributor in HEPS dropping by 44.5%, there was pressure in operating profits.

The group is investing heavily in its employee base, with headcount up 22.7% and operating expenses up by 43.8%. Although it makes sense that the company needs to invest for growth, Capital Appreciation can’t afford to fall into the same trap as US tech firms as local investors simply won’t be forgiving of it.

There are a few good news stories. One of them is the increase in revenue outside of South Africa, which is now 15.2% of the group total vs. just 6.6% in the comparable period. Another happy outcome is that annuity revenue in the Payments division is now just over half of total revenue in that division, so the sales of POS devices in prior years have created a substantial base of machines in the market that generate recurring income.

It’s also important to note that the there is no debt on this balance sheet. In fact, Capital Appreciation has a large cash balance that makes it a beneficiary of higher interest rates.

The total dividend for the year was 8.25 cents. This is a trailing dividend yield of 5.5%, which is high for a technology company.

Copper 360 enjoys a juicy rally (JSE: CPR)

The release of drilling results drove a strong day of trading, closing 17.9% higher

Copper 360 released an announcement full of geological terminology and a few comments that clearly got the market excited.

The Newmont Mining Company had previously drilled 123 boreholes during 1980 at the Rietberg Mine. The deposits were pre-developed but never mined. Copper 360 has a mining right over this area and owns the historical geological drillhole database, but needed to do some further drilling to confirm the validity of the database. This has been done and there’s good news, enabling the company upgrade the inferred resource of this mineralised body to the indicated and measured resource category.

The upgrade hasn’t actually happened yet, but is anticipated in coming months.

The company also gave some details on surface sampling at Wheal Julia, but stressed that these are early stage results and should be interpreted with a lot of caution. The market rally was thus surely driven by the Rietberg Mine news.

Emira flags a drop in its distribution per share (JSE: EMI)

You have to read this one very carefully

In a trading statement, Emira warned shareholders that the distribution per share for the nine months ended March 2023 will be between 18.19% and 20.69% lower than the twelve months ended June 2022.

Did you spot the nuance there? This is a nine-month period being compared to a twelve-month period.

Emira changed its financial year-end to align to that of Castleview Property Fund (JSE: CVW) which is the holding company of Emira after a reversal of assets into that listed structure.

I am not sure why the Emira announcement doesn’t make this far more explicit, as I nearly missed the change of period when I read it the first time.

Jubilee has a new partnership (JSE: JBL)

The company is investing $8 million in an upgraded plant

Jubilee has established a long-term relationship with a mining operation on the western limb of the Bushveld Complex. Jubilee is going to upgrade the existing brownfield processing facility at the mine using its process solution, with the goal of reaching annualised processing capacity of 360,000 tonnes per annum of run-of-mine by the end of June 2023. There is the option to expand this further.

The capital investment by Jubilee is $8 million.

This is a major step forward not just in terms of chrome production, but also potential earnings. This is especially true as chrome prices have remained strong at a time when PGM prices have been under pressure.

In separate news, Jubilee has now rolled out backup power to operations covering 60% of chrome processing capacity.

Perhaps surprisingly, the share price bounced around a bit during the day and closed flat.

A big year for Premier, but can it be repeated? (JSE: PMR)

There were some big strategic plays in this period that shouldn’t be ignored

In the year ended March 2023, Premier increased revenue by 23.4% and adjusted EBITDA by 16.2%. Normalised HEPS (which leaves out forex movements and a withholding tax adjustment) increased by 22.7%.

The important insight is that normalised HEPS didn’t adjust for some major strategic improvements to the business that create a significant base against which earnings need to grow next year. For example, the huge new bakery in Pretoria reached full production levels in this period. There was an acquisition of a bakery in the Western Cape. The Mister Sweet acquisition was also integrated in this period.

I take nothing away from Premier here – this was a very strong result. The numbers we saw previously during the period in which Premier was being incubated by Brait suggested that Premier is a powerful force in the market. Although this has been confirmed, I do wonder about what such a strong base means for earnings in the next period.

There’s no dividend yet, with the company intended to declare a maiden dividend after the FY24 results.

Santova releases its analyst presentation (JSE: SNV)

This makes for interesting reading after results were released in May

Santova has managed to build a business that runs at an excellent operating margin of 43%. There are many household names in the US tech industry that can only dream of this.

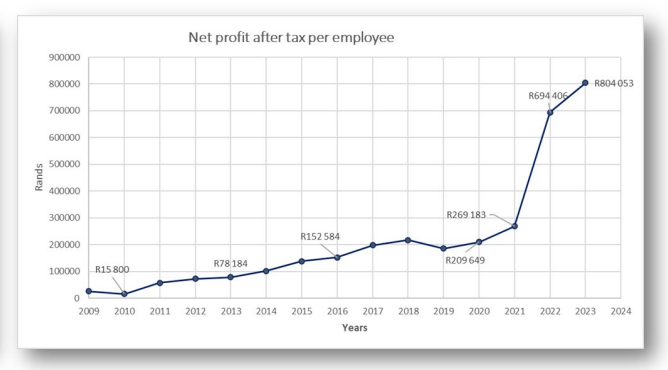

There is an incredible chart in the analyst presentation that shows just how rapidly the business model improved during the pandemic:

You can find the full presentation at this link.

Steinhoff points to the Pepco results (JSE: SNH)

This must be one of the most appealing assets for creditors

Pepco is a fast-growing discount retailer in Europe. The group is rolling out stores at pace, as evidenced in results for the six months to March.

Revenue grew by 22.8% of which only 11.1% was on a like-for-like basis, so roughly half the growth is thanks to new stores. The footprint increased by 12%.

Gross margin has come off a bit, down 90 basis points to 40.1%. This has somewhat blunted the benefit of revenue growth at profit level, with EBITDA up by 11% in constant currency.

A lot happens between EBITDA and profit before tax, not least of all depreciation on the growing store footprint. Profit after tax decreased by 14%. Although it’s not unusual to see a rapidly growing business come under margin pressure, this is something management will need to manage carefully. Importantly, the group expects gross margin to trend upwards in the second half of the financial year and that will certainly help.

Little Bites:

- Director dealings:

- A person closely associated with the CEO of Sirius Real Estate (JSE: SRE) has bought shares worth £4.7k.

- A director of Copper 360 (JSE: CPR) has acquired shares worth R36k.

- Life Healthcare (JSE: LHC) has renewed the cautionary related to the potential disposal of Alliance Medical Group. Life is engaging with various third parties.

- In a rather funny update, NEPI Rockcastle (JSE: NRP) had to release an explanatory note for an agenda item in the AGM that seeks to release directors of their liability for the 2022 financial year. South African investors obviously had a small heart attack when they saw this, but it’s a customary agenda item under Dutch law (NEPI Rockcastle is now incorporated in the Netherlands). Importedly, it doesn’t indemnify the directors from fraud etc.

- Trustco (JSE: TTO) renewed its cautionary announcement related to the management agreement and the potential resources transaction related to Meya, for which categorisation is being sought from the JSE.

- Although not really an indicator of equity returns, it’s good to see Curro (JSE: COH) receive a ratings upgrade from GCR based on improvements in the capital structure and liquidity. The agency gave Curro a stable outlook.

- As of Wednesday this week, Mediclinic (JSE: MEI) will be gone from the JSE. Another one bites the dust, taken private by Remgro (JSE: REM) alongside Mediterranean Shipping Company. Of course, indirect exposure is still possible via Remgro.

FFA deal with P & P seems to be funded with the distribution that was not made hence no LTV change.

Sirius over 5 years was a good investment per your graff other for those that bought shares when things were too good to be.true.

Thanks, Ghost.