African Bank: you can’t buy shares, but it’s worth following this story (JSE: ABKI)

Hopefully, African Bank will return to the equity market one day

African Bank is somewhat of a phoenix, having genuinely emerged from the ashes as a stable bank. Recent acquisitions have taken it a step further towards success, with Grindrod Bank now in the group as well as the assets and liabilities of Ubank.

This is now a big balance sheet, with net advances of R32.4 billion and total capital adequacy of 29.4%. In the six months ended March, operating income before credit impairments grew by 47% to nearly R4 billion.

Today, African Bank really is a bank rather than just an unsecured lending business. Unfortunately, it is struggling with credit quality in this environment, with a huge credit loss ratio of 11.1% that takes the group into a net loss position of R44 million.

The bank expects to report a profit for the full year, which suggests fairly conservative provisioning in this interim period.

Argent is growing earnings in tricky times (JSE: ART)

We have to wait until the end of June for full details

For the year ended March 2023, Argent Industrial managed to grow HEPS by somewhere between 11.3% and 31.3%. That’s a wide range and detailed earnings will only be released at the end of June, so well done to Argent for using a trading statement the way it should be used: an early warning system for a big earnings move (20% is the threshold).

This puts HEPS on between 377.4 cents and 445.3 cents. The share price closed 5.8% higher at R15.48, which means a Price/Earnings multiple of roughly 3.75x at the midpoint.

This is a very good example of a local small cap on a modest multiple.

Castleview reports on its first year that really matters (JSE: CVW)

After a recent reversal of a large portfolio of assets into this company, this will be seen as the base year

Listing a new group is a pain. A reverse listing is only slightly better to be honest, but is still seen as an easier process. This is why listed companies are sometimes used for the injection of new assets into the vehicle, with shares issued to pay for the assets and new owners effectively taking over the listed company.

This happened recently at Castleview Property Fund, a REIT that has been listed on the AltX of the JSE since 2017. Having previously owned a small portfolio of direct assets, the company is now a mid-tier REIT with net asset value of R8.1 billion after the I Group portfolio was reversed into the structure. This includes controlling stakes in property funds Emira Property Fund (JSE: EMI) and Transcend Residential Property Fund (JSE: TPF).

The year-on-year moves are thus pointless. All that matters is the current balance sheet, which reflects a net asset value of R8.64 per share and a loan-to-value ratio of 49.78%. The share price is currently R7.10 but there is absolutely no liquidity at the moment.

Emira reports for the nine-month period (JSE: EMI)

The change in year-end is key to understanding the year-on-year numbers

When comparing a nine-month period to a twelve-month period, there’s literally no point in comparing the two periods. Emira Property Fund changed its year-end to align with Castleview Property Fund (JSE: CVW) as discussed above.

The net asset value (NAV) is R16.964 per share and the current share price is R9.00, so there’s a significant discount to NAV here as we often see in this sector.

The total dividend for this period is 96.78 cents per share. If we gross that up to twelve months, it suggests a yield of roughly 14% on the current share price. Obviously, that’s a simplifying assumption that should be interpreted with caution.

At Newpark, every lease counts (JSE: NRL)

Just one lease at this small fund makes a big difference to weighted average expiry

Newpark only owns a handful of buildings, so news of a new 10-year lease at the Linbro Business Park property is important for this small fund. It’s also worth noting that the new lease allows for a solar installation, a trend that is clearly growing.

The cost to improve the property is R31.4 million and the lease renewal increases the weighted average lease expiry from 2.9 years to 5.0 years.

The renewal is in line with expectations and hasn’t affected guidance for Funds From Operations of between 63.83 cents and 70.55 cents for the year ending February 2024.

Tiny company Nictus grows earnings sharply (JSE: NCS)

With a market cap of R26.7 million, I’ll never understand why this business is listed

There’s been a steady stream of delistings from the JSE in recent times, including companies with market caps easily going into the billions. Yet, here we have Nictus and its market cap of R26.7 million, remaining listed.

I have no idea how they justify the costs or the regulatory headaches, but as long as they are happy then I guess that’s what counts.

HEPS for the year ended March is between 56% and 76% higher than the prior year, coming in at between 14.35 cents and 16.19 cents. The quoted share price is 50 cents per share but good luck getting in at that price, with the offer sitting at R1.10 per share.

Renergen reignites its share price – but will it stick? (JSE: REN)

A major milestone has been reached in the debt facilities

The good news is that Renergen has received conditional approval from the United States Development Finance Corporation for a $500 million senior debt package. A further $250 million debt facility from Standard Bank has also been approved, subject to conditions.

The conditions are very important, particularly given our recent tensions with the US. The loans need United States Congressional notification and I’m not sure what the risks are of someone raising the alarm. If there’s one thing I learnt in my dealmaking days, it’s that the deal isn’t done until the cash actually flows.

Other conditions include the raising of sufficient equity funding on the Nasdaq or through other initiatives, as well as approval by the lenders of the Engineering, Procurement and Construction (EPC) contractor as well as the Operations and Maintenance (O&M) contractor.

This is obviously a big step forward for Phase 2 at Renergen. The share price closed 7.6% higher and I suspect it will jump again once conditions are met. If they aren’t met, then it will take more than helium-filled balloons to make shareholders feel better.

Southern Palladium presents at the Junior Indaba (JSE: SDL)

This is a great opportunity to learn more about junior mining

Within the investment industry, there’s a section of people who are dedicated to junior mining assets and really digging into the geological prospects. This is highly specialised stuff, including all kinds of terminology that definitely isn’t available in your local finance textbook.

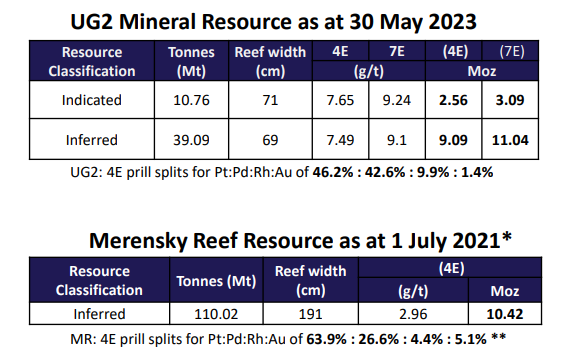

There are clever people out there who understand what this table means at Southern Palladium:

I’m definitely not one of them, which is why I would rather just give you the link to the presentation so that you can read it yourself.

Little Bites:

- Director dealings:

- If you’re looking for signs of significant buying by corporate insiders, Spear REIT (JSE: SEA) is now really dishing it up. The CEO usually buys for his family, but no fewer than seven directors have bought shares (through associates or otherwise) for a total of R3.2 million.

- Titan Premier Investments, one of the major investment vehicles of Christo Wiese, has bought shares in Tradehold (JSE: TDH) worth R790k.

- An associate of one director of Santova (JSE: SNV) has sold shares worth R270k, while an associate of a different director acquired shares worth R478k.

- Choppies (JSE: CHP) has released the circular for its rights offer that will sort out the debt : equity ratio on the balance sheet, including key shareholders effectively swapping debt for equity exposure through this process.

- Although the Exemplar REITail (JSE: EXP) shareholder register is going to look a little different, the various restructuring activities in the McCormick Property Development as the largest shareholder won’t materially change the eventual benefit ownership. This is just a typical restructure of a wealthy shareholder’s affairs.