The team at Trive South Africa looks at recent earnings from Dell Technologies Inc. To switch to Trive, >>”>visit this link>>>

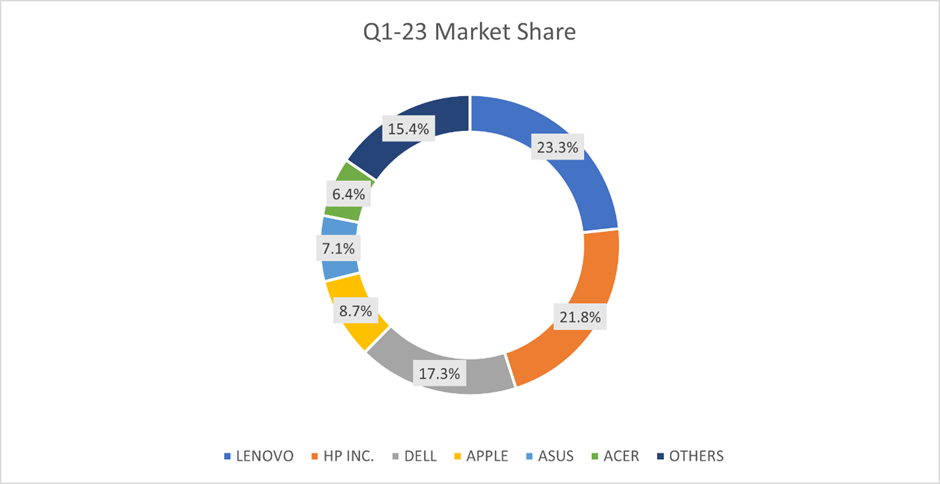

Following Dell Technologies Inc.’s earnings for the first quarter of its 2024 fiscal year, investors were probably left feeling conflicted. With a 53.06% beat, the third-largest worldwide computer manufacturer by market share crushed its earnings projections, bringing earnings per share to $1.31. Revenues were $20.92 billion, modestly exceeding Wall Street projections by 3.21%.

Although the most important income statement criteria for the quarter show decreased results year over year, the company’s performance is a far cry from the previous year. Major computer businesses are concerned, as demand is unlikely to achieve comparable levels as PC sales have fallen from their pandemic peak as work-from-home-induced electronics demand has faded.

Technical

Looking back to Dell’s 2022 fiscal year, we find a period that was one to be forgotten as the stock plunged 28.40% to the peril of its optimistic investors. The sell-off formed a descending channel pattern that caused the price to cross below the 100-day moving average, thereby validating the downtrend. Support and resistance were established at the $36.00 and $51.00 per share levels, respectively

2023 has been a reverse image of 2022 so far, with Dell’s share price up 16.5% year-to-date, supported by the rejuvenated bullish investor. The share price attracted enough upside momentum to break it out of the descending channel pattern on high volume, indicating that bearish momentum was outdone.

The share price was led toward the $51.00 per share resistance level before being met with supply pressures. A retracement is now at play, and optimistic investors could be best placed to buy the stock at a steeper discount based on the Fibonacci Retracement levels. The 50% and 61.80% Golden Ratio Fibonacci Retracement levels will likely entice bulls to participate in the market. If price action approaches either level on declining volumes, it could indicate weakening downside momentum, with a reversal imminent. Optimistic investors will likely aim for resistance at the $51.00 per share level as the exit door for a long opportunity.

Fundamental

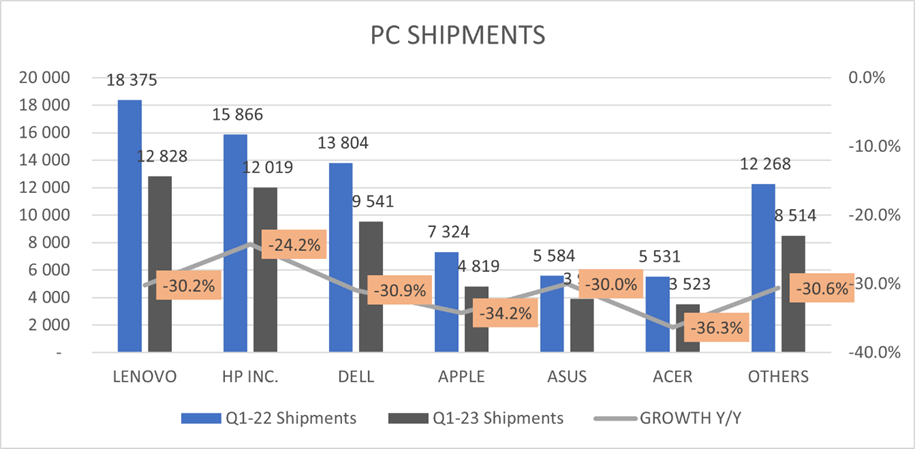

For the third straight quarter, Dell’s revenues decreased, demonstrating weakness in the broader market environment. Revenues dropped a startling 20% year over year to $20.92 billion. The corporation had a somewhat dismal quarter because revenues fell in all key areas. While revenues in the infrastructure solutions section, which houses servers, networking hardware, and storage devices, decreased by 18%, those in the client solution unit, which caters to the consumer and enterprise PC market, plummeted by 23%. In general, the PC market has been restrained by changing consumer sentiment. Non-discretionary purchasing power has decreased due to rising interest rates, and business IT spending is turning towards a stricter budgeting procedure. Dell’s shipments declined by 30.9% during the quarter as PC shipments as a whole were down 30% year over year.

Revenues falling by 20% had a ripple effect on the rest of the income statement, causing operating income and net income to drop by 31% and 46%, to $1.1 billion and $0.6 billion, respectively. Despite Dell’s achievement in cost management, costs fell by 6% annually, which was insufficient to make up for the drop in operating and net incomes.

Dell’s market share of PC shipments was 17.3% as of the first quarter of 2023, a modest decline from 17.5% in the same quarter last year. The next competitor only accounts for half of Dell’s market share, which is a sizable portion of the whole market.

Dell’s unfavourable guidance put additional pressure on the share price outlook. The business projects that IT investment will remain weak due to rising inflation, high borrowing rates, and sluggish economic growth. Although revenues are predicted to be between $20.2 billion and $21.2 billion, they will be down year over year by 21.6% for the second quarter if they match guidance.

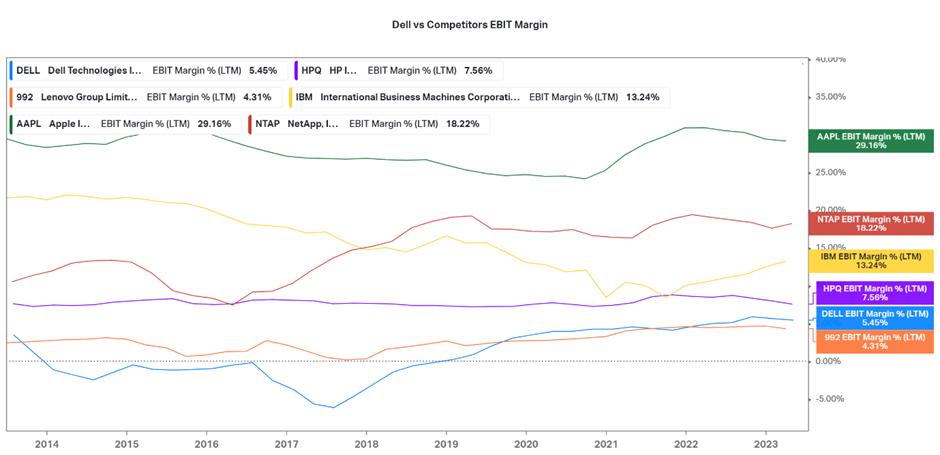

Dell’s EBIT margin of 5.45% is considerably lower than that of its rivals. Although the company’s earning capacity has remained largely consistent over the previous ten years, investors do not have enough reason to prefer its earning quality to that of its rivals.

Dell’s fair value is estimated at $51.00 per share after discounting for future cash flows. The estimated fair value is spot on at the technical resistance level and has a 12% upside potential.

Summary

Dell will probably experience greater challenges in the upcoming months as the possibility of a recession increases, and high borrowing rates restrain both consumer and business expenditure. However, a strong focus on innovation through cloud computing and artificial intelligence could support revenue growth. Given that the macroeconomic environment is challenging the struggling industry and business, the $51.00 per share level may be a long-term point of interest.

Sources: Dell Technologies Inc, Nasdaq, Gartner, TradingView, Koyfin