Attacq’s deal with the GEPF has been agreed (JSE: ATT)

This is great news for shareholders – like me!

In February 2023, Attacq announced that the Government Employees’ Pension Fund (GEPF), represented by the PIC, had reached a non-binding agreement with Attacq to take a 30% stake in Attacq Waterfall Investment Company.

A deal isn’t a deal until it’s actually a deal. Thankfully, this is now a deal, with a binding term sheet now agreed.

The GEPF will acquire 30% of the shares and shareholder loans in the Attacq Waterfall portfolio from Attacq for R2.388 billion in cash. The price has been calculated with reference to NAV and some adjustments, with a 15% discount then applied. That’s still a lot less than the traded discount in most property funds, which is why the Attacq share price benefitted from this.

Additionally, the GEPF will inject R300 million into Attacq Waterfall as a shareholder loan. Attacq will put another R700 million into Attacq Waterfall to keep the loans in line with relative shareholdings.

Attacq will retain 70% in Attacq Waterfall and will continue to provide asset, property, development and fund management services to the business at market-related fees. That’s good news for return on equity, as asset-light income is the holy grail in property funds.

There will be a substantial decrease in group gearing from 38% to 26.3%. The hope is to negotiate with debt providers to refinance the remaining debt in the group on more beneficial terms.

This is a Category 1 transaction, so a circular will be released to shareholders and they will be asked to vote.

For more from Attacq, be sure to watch the recent recording of the Unlock the Stock event that featured Attacq and Tharisa.

Invicta’s shareholders approve the odd-lot offer (JSE: IVT)

This can be an opportunity for retail investors, but probably not this time

An odd-lot offer can give retail investors an arbitrage opportunity. Once the price is set, then buying up 99 shares in the market (to be safe) at anything less than that price gives you a risk-free profit. Obviously, the difference between the market price and the odd-lot price needs to be big enough to justify (1) the trading costs and (2) the time.

As an odd-lot offer is always based on fewer than 100 shares, the share price is what determines the opportunity. Although Invicta Holdings shareholders have approved an odd-lot offer at 5% premium to the 30-day VWAP calculated on 24 July, the problem is that the current share price is only R28.80.

This gives you a value of R2,880 on which to earn an arbitrage profit, which probably won’t even buy you anything interesting at McDonald’s.

RMB Holdings and Atterbury are still fighting (JSE: RMH)

Arbitration isn’t the way forward, apparently

This is starting to sound a bit like a bad divorce. Efforts to resolve the impasse between RMB Holdings and key investment Atterbury have been unsuccessful. The parties agreed in principle to arbitrate, but couldn’t agree on the terms of the arbitration.

That’s like agreeing to go to a seafood restaurant, then arguing about the fact that fish is on the menu.

The problem is that Atterbury is expected to issue a conversion notice to RMB (the bank – nothing to do with the legacy RMB Holdings vehicle anymore) that would see RMB Holdings’ stake in Atterbury be diluted. The key is that RMB Holdings has the right to decline the conversion notice being issued, so the impasse continues.

The parties have been trying to sort this out over the past six months. Like in basically every important soccer game ever, perhaps they should try a penalty shootout?

Sappi is talking to the Wirtschaftsausschuss (JSE: SAP)

Time to brush up on your German

In April 2023, Sappi announced that negotiations to sell three mills, including the Stockstadt Mill in Germany, had fallen through. Sappi is hanging onto the other two mills and needs to take action on the Stockstadt Mill, as it is unlikely to be sold as a going concern.

Sappi is consulting on the future of the mill with relevant parties, including the Wirtschaftsausschuss. As your curiosity must be peaking by now, that’s the Economic Works Council. And since this is Germany, it probably does work.

It looks like the mill will close and the site will be sold, so the pulp mill and paper machine will close. This pulp was being used in the production of woodfree paper for the European print market. These decisions are part of Sappi’s strategic shift in Europe.

What’s up at Wesizwe? (JSE: WEZ)

Hot commissioning is getting people hot under the collar

Wesizwe Platinum is trying to get to a point where it can commission the concentrator plant at the Bakubung Platinum Mine. But alas, there have been “several defects” during the testing process, ranging from lube systems to hydraulic failures. These are being resolved as quickly as possible.

This also isn’t exactly the best timing for a director to have resigned, even if it is only a non-executive director.

Little Bites:

- Director dealings:

- A director of a major subsidiary of PSG Konsult (JSE: KST) has sold shares worth R5.28 million.

- An associate of a director of Afrimat (JSE: AFT) has sold shares worth R1.4 million.

- In a whoopsie, a director dealings announcement hadn’t been released by Orion Minerals (JSE: ORN) in relation to a further acquisition of shares in the company by Clover Alloys Copper Investments. The director in question is a director of both Orion and Clover Alloys. This isn’t a director dealing in its purest form, but the important point is that Clover Alloys is increasing its stake.

- While we are dealing with companies increasing their stakes, the news from Heriot REIT (JSE: HET) is that the company has acquired more shares in Safari Investments (JSE: SAR). Along with its concert parties (Reya Gola Investments and Heriot Investments), the stake has increased from 56.8% to 57.0%. It’s a small move, but the focus here is that the stake is being increased.

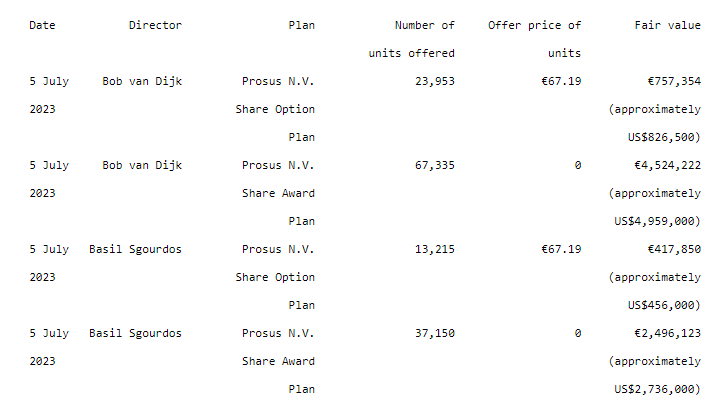

- In case you wondered whether the Bob and Basil show at Naspers / Prosus (JSE: NPN / JSE: PRX) has calmed down in terms of how much money they are making, here’s confirmation that it hasn’t:

- Investec Property Fund (JSE: IPF) has completed the transaction to internalise its management company (ManCo), a deal that is great news for the ManCo and very expensive for shareholders.

- The game of musical chairs continues at the nightmare that is Pembury Lifestyle Group (JSE: PEM), with the announcement of multiple changes to the board of directors, including the resignation of the chairman and the company secretary.

This situation with the management of Naspers and how value is being destroyed, is curious. Why have shareholders allowed this to continue for so long? Are we holding out for another ‘Koos Bekker’ moment while management has the time of their lives at our expense?