A surprising resignation of the Bell Equipment CEO (JSE: BEL)

It’s never a good sign when a successor isn’t named, although there’s time to find one

Markets love certainty. By implication, markets hate uncertainty. With the Bell Equipment share price up by 23% in the past 12 months and almost 200% higher since the depths of the pandemic, CEO Leon Goosen was respected by the market. This share price performance came against the backdrop of a difficult relationship between the Bell family and a number of shareholders, related to a potential take-private of the company that never happened in the end.

Goosen has resigned from Bell to pursue another opportunity, whatever that may be. The saving grace here is that the effective date of the resignation is 31 December 2023, so there is time to find a successor. We just don’t know yet who the successor will be.

With Goosen having been on the board of directors since 2009, including roles as COO from 2014 to 2018 and then CEO until now, the successor will have big shoes to fill.

Invicta invests further in Singapore (JSE: IVT)

The group is acquiring a 50% stake in KMP Far East

Back in January 2022, Invicta acquired KMP with operations in the UK and USA. The group describes it as a “natural progression” to acquire a stake in KMP Far East, giving Invicta the KMP brand on a worldwide basis.

Importantly, Invicta is only acquiring 50% in KMP Far East. This allows existing shareholders and management to retain a large shareholding, which is important for incentivisation.

The business is focused on heavy-duty diesel engine parts for industrial and agricultural machinery in South-East Asia. The effective date of the deal was 1 April 2023, but the deal is too small to be categorised for JSE purposes and so this is a voluntary announcement.

Mondi buys a mill in Canada (JSE: MNP)

This is a $5 million deal with more investment to come

While Mondi is trying hard to sell Russian assets on one side of the world, the group is investing in Canada on the other side. Well, the “other side” is assuming you use the classic flat map of the world. In reality, Canada and Russia aren’t that far from one each other, with the Bering Strait separating Russia and Alaska by just 88kms. Canada borders Alaska.

Moving on from a geography lesson, Mondi is acquiring the Hinton Pulp Mill in Alberta, Canada from West Fraser Timber for $5 million. Mondi then plans to invest another €400 million in the asset (note the currency change), so the purchase price is barely a drop in the Bering Sea vs. that investment.

The goal is to produce and supply kraft paper into Mondi’s network of 10 paper bags plants in the region. At its core, this deal is all about securing the right site to improve the supply chain for sustainable packaging solutions across the Americas.

The RMBH – Atterbury issue heats up (JSE: RMH)

Like Dricus Du Plessis, but in a boardroom instead of the octagon

You have to focus here. RMB Holdings has an investment in Atterbury, but not enough to control the board. Atterbury owed R487 million to RMB bank (no longer related to RMB Holdings), for which RMB Holdings had provided a guarantee.

In an attempt to settle this amount, Atterbury was able to issue a share conversion notice to RMB bank to settle the loan with shares instead of cash. Instead, RMB demanded repayment under the guarantee from RMB Holdings, as the bank doesn’t want the shares in Atterbury.

RMB Holdings settled the debt under the guarantee through one of its subsidiaries and has now stepped into the shoes of the lender. In other words, after arbitration between the parties broke down, we now have a scenario where Atterbury owes RMB Holdings the money instead of RMB bank.

It goes a step further. Through the subsidiary that settled the debt, RMB Holdings has now demanded the amount of R487 million from Atterbury in cash.

It’s impossible to know for sure where this ends without seeing all the facility agreements, but the team at RMB Holdings knows a thing or two about investment banking.

Southern Palladium’s resource potential is clearer (JSE: SDL)

The total mineral resource (indicated and inferred) is 34% higher since drilling began

Southern Palladium has announced the first interim combined mineral resource update for the Merensky Reef and UG2 at the Bengwenyama Platinum Group Metal project.

The broader resource is larger than the figures presented in the 2022 IPO prospectus, thanks to the far east block of the UG2 resource rather than the Merensky Reef. Although there is a bigger opportunity, the initial drilling focuses on the defined UG2 payback area: the portion of the UG2 reef that can achieve capital payback of the project.

Junior mining is all about making the most of limited capital.

Vukile reminds us how severe the rate hikes have been (JSE: VKE)

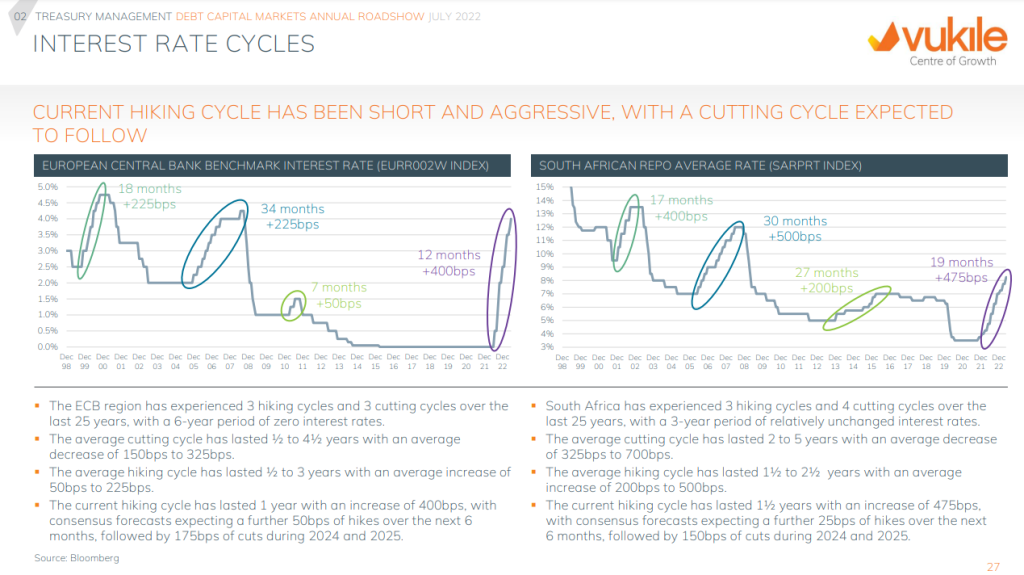

There’s a lot of good stuff in the debt roadshow presentation

Vukile is busy with a debt capital markets roadshow. This is perfectly normal for a property fund, as there is always debt on the balance sheet and it regularly needs to be refinanced or optimised.

The full presentation is available here, including interesting slides like this one:

We often lose perspective on just how severe this hiking cycle has been, particularly in Europe off a base of zero rates. These Vukile charts do a very good job of reminding the markets what we have all lived through.

Little Bites:

- Director dealings:

- An associate of a director of Afrimat (JSE: AFT) has sold shares worth R2.38 million.