Absa gives an update for the interim period (JSE: ABG)

Credit provisions are biting

After the other major banks gave us fairly recent updates on performance, Absa has now joined the fray with earnings guidance for the six months ended June. I always appreciate it when listed companies play open cards like this, rather than leaving it until the last minute to release full results.

The results are normalised based on the separation from Barclays, which is reasonable. This helps investors understand how the business is really performing.

Before we take into account credit losses, things look good! Group revenue for the interim period is expected to be up by low-teens, driven by net interest income in an environment of higher interest rates. Net interest income is expected to be up by mid-teens, with low double-digit growth in loans and deposits. In a higher rate environment, there is also net interest margin expansion.

The story is less exciting in non-interest income growth, which is an important driver of return on equity (ROE). This metric only grew by high-single digits, driven by the African Regions and insurance revenue.

An important term to look out for in banking is “JAWS” – less about the shark, more about operating margin. JAWS measures income growth vs. expenses growth, with the goal being that the former outpaces the latter. Positive JAWS is the name of the game here, which means the cost-to-income ratio has improved further to around 50%.

On a pre-provisions basis (i.e. before credit losses), profit is up by mid-teen rates.

Unfortunately, South Africans are under a lot of financial pressure and this is coming through in the numbers. The credit loss ratio is up from 0.91% to between 1.25% and 1.30%, which means that HEPS will only increase by low-single digits. On a per share basis, earnings will be up by mid-single digits.

The good news is that Absa has a strong balance sheet, so the dividend payout ratio will increase ever-so-slightly from 51% to at least 52% for the period. Don’t spend that difference all at once.

Return on equity is likely to be slightly below 17%. That’s a significant drop from 17.7% in the comparable period.

One-way traffic in the Ninety One assets (JSE: NY1)

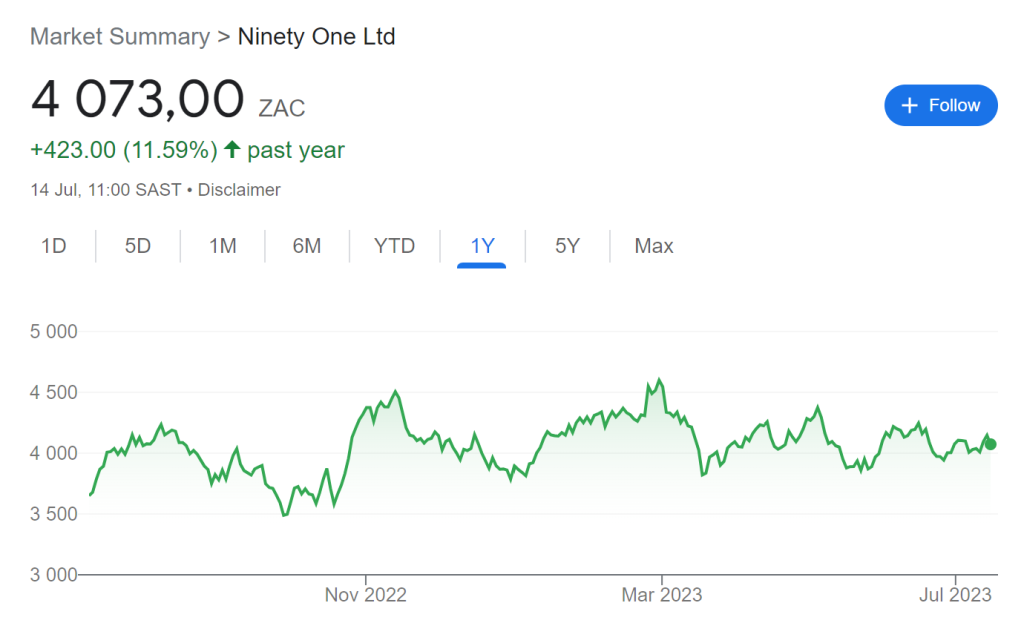

If you enjoy range trading, take a look at a Ninety One chart

Every quarter, Ninety One releases an update on assets under management (AUM). This is a function of (1) market prices of assets and (2) net flows into or out of the funds.

This is why asset management firms tend to be highly correlated with broader asset prices.

As at 30 June 2023, total AUM was £124.8 billion. That’s down from £129.3 at the end of March 2023. It’s significantly down from £134.9 as at the end of June 2022.

The share price didn’t love this update, trading 2.7% lower in late morning trade. Here’s the share price chart that might appeal to range traders:

A monthly update on the Rebosis garage sale (JSE: REA | JSE: REB)

Final binding offers are expected by 17 July 2023

After a bumpy start to the process, the Rebosis sale of assets seems to be making progress.

After expressions of interest were received, 22 preferred bidders were selected to proceed to the due diligence phase. This ranges from private individuals through to listed REITs.

There have been various subsequent meetings with the management teams, as well as site visits by certain bidders.

Based on this, the company and its business rescue practitioners believe that they are on track to receive final binding offers by 17 July. By 14 August, they hope to have selected the final purchasers and executed final sales agreements, so the process is expected to move quickly once binding offers are received.

Importantly, the bidders are being “encouraged” to include proof of funding in the binding offers, like credit approved term sheets from banks. This will play a big role in helping the business rescue practitioners choose serious buyers.

Although the business continues to run in the background and rental collections sit at 100%, commercial vacancies have increased from 26.7% to 27.27%. This is well above the South African Property Owners Association (SAPOA) vacancy rate of 16.7%, which is a scary number in and of itself. The Rebosis office portfolio is primarily in the Johannesburg and Pretoria CBDs, where supply of office space far outweighs demand.

Little Bites:

- Director dealings:

- Pay attention to this one: the CFO of The Foschini Group (JSE: TFG) has sold shares worth R1.8 million. A director of a major subsidiary also sold shares to the value of R2.3 million.

- After an administrative oversight meant that the announcement about this dealing wasn’t made at the time, we now know that a Bytes (JSE: BYI) director bought shares worth nearly £3k in May.

- An associate of a director of Mantengu Mining (JSE: MTU) bought shares worth R51.5k.

- Entities linked to the CEO of Spear REIT (JSE: SEA) and his family bought shares in the company worth R33k.

- Astoria Investments (JSE: ARA) has issued a cautionary announcement regarding a potential acquisition. No further details have been provided to the market at this stage.

- Grindrod Shipping (JSE: GSH) has issued a notice for an extraordinary general meeting. Shareholders will be asked to vote on the proposed capital reduction of $45 million that will take the form of a payment to shareholders. There are important tax implications here, as this isn’t a normal distribution.

- Vukile Property Fund (JSE: VKE) announced that Global Credit Ratings has affirmed the credit rating for the group, citing robust property metrics and the diverse funding structure as positives.

- The ex-CEO of Santam, Lizé Lambrechts, has been appointed as an independent non-executive director of PSG Konsult (JSE: KST).

- Deutsche Konsum REIT (JSE: DKR), perhaps the strangest of all listings on the JSE, has announced that the dividend of €0.12 was approved at the AGM.