Cashbuild keeps grinding lower (JSE: CSB)

These economic conditions make revenue growth almost impossible

In the latest quarterly update from Cashbuild, the company shows us that the pain continues in this sector. South Africans are dealing with huge economic pressures and high interest rates, which is hardly the right environment to justify major renovation projects. Long gone are the heady days of the pandemic, with low interest rates and South Africans investing in their homes.

This quarter was the final quarter in the 2023 financial year, so we now know that full-year revenue fell by 4% for the period ended June. If we exclude the stores looted in 2022, it’s even worse with a 7% reduction.

Perhaps the only silver lining here is that the sales performance in Q4 was flat, with -2% in existing growth and 2% in new store growth. That’s a lot better than Q3, where sales fell 9% after existing stores tanked by 10%.

Although a relatively small contributor, P&L Hardware fell 6% in this quarter after an awful drop of 15% in Q3, taking the full-year decrease to 10%. It contributes 16% of the store footprint and even less than that in revenue, as a Cashbuild store is much bigger than a hardware store.

Ellies goes from bad to worse (JSE: ELI)

The core business is in serious trouble

For the year ended April 2023, Ellies expects to report a headline loss per share of between 10.02 and 11.62 cents. That’s a lot worse than the headline loss of 7.13 cents per share in the comparable period. For context, the Ellies share price is only 7 cents!

A restructure and retrenchment process contributed 2.24 cents of the loss in this period. This means that earnings still deteriorated year-on-year in the core business, even if we take this into account.

One of the major business lines is satellite installations. With the shift to streaming, I don’t need to tell you how badly that is going. In the parts of the business that do have decent demand, like solar and surge protectors, working capital was a problem and so there were stock shortages. Disaster.

To help address this, there’s a new line of funding with the banks. That helps, but throwing debt into Ellies is literally pouring petrol on a fire.

The acquisition of Bundu Power is about the only thing that shareholders can get excited about. This solar business grew revenue by 60% this year and saw profits after tax jump from R11.2 million to R32.4 million. To pay for the acquisition, Ellies needs to raise R120 million through a rights issue at 7 cents per share. With a market cap of just R56 million, existing shareholders will be heavily diluted.

Ellies truly is the small cap that keeps breaking hearts:

Kumba is down year-on-year, but still very profitable (JSE: KIO)

Return on capital employed of 77% is incredibly juicy

We may be off the highs of 2022, but the mining cycle is still firmly in favour of the companies in this sector. With an EBITDA margin of 52% and production increases of 6% in the six months to June 2023, Kumba’s diluted HEPS has come in at R29.98 and the dividend is R22.60, so most of the profits are going to shareholders.

Diluted HEPS is down 17% year-on-year, as revenue fell by 11% and costs came under pressure particularly at Sishen (cash costs up 13%). It did help that Kolomela experienced a 6% drop in cash costs per metric tonne.

Rail performance remains a major worry. It was the driver of sales dropping 4% in the first half, with a particularly rough 8% decrease in the second quarter.

The market outlook is all about China, where low inventory levels and economic stimulus measures are helping. Although Kumba can’t do much about Transnet, a drop in capital expenditure guidance from R11 – R12 billion to R9 – R10 billion will give free cash flow a boost.

MC Mining gets an IDC extension (JSE: MCZ)

But not by much…

MC Mining’s IDC loan of R160 million plus interest was due on 30 June 2023. That date has clearly come and gone, with an extension granted to 30 September 2023. That’s only a few weeks away, let’s face it.

The company is busy with fund raising initiatives for the Makhado Project, which are expected to be concluded in the second half of the year. The clock is ticking.

Mpact reports a big year-on-year jump in HEPS (JSE: MPT)

Most of the improvement in profitability is in the plastics business

In its continuing operations, Mpact grew HEPS by between 30.3% and 37.3% for the six months to June. Revenue only increased by 9%, so this is very much a story around profitability rather than high levels of growth.

Strategic initiatives in the plastics business helped drive improved profitability, like the investment in bins and crates. Higher selling prices in paper didn’t hurt either, with April 2022 floods in the KZN in the base period also playing a role.

Investors need to keep an eye on the balance sheet, as net debt increased by R313 million to R2.64 billion after investing R843 million in capital projects. Mpact is investing in South Africa which is great, provided return on capital will be sufficient.

The discontinued operation is the plastic trays and films business, Versapak. Discussions with potential buyers are currently underway. It helps that revenue increased from R510 million to R545 million and net earnings grew from R28 million to R34 million. Mpact is simplifying a potential deal by excluding most of the working capital from the sale (receivables / cash / payables), so the net asset held-for-sale has decreased from R337 million to R173 million.

If we include Versapak and look at total operations, HEPS increased by between 27.1% and 36.4%.

Despite such strong growth, the share price closed 1.6% lower on the day. Being a JSE-listed mid-cap is an extreme sport.

Orion moves closer to trial mining (JSE: ORN)

This is one of those junior mining announcements that requires a geology degree

Looking through all the technical stuff, this Orion Minerals announcement is all about moving closer to getting the Prieska copper-zinc mine to the point of trial mining. The mineral resource estimate has been updated and management sounds happy with the results and how this creates an attractive early mining opportunity.

The company is in negotiations with metallurgical processing and engineering groups regarding processing facilities under “Build-Own-Operate-Transfer” arrangements. Google tells me that this is a method used to finance large projects that is usually used by governments in public-private partnerships. In this case, I guess Orion is the “government” looking to bring someone in for a defined period of time.

The trial mining phase is fully funded by the IDC and Triple Flag facilities. Orion has already executed its first draw-down of R167 million, with a total availability facility of R370 million.

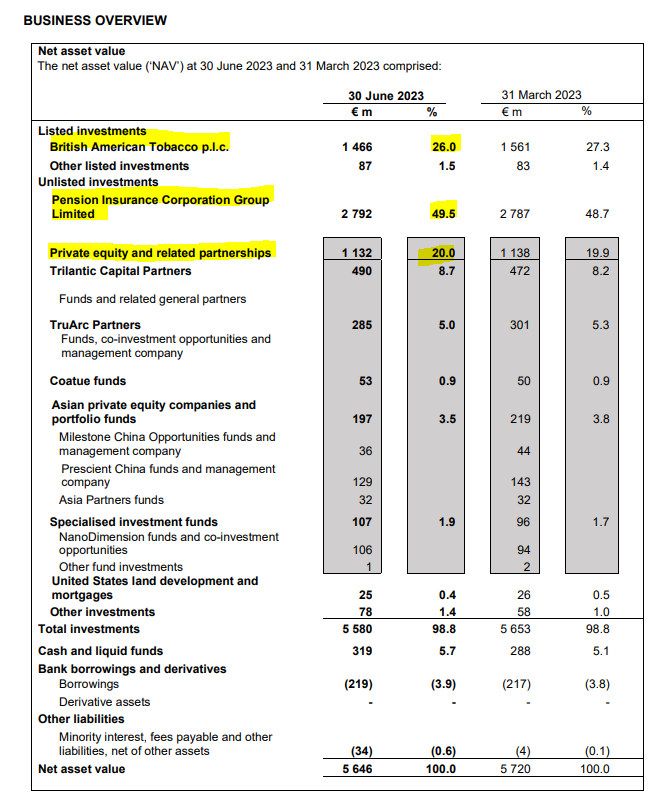

Reinet’s net asset value fell slightly this quarter (JSE: RNI)

Rupert’s “stay rich” investment vehicle is not trending in the right direction

Reinet is quick to remind the market that since March 2009, the compound growth rate (including dividends) is 8.6% measured in euros. That’s all good and well, but British American Tobacco as one of the key underlying assets is one that I just can’t get my head around.

You see, if you want something truly defensive, why not look internationally to businesses like PepsiCo or Johnson & Johnson? Locally, I would prefer to have AB InBev in my portfolio over the next five years than British American Tobacco. I barely know anyone who smokes. I know a lot of people who drink. Reinet is stuck with the stake, but you certainly aren’t.

Either way, the net asset value of Reinet dropped by 1.3% in the past three months. Compared to a year ago, it’s down just over 1%. In both cases, this is in euros.

Dividends of €57 million were received from Pension Insurance Corporation (the biggest asset in the portfolio) and commitments to new investments worth €38 million were made in this quarter. The other assets are generally private equity funds focused on regions like Asia.

Here’s how Johann Rupert chooses to stay wealthy, with most of the fun stuff happening in Remgro instead:

Sasol’s FY23 production is generally lower (JSE: SOL)

In several cases, the guidance had prepared the market for a year-on-year decline

As a precursor to the release of financial results, Sasol announces a detailed set of production and sales figures. This deals with the year ended June 2023.

In the mining business, export sales fell 13%. You guessed it! Transnet. Thankfully, most of the coal gets used internally at Sasol, so the focus is actually on production numbers which fell 3%.

In the gas business, the Mozambique operations achieved production at the upper end of the market guidance, which means a 2% year-on-year increase.

In fuels, the Secunda Operations production was 1% higher year-on-year and the run-rate at Natref was within market guidance, although 9% lower than FY22. Liquid fuels sales volumes fell by 2% vs. FY22.

In chemicals, external sales volumes fell by 4% and revenue was down 15%, as the basket price fell by 12%. There have been a number of issues here, with Transnet featuring strongly once more. In the American business specifically, far away from Transnet, revenue fell 8% despite a 9% increase in sales volumes, as market prices were lower than in the prior year. The business in Eurasia saw volumes drop by 19%, adjusting for the disposal of the European Wax business.

Group level revenue has fallen by 15% in US dollars.

Shoprite is smashing its competitors (JSE: SHP)

The Shoprite vs. Pick n Pay gap is just widening

Let’s start with a 5-year share price chart:

Shoprite’s 20% return over 5 years is nothing to get excited about. The pandemic was tough. Pick n Pay’s performance is really frightening though, especially as a stock that investors put in a “defensive” bucket.

The share price chart is a reflection of the difference in performance. In the 52 weeks to July, Shoprite grew group sales by a lovely 16.9%. Now, before you point out that the recent Pick n Pay update with lethargic growth only covered the last few months, I must note that Shoprite’s H2 growth (26 weeks to 2 July) was 17%. In other words, the halves were equally impressive.

The superstar is Supermarkets RSA, with 18.2% growth. Supermarkets non-RSA could only manage 15.2% and Furniture is up just 1%. In other words, Shoprite is literally ripping away market share from competitors in the grocery business, especially from Pick n Pay.

The grocery performance is strong across the LSM curve. Checkers and Checkers Hyper grew 18% and Shoprite and Usave grew 15.6%. These are astonishingly good numbers.

Of course, the sales performance is only part of it. The group has flagged a decrease in gross margin vs. the prior year (24.5%). The decline is expected to be less than the decline that was reported in the interim results (64 basis points).

Another important point is that Shoprite incurred R1.3 billion in diesel costs in this financial year. That’s a very big number, as headline earnings in the prior financial year came in at R5.9 billion and diesel costs weren’t significant in that period.

The net profit growth will be blunted by Eskom and pricing pressure. The shift in market share is clear though. I’m very happy to not be a Pick n Pay shareholder.

Little Bites:

- Director dealings:

- An associate of a non-executive director of Crookes Brothers (JSE: CKS) bought shares worth R267k.

- The finance director of EOH (JSE: EOH), Megan Pydigadu, is on her way to a new adventure. She will leave the company on 31 October 2023 and the announcement hasn’t indicated her next move. A replacement hasn’t been announced as of yet.

- Zeder (JSE: ZED) has declared a small special dividend of 5 cents per share. The share price is R1.74 and the announcement doesn’t give an explanation of the source of these funds or how this ties into the broader value unlock strategy at the company.

- Invicta (JSE: IVT) has confirmed that the odd-lot offer price is R29.8298446 per share. This is a 5% premium to the 30-day VWAP. The current share price is R27.99 so the “arbitrage” here based on 99 shares is R184. Try not to spend it all at once.

- enX Group (JSE: ENX) renewed the cautionary announcement related to the potential sale of Eqstra Investment Holdings.

- Europa Metals (JSE: EUZ) has drawn down €137k from the Spanish Government’s Centre for the Development of Industrial Technology (CDTI), taking the total loan to €460k.