British American Tobacco to reduce debt by $2.9bn (JSE: BTI)

This is a debt tender offer with different acceptance priorities

A group as large and complicated as British American Tobacco runs an equally large and complicated balance sheet, which includes numerous debt instruments that have different funding costs and tenures. Yes, British American Tobacco effectively has its own yield curve!

When they aren’t paying ESG consultants a fortune to make tobacco look like rainbows and unicorns, the group is highly focused on capital allocation decisions that help boost earnings growth off modest revenue growth. This debt tender offer is a perfect example of active balance sheet management.

British American Tobacco has allocated $2.9 billion to this initiative, in which holders of the various debt securities can “tender” their securities i.e. ask to be repaid. There are different pools of securities and the company has indicated the priority levels for each pool. Obviously, the priority is to repay the most expensive debt. The holders of those instruments are also the least inclined to sell them because the yields are good, so there’s a natural tension there.

Still, there will no doubt be sellers in every debt pool. The question is whether the full $2.9 billion will be taken up by debt holders and in which pools.

EOH seems to be stable (JSE: EOH)

There’s still a loss after tax for this period, hopefully for the last time

For the six months to January 2023, EOH grew continuing revenue by 8% and achieved 45% growth in international revenue, which tells you that the local story is slow. This is particularly the case in the public sector, where challenges continue to be faced.

Gross profit margin was stable at 29% and adjusted EBITDA more than doubled, with continuing operating profit of R110 million. That’s more than they managed in the last full financial year, let alone the interim period!

Unfortunately, the equity capital raise of R600 million was only completed in February 2023, so this period still reflects the full impact of the debt on the balance sheet. This is why there is still a loss after tax, albeit reduced by 82% vs. the comparable period. The company used the announcement to remind the market that the capital raise was significantly oversubscribed, although this was certainly helped along by the huge discount at which the capital was raised.

Aside from the IFRS2 charge on the discounted equity issue to the Lebashe Investment Group, there was also a R65 million impairment to the tech leasing book. Most of the legacy debts are from customers in the casino industry and they were badly hit by lockdowns. Although EOH is trying to recover the debt, they have provided for it in full.

Importantly, as at the end of July, there’s no overdraft and a positive cash balance of R255 million.

A strong half at Gemfields (JSE: GML)

The rubies and emeralds continue to shine

Gemfields is one of the most interesting companies on the local market. Unlike anything else we can invest in here, the group mines emeralds in Zambia and rubies in Mozambique. Unrest in Mozambique is one of the reasons why the company tends to trade on modest multiples.

For the six months ended June 2023, the company highlighted the third highest interim period in company history in terms of auction revenues. This includes the highest ever revenue from a Kagem emerald auction.

The group has net cash of $62 million and auction receivables of $64 million. The balance sheet is very strong despite paying a $35 million dividend to shareholders in May 2023.

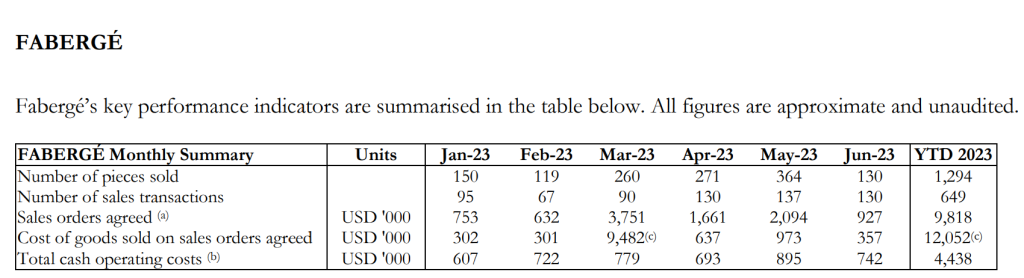

The problem child in the group is Faberge, which continues to have pretty questionable economics. I love the monthly disclosure, as it shows the big clearance of goods in March 2023 at a large loss. The provision on the inventory was recognised in previous years but that’s not the point. I highlight this because the harsh reality is that being in the “luxury” sector isn’t a guarantee of success. When there is strong demand for products, you don’t need to sell them at discounted prices.

Glencore invests further into Copper (JSE: GLN)

Does the deal team at Glencore ever rest?

The flurry of deals at Glencore is quite something. The group is always busy with something, ranging from large proposed mergers through to mine-level deals.

The latest announcement is a smaller transaction than some of the other opportunities the company has looked at, but is still substantial. The MARA project is a copper and gold project in Argentina that already has significant infrastructure, so Glencore describes it as one of the lowest capital-intensive copper projects in the world. The project has a life-of-mine of 27 years and has proven and probable mineral reserves of 5.4 million tonnes of copper and 7.4 million ounces of gold.

Glencore has been involved since the inception of the project in December 2020 when it was formed as a joint venture between Yamana Gold, Glencore and Newmont. Glencore subsequently acquired Newmont’s 18.75% stake in October 2022, taking its shareholding to 43.75%.

When Pan American acquired Yamana Gold Inc. it also acquired the company’s 56.25% stake in MARA. This is the subject of the latest deal, with Glencore acquiring that 56.25% for $475 million and a net smelter return royalty of 0.75%. Mining deal structures really are fascinating.

MARA is expected to be a top 25 global copper producer when operational and will be 100% owned by Glencore after this deal.

At this point, if you’re a young finance professional looking for M&A exposure, you would probably see more deal flow by joining Glencore than many of the local advisory houses!

Liberty Two Degrees releases results (JSE: L2D)

In case you’ve been under a rock, Liberty has made a bid to take the company private

We now know that the net asset value of Liberty Two Degrees is R7.59, up 0.8% and well above the R5.55 price that Liberty has put on the table. With retail reversions improving to -0.3% vs. -9.7% in full year 2022, Liberty seems to have swooped in just as things were improving. That makes sense for obvious reasons.

The interim distribution of 18.77 cents is 7.4% higher than the comparable period.

The loan-to-value is 24.58%, so Liberty is looking at acquiring a group with a solid balance sheet.

You may find it interesting to compare the trading density at Sandton City (R78,800/sqm) to Eastgate (R39,274/sqm). The fastest growing mall in the portfolio in terms of turnover was Melrose Arch, up 10.9% for the interim period. Sandton City was just behind it at 10.2%.

Office leasing remains a challenge, with occupancy of 82.1% vs. 97.1% in retail. The negative reversion in office was a monstrous -20.4%, which is at least an improvement on the truly shocking 2022 number of -25.5%. They are practically begging tenants to sign office leases.

MC Mining quarterly report (JSE: MCZ)

The focus is on Makhado, with the Uitkomst colliery continuing to be impacted by Eskom

In the quarter ended June 2023, MC Mining’s coal production at Uitkomst was 1% lower year-on-year, with load shedding and some geological conditions having a negative impact. Although production fell slightly, coal sales were way up on last year.

At the Makhado project, the updated life of mine plan and coal reserve estimate have improved the project’s economics. The tender processes to select the outsourced mining, plant and laboratory operators are expected to be completed in the next quarter. Where possible, the company is negotiating build, own, operate, transfer (BOOT) funding arrangements.

After the end of the quarter, the IDC extended the repayment date of the R160 million loan to 30 September 2023.

A change of CFO at Mr Price (JSE: MRP)

This sounds like a difficult exit

Mr Price hasn’t been performing well recently, so a change of management brings more uncertainty into the investment story. CFO Mark Stirton has stepped down from the CFO role as of 31 July 2023, which is basically “with immediate effect” without them saying as much. The change is on “mutually agreed terms” which also makes it sound like this wasn’t the standard process.

He will be sticking around until March 2024 to assist with a handover to new CFO, Praneel Nundkumar, who has been with the group for 7 years and is currently the Managing Director of Mr Price Money.

It’s been a very volatile year in the local retail industry, with Mr Price not escaping the sharp swings in sentiment:

MTN grows HEPS by between 0% and 10% (JSE: MTN)

A difficult industry is made much harder by African currency challenges

A trading statement has confirmed that in the six months to June, MTN grew HEPS by between 0% and 10%. This means a range of 506 cents to 557 cents for the interim period. The forex losses were huge in this period, impacted HEPS by 169 cents. Hyperinflation of 38 cents didn’t help either.

Within the forex losses, 128 cents is from Nigeria of which 95 cents was incurred in June when the naira was allowed to float. This caused a rapid depreciation in the Nigerian currency. The shortage of forex reserves in Nigeria (and Ghana for that matter) makes life difficult for MTN, with the company electing to receive scrip dividends rather than cash. This is good for attributable earnings and bad for cash upstreaming.

Group holding company leverage is towards the upper end of the guidance range of less than 1.5x. Net debt to EBITDA on a consolidated basis is in line with the December 2022 level. Consolidated numbers don’t really help though, as it matters where the cash actually sits in the group.

In a separate announcement, MTN Nigeria released numbers for the six months to June. Service revenue increased by 21.6% and EBITDA margin fell by 60 basis points to 53.0%. Because of forex losses, profit before tax fell 25.4% and earnings per share fell 29.3%. Capital expenditure fell by 14.4%.

Here’s a reminder that your life in South Africa can always be worse:

“As a result, the inflation rate in Nigeria rose to an 18-year high of 22.8% in June 2023, representing the sixth consecutive month-on-month increase in 2023, with an average of 22.2% in H1. To rein in inflation, the Central Bank of Nigeria (CBN) continued its monetary policy tightening, increasing the monetary policy rate by 2pp to 18.5% in H1, and a further 0.25pp increase in July.”

Orion Minerals quarterly report (JSE: ORN)

Cheekily, they start with the biggest news after the end of the quarter

Orion Minerals released an update on activities in the quarter ended June. The real news of course is the drawdown on the IDC and Triple Flag facilities, which only happened after the end of the quarter. This didn’t stop the company kicking off with a reminder of that news.

On a strict view of this quarter, the big news was actually the share placement with Clover Alloys. If all placement options are ultimately exercised, the total value of the equity funding package is A$73 million.

The focus is on the Prieska Copper-Zinc project, with the goal of accelerated development. An updated mineral resource estimate has been completed. A feasibility study is also well advanced at the Okiep Copper Project. The company is making solid progress at both hubs.

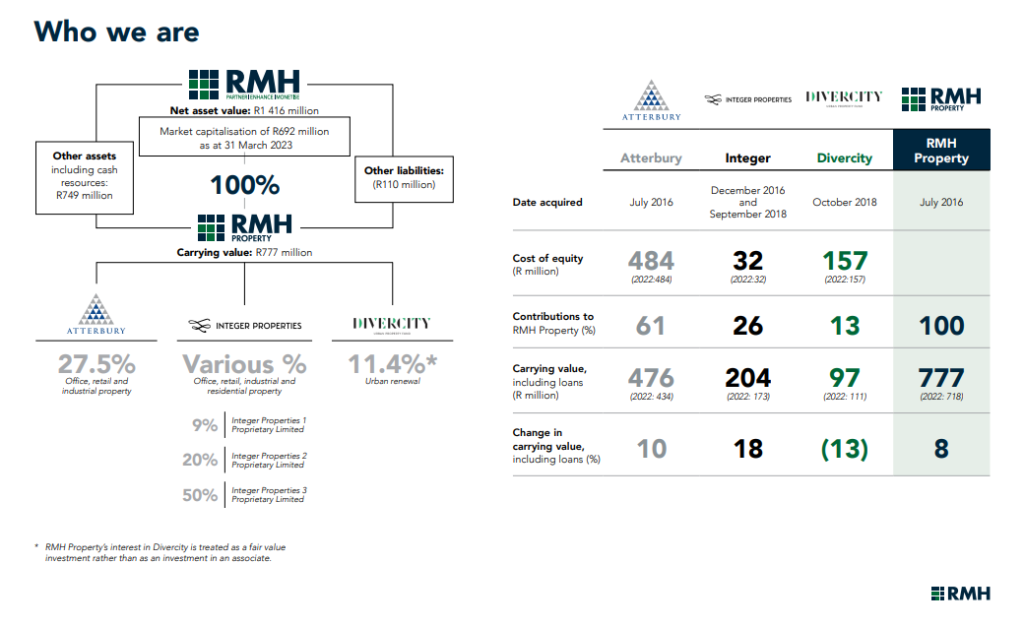

RMB Holdings releases results for the year ended March (JSE: RMH)

This will help you understand why the Atterbury dispute is so important

RMB Holdings had a net asset value per share of 100.3 cents at the end of March 2023. The current share price is 48 cents, which is why the market is focused on the company realising that value.

A very big chunk of the value sits in Atterbury, with whom RMB Holdings is currently in dispute. Here’s an excerpt from the annual report:

The current position is that RMB Holdings has demanded repayment of a R487 million loan from Atterbury. The company previously tried to issue shares to the bankers in repayment of this loan, which triggered RMB Holdings to step into the banker’s shoes and demand cash repayment instead.

Southern Palladium quarterly report (JSE: SDL)

This is a very early stage company that is focused on drilling

At Southern Palladium, the quarter ended June was all about drilling. The company is preparing for the pre-feasibility study in the first quarter of 2024.

Thanks to drilling efforts, the total mineral resource has been increased by 34% since drilling began.

The mining right application remains on track for submission in the third quarter, which is five months ahead of the original schedule.

The company has $11.55 million in cash, down from $12.93 million at the end of March.

More cash flows into Stefanutti Stocks (JSE: SSK)

The costs of the arbitration process have also been received

Back in May 2023, Stefanutti Stocks alerted shareholders to the receipt of a capital award of R90.85 million under the mechanical project termination arbitration.

To give you an idea of how expensive a legal process can be, the company has now also received R15 million for expert and legal fees incurred. This is obviously more good news for the company, especially with a market cap of just R270 million.

Telkom: revenue up, profits down (JSE: TKG)

Recent labour restructuring initiatives supposedly offset the impact of load shedding

Every time I write about Telkom, I remind you that the company finds itself on a treadmill. The legacy business is dying rapidly, with new revenue initiatives struggling to keep pace with the rate of decline in the old business.

In the quarter ended June, revenue was up 3.8% but group EBITDA fell by 4.2%. This is despite the group saying that labour restructuring initiatives offset the impact of load shedding.

Mobile revenue increased by 5.2%, Openserve grew new generation revenue by 10.6%, BCX was up by just 2.9% and Swiftnet limped along with growth of 1.2%.

Legacy voice services in Telkom Consumer fell by 24.2% and only account for 4.8% of group revenue. In stark contrast, mobile data traffic jumped by 25.1%. Once technology reaches an inflection point, the rate of change is remarkable.

In Openserve, fixed voice revenue fell by 29%. This led to the segment reporting an overall revenue decline of 2.7%. Expressions of interest for strategic equity stakes in Openserve have been received, though Telkom isn’t acting on any of them yet.

In BCX, the legacy Converged Communications business saw revenue drop by 12.8%. The IT business was 17.5% higher, giving the blended increase in revenue of 2.9%. EBITDA came under particular pressure in this business, down 38.2% with a margin of just 7.9% (down 520 basis points). Telkom is looking at options to introduce a strategic equity partner in this business, particularly to enhance its capabilities in key areas like cloud services and cybersecurity.

Swiftnet has been impacted by terminations by a mobile network operator customer. The towers business isn’t easy and profitability is very sensitive to changes in revenue. Swiftnet is currently up for sale and Telkom is in discussions with two bidders after refining a list of shortlisted bidders.

Telkom unfortunately finds itself with a portfolio of problematic businesses and a complicated road to travel to improve them.

Little Bites:

- Director dealings:

- Value Capital Partners, which has director representation on the board of Altron (JSE: AEL), has invested another R13 million in shares in the company.

- A director of Argent Industrial (JSE: ART) – and not the CEO who has recently been active in the shares – has sold shares worth R182.6k.

- Investec Property Fund (JSE: IPF) wants to change its name to Burstone Group. After the (very expensive) internalisation of the ManCo, moving away from the Investec branding is the logical next step.

- Awkwardly, the chairperson of the Social and Ethics Committee at Clientele Limited (JSE: CLI), Pheladi Gwangwa, has been suspended for 6 months from practising as an attorney by the Supreme Court of Appeal pending an investigation into her conduct at a law firm.

- Finbond’s (JSE: FGL) acquisition of Trustco Finance Namibia from Trustco (JSE: TTO) is taking longer than expected. The fulfilment date for conditions precedent has been extended from 31 July to 31 August 2023.

- African Dawn Capital (JSE: ADW) reported a headline loss per share of 24.5 cents for the year ended February. That’s 20.7% worse than the prior year. The auditors have noted a material uncertainty regarding the group continuing as a going concern.