Astoria’s NAV is flat in ZAR for the interim period (JSE: ARA)

The company reports in dollars but is exposed to rand assets, so the reported NAV is down

The rand depreciated significantly against the dollar in the six months to June. This is why the Astoria net asset value (NAV) per share is up by 0.1% in rand but down 9.6% in dollars.

Although the net asset value is flat in rand, the movements within the portfolio are notable in some cases. For example, the investment in Outdoor Investment Holdings (which owns Safari & Outdoor alongside other businesses) increased in value by 10% since December 2022.

In Trans Hex, the value was impacted by a significant dividend payment, of which Astoria received R7.5 million. Realised diamond prices were around 20% lower in this period. In the marine diamonds operations, the impact of lower diamond prices was mitigated to an extent by lower fuel prices for the ships.

The value of Goldrush (held via listed entity RECM & Calibre JSE: RACP) fell by 25% as it is valued with reference to the listed share price of RACP. Load shedding had a negative impact on this business, as was separately disclosed in RACP announcements.

The valuations of both ISA Carstens and Vehicle Care Group have moved slightly higher. Both are valued at nearly R55 million, although that is the only thing they have in common. ISA Carstens is a tertiary education business and Vehicle Care Group provides funding and other services to the used vehicle trade and related consumers.

Finally, the value of Leatt took a 40% knock in the past six months because of pressure on its share price in the OTC market in the US where it trades. Many global retailers were heavily overstocked at the end of 2022 and this has impacted sales by suppliers like Leatt. This investment now represents 3.8% of the group NAV.

Astoria has R12.9 million in cash on the balance sheet, similar to the R13.1 million held at the end of December 2022.

The company is currently trading under a cautionary announcement due to ongoing negotiations about a potential acquisition.

Curro flags strong growth in recurring HEPS (JSE: COH)

These look like strong numbers during a challenging time in South Africa

Curro finds itself staring down the barrel of a number of ugly South African realities, ranging from middle-class emigration and general lack of spending power through to utility and energy costs. Perhaps in the eye of the storm for now, the results for the six months to June actually look really good.

You need to work with recurring headline earnings per share (HEPS), as the comparable period included the receipt of a long-overdue education subsidy by Meridian. That metric is expected to be between 26.5% and 45.5% higher, coming in at between 32.3 cents and 37.1 cents.

The share price has had an extremely volatile 12 months:

Give that dog a Rathbone(s) (JSE: INL)

Investec gets the all-important regulatory approval for the Rathbones merger

The deal between Investec Wealth & Investment in the UK and Rathbones was announced back in April 2023. It’s an exciting merger that will see Investec achieve scale in the UK market and a 41.25% economic interest in the merged entity, with 29.9% voting rights.

The key regulatory approvals have now been obtained, so in the absence of a material adverse change the deal will go ahead on 21 September 2023.

I like this deal for Investec.

Gold Fields has also gone backwards (JSE: GFI)

Thankfully, to a far lesser extent than rival AngloGold

For the six months to June, Gold Fields has reported a drop in HEPS of between 9% and 16%. This is due to lower gold volumes sold and pressure on operating costs. Mining inflation is a theme that is playing out across the industry, leaving miners reliant on an increase in commodity prices.

All-in costs for the six months came in at $1,398/oz which is 3% higher year-on-year. The trend is worrying, as that metric was $1,454/oz in the second quarter. That’s not a great setup heading into the second half of the financial year.

Detailed results for the interim period will be released on 17 August.

The JSE reports flat operating results (JSE: JSE)

For the newbies: yes, the JSE is listed on the JSE!

This tends to blow a few minds every time I write about it. The JSE is listed on the JSE, because the JSE Limited is a public company and is effectively using its own product by being listed on the exchange. I hope that makes sense now.

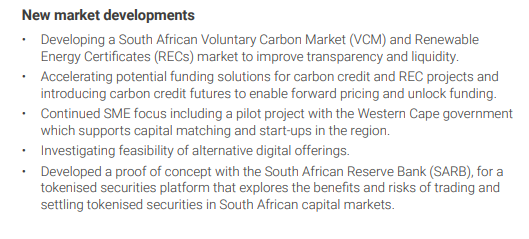

Unless you really haven’t been paying attention, you’ll know that the number of listings has decreased over the years. This problem isn’t unique to South Africa. The good news is that the JSE has other markets as well, like the debt market that is used extensively by South African corporates and institutions. There are also several initiatives underway to move away from dependency on trading revenue, with non-trading revenue (like Information Services and JSE Investor Services) now representing 36% of growth.

Of course, the fact that a significant amount of trading has moved to competitor A2X is a contributor to this.

In the six months to June 2023, revenue increased by just 5% and operating expenses increased by 8%, with staff expenses up by a substantial 15% as the largest expense on the income statement. This means that Earnings Before Interest and Tax (EBIT) only grew by 1%. Pedestrian to say the least.

Below the EBIT line, it’s mainly about the balance sheet as tax rates tend to be consistent. The JSE earns net finance income rather than incurs a net finance cost, so net finance income jumped by 53% in an environment of higher interest rates. This is why net profit after tax grew by 10% despite the anemic operating profit performance. HEPS increased by 12%.

Investors who are focused on the dividend will be pleased to note that capital expenditure fell by 35%, although it isn’t great at all to see cash generated from operations dropping by 9%.

The new market developments section makes for interesting reading, especially the last bullet about what I presume means a crypto project:

MiX Telematics reports a much-improved quarter (JSE: MIX)

Key metrics have moved in the right direction

MiX Telematics operates a number of fleet management businesses, with Matrix as the brand that most consumers will know about. The company achieved 40,500 net subscriber additions in this quarter, bringing the total subscribers to 1,042,000.

Total revenue increased by 15% year-on-year on a constant currency basis. The company reports in dollars because it is listed in New York and makes most of its money in rand, so unfortunately the dollar growth is very modest at 3.8%.

Gross profit margin improved by 160 basis points to 63.6% and operating income margin jumped by 520 basis points to 12.1%, certainly a far better performance than in the comparable period and helped along by restructuring activities completed in March.

These businesses aren’t great at generating free cash flow, as most of the cash gets reinvested in devices. This quarter was no exception, with $5 million in cash from operating activities and capital expenditure of, wait for it, $5 million!

Despite this, there’s a quarterly dividend of 4.5 ZAR cents. On a share price of R4.84, that’s an annualised yield of 3.7%.

OUTsurance: solid numbers and a potential exit of OUTvest (JSE: OUT)

And an entry into Ireland, of all places!

OUTsurance Group has released a trading update for the year ended June 2023. You still have to be very careful when interpreting these numbers, as the base period included the group’s life as Rand Merchant Investment Holdings. In that period, it disposed of Hastings Group, settled preference share debt and unbundled the interests in Discovery and Momentum Metropolitan.

In other words, reading the group numbers in isolation will make no sense at all. I’m ignoring them.

To help with this issue, the group has released a voluntary trading update dealing specifically with OUTsurance Holdings, the 90%-held subsidiary that owns the OUTsurance business in South Africa and Youi in Australia. The company will also be entering the market in Ireland in the second half of 2024.

The growth is very much in Australia, with normalised earnings of R413 million, an increase of 220% to 250%. In South Africa, OUTsurance’s short-term business limped along with earnings growth of 0% to 10% and OUTsurance Life managed between 5% and 15%. As Australia is only 17.8% of the earnings base, the group level growth came in at between 35% and 45%.

Interestingly, the group is walking away from the OUTvest initiative as it remains sub-scale. They will try and sell the thing if they can find a buyer. Client investments will not be impacted by this. If nothing else, it just shows that plugging one set of financial services into an existing ecosystem isn’t a guarantee of success.

Workforce Holdings reports a collapse in profits (JSE: WKF)

The first six months of the year are a disaster

In today’s example of “things you don’t want to read as an investor”, I give you the drop in HEPS at Workforce Holdings of between 78.36% and 98.36%. That’s awful.

It’s thankfully only for the six months to June, with the company noting that corrective measures have been put in place to try and save face in the second half of the year. The reasons given for the performance are worrying as they aren’t exactly disappearing overnight, ranging from high interest rates to load shedding and low demand for services.

Although revenue was slightly higher, the problem is that the cost base was way too high for this level of activity. This explains the “corrective measures” – surely just a nice way of saying that people got retrenched.

4Sight Holdings sees HEPS approximately triple (JSE: 4SI)

The announcement is light on details

For the six months to June 2023, 4Sight Holdings expects HEPS to jump from 1.288 cents to between 3.704 and 3.952 cents. That’s potentially a tripling of its HEPS!

There are no further details in the announcement, so we will have to be patient for results. The share price has very little liquidity and is trading at 25 cents.

Little Bites:

- Director dealings:

- There was massive trade in Novus (JSE: NVS) shares on the 31st of July. A2 Investment Partners (linked to Andre van der Veen and Adrian Zetler) bought R32.26 million worth of shares and Sphere Investments (linked to director Marang Mashologu) executed exactly the same trade, so this was obviously a pre-arranged block trade through the market with a total value in excess of R64 million.

- The ex-CEO of Emira Property Fund (JSE: EMI) is buying more shares, this time R248.5k worth of shares in a trust.

- In an awkward one, a director of Remgro (JSE: REM) sold shares worth R85k without clearance. The portfolio manager apparently executed this in error. It doesn’t say whether the error was the trade (unlikely) or lack of clearance for it!

- Although the impact on AYO Technology (JSE: AYO) is limited as the company now has banking arrangements in place, it’s interesting to note that the Competition Appeal Court ruled in favour of the banks that refused to provide services to this group. This is specifically on the basis that AYO couldn’t prove that the behaviour was anticompetitive in nature. I’m not sure how refusing to provide a service could ever be anticompetitive. Surely that is directly encouraging competition?!?