Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

I discussed Shoprite on Kaya Biz with Gugulethu Mfuphi on Tuesday night:

Aspen takes a step towards filling its capacity (JSE: APN)

The company is focused on landing pharmaceutical manufacturing contracts

Build it and they will come. This is some of the worst business advice ever given to startups, with Aspen experimenting with this strategy at scale. The recently expanded sterile manufacturing capacity is ready to go and needs contracts for it to generate revenue and a return on the investment, especially after the COVID vaccines fizzled out.

Aspen has announced the fourth such contract, in this case with an unnamed multinational pharmaceutical group to manufacture medicine for a chronic disease. They really are as vague as that, so this agreement clearly comes with some pretty strong NDAs.

With R6 billion having been invested in the facility in Gqeberha, investors won’t really care what the product does, as long as its legal! Aspen can manufacture a variety of drugs at this facility and has positioned itself as a manufacturing gateway to Africa for global pharmaceutical players.

Calgro M3 has a good news story for shareholders (JSE: CGR)

A trading statement has flagged a 20% jump in HEPS

Trading statements range from being light on details through to giving a detailed operational update. The Calgro M3 announcement is the former, simply flagging a jump in HEPS and confirming that results will be released on approximately 16 October.

The company expects HEPS for the six months ended August to be at least 20% higher than the comparable period. This implies HEPS of at least 68.40 cents for this interim period.

I must remind you that the minimum change that triggers a trading statement is 20%. When a company releases such a bland trading statement with “at least 20%” as the guidance, it can literally mean anything from 20.1% through to any number you can imagine. Some companies release a “further trading statement” and others just hit you with the results.

Time will tell how this one pans out.

Capital & Regional completes the Gyle acquisition (JSE: CRP)

This looked like a solid acquisition to me

In August, Capital & Regional announced the acquisition of The Gyle Shopping Centre in Edinburgh for £40 million. The asset has been acquired at a net initial yield of 13.51%, which seems like an attractive price. The debt is being provided by Morgan Stanley at a fixed cost of 6.5% for 5 years.

To get the deal done, the company raised equity capital on the local market. This has sadly become a rare occurrence in South Africa, with very few companies tapping the local market for growth capital.

With an underwrite from controlling shareholder Growthpoint (JSE: GRT), Capital & Regional raised the capital and the acquisition has now become effective. This is a good example of a grocery-anchored community shopping centre, which fits right into the company’s strategy. The company also highlights the opportunity for active management of this asset, improving income and thus the valuation.

Grindrod Shipping: a lesson in cycles (JSE: GSH)

It’s hard to think of a more volatile sector than shipping

Unless you were living under a rock during the pandemic (OK – scrap that – we all were), you would’ve been reading about supply chain problems and how retailers just couldn’t get stock. As we emerged from that mess, pent-up demand for goods was extraordinary and people literally couldn’t get their hands on stuff quickly enough. That was a golden opportunity for shipping companies to make massive profits.

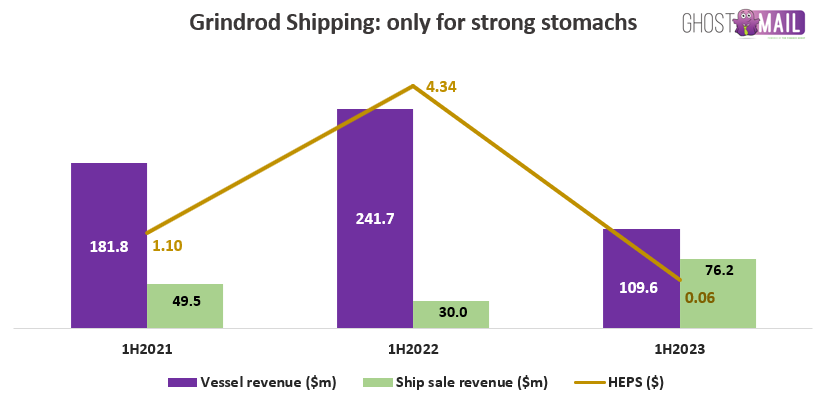

As is always the case, these supply-demand distortions tend to right themselves. This chart of Grindrod Shipping’s revenue and HEPS should hopefully illustrate the point:

I want to particularly draw your attention to how close ship sale revenue has been to vessel revenue in the past six months. Shipping companies regularly buy and sell vessels to right-size the fleet based on levels of demand. The proceeds are either used to reduce debt, execute share buybacks or pay special dividends, depending on the company’s balance sheet.

In Grindrod Shipping’s case, a capital reduction of $45 million was approved by shareholders in August. Because of this, no further dividends will be declared in 2023.

The focus area for the company is on the combined management of the Grindrod and TMI fleets and realising the associated synergies. The company is also hoping for a “gentle” structural recovery in the Chinese economy in 2024.

Little Bites:

- Director dealings:

- In a long announcement that says a lot without actually saying very much at all, AYO Technology (JSE: AYO) reminded the market that Khalid Abdulla’s fine and censure is the subject of a reconsideration application at the Financial Services Tribunal. This isn’t anything that the JSE didn’t already tell us. The company also reiterated its commitment to Abdulla regardless of this situation, which is another good example of why I’m not an investor in this group.

- For those following the Lighthouse Properties (JSE: LTE) trades, the results of the scrip distribution are now in for directors. Des de Beer will receive R42 million worth of shares under this distribution, adding to his numerous recent purchases of shares in the company. There’s a few million bucks worth of shares in total being received by other directors as well.

- Anglo American Platinum (JSE: AMS) announced that Sayurie Naidoo has been appointed as acting CFO of the company. This is an internal appointment, as Naidoo has been with the broader Anglo American group for 15 years.

- Richemont (JSE: CFR) announced a couple of senior changes. Gary Saage is an ex-CFO of Richemont and has been proposed for appointment to the board and as the chairman of the audit committee. Among other changes, I couldn’t help but smile at the appointment of a new CEO of the Laboratoire de Haute Parfumerie et Beauté – an incredibly pompous title to help the six Maisons involved in fragrances to reach critical mass. His name? Boet. There is officially a Boet in charge there, of the non-Fourways variety. He should surely enhance his name to Boët and give it a luxury spin!