Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Capitec finds bidders with a trading statement (JSE: CPI)

It’s a voluntary update, so don’t expect any “at least 20%” news here

There’s nothing stopping companies from giving the market more updates than the minimum required under JSE rules. Even though Capitec is a long way off the threshold that triggers a trading statement (a 20% move in earnings), the company released a voluntary update based on earnings for the six months to August.

Group HEPS will be between 8% and 10% higher year-on-year, which the market seemed to love as the share price closed nearly 10% higher.

It hasn’t exactly been a happy year for the share price, with the gain on Friday helping to regain some of the recent lost ground:

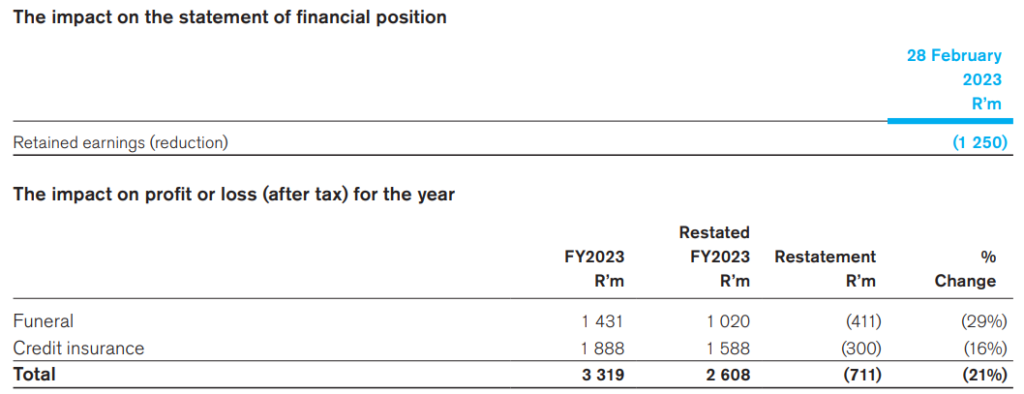

Due to the funeral and credit insurance businesses within Capitec, the group hasn’t escaped the introduction of IFRS 17 Insurance Contracts. This is the new standard that has caused major swings in earnings at the likes of Sanlam. There’s an entire report on the impact of this standard on Capitec (you can find it here) with this table showing how significant the difference is on restated full-year numbers:

Aside from the link to the IFRS 17 report and the guided HEPS growth range, the announcement is pretty light on financial details. There’s some commentary about consumers under pressure and credit granting criteria being tightened in response. Both transaction fee income and funeral insurance performed well according to the company.

Full details are expected to be released on 28 September.

Caxton is trading at roughly half of its NAV (JSE: CAT)

And the annual growth in the NAV doesn’t look too bad either

Caxton & CTP Publishers and Printers (or Caxton for our collective sanity) published record results for the year ended June 2023. HEPS grew by 20.2%, although I’m not sure that’s the ideal metric when assessing the valuation here.

The core business comes through on the income statement, with revenue up by 16.6% thanks to pricing and volume increases in the packaging business. The split is 49% publishing and printing, 51% packaging and stationery. The second half of the year wasn’t quite as exciting as the first half as demand softened and margins came under pressure and competition intensified. The packaging business is definitely the major growth driver at the moment.

Caxton is sitting on expensive stock and this will impact margins as it works through the system, although there’s already been a write-down on some stock items in this period.

Staff costs grew by 6.9% and other operating expenses grew 7.7%. That’s well below revenue growth.

Notably, operating profit of R810.8 million includes a net R84.6 million related to the insurance claim related to the KZN floods. Another important once-off is the R78.9 million profit on disposal of Cognition Holdings.

Cash is always king, with cash from operating activities of R523.2 million, which is a 21.7% increase over the prior year. In terms of capital allocation, the group made acquisitions of R144.6 million, of which the Amcor bag-in-box bladder business was the largest at R102 million. A dividend of R197.1 million was paid during the year and share repurchases were R25 million.

The outlook for the upcoming year isn’t as rosy as one might hope, as Caxton’s media publishing and printing business is highly exposed to local retailers. Certain parts of the packaging business are similarly exposed, although they also have exposure to more defensive sectors like alcohol, quick-service restaurants and cigarettes.

The reason why HEPS probably isn’t the best valuation metric here is because of assets of R9.2 billion, a whopping R1.4 billion is attributable to investments. Within that, R1.37 billion is in listed shares, which is mainly the investment in Mpact. The Mpact share price was down at R25.5 at the end of June, now up to over R30. The right place to see this benefit is the NAV per share rather than in HEPS.

Here’s an interesting media-related snippet that I thought was worth including here:

As another interesting strategic tidbit, the acquisition of Maskew Miller Learning by Novus Holdings (a competitor to Caxton) means that those textbook volumes have been lost. This was Caxton’s biggest textbook customer and the lost of volumes will mainly be felt in the new financial year.

Curro adds sustainability-linked funding metrics (JSE: COH)

What makes this especially interesting is that the metrics have been added to existing debt

Although banks and lenders will try hard to turn everything into a marketing opportunity about how altruistic they are, the reality is that most ESG-related decisions are a direct result of financial and regulatory pressures. In an effort to improve ESG scores, lenders look for opportunities to lend against sustainability-linked metrics that encourage the borrower to “do the right thing” in exchange for a better funding rate.

I always find it interesting when “the right thing” should be a core part of the business anyway. Curro is a perfect example, with one of the metrics being targets linked to bachelor’s degree pass rates. You would think that this is a key metric for Curro regardless, but if they can get lenders to reward them for it, then why not? Other metrics include employee diversity and water usage.

The thing I found most interesting about this news is that the metrics are an overlay to existing debt facilities with Standard Bank, FirstRand, Sanlam Specialised Finance, Investec and Absa. Standard Bank acted as the Sustainability Coordinator and PSG Capital as the Transaction Advisor, getting all these lenders across the line.

The debt value is R3.3 billion, so shaving some of the funding costs off this principal amount will be helpful. The announcement doesn’t indicate exactly what the targets are or what the potential saving might be.

Hammerson partially extended its debt maturities (JSE: HMN)

At this point in the cycle, that comes at a price

Hammerson recently announced a £100 million bond tap issuance, which means new debt raised under an existing bond programme. These are 7.25% coupon bonds maturing in 2028. The coupon drives the pricing of the yield, which is the actual cost of the debt to Hammerson. They were priced at a yield of 9.1%, which means they were issued at a discount to face value because a 7.25% return isn’t sufficient in this environment.

In a distinct but related transaction, Hammerson announced a tender offer for its £350 million 3.5% coupon bonds maturing in 2025 and its £300 million 6.0% coupon bonds maturing in 2026. If you look at the various transactions here, Hammerson effectively raised £100 million due in 2028 and used it to repay some of the short-dated debt through the holders of that debt “tendering” their debt back to Hammerson.

Hammerson accepted tenders for £11.7 million of the 2025 bonds and £88.4 million of the 2026 bonds at repurchase yields of 7.7% and 8.1% respectively. Remember, they issued debt at 9.1% to achieve this. The cost of shifting £100 million worth of maturities from 2025 and 2026 to 2028 is an annualised net interest cost of £3 million per year.

This debt cycle isn’t friendly to property companies, especially in the UK where rate hikes have been severe.

Little Bites:

- Director dealings:

- The spouse of a director of a major subsidiary of Northam Platinum (JSE: NPH) has executed a big sale of sales, coming in at R19.4 million.

- In case you’re wondering whether it pays to be CEO of a listed company, the answer is that yes it does. This isn’t quite the standard director dealing as it relates directly to a vested share scheme, but it’s still worth highlighting that Truworths (JSE: TRU) CEO Michael Mark has sold shares worth R19.4 million. It’s interesting to note that the shares were awarded in 2009 and only vested in 2023.

- The disposal of the Vyeboom Fruit Farm by Crookes Brothers Limited (JSE: CKS) was approved by shareholders at the general meeting with a 92.63% approval rate.