Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

The Brikor offer is on the table (JSE: BIK)

The offer price is 17 cents per share

As was communicated to the market recently, Nikkel Trading planned to move through the 35% threshold and make a mandatory offer to the remaining shareholders in Brikor. Nikkel smashed through that threshold rather than moved through it, taking its stake to 64.11% and triggering the mandatory offer in the process.

The mandatory offer price is 17 cents per share, which is identical to the price paid for the latest tranche of shares.

The CEO of Brikor gave Nikkel an irrevocable undertaking not to participate with his shareholding of roughly 12.8% of shares outstanding. The proof of funding given by Nikkel to the Takeover Regulation Panel (TRP) thus excludes the amount that would be applicable to those shares.

A circular will be issued to shareholders with the opinion of the independent board and its recommendation to shareholders. This recommendation will be informed by the work of the independent expert.

Discovery: all about the adjustments (JSE: DSY)

The company really wants you to ignore the effect of interest rates

I’m a fan of simple financial reporting that doesn’t try and use a million different adjustments to tell the story that management wants to tell. With a share price that is down 15% over five years, there isn’t a great long-term story at Discovery. In fact, the share price is pretty similar to where it was in 2015!

It’s had a good time in 2023 though, up 19% this year.

The performance for the year ended June 2023 reflects growth in headline earnings of only 3% to 8%. Normalised headline earnings is 30% to 35% higher, so no prizes for guessing which metric they would like you to focus on. The major reason for the adjustment is the change in interest rates, which impacts headline earnings but apparently has no impact on the operations of the group. This is rather funny when you consider that one of the operations is a bank.

To properly understand the results, we will have to wait for them to come out on 21 September.

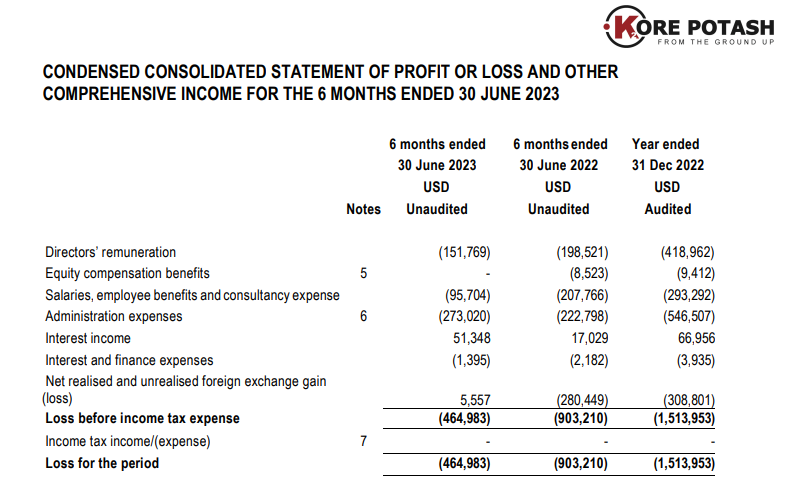

Kore Potash releases interim financials (JSE: KP2)

But the numbers don’t really matter at the moment

Junior mining companies have to release results just like everyone else, even though the market doesn’t care much about the numbers. At this stage in a mining company’s lifecycle, it’s all about progress being made on the project.

On that note, Kore Potash is working towards finalising terms for the EPC contract at the Kola Project. There’s no change to the position with Summit Consortium, which has committed to giving a financing proposal for Kola within six weeks of the finalisation of the EPC contract with PowerChina and SEPCO.

As you can see in this screenshot from the results, there are only expenses on the income statement with interest income on the cash reserve providing a minor offset:

Volumes drop 7% at Libstar as consumers cut back (JSE: LBR)

But revenue is 4% higher thanks to pricing and mix changes

There aren’t many winners in this inflationary environment, especially not in the consumer-facing industries like grocery retail and their suppliers. At least beach tourism will probably do well this year, as a lot of summer bodies are being made in winter thanks to people cutting back on food in their baskets.

Volumes at Libstar dropped by 7% in the six months to June, mainly driven by a drop in consumer demand, although the discontinuation of certain personal care lines is also a contributor here. Thanks to positive pricing and mix changes of 11%, revenue increased by 4%.

I must highlight an increase of just 1.4% in operating expenses, which is way below inflation.

Sadly, when manufacturers experience a drop in volumes, it generally ends quite badly for margins even when expenses have been well controlled. Gross profit margin fell by 210 basis points to 20%. Normalised operating profit took a 26.6% hiding, with margin dropping from 6.3% to 4.5%.

By the time you reach the bottom of the income statement, I’m afraid that diluted HEPS (which takes into account any stock options etc. and assumes those shares have been issued) has dropped 58.2%. Normalised HEPS is down 44.9% which is hardly any better. There is no interim dividend, but that is Libstar’s standard practice as the company only declares an annual dividend.

Net interest bearing debt to EBITDA increased from 1.5x to 2.1x as at the reporting date, although the post-period receipt of insurance proceeds for the fire at the Denny Mushrooms Shongweni facility brings this down to 1.9x.

The only real highlight in this result is cash conversion, which improved significantly as cash generated from operations jumped by 92.2% year-on-year. This is all thanks to a decrease in the amount of working capital needed by the business. A further boost to cash flow is that capital expenditure fell by 12.8%, although one wonders whether this is simply a short-term tactic to improve the debt picture with potential long-term ramifications.

This clearly isn’t a happy story, with various strategic initiatives in process to try and fix it. The HPC division has been difficult to sell, with the group still committed to disposing of this business if a buyer appears. In the meantime, they need to improve the operations and make it a lot more appealing to buyers.

Those sitting in back office jobs at Libstar should probably be worried, with management commentary like this:

“Libstar’s portfolio currently comprises five product categories, eighteen business units, twelve separate sales, marketing and operational teams and seventeen separate back-office teams. The Top Six divisions of the Group, based on economic profit, contribute more than 80% of the Group’s intrinsic value.”

With results like this and a structure like that, I can’t see how extensive restructuring won’t be part of the turnaround plan.

But here’s the saddest paragraph in all of this, which is a perfect snapshot of why our GDP growth is nothing close to what it should be:

“Current market and operating conditions, most notably the dependency of farming operations on stable electricity supply, are not conducive to the reinstatement of the Shongweni facility. As such, the Group will retain the proceeds from the insurance claim for application to value-accretive opportunities.”

Libstar’s share price was already down 43% year-to-date before this announcement came out.

Stefanutti Stocks increases the Kusile claim (JSE: SSK)

The wheels keep turning towards a big payout

Stefanutti Stocks’ provisional claim for Kusile was R1.14 billion, consisting of various cost and finance claims. An updated claim has now been submitted that comes to R1.614 billion.

This will be reviewed by experts and then referred to the Dispute Adjudication Board (DAB) for a decision. The company hopes to receive the binding decision late this year. At that stage, either party may issue a notice of dissatisfaction and and refer it to arbitration.

WBHO reports better results from continuing operations (JSE: WBO)

And thanks to reduced losses in discontinued operations, the group result is better too

In the year ended June 2023, revenue from continuing operations at WBHO increased by 38% and HEPS jumped by 31%. That’s good news. This is a construction company, so expecting a dividend is less realistic than hoping the Proteas will still win the Aussie series. In case it’s not clear: there’s no dividend for this period.

In discontinued operations, the loss was “only” R101 million vs. a whopping R1.9 billion loss in the prior year. This is because the provisions related to the mess in Australia needed to be increased in rand terms as the currency depreciated.

This means that for the total group, headline earnings per share swung wildly from a loss of R36.93 per share to profit of R15.14 per share. That’s a whole lot more like it.

The full announcement gives astonishing detail around the underlying projects. I won’t touch on it here because it would honestly take you all morning to read. Something I will highlight is that the renewable energy enthusiasts among you will be interested to learn that the Civil Engineering segment saw revenue increased by 162% thanks to big wins in solar and wind farm projects.

Thanks to the improvement in earnings, WBHO’s share price is up 44% in the past 12 months.

Little Bites:

- Director dealings:

- A director of Lighthouse Properties (JSE: LTE) – and NOT Des de Beer for once – bought shares worth R1.9 million.

- A non-executive director of Richemont (JSE: CFR) has acquired shares worth roughly R247k.

- Novus (JSE: NVS) is about to bank the R125 million related to the disposal of the Novus Print Letting Enterprise to Micasa. The registration of the transfer of the properties has taken place on 11 September.

- The reorganisation of AngloGold Ashanti’s (JSE: ANG) listing structure will be finalised during September. This will see the primary listing of the company effectively move to the New York Stock Exchange.

- Investec Property Fund (JSE: IPF) will change its name to Burstone Group Limited (JSE: BTN) will effect from 20th September.