Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Aspen lands an important manufacturing contract (JSE: APN)

The company is making progress with filling capacity in Gqeberha

If you’ve been following recent news at Aspen, you’ll know that the company is working on filling the manufacturing capacity at the R6 billion plant in Gqeberha. This is obviously very important to that city’s economy, as the Eastern Cape isn’t exactly seen as an economic powerhouse on a good day.

The latest contract sounds like a big one, with Aspen set to manufacture human insulin for Novo Nordisk. The collaboration aims to supply 1 million patients in 2024, ramping up to 4 million patients by 2026.

I like Aspen’s positioning as a gateway to Africa for global pharmaceutical giants. Not only does it reduce the carbon footprint of transporting drugs (something Aspen points out), but it makes our country less vulnerable to supply disruptions for important medicines. Let’s not forget the job creation angle as well, with Aspen deploying 250 people for this project when it commences in 2024.

Good news indeed!

Capital Appreciation’s business is under pressure (JSE: CTA)

Even the technology industry cannot escape the realities of our economy

Capital Appreciation released a “business update” for the six months to September, which is heavy on narrative and light on financial details. Shareholders will have to wait for results to come out on 4 December before getting all the details. In the meantime, investors must read between the lines in this announcement.

The software division isn’t really a problem, with revenue up high single digits excluding the acquisition of Dariel. With that acquisition included, revenue is up by more than a third. Although this is below management’s expectations and profit has been adversely impacted by revenue below plans, it’s still unlikely to be a bad outcome.

The payments division is a different story. The announcement doesn’t give specific revenue guidance but the narrative isn’t encouraging, noting a reluctance by customers to upgrade their terminals and invest in equipment in current economic conditions. Linked to this, customers are interested in leasing rather than buying terminals, which does at least provide annuity income at the expense of short-term profits. My view is always that when management teams are shy to give detailed guidance, it’s usually because the numbers aren’t great.

As a brief comment on GovChat, Capital Appreciation will limit further funding of that business and attributable losses will be materially lower. The Competition Tribunal recently decided in GovChat’s favour, giving it the right to intervene in the Competition Commission’s prosecution of Meta.

The good news is that the balance sheet remains incredibly strong, with R500 million in cash and no debt.

Grand Parade swings into the green (JSE: GPL)

The share price didn’t give much of a reaction, closing 3% higher

For the year ended June 2023, Grand Parade Investments swung from a headline loss per share into a profit.

Compared to a headline loss per share of 3.2 cents last year, the company has reported HEPS of between 2.24 cents and 2.88 cents.

ISA Holdings expects a juicy jump in earnings (JSE: ISA)

A trading statement sent the share price 9.8% higher in late afternoon trade

ISA Holdings has a market cap of roughly R200 million, so this is small even by small cap standards. The technology company is doing well though, releasing an initial trading statement that the market liked.

For the six months to August, HEPS will be at least 20% higher. With wording like “at least” and the fact that this is an “initial” trading statement, the eventual growth could be a lot higher.

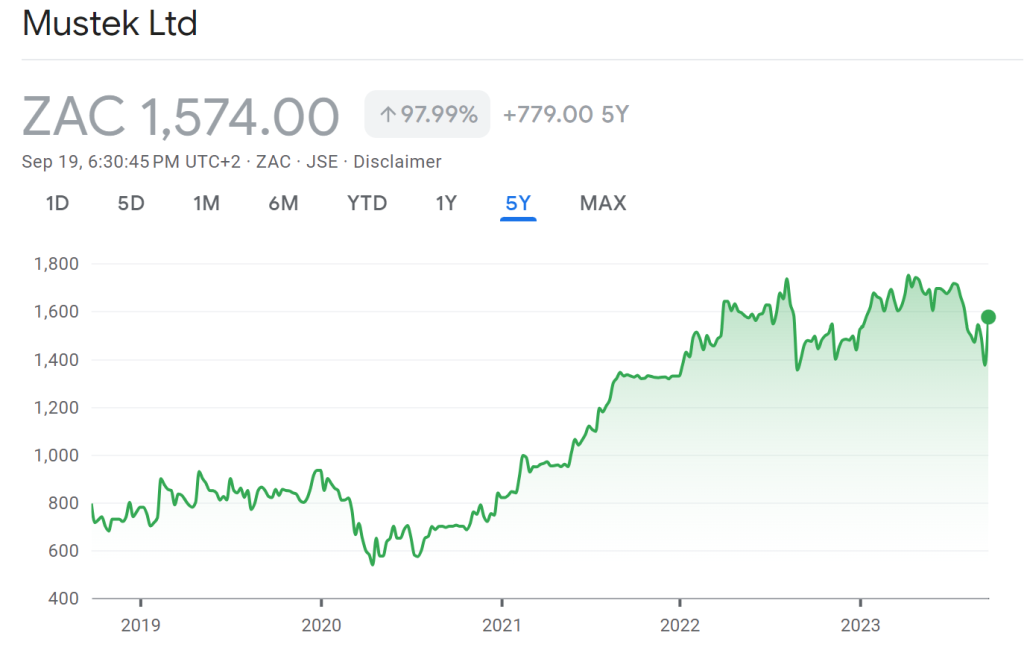

Mustek moves the HEPS dial in the right direction (JSE: MST)

The share price closed 8.9% higher on decent volumes by small cap standards

With a market cap of well under R1 billion, Mustek is one of the more interesting members of the small cap universe on the local market. This inevitably means relatively low valuation multiples, with the share price closing at R15.74 based on HEPS for the year ended June of 375 cents per share. The dividend per share is 77 cents, so that’s a P/E multiple of 4.2x and a dividend yield of 4.9%.

Another way to look at it is return on equity of 15% vs. the net asset value per share of R27.24 and closing share price as mentioned of R15.74. This means the effective return on equity (based on what investors are actually paying per share) is roughly 26%. You calculate this by taking 15% of R27.24 (ROE x NAV per share) and then comparing it to the share price.

Whichever method you choose to use, the conclusion is the same: Mustek doesn’t trade at a demanding valuation. This is why HEPS growth of just 5% is enough to give the share price a boost, as expectations aren’t high.

It’s important to split the operational performance from the effect of the balance sheet. Revenue increased by 14% and EBITDA by 12%. A concern is that cash from operations fell by 35%, so that’s a big disconnect from EBITDA. If you dig into the cash flow statement and supporting notes, you’ll see that an increase in debtors is to blame, so that’s not ideal.

The other important point is that financing costs are much higher than before. In fact, the finance cost in FY23 was higher than FY22 and FY21 combined! This is why EBITDA growth of 12% didn’t translate into exciting HEPS growth.

Still, here’s the benefit of trading at low valuation multiples at a time when technology has enjoyed strong demand:

Little Bites:

- Director dealings:

- A director and the company secretary of Omnia Holdings (JSE: OMN) collectively sold shares worth R863k.

- An independent non-executive director of City Lodge Holdings (JSE: CLH) purchased shares worth R150k.

- An independent non-executive director of STADIO Holdings (JSE: SDO) purchased shares worth R150k.

Thanks for all you do. Re MUSTKEK, if I’m reading right, the plan is to decrease inventory and release cash to pay off debt. That could reduce finance costs by half, and they could make 30% more profit in the coming year just on that saving alone. Seems like a very good investment. What do you think?

At this valuation multiple, small gains will be rewarded and big gains will be PROPERLY rewarded. So the plan sounds great but of course if it was that easy, then there would be no risk in investing. Clearing inventory at proper gross margin into this economy isn’t that simple. But as small caps go, I would say that Mustek is one of the more interesting options. You should probably dig into the balance sheet and look at how much of the debt has floating rates. If the numbers still look good assuming another rate hike or two, that builds in a margin of safety.