Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

AngloGold begins its new corporate life (JSE: ANG)

Will the primary listing in the US make a difference in years to come?

AngloGold is a company with a rich history in South Africa. This makes it historically significant that the primary listing has been moved to the New York Stock Exchange, with only a secondary listing maintained on the JSE (and A2X and the Ghana Stock Exchange for that matter).

Although this sounds like semantics and even the stock ticker on the local market hasn’t changed, it signals intent to take a global gold story to a US investor base. The headquarters are now in Denver, Colorado, though it obviously retains a large corporate office in the City of No Water. I mean, the City of Gold. I mean, Joburg.

Headline loss narrows at Ascendis (JSE: ASC)

But it’s still a loss

I can finally call Ascendis by its correct name, rather than the very cheeky “Descendis” that I used for a long time when the thing was in a death spiral. Although the company is still loss-making, the trajectory of the losses is firmly in the right direction.

In a trading statement for the year ended June 2023, the company noted that the headline loss per share from continuing operations will be between -37.4 cents and -45.7 cents. This is an improvement of between 69.5% and 62.7% vs. the comparable period.

The headline loss from total operations is between -35.7 cents and -43.6 cents, an improvement of between 55.8% and 46.0%.

Bytes is achieving double-digit growth (JSE: BYI)

The market really liked this story

Bytes closed 9.5% higher on the news that trading conditions are solid, with the operations in the UK and Ireland growing gross invoiced income, gross profit and adjusted operating profit. In other words, things are heading firmly in the correct direction thanks to market share gains in private and public sector work.

Both gross profit and adjusted operating profit grew “comfortably in double digits” in the six months to August. Net cash at the end of the period was £51.3 million, net of £30 million worth of dividends in the period. The company has seasonal cash conversion and expects a strong second half.

Detailed results are due for release on 25 October.

Equites brings more capital home (JSE: EQU)

The company has sold a distribution warehouse in the UK

The property in question has a lease in place with Tesco Distribution until December 2023. That isn’t a typo. The lease is right on the cusp of expiring and the tenant hasn’t committed to a new lease, so Equites was staring down the barrel of a potentially significant vacancy.

A European logistics income fund is clearly feeling less worried, swooping in to buy the property for £29.75 million. This drops the loan-to-value ratio at Equites by 170 basis points, increases the weighted average lease expiry (obviously) and unlocks net cash proceeds of R684 million. Other than the reduction of debt in the UK, Equites is going to bring the capital back to South Africa to support the local development pipeline.

Equites claims that an internal rate of return of 12.1% was achieved on the property (measured in pounds and net of debt). The selling price is a 16.2% premium to the latest book value but I wouldn’t put much focus on that, as UK property prices have been heavily written down as yields have increased in the UK.

The property contributed £2.476 million to distributable income for the year ended February 2023, so the price is a yield of 8.3%.

Grindrod Shipping acquires Taylor Maritime’s ship management businesses (JSE: GSH)

This is part of the strategy of central management of a larger fleet

Grindrod Shipping announced the acquisition of 100% of two ship management companies. Taylor Maritime is the sole owner of one of the companies and part owner of the other. In case you’ve forgotten, Taylor Maritime also holds the vast majority of shares in Grindrod Shipping.

The acquisition price is between $11.75 million and $13.5 million, depending on how the earn-outs play out. The payment structure is a mix of cash and shares, payable over two years.

The company says that this will increase ship management income fees, “unlock synergies” (that dirty M&A term) in the commercial deployment of the dry bulk fleet and achieve savings on the technical side.

An awkward disclosure error by Investec (JSE: INP | JSE: INL)

The UK funds under management number actually went the other way

In the trading update released last Friday, Investec disclosed the UK Wealth and Investment funds under management (FUM) number as having increased by 1.3%. This was wrong, as there was actually a decrease of 2.0% since March 2023.

There were positive net inflows, so this is more to do with changes in asset values than anything wrong with the underlying business.

Nampak’s rights offer was heavily supported (JSE: NPK)

Coronation is the only underwriter that received additional shares

The important news for Nampak as a whole is that the company has successfully raised the intended R1 billion in equity at a price of R175 per share. The important news for its shareholders is that if you hoped to get any excess applications through this process, I’m afraid you will be disappointed. Such was the demand for the rights offer (over 138% of available shares) that a couple of the underwriters aren’t even getting excess shares.

Excluding excess applications, 90.08% of shares were subscribed for. Coronation gets first bite at the cherry based on the underwriting agreements, which means the remaining 9.92% all went to them. The other underwriters didn’t get anything and there’s certainly nothing for anyone else who asked for additional shares.

All eyes will now be on whether Nampak can steady the ship.

Vukile releases a fascinating pre-close update (JSE: VKE)

The South African retail portfolio is performing very well

The concept of “property” as an asset class is a dangerous umbrella term. There is a vast difference between an office building in Sandton and a value shopping centre on the edge of a township area or on a busy commuter route. If you need any further proof, you can look at Vukile’s pre-close investor presentation.

In the South African portfolio, turnover is 3.6% higher than the comparable period and trading densities are growing across all segments. Vacancies at August 2023 are steady at 2.0% and reversions have improved from 2.3% for the year ended March to 2.4% for the six months to September. Footfall is 107% higher than in FY23.

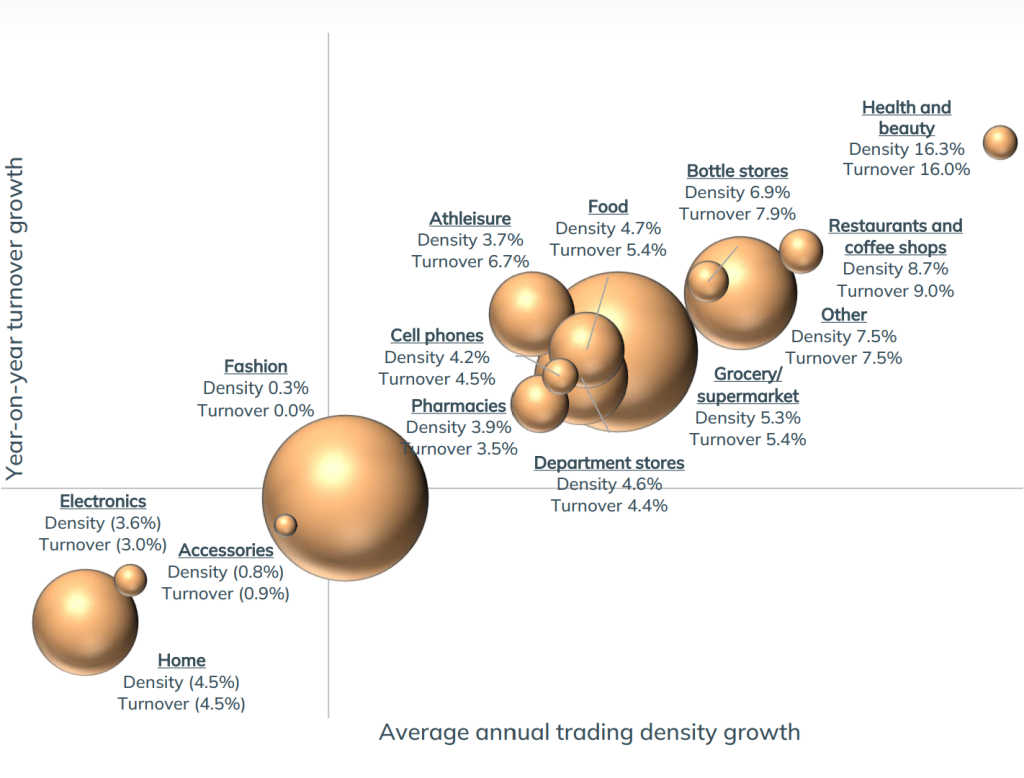

I really enjoyed this chart in the update, showing the size of each category (the bubble) and the current performance across turnover growth and density growth. Top right is where you want to be. Bottom left is where you don’t want to be. The concerning bubble is Fashion, which is (1) very large and (2) very stagnant:

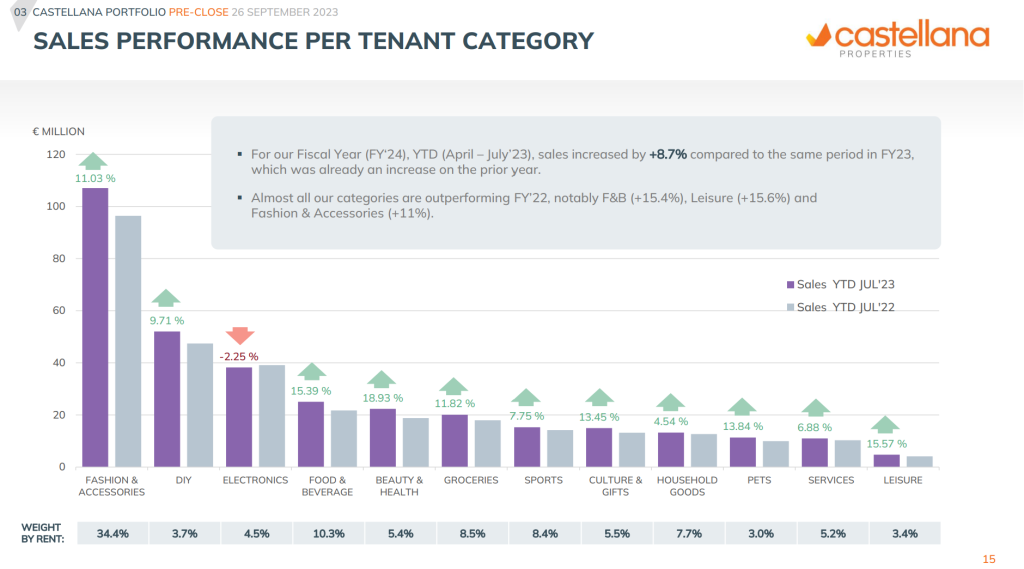

The performance in the Spanish portfolio also looks very good. Turnover at all the centres is up by strong double digits year-on-year. Unlike in South Africa, Spanish consumers have money for clothes:

Looking at the balance sheet, Vukile held a successful R526 million bond auction in August, so there’s support from the market for this story. The loan-to-value ratio of 44% seems a little high to me in this environment, but the credit rating is strong with a stable outlook.

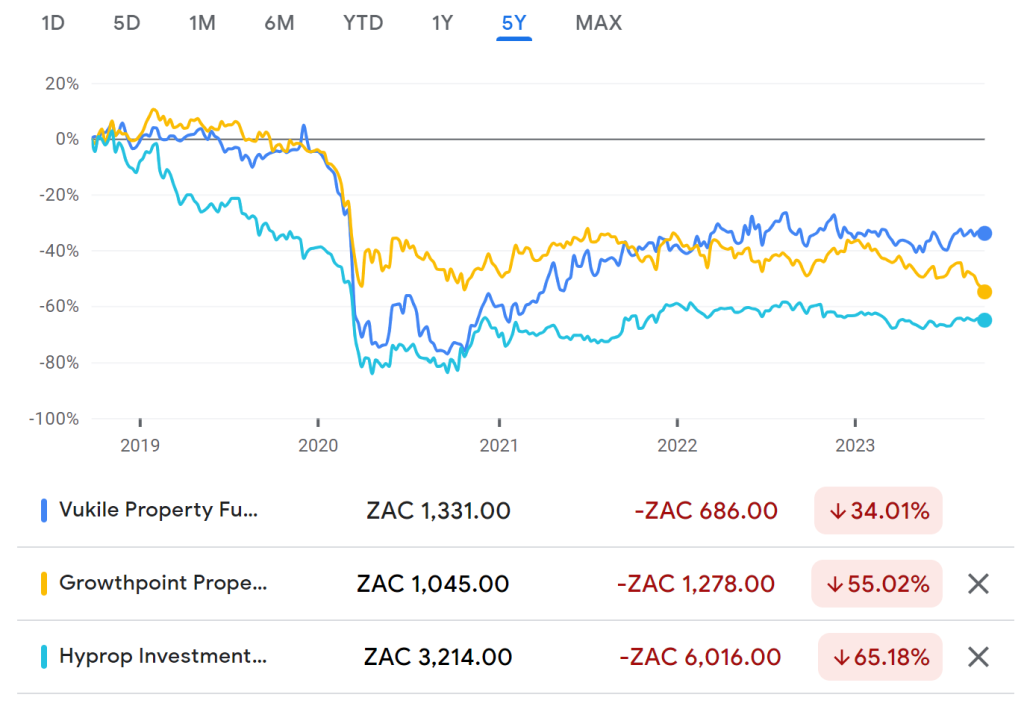

Most importantly, the guidance for FY24 is positive. The dividend per share is expected to grow by 7% to 9%. That is vastly different to what we’ve seen from the likes of Growthpoint and Hyprop.

This is why the chart over the last 12 months looks like this for the three funds:

Sadly, this is what the chart looks like over five years:

Little Bites:

- Director dealings:

- Des de Beer was clearly feeling flush for the latest purchase of shares, buying R8.2 million worth of shares in Lighthouse Properties (JSE: LTE).

- The CEO of Sirius Real Estate (JSE: SRE) sold shares worth £450k. Interestingly, other directors / associates / senior execs bought shares worth a total of £19k.

- A non-executive director of Richemont (JSE: CFR) has bought shares worth almost R2.3 million.

- An associate of a director of NEPI Rockcastle (JSE: NRP) bought shares worth R1.27 million.

- A founder of Brimstone (JSE: BRN) has bought N ordinary shares worth R165.5k.

- OUTsurance Group (JSE: OGL) shareholders are looking forward to the final dividend of 78 cents a share and special dividend of 8.5 cents a share that the company has declared. The special dividend requires SARB approval and this approval hasn’t been obtained yet, so this may kick out the date for that dividend. The final dividend is unaffected.

- If you’re wondering about your clean-out dividend from Advanced Health (JSE: AVL), there are “unforeseen circumstances” that have delayed the payment to 27 September.

Love the new format:-)

I’m thrilled to be part of the Ghost family.

Keep up the good work!

Great new format! Love it.