Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Ascendis is still loss-making (JSE: ASC)

A delisting without a premium to shareholders will upset a lot of minority holders

The Ascendis share price hasn’t really gone anywhere this year. Neither has revenue, which is slightly down in the year ended June 2023. Gross profit margin fell by 145 basis points to 39.4% and the operating loss has improved from R758 million to R286 million.

That’s still a big loss when your market cap is R424 million.

The headline loss per share is -41.5 cents and the tangible net asset value per share is 81 cents. The share price closed at 67 cents on Friday.

It was a watershed year for the group, with the rights offer closing in August 2022, the Pharma business disposed of in October 2022 and the senior debt fully repaid in March 2023. The company notes that many operational improvements will only bear fruit in the 2024 financial year, which is why talk of a delisting doesn’t win any popularity contests among shareholders.

When you look at the individual business units, performance can vary wildly. The Consumer Health business declined 18% and the Medical Devices segment grew by 20%.

The good news is that the balance sheet is in much better shape, with cash reserves of R102 million and net working capital of over R300 million.

Delta Property makes a tiny dent in its debt (JSE: DLT)

This balance sheet elephant is being eaten spoon-by-spoon

Delta Property Fund has a loan-to-value ratio of 61.36% and a vacancy rate of 32.9%. These are metrics that usually end in financial disaster. The company is desperately trying to offload properties, but it’s really tough in this environment.

The latest announcement deals with the sale of two properties in Bloemfontein for a combined value of R26.1 million. The company is trying to exit Bloemfontein in its entirety. These proceeds will reduce the loan-to-value by just 15 basis points to 61.22% and vacancy levels by 60 basis points to 32.3%.

Kibo Energy has released interim results (JSE: KBO)

The focus isn’t on the financials, but rather on the corporate activities

Kibo Energy is putting together a portfolio of renewable energy assets. This isn’t just rooftop solar for residential complexes. The company is involved in all kinds of things, ranging from plastic-to-syngas through to biofuel and long duration storage.

The company is big on narrative and low on financial results right now, which is why much of the corporate activity has been around agreeing with debt holders to extend the term of the debt and/or convert the loans into equity.

Looking deeper, the company is busy with an optimisation study and laboratory test results at the ICON Park project, which focuses on plastic-to-syngas. The bio-methane Southport project in the UK has been delayed. There is also a dispute related to Shankley Biogas, with settlement negotiations underway.

Moving onto biofuel, there is currently a due diligence programme underway by TANESCO regarding a project in Tanzania. If all goes well, this will end in a power purchase agreement.

In long-duration energy storage, the company is busy with two projects and is targeting the South African market for obvious reasons.

Subsidiary Mast Energy Developments (MED) is another focus area, with a joint venture being put in place with an institutional investor. The completion date has been extended twice, so hopefully nothing falls over there.

As you can see, this is very much a set of promises rather than current financial results. At a share price of 2 cents a share, speculators only need apply.

Orion Minerals looks back on the year ended June (JSE: ORN)

It’s been a period of solid progress, with the share price up 26% over 12 months

This period was a big one for Orion Minerals, with the strategic funding package coming into play. This includes a convertible loan from the IDC, an early funding arrangement with Triple Flag Precious Metals and an equity investment from Clover Alloys as cornerstone investor.

With money in the bank, full focus is on developing the projects. At the Prieska Copper Zinc Mine, the mine development and construction phase has commenced. An updated Bankable Feasibility Study is the goal here, with substantial progress made. At the Okiep Copper Project, the granting of a mining right was achieved. This was the prerequisite for confirmation drilling and metallurgical sampling to complete the Feasibility Study.

There are a couple of other early stage projects within the group, but Prieska and Okiep are the focus areas for investors.

The focus isn’t on the financials at this stage in the life-cycle. Still, it’s worth noting that the operating loss increased from A$15.5 million to A$17.1 million.

Things have been quieter at Renergen (JSE: REN)

Do you remember when there were practically weekly updates from the group?

It feels like Renergen has been lying low lately. The share price is down around 30% this year and the days of regular updates (arguably too regular) seem to be behind us. The company does need to release quarterly updates though, with the second quarter highlights released to the market on Friday.

LNG production has increased by 88% vs. the previous quarter, so that’s good news. The other good news is that the environmental authorisation for the Virginia Phase 2 Gas Project has been received.

The focus, of course, is on helium production (or lack thereof at the moment). The company previously announced a leak in the helium cold box module prior to initial performance testing. The cold box has been successfully repaired off-site and has been delivered back to the site. The performance test is scheduled for November 2023, so there will hopefully be exciting news about the helium soon.

The cold box issue has not impacted phase 2 of the project, as they are being run in parallel.

The company also mentions “new gas anomalies” that have been identified from a drilling and exploration perspective. The announcement doesn’t really give the non-geologists any information on whether this is a big deal or not.

For the speculators out there, one wonders whether a good outcome from the November testing might inject some life back into this share price?

Rex Trueform moves into school sports streaming (JSE: RTO)

This is infinitely more interesting than acquiring another property

The recent acquisitive activity at Rex Trueform has been as exciting as watching a Rugby World Cup minnow get given an absolute hiding. I’m not sure whey they are so keen on acquiring properties in this market.

There’s now a far more interesting deal on the table, with the acquisition of a 35% stake in ITV Africa for R18 million, payable in cash. The company uses and distributes products, software and hardware related to sports broadcasts and streaming services. The words “artificial intelligence” get used a lot. The business was only founded in 2020, so it’s absolutely remarkable how valuable it became in such a short space of time.

And in case you’re wondering whether this is some kind of tech play that never makes money, the business generated a profit of R15.7 million in the year ended February 2023. This sounds like a smart deal for Rex Trueform and is a much, much better use of capital than buying properties.

Weirdly, Sasfin’s results are late (JSE: SFN)

We normally only see delays in results from messy small caps

Sasfin is by no means the poster child for success on the local market. The market cap is R700 million and the share price has shed over a quarter of its value in 2023. Still, it’s unusual to see a company of this magnitude miss the deadline to release financial results.

Sasfin’s results for the year ended June will only be published on around 13 October because of a delay in finalisation of the audit. That reason won’t exactly give investors a warm and fuzzy feeling either.

The company has at least indicated that headline earnings moved in the correct direction, notwithstanding higher impairments and costs. It would be very concerning if a banking group couldn’t grow earnings in this environment of higher interest rates and inflation.

Telemasters has swung into a profit (JSE: TLM)

But this is still a really marginal business

Telemasters Holdings has a market cap of R44.8 million. It doesn’t trade terribly often, as liquidity in a company like this is almost non-existent. The share price has barely gone anywhere for 5 years.

Nonetheless, I’m giving the results for the year ended June some airtime to show you how marginally profitable a business model can be.

This technology group (mainly connectivity and communications from what I can see) generated R64.2 million in revenue this year and an operating profit of just R2.3 million. In the prior year, revenue was R65 million and the loss was R500k.

Why is this company listed? I genuinely have no idea.

We now have full details on York Timber (JSE: YRK)

Fair value movements on biological assets cause huge swings

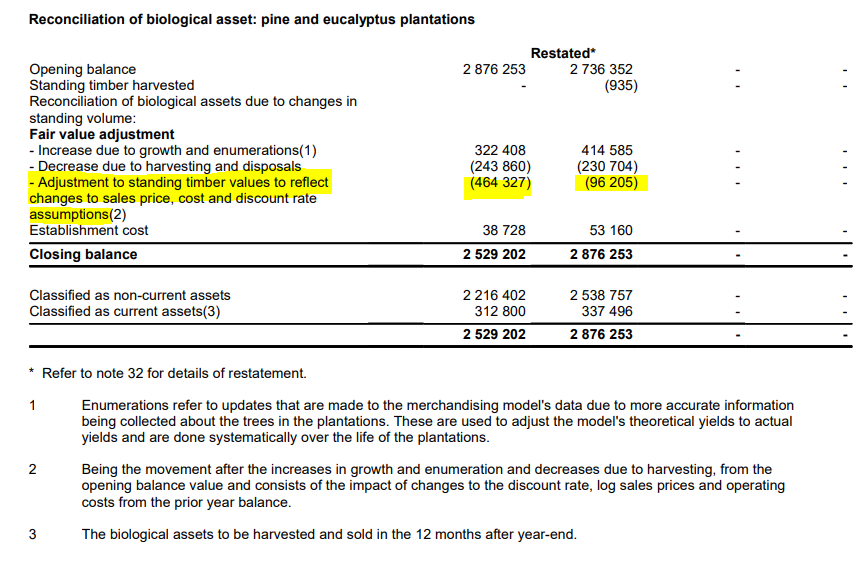

The financial results of York Timber tend to be very volatile. Although the actual business fundamentals aren’t exactly consistent either, the biggest source of volatility is the fair value movements on the biological assets i.e. the value of the trees themselves.

For example, the comparable period showed a fair value profit of R90.8 million and this period was a loss of R384 million. This gets recognised in cost of sales and thus affects gross profit, which is why that line swung from R590 million last year to a loss of R36 million this year. It also gets included in headline earnings.

To understand more about the fair value adjustment, we can refer to the notes to the financials. You’ll note that harvesting and disposals tend to be consistent, but the adjustment to values based on underlying assumptions was much worse this year.

The underlying assumptions that drive the fair value include log prices, operating costs, the costs to sell the logs, the discount rate and the volumes over the cycle of the trees. The discount rate is priced off the 10-year yield curve, which is why an increase in fixed income yields has a negative impact on equity values.

Moving on, the tough result for the year ended June 2023 hasn’t been helped by a drop in revenue of nearly 9.5%. Leaving aside the biological asset valuations, the drop in cash generated from operations of 50% shows that the core business is struggling. The change in biological asset valuation is simply the present value of the future expectations of the business, so there’s a double-whammy effect when things aren’t going well.

The share price is down roughly 20% this year.

Little Bites:

- Director dealings:

- An executive director of Medscheme, a major subsidiary of AfroCentric (JSE: ACT) has sold shares worth R254k.

- A prescribed officer of ADvTECH (JSE: ADH) has sold shares worth R205k.

- The CEO of Libstar (JSE: LBR) has bought shares in the company worth just under R50k.

- The company secretary of SA Corporate Real Estate (JSE: SAC) has sold shares worth nearly R10k.

- Wesizwe Platinum (JSE: WEZ) released results for the six months to June 2023. The biggest movements have been in foreign denominated loans. The headline loss per share was 59.63 cents, much higher than 4.09 cents in the comparable period. The share price is 67 cents a share.

- London Finance & Investment Group (JSE: LNF) has practically zero liquidity on the local market. I’ll therefore just give it a cursory mention, with headline earnings of 4.4p per share vs. a loss of 1.4p in the comparable period. A final dividend of 0.60p (roughly 14 ZAR cents per share) has been recommended for shareholder approval.

- Finbond (JSE: FGL) announced that the acquisition of a 49% stake in Trustco Finance Namibia has once again had the fulfilment date extended, this time to 31 October.

- OUTsurance Group (JSE: OUT) has received SARB approval for the special dividend, with a planned payment date of 16th October.

- Buka Investments (JSE: BKI) hasn’t really done anything yet as a listed company. This is why the results for the six months to August reflect an operating loss of R1.7 million and no revenue. The listing has been suspended since February, as the company has not met the requirements for listing. Assets need to be injected into this cash shell to meet the requirements and the board hopes to announce a final transaction within the next four months. The ambition remains to grow into a sizable fashion business.

- In a quarterly progress report, suspended company Conduit Capital (JSE: CND) noted that the financials for the year ended June 2022 (not a typo) should be finalised by October 2023. The company also announced that the 30% shareholding in Oraclemed Investments and related claims will be sold for R9 million.

- Steinhoff (JSE: SNH) is a step closer to disappearing from the market, with the expiry of the two-month creditor opposition period. No opposition was filed. The listings in Frankfurt and on the JSE will now be terminated, with the latter subject to SARB approval.

- Nonkululeko Dlamini has left the CFO role at Transnet to take up the CFO role at Telkom (JSE: TKG). Her previous experience also includes being acting CFO at Eskom and CFO at the IDC. It’s like playing state-owned bingo.

- Sable Exploration and Mining (JSE: SXM) released interim results. There’s no revenue at all and the loss was R3.1 million, worse than a loss of R2.4 million in the comparable period. The company only has assets of R1.4 million. The company is in the process of being recapitalised via a rights issue.

- Afristrat Investment Holdings (JSE: ATI) is a long and sorry tale of corporate pain. If you want to see how bad it is, you can read the latest quarterly progress report. The new news seems to be that Getbucks Limited (now called GetB) has been placed into liquidation. I’ve long since given up trying to even find a website for the company.