Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Alphamin’s EBITDA is up quarter-on-quarter (JSE: APH)

There’s a big spike in sustaining capex, though

Alphamin reminds us every quarter that it produces 4% of the world’s mined tin. Thankfully, the company gives us new content each quarter in the form of financial results as well.

In the third quarter (the three months ended September), tin production was down 1% vs. the second quarter and sales were up 1%. The average tin price achieved was 4% higher, so this contributed to 8% growth in EBITDA. Importantly, sustaining capex jumped by 39%. Note, these are all quarter-on-quarter numbers (i.e. sequential) rather than year-on-year.

Looking at the nine-month period, the run-rate for tin production is ahead of the level required to achieve market guidance for the full year.

The Mpama South project is still expected to be “substantially completed” within the budget of $116 million, of which $99 million in total has already been spent. To help with liquidity requirements on this journey, debt facilities have been increased.

Towards the end of the quarter, a bridge on the primary export / import route was damaged. Alternative routes have apparently proven effective in the past, so the company expects the negative liquidity impact from this issue to reverse during the fourth quarter.

Famous Brands is struggling (JSE: FBR)

This is a very different tune to the one that competitor Spur has been singing

Even before this update, I wouldn’t have had any difficulty choosing Spur (JSE: SUR) over Famous Brands. The Wimpy at the shopping centre near my house never seems to have anyone under the age of 75 in it and the Mugg & Bean doesn’t operate during load shedding. In stark contrast, Spur always seems to be buzzing.

Although one has to be very careful of interpreting the “local store” and then applying that to a national footprint, it’s also true that there’s no due diligence quite like seeing the business in action. After all, you could’ve saved yourself a lot of pain in the grocery sector by just asking your friends where they are shopping.

For the six months ended August, Famous Brands expects HEPS to be between 3% higher and 17% lower than the comparable period. This means it is very likely that HEPS has gone backwards. The company blames load shedding, cost pressures and the overall economic environment for the profitability of the group.

Personally, I blame the strategic execution vs. competitors. They need a wake up call, as this chart shows:

Sirius sounds upbeat about performance (JSE: SRE)

The strategy remains to sell mature assets and acquire assets that need some work

Sirius Real Estate is focused on the German and UK markets. The company has given an update on trading performance for the six months ended September.

In Germany, like-for-like rent roll growth was 7.7%, measured on a constant currency basis. Rental growth is ahead of inflation and the company thinks that this will be enough to offset yield expansion and the negative impact that this is having on property valuations in the region.

In the UK, rent roll growth is ahead of Germany, but the company doesn’t say by how much. They have indicated that it has exceeded the £50 million milestone for the first time.

Looking at the balance sheet, the weighted average cost of debt will be 2.1% when a new £58.3 million facility with a cost of 4.25% kicks in from December 2023. The weighted average debt expiry will be 4.2 years. Obviously, any debt being refinanced in this market is going to be at a higher rate than the weighted average.

In terms of recycling of capital, Sirius prefers selling mature assets and buying fixer-uppers that need active asset management to unlock value. In this period, they sold a property in Germany on a 6% net initial yield and acquired two properties in the UK on a net initial yield of 9.6%.

Detailed interim results are expected to be released on Monday 20th November.

Transpaco releases the circular for the share repurchase (JSE: TPC)

This is a mature allocation of capital

In case you would like to read the full circular, you’ll find it at this link.

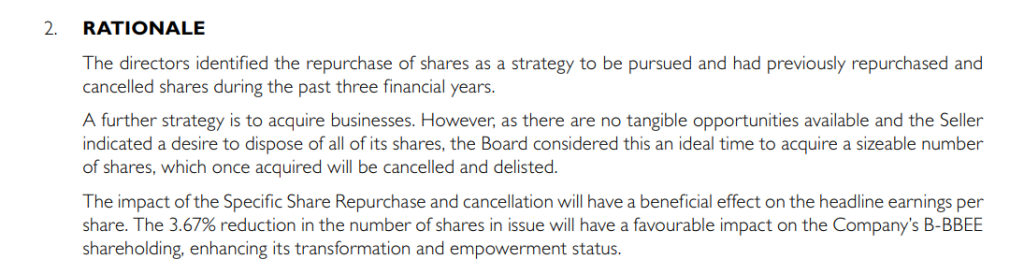

Long story short, Transpaco wants to repurchase 3.67% of shares in issue from a single seller who is not a related party. Here’s the paragraph from the circular that I really like, explaining why the repurchase makes sense:

I wish there were more companies on the market that had the maturity to return capital to shareholders instead of pursuing dicey acquisitions.

Transpaco is repurchasing the shares at R27.83, which is a 10.1% discount to the 30-day VWAP.

Little Bites:

- Director dealings:

- Des de Beer has bought another R527k worth of shares in Lighthouse Properties (JSE: LTE)

- A director of AVI (SE: AVI) has bought shares worth R37k.

- A director of Mpact (JSE: MPT) has sold shares worth R15.5k.

- Gold Fields (JSE: GFI) has announced the appointment of Mike Fraser as CEO with effect from 1 January 2024. He will take over from Martin Preece who has been interim CEO since 1 January 2023. Fraser is currently the CEO of AIM-listed Chaarat Gold Holdings and previously served as COO of the aluminium, nickel, SA manganese and energy coal businesses at South32. His other senior roles have been at BHP.

- In case you thought the restructure of AngloGold Ashanti (JSE: ANG) and the move of the primary listing to New York wasn’t already expensive enough, the transaction triggered a tax liability of $286 million across South Africa and Australia. Only $46 million of that is in Australia, with the rest boosting our battered local fiscus.

- Salungano Group (JSE: SLG) has reminded the market that subsidiary Wescoal Mining is in voluntary business rescue, hence the group is trading under a cautionary announcement.