Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Barloworld’s HEPS has inched forwards (JSE: BAW)

This is a perfect example of the importance of continuing vs. discontinued operations

When a group has either disposed of or shut down an important part of its business, the concept of continuing and discontinued operations becomes critical. If a business is no longer there, then obviously the total level of earnings is not comparable to the prior period in which it was there.

Where a business was loss-making, then excluding it makes the current results seem better than they really are on a year-on-year basis. When a successful business is sold or unbundled (as in the case of Barloworld and Zeda), then excluding them can make results look worse.

Barloworld has released a trading statement for the year ended September and the numbers are heavily skewed by the Zeda deal (and the disposal of Barloworld Logistics to a lesser extent), so the only year-on-year change worth looking at is HEPS from continuing operations, as this tells you how the rest of the group is doing.

For this period, HEPS from continuing operations grew by between 4.8% and 6.2%.

Bidcorp is still growing by double digits (JSE: BID)

Watch out for volatility based on the rand, though

Food services giant Bidcorp is one of the very best rand hedges on the local market. The company is a top performer and the vast majority of income is earned outside of South Africa. That’s good when the rand is weakening and bad when the rand is strengthening. This causes volatility in the JSE-listed share price because both the currency and sentiment about the underlying company have an impact.

Bidcorp has given the market an update on the four months to October, with headline earnings showing “real growth” in an environment of 8% inflation. In other words, headline earnings is up by more than 8%. It could be a fair bit more than that actually, as revenue for the four months is up 12.8% year-on-year. What we do know is that gross margin has dipped slightly year-on-year and operating costs as a percentage of net revenue improved by 10 basis points to 18.4%. This has offset the decline in gross margin, allowing EBITDA margin to remain steady at 5.8% of net revenue.

Looking at regional exposures, trading margins have improved in both Australia and New Zealand as well as Europe. Sales are doing well in the UK where food inflation sits at 12%, but it’s been difficult to pass on increases and so margins are underperforming. The Emerging Markets segment includes a huge number of countries and they haven’t given commentary on the margin performance as a whole. A comment that I wouldn’t ignore is that gross margin in China has come under pressure.

Capital expenditure of R1.4 billion is higher than R1.0 billion in the comparative period, with R1.0 billion going into replacement of capital equipment and R0.4 billion into creation of future capacity. There has only been one bolt-on acquisition in Australia in this period.

Capital Appreciation has gone slightly backwards (JSE: CTA)

The use of normalised earnings is helpful here

In a business update published towards the end of September, Capital Appreciation gave an idea of the difficulties being faced in this environment. This is distinct from the expected credit loss at GovChat, with R56.3 million raised in the prior period and R9.4 million in this period. This has obviously driven a very attractive jump in HEPS that isn’t reflective of the performance of the underlying business.

It’s important to note that this is because the credit loss is included in headline earnings, with the number for the comparative period having been restated to reflect this accounting treatment.

To give a better idea of how the core business is performing, the company has also reported normalised earnings. This excludes the GovChat impairments from the previous and current periods, showing a drop of between 7.3% and 5.5% in HEPS for the interim period. On this basis, it came in at between 7.19 and 7.33 cents,

The share price closed 4.6% higher at R1.15 per share.

Putting the dip in Dipula: interest rates are biting (JSE: DIB)

Distributable earnings have dropped under the pressure of interest rates

Dipula Income Fund has released a trading statement for the year ended August. It gives actual numbers rather than an estimated range.

Distributable earnings fell by 6.94% year-on-year. After the restructure of the capital structure that saw B shares issued for every A share held, there are vastly more shares in issue than before. Distributable earnings per share thus dropped by 22.2%.

Glencore acquires 77% in Teck’s steelmaking coal business (JSE: GLN)

If the name sounds familiar, it’s because Glencore has been flirting with Teck for a while now

Glencore has agreed with Teck Resources to acquire a 77% effective interest in Teck’s steelmaking coal business, Elk Valley Resources (EVR), for $6.93 billion in cash. There’s also the acquisition of shareholder loans worth between $250 million and $300 million on closing.

In a separate deal, Nippon Steel Corporation will roll its 2.5% interest in Elkview Operations up into equity in EVR. That company will also acquire equity in EVR from Teck such that it will hold a 20% interest in EVR on closing.

In case you’re keeping track of the maths, POSCO is going to exchange its 2.5% interest in Elkview Operations and its 20% interest in the Greenhills joint venture for a 3% interest in EVR.

In short, this gives Teck an exit from the steelmaking coal business. It gives Glencore a solid business in Canada, one which generated profit before tax of C$6 billion in the 2022 financial year. This makes it sound like the purchase price is a steal, if you’ll exclude a bad pun.

Within 24 months of the close of this deal, Glencore still hopes to move forward with a demerger plan that would see the coal and carbon steel businesses spun out as a standalone entity. Such a transaction would be triggered by sufficient deleveraging of the balance sheet.

Netcare’s HEPS is significantly higher (JSE: NTC)

This trading statement is the pre-cursor to results being released next week

Netcare has released a trading statement for the year ended September, reflecting strong growth in HEPS of between 35% and 38%. Adjusted HEPS grew by between 25.5% and 28.5%.

If we simply use HEPS as reported, the expected range is 99.9 cents to 102.1 cents. The share price closed 4.4% higher at R13.19, so that’s a Price/Earnings multiple of around 13x.

Detailed results are due on Monday, 20 November.

Novus gives an exact HEPS number for the interim period (JSE: NVS)

I’m not entirely sure what the point of this trading statement was

Novus will be releasing earnings on 15 November. I’m therefore not entirely sure why a further trading statement came out on 14 November, particularly when it gives the exact HEPS number for the interim period anyway.

Perhaps the company was just very eager to tell you that HEPS for the interim period will be 28.77 cents. The share price closed 2.4% lower at R4.10.

Santam is facing a difficult underwriting environment (JSE: SNT)

And this announcement came out before all the videos of the hail storm in Joburg

Short-term insurance has been a difficult game in South Africa, with some major loss events and a lag effect in premiums that has seen replacement and repair costs move substantially higher before insurance premiums could catch up. I’ve learnt through this process that inflationary conditions are tough for short-term insurers because policies are generally only revised once per year.

Santam is trying hard to improve the underwriting performance through various initiatives, including geo-coding that gives a comprehensive risk-based view of property locations. The hail storm this week is a perfect example of why over-exposure to a single area can be a disaster for insurance companies.

In an operational update covering the nine months to September, Santam announced that the Conventional Insurance side of the business achieved net earned premium growth of 7%, with positive contributions from all business units excluding Santam Re. This is because non-profitable business was cancelled in Santam Re. This is a theme throughout the announcement actually, with Santam referring to corrective measures taken on poorly priced insurance business.

The partnership with MTN seems to be going well, with almost 100,000 new policies sold to date. The transfer of the in-force book of MTN device insurance is still subject to regulatory approval.

Although top-line growth in Conventional Insurance looks alright, the net underwriting margin was below the target range of 5% to 10%. Natural disasters and property fires have been largely to blame.

The good news is that the investment return on insurance funds, a key part of the business, improved significantly year-on-year. The key float portfolio produced excess returns relative to the benchmark.

Moving on to the Alternative Risk Transfer business, the announcement has just one sentence that talks to strong growth, underwriting results and investment margins.

In the Sanlam Emerging Market partner business, disposal proceeds of EUR126.4 million were received in September for the disposal of the 10% interest in SAN JV to Allianz. These are gross proceeds of R2.6 billion, of which R2 billion was distributed to shareholders in the form of a gross special cash dividend of R17.80 per share. Shriram General Insurance achieved strong premium growth and saw underwriting margins improve.

The outlook doesn’t make for great reading, with an ongoing volatile environment as the backdrop to Santam’s efforts to improve the underwriting performance. The property book is the biggest focus area, particularly based on large fire losses.

Sibanye hosted a battery metals investor day (JSE: SSW)

The company regularly gives detailed strategic updates to the market

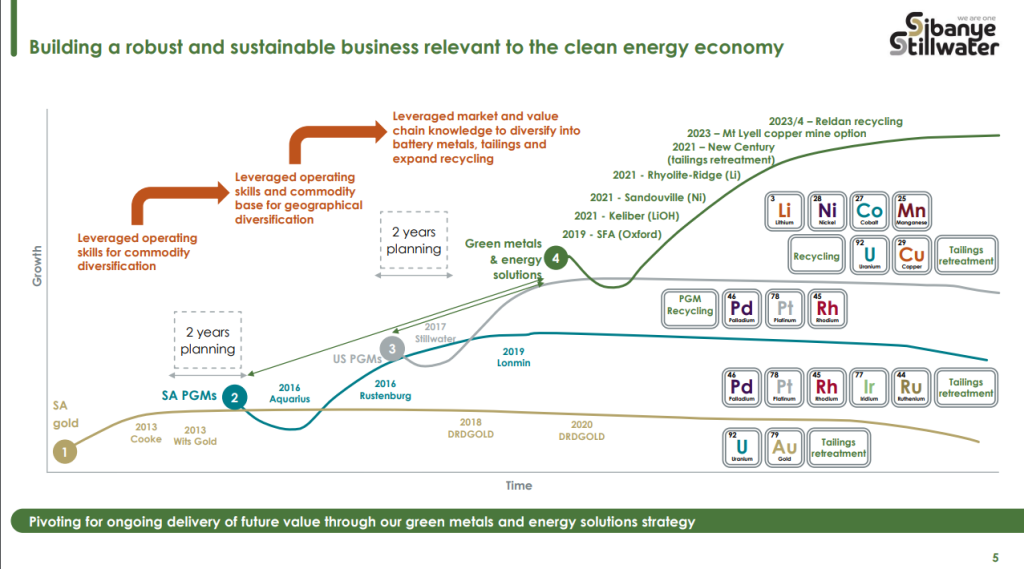

If you are interested in battery metals or if you are a shareholder in Sibanye, then you’ll want to refer to this presentation delivered by the company on Tuesday. This slide gives a very good idea of how Sibanye has developed over the past decade or so and where the group is headed:

Stor-Age’s dividend is higher, but only just (JSE: SSS)

Where so many property funds have faltered though, Stor-Age has been dependable

Investors in high quality REITs are generally looking for a hybrid return of debt and equity. This takes the form of a dependable dividend and some growth, ideally in line with inflation. Although Stor-Age has only managed to increase the dividend per share by 2% in the six months to September, there’s also an increase in net asset value of 7.2% to help the investment thesis.

Same-store rental income is up 13.6% in SA and 3.1% in the UK, with closing occupancy of 90.6% locally and 83.9% in the UK. The rental rate (i.e. the impact of just pricing, not pricing and occupancy etc.) increased by 9.6% in South Africa and 5.1% in the UK.

The loan-to-value ratio is 31.9% and over 75% of net debt is subject to interest rate hedging.

The full year dividend guidance is 118 to 122 cents per share. This is based on maintaining a 100% dividend payout ratio, which tells you a lot about how seriously Stor-Age takes its role as a dividend conduit for shareholders. Based on the current price of R12.20, this implies a six-month forward yield of 9.8%.

The net asset value is R15.58, based on SA REIT Best Practice Recommendations.

Trematon’s NAV went the wrong way (JSE: TMT)

Intrinsic NAV is the most sensible metric here

Trematon is an investment holding company, which means that using a metric like HEPS doesn’t make a lot of sense as some investments are consolidated and others aren’t. This doesn’t stop the company from including HEPS guidance in its trading statement, though I struggle to see the point. The move in HEPS is what triggered the release of a trading statement, coming in at less than half of the comparable period for the year ended August.

The thing to focus on is intrinsic net asset value, or INAV. This is the supposed to be the value of the portfolio assuming an efficient disposal of assets, net of debts and taxes. INAV per share has dropped by between 11% and 10%, coming in at 435 cents to 440 cents.

The share price closed slightly lower at R2.95, reflecting a discount to INAV that is typical of locally-listed investment holding companies.

The sun is shining at Tsogo Sun (JSE: TSG)

Part of this is the base effect of hotel management contract cancellations

Tsogo Sun published a trading statement for the six months ended September 2023, reflecting a massive jump of between 43% and 51% in HEPS. This equates to an expected range of between 83 cents and 87.5 cents.

The base period included the negative impact of hotel management contract cancellations, so this contributed to the substantial year-on-year move.

To fully understand this result, we need to wait for detailed results on 28 November.

Little Bites:

- Director dealings:

- The Chief Information Officer at Capitec (JSE: CPI) has sold shares worth around R10 million.

- A director of a major subsidiary of Super Group (JSE: SPG) received a significant award of performance shares and sold the entire lot for over R9.3 million.

- Des de Beer bought another R1.6 million worth of shares in Lighthouse Capital (JSE: LTE).

- A non-executive director of Shaftesbury Capital (JSE: SHC) bought shares worth £56.5k.

- A director of Harmony Gold (JSE: HAR) has sold shares in the company worth R741k, perhaps taking advantage of the spike after the release of results.

- Orion Minerals (JSE: ORN) announced that Clover Alloys (SA) has notified Orion that it will not exercise the options expiring 30 November. Clover has a 9% stake in Orion and remains a supportive shareholder with representation on the board. Clover is just taking a measured approach here (according to Orion at least), with Orion’s work at the Prieska Copper Zinc Mine being funded by the IDC and the Triple Flag facility. In contrast, previous director Thomas Borman exercised his option to acquire shares at R0.20 for a total value of $2.27 million.

- Universal Partners (JSE: UPL) released a quarterly update that shows a flat NAV vs. June 2023. The dental side of the business is growing and Universal followed its proportional rights, investing a further £1.4 million in payment-in-kind notes in that business. The UK contractor accountancy and payroll solutions business is holding its own in a tough market. Credit investing group SC Lowy achieved good performance in its funds. Recruitment group Xcede is unfortunately not doing so well in these conditions, although new management is having a positive impact. Despite “reinventing the toilet”, Propelair is still way behind the original business plan and is recognised at a nominal value.

- There’s a rather unusual situation at Brikor (JSE: BIK), which is currently under offer by Nikkel Trading. The circular for the offer hasn’t been sent out yet, despite an extension having been granted by the Takeover Regulation Panel (TRP). A further extension has been granted, as they are now sorting out an issue related to the expiry of the irrevocable undertaking given by the CEO of the group. He previously gave an irrevocable not to participate in the offer. That irrevocable has expired and he refuses to give another irrevocable, which means Nikkel now needs to stump up a guarantee showing it can acquire all the planned shares plus those held by the CEO. It’s an extraordinary swing to see the CEO now potentially exiting his stake after the initial offer was made based on him not accepting it.