Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

The poultry industry isn’t for chickens (JSE: ARL)

I promise that’s my only pun about these results from Astral Foods

The chicken business is so tough that all of the listed companies in this space have “Foods” in their name rather than chicken, in the hope that perhaps you won’t notice what they do. Jokes aside, it’s often because of a desire to diversify beyond chicken, with RCL having made the biggest strides in that regard.

The focus here is on Astral Foods, which has released results for the year to September. It was a truly terrible period, with flat revenue and a complete collapse in profitability. Between load shedding and bird flu, this was a perfect storm.

Off the back of the first financial loss in the group’s 23-year history, the overdraft ended the period at R1 billion. A full R600 million was drawn over this period, with R398 million in capital expenditure focused on electricity and water services. In other words, the failings of government are hitting Astral squarely between the eyes.

The poultry game is so tough that a backlog in slaughtering can cause a serious problem for profits. Bluntly, a chicken that is past its ideal weight is now a financial liability that needs to still eat. This leads to older birds that are heavier than they should be. The chickens probably appreciate that, but shareholders don’t. When feed costs are 70% of the cost of raising a broiler and those prices increased 15.4% even before the load shedding-driven backlog, Astral never really stood a chance in this period.

The poultry division swung from an operating profit of R802 million to an operating loss of R1.38 billion. Bird flu was a R400 million hit, which really puts the estimated cost of load shedding (R1.6 billion) into perspective.

The feed division offered a modest silver lining, with revenue up 11.9% in response to higher selling prices. Volumes increased by 1.1%, not least of all thanks to the too-fat internal chickens. External sales volumes fell 10.9% as the pig and table egg sectors took strain. There really is nowhere to hide at the breakfast table. The feed division managed to increase operating profit by 21.5%, but much of the gain here was simply a loss in the poultry division.

There are a number of strategic initiatives underway to try and improve the situation and repair the balance sheet. The stark reality is that government needs to keep the lights on, otherwise South Africa’s staple protein is going to need to become more expensive.

Barloworld keeps grinding higher (JSE: BAW)

Key metrics have gone the right way

The highlights reel of this Barloworld result shows a group that is getting things right. Revenue is up 14% for the year ended September and EBITDA is up by 15%. Group net debt has come down drastically by 86% thanks to the unbundling of Zeda and a period of strong free cash flow generation.

It’s important to consider continuing vs. discontinued operations, as Barloworld unbundled Avis Car Rental and Leasing (now separately listed as Zeda) in December 2022 and sold the Supply Chain Solutions business in March 2023. The right thing to focus on is continuing operations.

If we look deeper, the largest segment is Equipment southern Africa and it grew revenue by 35%, so that’s rather helpful. Equipment Russia saw revenue decrease by 40% for obvious reasons. Equipment Mongolia was up 59%. Ingrain, the consumer industries business, grew revenue by 11%.

Operating profit tells a different story though. Equipment southern Africa was up 19%, so there’s some margin pressure there. Equipment Mongolia had beautiful operating leverage, with profit up 179%. Fascinatingly, Equipment Russia only saw profit fall by 15%, whereas Ingrain was down by 17% despite growing revenue!

The cost of money can never be ignored, with net finance costs up by 52%. Most of this is because of the increased cost of funding, though some of it is due to higher financing needs overall.

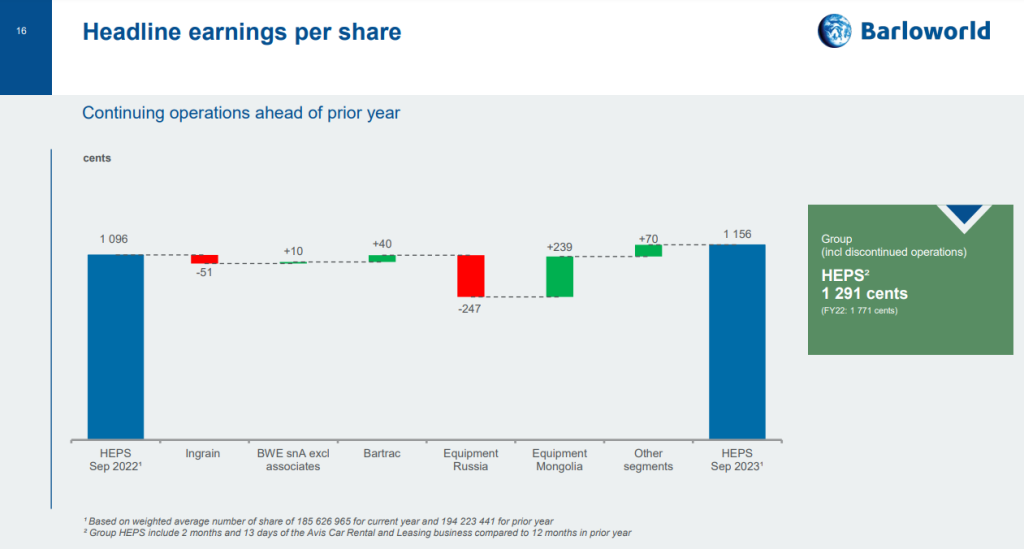

I love a good waterfall chart, so I’ll show the HEPS from continuing operations slide in all its glory. HEPS from continuing operations (the only one you should be looking at) increased by 5.5%, with the movements in Russia and Mongolia offsetting each other:

Brikor shows what an inflection point for profits looks like (JSE: BIK)

When the base period is break-even or close to it, modest revenue growth can cause fireworks

Brikor is currently under offer from Nikkel Trading, with the circular delayed because of a rather interesting turn of events that has seen the CEO of Brikor being unwilling to renew his irrevocable undertaking to not sell his shares.

Looking at the latest numbers, revenue for the six months to August has increased by 13.4%. That’s solid but not spectacular, until you see that revenue in the base period was only good enough for a break-even result. When you grow off that base, the impact on profit is huge.

EBITDA is more than 5x higher at R40.4 million vs. R7.3 million in the base period. Headline earnings per share moved from nil to 2.7 cents, with the share price currently at 17 cents. The tangible net asset value was 28.6% higher at 12.6 cents, so the current price is a significant premium to that metric.

The bricks segment achieved EBITDA of R17.1 million and the Coal segment was good for R9.8 million. In both cases, gross profit margin moved much higher than in the comparable period.

FirstRand reiterates guidance for the new financial year (JSE: FSR)

The financial services released a voluntary trading update

FirstRand has a June year-end. The guidance for results for the year ending June 2024 has been affirmed, but to be fair that guidance was given in September 2023 so there’s hardly been much time since then. The group is looking for earnings growth of real GDP plus CPI plus between 0% and 3%. ROE is expected to remain at the upper end of the targeted range of 18% to 22%, which is why FirstRand maintains a premium valuation vs. its peers.

The most interesting update is that the credit loss ratio is lower than initial guidance. It is not expected to even reach the midpoint of the through-the-cycle range, which shows how conservative the origination strategy has been. I must point out that a credit loss ratio can also be too low, leaving a bank exposed to losing market share. After all, the entire point of a bank is to lend out money.

Much of the current FirstRand performance is being achieved on the deposit side, with the bank continuing to execute a strategy of having a low funding cost relative to peers. This enables it to achieve a stronger net interest margin, particularly net of credit losses when being more selective about lending. Again, there are balancing arguments here.

FirstRand has cautioned the market that its interim results for the six months ending December won’t be in line with what the full-year results should look like, as there are importance once-offs in the interim base. Costs are also higher for this period, with expected normalisation in the second half.

Naspers and Prosus talk to “accelerated profitability” (JSE: NPN | JSE: PRX)

I think what they meant to say is “lower losses” in the portfolio beyond Tencent

Using the term “accelerated profitability” means that there is profitability to start with. Unless something drastic has changed since the last time I looked, the portfolio of businesses beyond Tencent is still firmly in cash burn stage. I accept that losses might have decreased year-on-year, but to describe this as accelerated profitability is a serious stretch.

After the exit of the OLX Auto business, the comparable numbers have been restated so that the group can report based on continuing and total operations.

If you look at HEPS from continuing operations, then Naspers jumped from 28 US cents to 282 – 284 US cents based on continuing operations. For total operations, HEPS showed a similar outcome by increasing from 24 US cents to 286 – 288 US cents.

At Prosus, which has more footnotes than anyone wants to deal with because of the effect of the cross-holding transaction, HEPS increased from 7 US cents to between 46 and 48 US cents.

A comment in the Prosus announcement should temper any enthusiasm about the portfolio. The company talks about how there were lower impairment losses of $0.5 billion in this period vs. $1.5 billion last year. This spike in profitability is because things are less bad, not because they are good.

Netcare posts a significant year-on-year recovery (JSE: NTC)

There’s still a long way to go to pre-pandemic levels

Netcare has released numbers for the year ended September. The year-on-year numbers look super strong, with revenue up 9.5%, EBITDA up 14.5% and HEPS up 36.5%. The dividend per share is up 30%, so the cash has mostly followed the earnings.

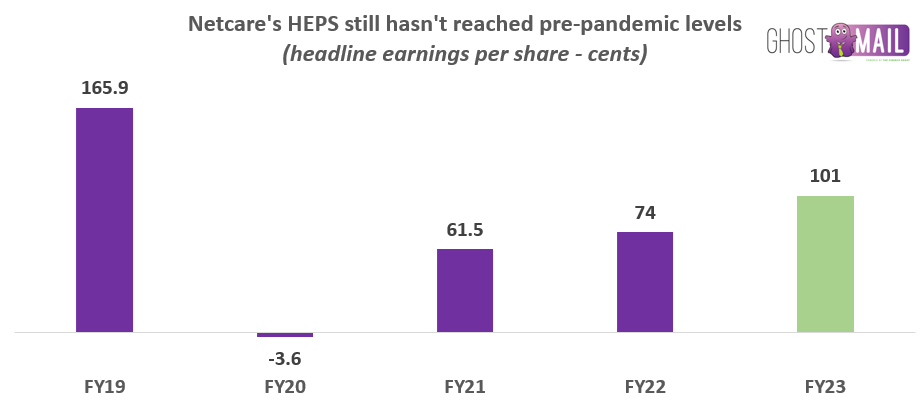

Before you rush to buy Netcare in the hope that you’re buying a high growth stock, here’s a chart that includes pre-pandemic earnings:

There’s clearly some way to go. It’s also worth noting that return on invested capital (ROIC) has increased from 8.8% to 10.8%. In an environment where the prime rate is 11.75%, a return of 10.8% is far from exciting.

As I’ve shared in Ghost Mail before, I generally don’t see the appeal of hospital groups. They inevitably generate sub-par returns on capital.

I do always look in the detailed numbers for stats that give you an indication of the times that we live in. Maternity cases declined, which is a broader sector trend. The other very unfortunate trend is a sharp increase in mental health days. This is a focus area for Netcare because demand is so high, with mental health occupancy as the highest in the group.

The outlook for 2024 is revenue growth of between 7.5% and 9.5%, along with further EBITDA margin expansion and a higher ROIC.

The share price closed 6% higher on the day. It has lost nearly half its value over five years.

Omnia’s Chemicals business dished out the most pain (JSE: OMN)

The only bright spot in these numbers was the Mining business

For the six months to September, Omnia wrote a lot of pretty things about resilience while posting revenue down 14%. If we exclude the Zimbabwe operations due to hyperinflation, we find operating profit down 34% and adjusted HEPS down 28%. If we include Zimbabwe, HEPS fell by 4%.

The segmental piece tells the most important story. The Agriculture business saw revenue drop by 13% and operating profit fall by 47%, with slower purchases from two major customers. They expect a better performance in the second half of the year. Mining revenue decreased 6%, but operating profit increased by 26% thanks to the performance of the international business and cost benefits in the local business.

But the Chemicals segment is where the wheels really fell off, with revenue down 24% and operating profit collapsing by 95% to just R5 million off a revenue base of R1.09 billion. There’s a demand problem here which is cyclical, but there are also supply chain and manufacturing challenges that the company needs to overcome.

Omnia is still fighting with SARS over the tax assessments for 2014 to 2016. The process has reached the stage where the parties will go for Alternative Dispute Resolution.

PPC is focusing on southern Africa (JSE: PPC)

Will it be the right decision to concentrate on a low growth region?

PPC has released results for the six months to September. This is hot on the heels of the news of a disposal of CIMERWA in Rwanda, which the market liked when that deal was announced at a premium to the value at which the business was recognised in PPC’s books.

It may derisk things to turn a business into cash, but will it be the right long-term decision? After all, the decision to focus on southern Africa is a combination of PPC Zimbabwe (a good business in a volatile economy) and PPC South Africa (a business with excess capacity in a lame duck economy). We shouldn’t forget PPC Botswana as well, which gets lumped in with PPC South Africa for reporting purposes.

CEO Roland van Wijnen has done well during his tenure and this was his final strategic move, so I have no doubt it was well considered. His successor Matias Cardarelli won’t be taking many flights to East Africa, it seems.

The results from continuing operations are the ones to focus on, showing revenue up 20.9% and EBITDA up by a meaty 46.8%, as EBITDA margin moved 400 basis points higher. HEPS has moved strongly into the green at 26 cents vs. a loss of 5 cents in the comparable period.

The SA and Botswana businesses increased revenue by just 2%, hence my lame duck comment. Cement volumes fell 4.7%, mainly in the coastal regions (due to cheap imports) and in Botswana. At least EBITDA margins increased from 12.2% to 12.6%. PPC Zimbabwe grew revenue by 104% and saw EBITDA margins jump from 17.3% to 24.6%. A dividend of $4 million was paid and a further dividend of $7 million was declared in November.

Although the business in Rwanda is on its way out, it’s worth noting that revenue was up 14.5% but EBITDA margins decreased from 32.3% to 29.4%. Perhaps it’s the right time to sell, after all.

As a sign of how well PPC has done to repair the balance sheet, finance costs actually fell slightly year-on-year, despite the jump in interest rates. That’s a direct result of the reduction in gross debt.

Sirius taps the market for £145 million (JSE: SRE)

In an accelerated bookbuild structure, retail investors don’t get the chance to participate

Sirius had a busy day. The company released results for the six months to September and looked to raise £145 million on the market. In an accelerated bookbuild approach, the bookrunners get on the phone to institutional investors to offer them shares and find out how many they want. By “building the book” in this fashion, they basically keep going until the entire capital raise has been filled. If there is sufficient demand, the quantum of the raise can be increased.

The final pricing of the capital raise will depend on the level of institutional demand and at what price. Retail investors sit on the sidelines in this process. If the raise is at a discount (and it usually is), then there’s effectively dilution that cannot be avoided. We will have to wait for the results of the bookbuild to see what happened.

The intention behind the bookbuild was to raise money for potential acquisitions in the UK and Germany. The German assets are typically under-rented opportunities with a site value of €10-50 million. There is limited competition among buyers for these properties. In the UK, they also look for assets with asset management potential, usually with a site value range of £5-25 million. The group has identified eight properties that it wishes to acquire, of which four are in the Germany with a total value of €85 million and four are in the UK with a total value of £45 million. The bookbuild would also strengthen the balance sheet, taking the loan-to-value to below 35%, which is well below the group target of 40%.

Alongside the bookbuild, Sirius announced results for the six months to September. Funds from operations per share increased by 9.4%, with this metric seen by many property investors as being the most important one to focus on. Goodness knows that the dividend matters as well, up by 11.1%.

97% of group debt is at fixed interest rates for the next 2.5 years. The loan-to-value is 40.8%, which shows why the bookbuild is important for further acquisitions.

The net asset value per share is 102.65c. This is in euros, with a current conversion putting it at around R20.50. The current share price is R20.25, so hopefully the bookbuild was completed at or close to book value.

Smaller losses at Stefanutti Stocks (JSE: SSK)

But a loss is still a loss

Stefanutti Stocks released a trading statement for the six months to August. The split between continuing and total operations is important because the group is busy with a restructuring plan and related disposals. From continuing operations, the headline loss per share will be between -10.13 cents and -5.07 cents, which is at least a significant improvement vs. -25.33 cents in the comparable period.

For total operations, the headline loss per share is between -25.02 cents and -20.02 cents vs. -25.02 cents in the comparable period, so the discontinued operations are the problem. Disposals are expected to be concluded within the next 12 months.

Little Bites:

- Director dealings:

- A director of Investec Bank Limited, which is a major subsidiary of Investec (JSE: INL | JSE: INP), has sold shares worth R2.5 million.

- The spouse of the CEO of WBHO (JSE: WBO) has sold shares worth nearly R1.7 million.

- The Mouton family (through various vehicles) has bought shares in Curro (JSE: COH) worth a total of R1.6 million.

- Two independent directors have resigned from the board of Spar (JSE: SPP) just 10 days before full-year results will be released.

- Castleview Property Fund (JSE: CVW) announced that the expected dividend per share for the six months to September will be 10.676 cents per share. Interim results are expected to be released on 30 November. The current share price is R8.50.

- Grand Parade Investments (JSE: GPL) has declared a cash dividend of 10 cents per share in respect of the year ended June 2023.

- Sasol (JSE: SOL) shareholders voted in favour of the special resolution that would allow the company to issue shares to holders of convertible bonds who exercise their rights. This is dilutive for shareholders who don’t have these bonds i.e. most of them.

- Salungano (JSE: SLG) renewed the cautionary announcement related to the voluntary business rescue process at subsidiary Wescoal Mining.

- In case something went terribly wrong in your life and you are stuck with Go Life International (JSE: GLI) in your portfolio, then I guess you’ll want to know that results for the three months to May were released. The company doesn’t make any revenue. The operating loss is $43k and the net asset value per share is still negative. Good luck to you.