Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

The inevitable delisting of Ascendis is upon us (JSE: ASC)

Interestingly, this is a general offer rather than a scheme – and that’s unusual

Typically, a delisting of a company is achieved through a scheme of arrangement. This is called an expropriation mechanism by advisors, as you need 75% approval to force the outcome on 100% of shareholders. Without this mechanism, things would grind to a halt in corporates, as you can’t have just a handful of shareholders blocking the rest from an outcome.

Sometimes, you’ll see a general offer instead. In such a case, shareholders can choose to reject the offer and follow the company into unlisted territory. The downside of course is that liquidity is non-existent in the private space, so you’re probably going to hold those shares for a long time.

In a consortium led by ACN Capital, the offer price to shareholders of Ascendis is 80 cents per share, reflecting a premium of 25% to the 30-day VWAP. The consortium has been put together by Carl Neethling of Acorn Agri fame. I must of course point out that Carl is the current CEO of Ascendis, so this is essentially an offer by the management team to either accept 80 cents a share or join them in the private market rather than the listed market.

The post-delisting strategy includes a variety of restructuring and growth initiatives. This is a classic private equity play of taking a business and fixing it in private rather than in public, as that’s a far more efficient way to do it.

Now, here’s the most important part: the exit offer is conditional upon the delisting resolution being approved by shareholders by no later than 30 April 2024. A delisting requires approval by 75% of shareholders. Based on irrevocable undertakings and strong intentions of support, the company believes that it has already secured 59.98% approval.

Despite the fact that this isn’t a foregone conclusion, the share price jumped to 80 cents anyway. Anyone buying at that price is presumably looking forward to joining the team in private, as the offer of 80 cents is months away from being paid.

Revenue up at Invicta, but HEPS has gone nowhere (JSE: IVT)

The bankers are getting the spoils at the moment, with finance costs up significantly

In an industrials firm, a decent revenue performance is usually accompanied by improved operating margins and a juicy jump in net profits. That hasn’t transpired at Invicta, at least not on a HEPS basis.

Revenue increased by 12% in the six months ended September and so did gross profit, so it’s not a gross margin issue. Operating profit was up 7%, with expected credit losses on trade receivables driving the deterioration in operating margin. Profit before tax increased by 6%, with the further knock to margin coming from the jump in finance costs that offset the improved equity-accounted earnings from joint ventures.

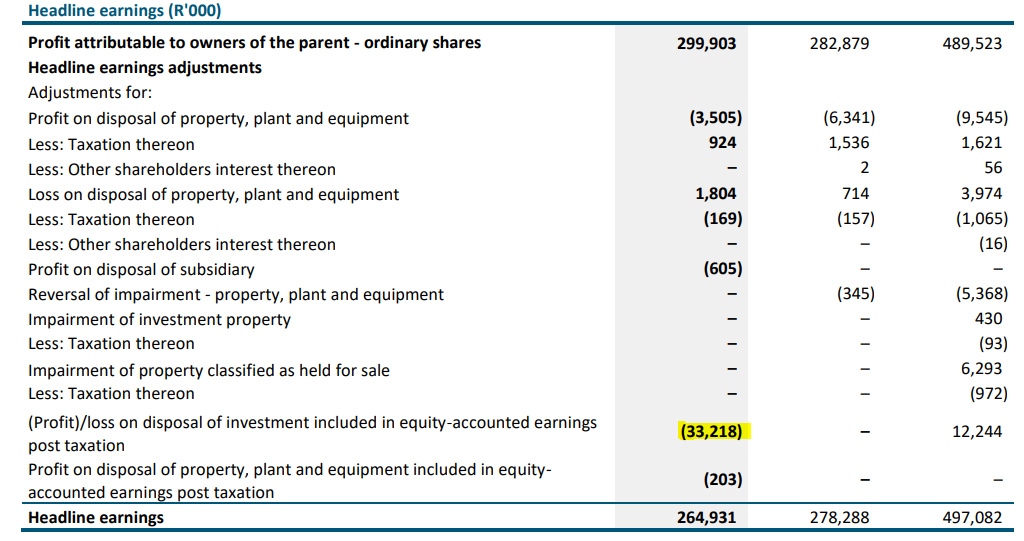

By this stage, you must be wondering why HEPS was flat despite a 6% increase in profit before tax, particularly in a period where Invicta repurchased 1% of ordinary shares outstanding. To figure that out, we have to refer to the note on headline earnings, where you’ll see a substantial profit in the equity-accounted earnings that gets reversed out for headline earnings:

You can now see that headline earnings actually dropped slightly, with the share repurchases bringing this up to a flat HEPS result (269 cents vs. 268 cents in the comparable period).

So, we now know that the sale of a property by Kian Ann (the associate in Asia) is what improved profits, as the operational profit growth from the core business was actually eaten up by finance costs. This is why debt reduction is a strategic focus for the group, as the management team at Invicta is currently working hard so that their bankers can live better lives.

As a final comment, these industrial groups are always far more volatile at segmental level than group level. It’s a game of swings and roundabouts, with some segments doing well (like operating profit up 34% in the Capital Equipment segment) and others taking a nasty smack, like the auto / agri parts business where operating profit fell 28%.

In line with last year, there’s no interim dividend. Invicta only pays a final dividend.

Oceana prioritises volumes over margins at Lucky Star (JSE: OCE)

And in this period, it seemed to work

Oceana reported numbers for the year ended September 2023 and they look excellent. From continuing operations, revenue increased by 22.6% and HEPS was good for 29.2%. That’s the shape that you want to see on the income statement.

In some areas, like fish oil, improved pricing gave the group a significant boost. In others, like the canned fish businesses, the group opted to absorb some of the input cost pressures in an effort to maintain affordability of the products. Along with other challenges like catch rates and load shedding costs, the impact was a drop in gross margin from 30.8% to 28.6%.

They tried to make up for it in other areas, like sales and distribution expenditure from continuing operations up by 9.9%, which means these costs fell as a percentage of revenue from 5.9% to 5.3%. Overheads were up by 16.5%, mainly due to employment costs. Thankfully, that’s still below revenue growth.

Unlike so many other companies at the moment, the net interest cost actually reduced from R168 million to R154 million thanks to debt repayments.

The group is doing a good job of generating cash and is doing an even better job of investing it in the business. Capital investment jumped by 120%, allocated to various projects within the operations.

The only negative in the segmental result was wild caught seafood, which grew revenue by 9.1% and saw operating profit fall by 15.3%. Notably, Lucky Star volumes were up 9%. Canned fish inventory was 18.7% higher, so there’s been significant investment here to ensure availability of product. That isn’t the case everywhere in the business, like local fish oil stocks which have dropped substantially.

And in case you need a reminder of how risky this business is, I couldn’t resist highlighting the cancellation of Peru’s main anchovy fishing season due to the high presence of juveniles, resulting from the effect of the El Niño weather pattern. These fishing groups can have good years and terrible years, often for reasons well outside of their control. In this case, that cancellation gave global prices a boost, which helped Oceana. Of course, if Oceana actually owned a business in Peru, it would be a very different outcome. Oceana wasn’t immune to the weather patterns in this period, as La Niña caused local horse mackerel catch rates to drop by 32.4%.

The outlook seems to generally be positive, but of course there are many reasons why the final performance might be very different to expectations.

Shaftesbury celebrates strong trading in the West End (JSE: SHC)

The target is 5% to 7% rental growth per annum – and that’s measured in GBP

London’s West End is world famous and with good reason. Shaftesbury refers to its portfolio as “irreplaceable” – so at least they have no shortage of love for their properties. Shoppers seem to like them as well, with footfall up 12% year-on-year. Leasing transactions signed over the past few months are running at rentals 6% higher than the June 2023 financial year.

The vacancy rate has moved even lower, down at 2.2% from 2.5% in the year ended June 2023.

Perhaps most importantly, asset disposals have been 12% ahead of the June 2023 valuation. They’ve identified 5% of the portfolio to be recycled, which is the REIT term for selling properties to unlock capital for reinvestment elsewhere.

The fund is targeting growth in rentals of 5% to 7% per annum. Provided cap rates (the valuation methodology for properties) remain stable, this implies total annual property returns of 7% to 9%. It’s quite interesting to note that the expectation is for 1% of the total property value to be invested per annum in refurbishment, asset management and “repositioning opportunities”, along with energy upgrades.

The loan-to-value ratio is 30%, adjusted for disposals since June. All of the group’s debt is at fixed rates and the weighted average cost of debt is 4.2%.

Standard Bank affirms guidance for a strong full-year result (JSE: SBK)

Based on the ten months to October, things are still looking good

Standard Bank has released a voluntary trading update for the ten months to October 2023. It’s good news for shareholders, with full-year guidance affirmed. This means the group expects to deliver better margins, a credit loss ratio within the through-the-cycle target range of 70 – 100 basis points and return on equity between 17% and 20%.

Looking deeper, banking revenue growth over the 10-month period is up by more than 20%, although the rate of growth has slowed as the bank has started lapping periods of higher interest rates.

This is why net interest margin expansion has calmed down in recent months, with lower retail demand for credit and more competitive pricing (especially on mortgages) also playing a role. Notably, corporate-related demand for debt is strong, particularly for energy-related opportunities. Dankie, Eskom.

Non-interest revenue is up by low-to-mid teens, helped along by transaction volumes, price increases and general market volatility that supports trading revenues. Remember, banks want volatility in the market, as they provide execution on the market rather than taking a view on the direction of the market. This is very different to asset managers.

As a reminder, cost growth in the interim period was 16%. The group notes that this growth rate has come down, but it remains “elevated” overall. Other than that rather cryptic description, what we do know is that the bank has achieved positive jaws, which means revenue growth has exceeded cost growth i.e. margins expanded.

The credit-loss-ratio “remains below the top of the target range” so we have to assume it is pretty close to 100 basis points, which certainly makes sense given the broader operating environment.

Finally, before you forget that there’s far more to Standard Bank than just South Africa, the Africa Regions contributed 44% of group headline earnings.

Tsogo Sun heads sideways (JSE: TSG)

Load shedding is incredibly expensive for the group

It’s hard out there. When you see a company with revenue growth of 7% and EBITDA growth of just 1%, then you know cost pressures are severe. Tsogo Sun’s results for the six months to September may reflect HEPS growth of 48%, but don’t let that fool you about the story on the ground.

You see, the prior period reflected headline earnings of R607 million, but this included the once-off cost to terminate hotel management contracts. If we strip that out to make it more comparable, we find headline earnings of R896 million. In this period, headline earnings came in at R895 million. It’s a resilient result, but there’s been zero growth here.

The first culprit is load shedding, which the group reckons was responsible for a 100 basis points knock to EBITDA margin. They achieved a margin of 34% this period and they believe it would’ve been 35% without the cost of diesel.

The other issue is the same one that many corporates are facing, a sharp rise in net finance costs. They have increased from R316 million to R370 million. Just like at Invicta as referenced further up, the banks are getting the growth, not the equity investors.

Looking deeper, the bingo and limited payout machines took the biggest knock. There were some encouraging signs elsewhere, like improvement in hotel vacancies despite a jump in average room rate, driving double-digit revenue growth in that part of the business. And perhaps in sync with the commodity that it is named after, Gold Reef City is performing well.

Wesizwe’s Bakubung mine enters a s189 process (JSE: WEZ)

I fear that there is more to come in the PGM sector based on commodity prices

Wesizwe Platinum announced that the Bakubung Platinum Mine has entered into s189 consultations, which is a fancy way of saying that retrenchments are the Christmas present that none of the staff wanted. After two strikes in 2022 and 2023 as well as an unprotected strike over five weeks, executed against a backdrop of plummeting PGM prices, the sad reality is that economic troubles eventually lead to long-lasting consequences.

There are 571 employees that could be affected. The current headcount is 761 employees. This is a huge cutback, with the company referring to it as a “bloated structure” that simply isn’t viable.

Zeda’s rental business looks good, but used cars are struggling (JSE: ZZD)

It seems that the used car market is finally feeling the pinch

Zeda has released its first annual results as a listed company. They will go down as a great start to the company’s life-after-Barloworld, with revenue for the year ended September up by 12% and HEPS up by 17%. A return on equity of 36.7% is exceptional.

The segmental performance is interesting. Car rentals grew 12% and leasing grew by 13%, but the car business recorded flat revenue and unit sales.

Still, it was enough for Zeda to settle the unbundling debt of R1.55 billion two years ahead of schedule. There is now a healthy net debt to EBITDA ratio of 1.5x. Although this obviously puts HEPS growth under pressure, it juices up return on equity as much of the growth is being funded with bank debt rather than shareholder equity.

The share price has been on quite the rollercoaster ride. Despite a rally of 27% in the past 30 days, it’s still slightly down year-to-date.

Little Bites:

- Director dealings:

- An executive director of Richemont (JSE: CFR) – and we can probably guess who – exercised warrants for B shares and paid R2.2 billion for the new shares. See the note further down regarding these warrants.

- A non-executive director of Bytes Technology Group (JSE: BYI) sold shares worth £294k and a senior executive sold shares worth £1.1 million.

- An associate of a director of a major subsidiary of Discovery (JSE: DSY) has sold shares worth R8.25 million.

- Dr. Christo Wiese has bought shares in Collins Property Group (JSE: CPP) worth R1.02 million.

- The general partner of the ARC Fund, UBI General Partner Proprietary Limited, is a related party to Dr. Johan van Zyl. UBI has bought shares in African Rainbow Capital (JSE: AIL) worth R992k.

- A non-executive director of Glencore (JSE: GLN) has bought shares worth £49k.

- The CEO of Primary Health Properties (JSE: PHP) bought shares worth £3.1k as part of a dividend reinvestment plan.

- Take note Sun International (JSE: SUI) shareholders: the company is now trading under cautionary due to a potential acquisition. No further details have been announced at this stage. As always, there is no certainty whatsoever of a deal being put to shareholders. All we know is that discussions are underway.

- Ellies Holdings (JSE: ELI) has renewed the cautionary announcement. This company has been trading under cautionary since September 2022, so it’s a bit of a joke now. The share price is down at 5 cents.

- The work permit for Matias Cardarelli has finally been issued, so he can replace Roland van Wijnen as CEO of PPC (JSE: PPC) with effect from 1 December 2023.

- Vodacom’s B-BBEE scheme YeboYethu (JSE: YYLBEE) released results for the six months to September 2023. These structures are usually highly leveraged and Vodacom’s is no different, so higher interest rates are a problem. An interim dividend of 92 cents per share has been declared. The share price is R28.

- Back in 2020, Richemont (JSE: CFR) created a “loyalty scheme” to mitigate the reduction in the cash dividend by issuing share warrants to investors. There was a three-year exercise period. 98.9% of those warrants were executed, representing around 2.9% of shares currently in issue. This has obviously been dilutive for shareholders who didn’t receive or exercise the warrants, but those shareholders also benefitted from the company finding an innovative way to retain its cash.

- Tiny little Nictus Limited (JSE: NCS) – market cap R33 million – released a trading statement for the six months to September. HEPS is expected to be between 6.86 cents and 7.02 cents, which is a solid turnaround from a headline loss of 0.82 cents in the comparable period. The share price is 62 cents but the bid-offer spread is the size of earth.

- Super Group (JSE: SPG) announced that its very strong credit rating has been affirmed by S&P Global Ratings. It has a long-term national scale rating of zaAAA and a short-term rating of zaA-1+. When it comes to credit ratings, seeing a lot of As is a good thing.

- In case you are stuck in suspended counter Efora Energy (JSE: EEL), you might want to know that the company has now released results for the six months to August 2021, as well as the year ended February 2022.

- At least there’s one less zombie on the JSE, with the listing of W G Wearne (JSE: WEA) being removed from 28 November. The company says that it will consider a listing on other exchanges in South Africa in due course. Good luck to you if you are stuck in that thing with unlisted shares.