Frontier Transport makes investors feel special (JSE: FTH)

The market clearly liked this, with a strong rally on the day

You always have to be careful when looking at the share price of illiquid small- and mid-caps. Frontier Transport is better than many others, but I still look at the volume traded along with the price moves, particularly when the stock closes nearly 22% higher on a single day. With volume on the day more than 3x average trading volume according to Moneyweb’s data tools, that suggests this was a proper rally rather than just illiquid distortions in the price.

The catalyst? An announcement by the company of a special dividend of 137.38 cents per share. The share price started the day at R6.07 per share, so that’s a big portion of the share price. Even at R7.40 where it closed, that’s a substantial cash payout as a percentage of the share price. This is what happens when a share trades at such a low earnings multiple!

The dividend is due for payment in February, provided the SARB approval is obtained in time. The SARB needs to approve all special dividends by JSE-listed companies. I can’t think of an example off-hand where the approval wasn’t given, but sometimes it can be delayed.

Merafe confirms the drop in production for 2023 (JSE: MRF)

Production was curtailed due to market conditions and electricity costs in winter

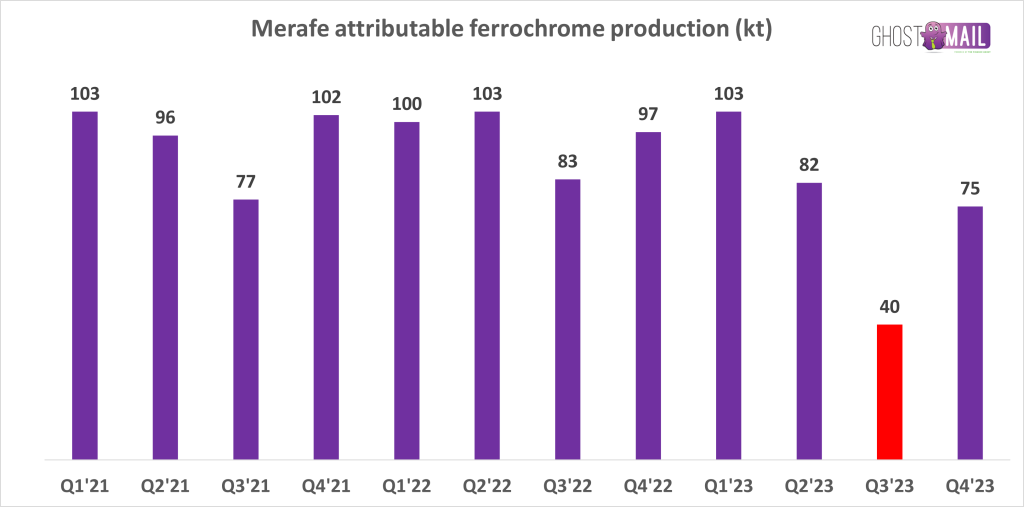

Merafe has announced its attributable ferrochrome production for the fourth quarter and year ended December 2023. I decided that this was best explained with a chart of quarterly production for the past three years:

I’ve made it very easy for you to spot the problematic quarter. Load shedding was so terrible this year and electricity costs were so high during the colder months that the Lion smelter was the only smelter in operation over the three-month peak demand season. Of course if Eskom was actually operating properly, then power availability and pricing would probably be more palatable.

Instead, we have a scenario where full-year production for 2023 was 300kt, well off 384kt in 2022 and 379kt in 2021. The 2021 and 2022 numbers show how reliable production can be when electricity is available at an economically viable cost.

Sappi shuts the Lanaken Mill (JSE: SAP)

The paper market in Europe is in a tough space

Back in October 2023, Sappi announced a consultation process relating to the possible closure of Sappi Lanaken Mill in Belgium. It employed 581 workers and produced coated woodfree paper that was sold into the European paper market.

You’ll notice the use of past tense there. Sadly, production of paper stopped in December 2023 once Sappi had completed and agreed on a social plan for the employees. The closure of the site is expected to be completed during the second quarter of 2024.

Financial information relating to the closure will be provided during the results announcement for the first quarter.

This is part of a broader strategic focus by the company on packaging, speciality papers, pulp and biomaterials. Exposure to the graphic paper segment is being reduced. The European business needs to be more resilient overall, which inevitably means difficult decisions like this one for uncompetitive assets.

Interestingly, production is being transferred to other Sappi facilities with no disruption to customers. This shows that there was just way too much capacity in the European business, leading to inevitable closure of the least competitive sites.

Valuations at Schroder European Real Estate Investment Trust are still moving lower (JSE: SCD)

The yield curve is still hurting European property

Schroder European Real Estate Investment Trust announced the updated independent valuation of its property portfolio as at 31 December 2023. The company does this every quarter.

The direction of travel is downwards, mainly due to the capitalisation rates being applied by the independent valuators. This is just a fancy term for the required rate of return on the properties, a rate which is directly influenced by the yield curve (the government bond rate curve).

When rates are higher, the valuation of the portfolio comes down. This is why property funds have been struggling in recent times. The shape of the curve also matters, as the valuation experts will likely use a longer-dated rate in these valuations.

In terms of valuation vs. the end of September, the direct property portfolio fell 1.8%, the portfolio office assets were down 2.5% and the portfolio industrial assets fell 1.2%. The German retail portfolio was flat, thanks to strong investor demand in that space. The “alternative assets” fell by 4.3%.

The portfolio loan-to-value is 33% based on gross asset value and 24% net of cash. That’s in line with September 2023 numbers. The fund is in good shape overall, with some valuation relief hopefully not too far away if we start to move into an environment of decreasing rates.

The Tongaat business plan has been adopted (JSE: TON)

By the time of the meeting, there was only one proposal left on the table

If you’ve been following the Tongaat-Hulett business rescue process, you’ll know that bidders other than Robert Gumede’s Vision consortium had walked away before the final meeting of creditors to vote on a business rescue plan. In other words, the vote was basically a formality unless creditors voted against having any plan at all, in which case they would lose everything and there would be a social catastrophe.

Thankfully, the plan was approved by roughly 98.5% of creditors. It has therefore been adopted and the plan is final and binding on all affected persons as defined in the legal process.

Little Bites:

- Director dealings:

- Argent Industrial (JSE: ART) is quite popular among local small cap enthusiasts, but the CEO isn’t doing the story any favours at all by selling shares worth R4.3 million in his own name and in a trust of which he is a trustee.

- A divisional executive of Capitec (JSE: CPI) exercised options to acquire 1,555 shares at a strike price of R973.05. He borrowed some money to do it, as the total value is R1.5 million. It sounds like a major show of faith in the financial services group, but you also have to keep in mind that the current market price is over R2,000 per share and so it’s arguably a no-brainer at that strike price. What I did find interesting is that the financing is for a period of 6 years and 6 months, which implies a long-term holding strategy for them.

- Rex Trueform (JSE: RTO) invested in just under R5 million worth of Texton (JSE: TEX) shares as an underwriter to the recent rights issue.