Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Afrimat is much closer to concluding the Lafarge acquisition (JSE: AFT)

These deals take a long time to finalise due to regulatory approvals

Back in June 2023, Afrimat announced that it was acquiring 100% of Lafarge South Africa from Holcim Group. This is a landmark transaction for Afrimat and important in the South African industry context, so various regulatory approvals needed to be obtained as part of finalising the transaction.

A few of these can now be ticked off the list, including the SARB, the Competition Authorities in Botswana and Eswatini and the Minister of Mineral Resources and Energy of South Africa in terms of section 11 of the Mineral and Petroleum Resources Development Act.

If you read that carefully, you would’ve noticed that the South African Competition Commission isn’t on the list of approvals. At this stage, the Commission has referred the transaction to the Competition Tribunal (which rules on larger mergers) and has recommended a conditional approval.

Importantly, the Tribunal doesn’t always follow the recommendation of the Commission. Also, we don’t know yet what the conditions of the approval will be and we’ve seen some pretty wild stuff from this regulator before.

This is the last remaining condition precedent for the deal, so Afrimat will be hoping for a timeous and successful outcome.

Attacq enjoyed strong festive trading (JSE: ATT)

Some of the underlying trends are particularly interesting

Attacq refers to its shopping malls as “retail-experience hubs” – a rather creative name that nobody else really uses. The name isn’t nearly as important as the performance, which in this case looks pretty strong. The company has released turnover and footcount numbers for November and December 2023 vs. the prior year i.e. covering Black Friday and Christmas trading.

At total portfolio level, November was up 6.4% year-on-year and December was up 10%. This means that in relative terms, Black Friday was less exciting this year than Christmas season trading. They make the point that December 2023 vs. November 2023 was a 40.3% increase in turnover, which is much higher than 35.6% last year. This suggests a return to December rather than November shopping.

Importantly, Mall of Africa was the standout performer in December with growth of 12.7% in turnover. In November, turnover was only up 5.2%. Perhaps the trend here is less about overall relative spend for Black Friday vs. Christmas and more about the online penetration of Black Friday vs. Christmas. My sense is that a lot of people look for online bargains for Black Friday, whereas December shopping is all about walking through the malls to buy for loved ones.

At category level, the top performances in December were apparel (up 19.4%) and health and beauty (up 15.4%). Restaurants managed 8.1% and take-out grew 7.4%, so that’s not great news for the likes of Famous Brands. It’s also interesting to note a significant drop in cinema attendance due to lack of movie releases. Perhaps most interestingly, the announcement notes that Game’s four stores in the portfolio grew by 14% year-on-year in December!

Brimstone saves us from the Sea Harvest announcement (JSE: BRT | JSE: SHG)

The Sea Harvest announcement is absolute overkill

Sea Harvest is going to acquire certain subsidiaries from Terrasan. Normally, a public announcement gives the basics of the deal and leaves the mechanics to happen behind closed doors. For some reason, this announcement gives all of the pre-deal restructuring steps in Terrasan in nauseating detail. I was very grateful that Brimstone released a much simpler announcement later in the day.

The impact on Brimstone of this transaction is significant, as it will no longer hold more than 50% in Sea Harvest once the Terrasan transactions are complete. This is because Sea Harvest will issue shares as part of the purchase price.

Long story short (literally, if you saw the Sea Harvest and Brimstone announcements next to each other), Sea Harvest will acquire 100% of the shares and claims in WP Fishing and Saldanha Sales and Marketing (catching, processing and sale of pelagic fish), as well as 63.7% of Aqunion (a vertically integrated abalone business).

The purchase price is around R965 million, of which roughly R365 million will be settled in cash and the rest in Sea Harvest shares. The eventual price may change based on the usual adjustments in these types of deals. There are also potential earnout payments based on 2023 and 2024 performance.

The full financial details will be available in the circular to be released to shareholders, as this is a Category 1 transaction for both Sea Harvest and Brimstone.

Datatec makes a small acquisition (JSE: DTC)

This represents a further push into cloud security services

Datatec announced that its subsidiary Westcon-Comstor has acquired Rebura, a London-based Amazon Web Services (AWS) consulting partner. The cloud industry has many companies that do this kind of thing, often specialising in either AWS or Azure (Microsoft) services – and occasionally both. The announcement makes it sound like Rebura is particularly strong in cloud security.

This is a voluntary announcement, so there’s no information on the price paid for the deal. We also don’t know how big Rebura is, so all we can really take from this is the strategic thinking at Datatec rather than the ability to assess the financial impact of the deal.

The price (whatever it may be) will be settled in cash.

Pan African Resources improved production at the right time (JSE: PAN)

The metrics look good for the six months to December 2023

The gold price has been doing some delightful things recently, with Pan African Resources noting a 13.7% year-on-year increase in the dollar gold price for the six months to December 2023. At exactly the right time, the group managed to increase gold production by 6.7%.

To add to the happy news, production costs are below guidance. All-in sustaining cost was $1,300/oz, which is below the FY24 guidance of $1,350/oz. Improved production leads to lower costs per ounce, but decent cost control was also required to achieve this number.

At this stage, guidance has been maintained for FY24. The company does acknowledge that it may be revised in due course based on the strong performance in the first half of the financial year. Importantly, annual output is going to increase substantially in FY25 following commissioning of the MTR project.

These projects don’t come cheap, with investment of $23.2 million on the MTR project driving an increase in group net senior debt from $18.9 million to $60.0 million. The group has also been investing heavily in solar PV energy solutions for obvious reasons.

Reinet Fund’s NAV moved higher at the end of 2023 (JSE: RNI)

The release of the fund NAV is always the precursor to the group NAV

Reinet Fund is where Reinet’s investments in Pension Fund Corporation, British American Tobacco and other investments can be found. This is why it represents the biggest part of Reinet’s balance sheet.

The net asset value (NAV) of the group differs from the fund as the group has various assets and liabilities that sit above the fund. Still, the direction of travel of Reinet Fund’s NAV gives a very good idea of where the group NAV is going.

From 30 September 2023 to 31 December 2023, Reinet Fund’s NAV increased by 2.1%. This is measured in euros.

South32 had a mixed quarter – not unusual for a group this size (JSE: S32)

Some of the production issues have affected guidance for FY24

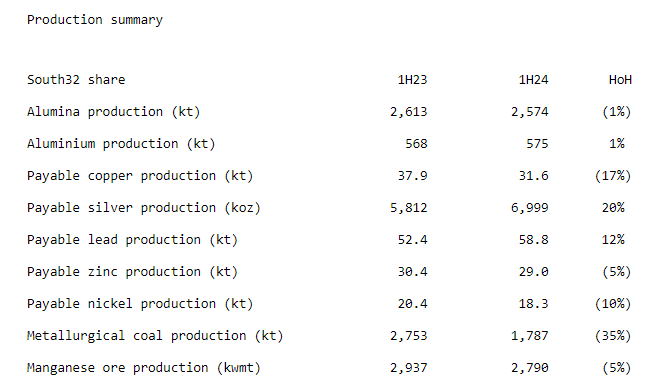

South32 has released a production update for the first half of the financial year. As is always the case in mining groups of this size, there are strong areas (like record half year aluminium production) and weaker areas (a reduction in copper equivalent production guidance). Zinc and nickel also deserve a mention, each up 20% in the second quarter.

This gives you an idea of the diversification in the group and the breadth of production performance:

The group has been extremely focused on cost control and it shows, with several commodities enjoyed updated guidance that reflects operating unit costs either in line with or below original guidance. Of course, there are exceptions where costs have jumped due to production challenges.

Generally, the prices achieved for commodities in the six months to December 2023 were down year-on-year as demand moderated.

South32 invested $188 million of growth capital expenditure in the first half of the year to make progress on the Taylor zinc-lead-silver and Clark battery-grade manganese deposits. There are also various other exploration initiatives underway across the world.

Little Bites:

- Director dealings:

- An independent non-executive director of Sibanye-Stillwater (JSE: SSW) has sold shares worth $12.8k. The sale is denominated in dollars because the sale was actually of American Depository Receipts (or ADRs), which reference the local shares. For the purposes of director dealings, it’s like any other share disposal.

- With the mandatory offer to shareholders of Brikor (JSE: BIK) having been concluded, Nikkel Trading has increased its stake from 68.01% to 84.20% in the company. With such a small float (the percentage held by public shareholders), there probably won’t be any liquidity in this stock.

- The shareholders of Mantengu Mining (JSE: MTU) gave resounding support to the resolutions required for the specific issue of shares and warrants to GEM Global Yield as part of a R500 million facility to be made available to Mantengu.