Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

ArcelorMittal’s profitability has been smashed (JSE: ACL)

This really isn’t the business model you want to be operating in South Africa

Before diving into the latest trading statement from ArcelorMittal, it’s worth looking at the share price chart:

Quite the rollercoaster, isn’t it?

It’s not getting any better, either. HEPS for the year ended December 2023 has fallen from R2.34 in 2022 to a headline loss per share of between -R1.55 and -R1.85. Ouch!

Headline earnings excludes the substantial impairment that has been recognised on the company’s Longs steel business. In November 2023, the company announced that this business would potentially be wound down. Extensive engagement followed, including with government stakeholders. Sadly, there are structural reasons why this business is failing, ranging from an environment of low demand through to governmental own-goals like logistics infrastructure. Another issue is the advantage that scrap has over iron ore.

Although the discussions have been positive, there are no quick solutions. It seems like a bit of a coin toss at the moment whether the company will keep the Longs business alive. It will take a significant effort from all stakeholders involved. In the meantime, the company has recognised an impairment charge of R2.1 billion against the assets of the business. This doesn’t include closure or retrenchment costs.

What hasn’t helped at all is that the second half of 2023 was poor for steel demand. Slow growth in China is a major factor here. Local demand is weak, with low to no growth. You can once again thank government (and specifically Eskom) for that. To make it even worse, Chinese manufacturers are dumping their steel in the South African and African markets as they don’t have sufficient domestic demand. It’s just a mess.

Despite everything, the company describes its debt as being at “tolerable levels” – for now, at least.

Gemfields sings a bullish tune (JSE: GML)

Emeralds and rubies continue to shine

At a time when diamonds are struggling, the more colourful stones are doing just fine thanks. Gemfields has released an update for the six months to December 2023 and it tells a good story, with auction revenues and pricing continuing to be positive.

2023 was the second highest year of auction revenues in Gemfields’ history, despite the withdrawal of November 2023’s auction of higher quality emeralds. The next auctions planned include a commercial quality emerald auction in Q1 2024 and a higher quality emerald auction and mixed quality ruby auction in Q2 2024.

Net cash at 31 December 2023 was $11.1 million, excluding auction receivables of $38.9 million.

MAS with a display of capital maturity (JSE: MAS)

The property fund is being extremely pro-active in managing the balance sheet

I was pleased to see the release of an investor presentation by MAS, the Eastern European real estate fund that gave the market a bit of a shock when it suspended its dividend. The suspension wasn’t due to an immediate problem. Instead, the company is looking ahead to 2026 and planning accordingly.

This perhaps came as a shock to South African investors, who are far more accustomed to management teams who collect bonuses right up until a company falls off the end of a cliff, at which point they blame “market conditions” for a highly dilutive rights issue before re-pricing share options and promising a lucrative “turnaround” strategy. Of course, they earn bonuses during the turnaround as well.

If that sounded like it was dripping with sarcasm and annoyance, then you got the right idea.

Full credit must therefore go to the MAS management team for showing the maturity to take the pain now in pursuit of a sustainable balance sheet. After the share price had an initial heart attack, things have improved:

In this presentation from the investor day, the company notes that the pressure comes down to one thing: bonds maturing in 2026 and the likely capital raising environment for MAS at that point in time. The overall fund does not have an investment grade credit rating, so conditions need to be highly favourable towards emerging markets and “risky assets” for a raise to be successful at decent rates. To get ahead of this problem, MAS is retaining its earnings from operations and is raising secured debt on unencumbered properties.

This point is worth explaining in more detail. You see, a property fund can either raise money at property level (like getting a mortgage on your house) or at portfolio level (like getting debt from the bank to go and buy various properties). The former is secured by a specific property. The latter is either unsecured, or is secured by the overall number of properties in the group. The problem for lenders at portfolio level is that they are second in the queue behind lenders who hold specific properties as security.

The lower the risk, the lower the cost of debt. This is why raising debt against specific properties is a cost effective way of raising capital to replace the bonds at portfolio level.

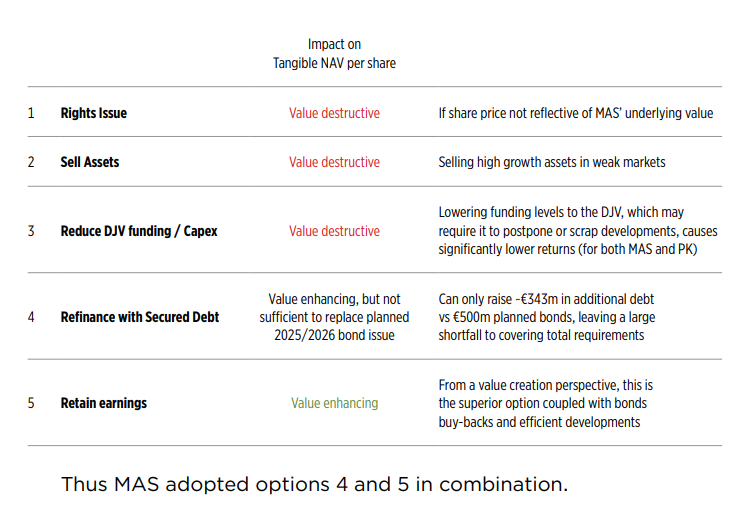

If you want to see what a mature approach to capital structure looks like, I highly recommend reading the presentation. This table should be stuck on the wall of every listed company executive in South Africa, especially in the property sector:

Truworths: now we know where the market share was lost (JSE: TRU)

Look no further than Truworths to see where Mr Price and The Foschini Group won back sales

Truworths shareholders may never have believed this day would come, but they can thank their lucky stars for the UK business. Without it, this would’ve been an ugly trading update.

For the 26 weeks to 31 December 2023, Truworths Africa experienced a 0.3% decrease in sales. Office (the UK business) was up 15.6% in GBP, so the group result was growth of 8.2% in rands. Guidance for HEPS growth is 0% to 4%, so the growth in sales doesn’t seem to have translated into an exciting increase in profits.

The Truworths Africa performance was impacted by a high base effect, the exact opposite of what we saw at Mr Price (which probably isn’t a coincidence). It’s not like there are suddenly loads of extra shoppers running around, so one store’s gain is a relative loss for another. Where Mr Price and The Foschini Group reported excellent sales in this period, Woolworths was disappointing and now we know that Truworths also lost out. Like-for-like store sales at Truworths fell by 3.3%. Trading space increased by 0.9% and is expected to be 1% higher for 2024, so they are still investing. Product inflation was 8.4% in this period, which is a lot more palatable than 13.3% in the comparable period.

After growing 13.4% in the comparable period, the two-year growth stack isn’t too bad for Truworths at all. Still, there are worrying signs here, as credit sales were flat year-on-year because credit scorecards deteriorated and thus credit extension declined. Overdue balances as a percentage of gross trade receivables deteriorated from 11% to 12%.

This means that Truworths had to rely on growth in cash sales, which wasn’t forthcoming. Cash sales fell by 0.9%. I must also point out that only 30% of Truworths Africa’s sales are cash sales.

The problem got worse towards the end of the period, with retail sales down 1.6% for the last 9 weeks of the period.

The silver lining in the local business is online sales, which increased by 41% to contribute 4.2% of Truworths Africa’s retail sales. That’s quite similar to what we’ve seen at competitors.

Looking at the UK, sales were up 15.6% in GBP and 33.1% in our beloved rands. That’s big growth in local currency (i.e. GBP – whenever people talk about local currency, they mean where the business is based rather than the head office) that is made even better by the trajectory of our currency.

Online sales in the UK grew even faster, with the contribution increasing from 44% of sales to 47% of sales. It’s a good reminder of how early the South African online story is in its journey.

Growth did slow down towards the end of the year, coming in at 11.6% in GBP in the last 9 weeks.

Interestingly, trading space in Office decreased by 2.8% for this period but is expected to increase by 12% for 2024, with the business looking to invest in new stores and renovations.

York acquires land (and trees) from Sappi (JSE: YRK | JSE: SAP)

And this deal isn’t just about the timber

York Timber (JSE: YRK) has acquired the Pine-valley Farms (yes, they use the hyphen) from Sappi for R65.4 million. The value is exactly in line with an independent valuation performed on the farms in March 2023.

The deal includes the commercial timber currently on the land, which York will harvest over time. This reduces York’s dependency on third-party lumber purchases.

Interestingly, the opportunity also brings 300 hectares of arable land for the expansion of York’s avocado and soft citrus farming operations. It’s debatable whether the market will love the risk of fruit farming on top of the existing lumber operations, but time will tell. To add to the risks, the deal is being funded through debt.

This is a Category 2 transaction, so shareholders won’t be asked to vote on it anyway.

Little Bites:

- Director dealings:

- The CEO of Marshall Monteagle (JSE: MMP) bought shares in the company worth R11.7 million in an off-market trade.

- An associate of the CEO of Acsion Limited (JSE: ACS) has bought shares worth R9.5 million in an off-market trade.

- An associate of directors of Argent Industrial (JSE: ART) has sold shares worth R1.1 million. We’ve seen sales by this associate before, with the rationale being that there’s an ex-director involved in that entity that is looking to cash out. I do see this as being different to existing directors looking to take money off the table, which is exactly why the company provides this explanation.

- An executive director of Afrimat (JSE: AFT) has sold shares worth R645k.

- At Finbond (JSE: FGL), Sean Riskowitz (acting through Protea Asset Management) has acquired shares worth R25k and an independent non-executive director has bought shares worth nearly R30k.

- Adcorp (JSE: ADR) has announced an odd-lot offer to clean up the shareholder register and reduce costs. Amazingly, 79.24% of total shareholders fall into the category of holding fewer than 100 shares. At the current share price, that means holdings worth R380 and less! These shares cumulatively represent 0.07% of total shares in issue. You can immediately see the administrative burden and why Adcorp is happy to clean this up at a 5% premium to the 30-day volume weighted average price.

- Southern Palladium (JSE: SDL) released a quarterly activities report for the three months ended December 2023. This quarter will be remembered for an increase in the Indicated Mineral Resource and the receipt of formal notification from the Department of Mineral and Resources and Energy that the Mining Right application was accepted. Southern Palladium held $8.34 million in cash at the end of December, down from $9.98 million at the end of September. This excludes cash held by 70% subsidiary Miracle Upon Miracle Investments, surely one of the most aptly named mining businesses on the JSE. It takes a whole lot of miracles for junior mining to make it in this country’s conditions!

- Mondi’s (JSE: MNP) share consolidation to offset the impact on its share price of a special dividend has become effective.

- Labat Africa (JSE: LAB) has withdrawn the cautionary announcement that was first issued in October. This officially means that caution is no longer needed when trading in this shares. Considering that the shares are suspended from trading and Labat is frequently a subject of unusual announcements, I would unofficially suggest that caution is shown whether suspended or otherwise!