Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

It doesn’t get more sideways than Adcock Ingram (JSE: AIP)

If you like small percentages, here’s one for you

Look, Adcock Ingram certainly isn’t going to set your hair on fire. For the six months ended December 2023, revenue was up 1%. Exciting, hey? Gross profit fell 2%, trading profit was down 1% and HEPS increased by 1%.

I actually can’t remember seeing a cluster of such small numbers! Normally, when revenue is so sideways, trading profit takes a dive. Not so in this case.

Once you get to segmental numbers, it does get more interesting at trading profit level. The biggest segment is Prescription, thanks to a 13% increase in trading profit despite flat revenue. Conversely, OTC saw profits drop 9% off flat revenue. Consumer maintained its margins, with both revenue and trading profit up 2%. The Hospital division is the smallest part of the group and saw profits fall 16% despite a 5% increase in revenue.

In a final nod to the sideways journey, the dividend of 125 cents per share is identical to the prior period.

Bidcorp just keeps marching on (JSE: BID)

Growth remains strong, although there’s a question mark around margins

Global food service giant Bidcorp is an excellent way to give your money a passport without leaving the JSE. The company only earns a fraction of its income from South Africa, with the largest markets being Europe and the UK. The food service industry is lucrative once a business reaches scale, as is the case at Bidcorp.

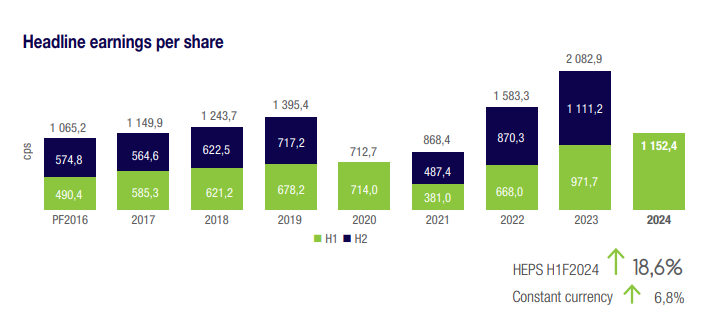

The pandemic obviously threw quite the spanner in the works. This chart is historically significant, showing how H2’20 earnings were literally non-existent:

The other thing to take from the chart is that earnings have grown beautifully if we look through the pandemic distortions. In the six months to December 2023, revenue was up 24% and trading profit increased by 20.8%. Now, this does mean some operating margin contraction, caused by operating expenses growing slightly faster than gross profit.

Still, 18.6% growth in HEPS and a 19.3% increase in the dividend per share isn’t anything to complain about.

If you look segmentally, the trading profit story does reveal a significant headache in the UK in particular. Revenue increased by 21.2% in that market and trading profit fell 15%. Gross margin pressure in that market is a direct result of the tough conditions being faced there in the hospitality sector. Again, the grass isn’t always greener!

The strategy going forward remains the same: organic growth plus the use of bolt-on acquisitions to expand either geographic reach or product range in existing markets.

What on earth is going on at Bytes? (JSE: BYI)

The share price fell 6% on very odd news of the CEO suddenly resigning

It’s never a good thing when an executive leaves out of the blue, especially the CEO. It’s even worse when a resignation comes through with immediate effect, as it suggests that something has gone badly wrong in the background. When the SENS announcement doesn’t give a good explanation for something like this (e.g. a health problem), speculation is rife.

So, the news of Bytes CEO Neil Murphy resigning with immediate effect (and with no explanation given) isn’t a happy thing, which is why the share price closed 6% lower. To add even more spice to this story, there have been trades in the company shares that he hadn’t disclosed to the company or the market.

As Alice cried, “Curiouser and curiouser!”

The jokes write themselves about the clarity of the situation, with Sam Mudd (MD of Phoenix Software and an executive director of the company) taking the role of interim CEO.

The only positive here is that trading for the year ending 29 February 2024 has been in line with expectations, with a trading update due in March.

Choppy results at Choppies (JSE: CHP)

The per-share numbers have been significantly impacted by the rights offer in June 2023

Retail group Choppies has released a trading statement for the six months to December 2023. Earnings actually did rather well, with profit after tax from continuing operations up by between 36% and 46%. On a per-share basis, the picture looks very different, with HEPS expected to differ by between -3% and 7%.

This is because of the rights offer that was completed in June 2023 that resulted in more shares being in issue.

Glencore’s numbers are way down year-on-year (JSE: GLN)

This is another good example of mining cycles in action

At Glencore, revenue dropped by 15% in 2023 and adjusted EBITDA was down 50%. Funds from operations tanked by 67%. Clearly, the year-on-year story is typical of the hard correction we’ve seen in the commodity sector over the past 12 months.

Glencore is quick to remind the market that although the year-on-year picture might look awful, the group remains highly cash generative. This supports the deal to acquire a 77% stake in Teck’s Elk Valley Resources business for $6.93 billion in cash is in the process of regulatory approvals, with an expected closing date no later than Q3 2024.

The focus is on deleveraging the balance sheet towards a $5 billion net debt cap before a demerger into a fossil fuels and transition metals structure could be considered. Glencore expects the deleveraging to occur within 24 months from transaction close.

This is why there is no “top-up” distribution at this point, with Glencore hoping that such distributions will happen again in the future. It’s a vague comment from the company that is surrounded by reminders that the real focus is on deleveraging, so don’t hold your breath for a high payout ratio over the next couple of years.

Profitability has collapsed at Sibanye-Stillwater (JSE: SSW)

The share price is back below R20

The good news is that Sibanye achieved revised production guidance for the year ended December 2023 at all operations other than US PGM recycling, which was impacted by deliveries of used autocatalysts remaining depressed as used vehicles are taking longer to be replaced in an environment of higher interest rates.

That’s where the good news ends.

Other than gold, commodity prices plummeted in 2023. This has led to substantial impairments being recognised on various operations, including even the SA gold operations due to the Kloof 4 shaft closure and the deferral of the Burnstone project.

Those impairments can’t even be blamed for the precipitous drop in HEPS, which will be over 90% lower year-on-year at between 60 cents and 66 cents.

The share price has lost almost half its value in the past 12 months.

Spar’s local volumes are still under pressure (JSE: SPP)

And in a shock to nobody, the SAP issues continue

Spar has released a trading update for the 26 weeks to 16 February, showing an increase in turnover of 9.3% for the period. This number needs to be unpacked though, as Spar has operations in several countries.

SPAR Southern Africa remains the most important part of the business. Core grocery and liquor turnover growth was only 6.1% vs. internal inflation of 7.5%, so volumes moved in the wrong direction. The grocery wholesale business was only up 5.1% thanks to ongoing systems issues in the KZN region after the business gave itself the kiss of death: a SAP implementation.

To this day, I cannot think of a single SAP implementation at a retailer that hasn’t caused severe disruptions.

SPAR2U, the rather obscure online offering, is now available at 403 sites. Sales increased by 450% but that’s vs. a tiny base.

The star of the local business is TOPS at SPAR, which increased sales by 12.7%. Pharmacy at Spar was also solid, up 11.6%. Conversely, building materials and construction business Build it could only manage 0.5%.

Moving abroad, BWG Group in Ireland and South West England grew turnover by 7.1% in EUR and thus 19.1% in ZAR, with the rand depreciation helping massively here. Ditto for SPAR Switzerland, where a decline in turnover of 5.7% in CHF translated into a 9.2% increase in ZAR.

In Poland, an ongoing headache that Spar wants to sell, turnover was down 2.9% in PLN terms and up 16.1% in ZAR.

The group is considering various debt structuring options, with an optimised debt structure dependent on the outcome of the disposal of the interests in Poland.

Interim results for the six months ending March will be released on 5 June.

Stor-Age’s key metrics moved in the right direction (JSE: SSS)

The company has released a trading update for the four months to January 2024

Growth at Stor-Age comes from three sources: new developments, higher occupancy in existing developments and pricing increases charged to customers for the storage space. The company is very good at pulling all three of those levers.

In the four months to January 2024, group occupancy in the owned portfolio increased 230 basis points to 90.1%. The South African portfolio was the star here, up 280 basis points to 92.1%. The UK was up 40 basis points to 83.0%. The joint venture portfolio is a lot smaller and runs at a significantly lower occupancy rate, but this is increasing quickly as the properties mature.

Importantly, the South African portfolio saw average rentals up by 9.4% and the UK portfolio achieved 4.8% growth in that key pricing metric.

And with respect to the third lever (new developments), there are currently four developments underway – two in South Africa and two in the UK. Stor-age is also expanding certain existing properties to respond to demand.

There’s actually a bonus lever of growth which is still in its infancy: managing properties on behalf of third parties. This is a great way to increase return on equity, as the group is earning income off assets that it didn’t pay to build.

Little Bites:

- Director dealings:

- Sean Riskowitz, acting through Protea Asset Management, has bought more shares in Finbond (JSE: FGL) worth R758k.

- A non-executive director of British American Tobacco (JSE: BTI) has acquired shares in the company worth £99k.

- Brimstone Investment Corporation (JSE: BRT) released a trading statement dealing with the year ended December 2023. It’s based on EPS growing by between 49% and 59%, which really isn’t a useful measure for Brimstone’s investment holding company structure. Let’s wait and see what the movement in net asset value (NAV) is when results are released on 6 March.

- Due to the process with the Prudential Authority taking longer than expected, Conduit Capital (JSE: CND) and the acquirer of the Copper Sunset Trading subsidiary (a deal worth R55 million) have agreed to extend the fulfilment date once more to no later than 31 March 2024.

- The application to liquidate Afristrat Investment Holdings (JSE: ATI) was dismissed in the High Court, with costs. This has been going on for a while now and the company has earned itself some breathing room with this judgment.

- Primeserv (JSE: PMV) has repurchased 0.45% of shares in issue between 12 December 2023 and 19 February 2024 for a total amount of R667k.