Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Anglo American to bulk up the Minas Rio asset in Brazil (JSE: AGL)

This announcement accompanied the results for the year ended December 2023

Let’s get the news of the deal out of the way first. Under the terms of the Minas Rio deal that Anglo American has agreed with fellow mining giant Vale, the latter will contribute Serpentina and $157.5 million in cash to acquire a 15% shareholding in the enlarged Minas-Rio operation, so this is really a merger of the two assets to create a much larger iron ore operation. Vale will have the option to acquire an additional 15% shareholding in the enlarged asset if certain events linked to future expansion occur.

There is a formula that could lead to an adjustment to the purchase price if the four-year average iron ore price is above $100/t or below $80/t.

The benefit to the parties? Scale and synergies, of course, along with shared infrastructure.

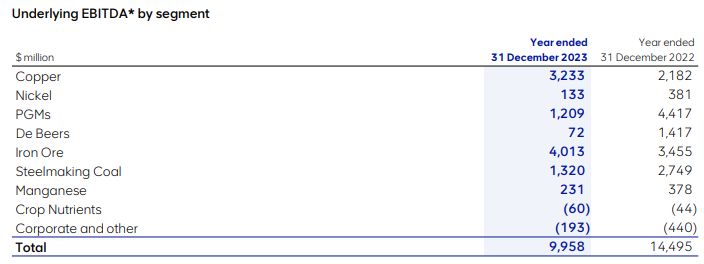

Now, we move on to the results at Anglo American for the year ended December 2023. The good news is that Quellaveco is fully ramped up and producing copper. Other good news is that Anglo American is on track to reduce annual costs by around $1 billion over the next three years. The bad news is that underlying EBITDA fell 31% in 2023, with PGMs and diamonds taking the shine off the numbers.

HEPS is down 59% to $2.06 from $4.98 in the comparable period. A 40% payout policy has been maintained, which means a dividend of $0.96 per share.

The results in subsidiaries like Anglo American Platinum and Kumba Iron Ore can be seen in the separate reports of those companies, so I’ll focus on the other stuff here, like a $1.6 billion impairment of the book value of De Beers in response to a tough market for diamonds. Rough diamond production was down 8% for the year as the group pulled back on production. EBITDA at De Beers crumbled from $1.4 billion to just $72 million.

This table does a great job of summarising the result:

Blue Label Telecoms: why I don’t buy things I don’t understand (JSE: BLU)

The share price is moving lower in response to a drop in earnings

I’m convinced that even the 4th year accounting lecturers at Wits (where I studied) don’t have it in their hearts to use Blue Label Telecoms as a case study for the students. I used to sit at varsity and wonder where the structures in the exams were dreamed up, as surely they don’t exist in practice.

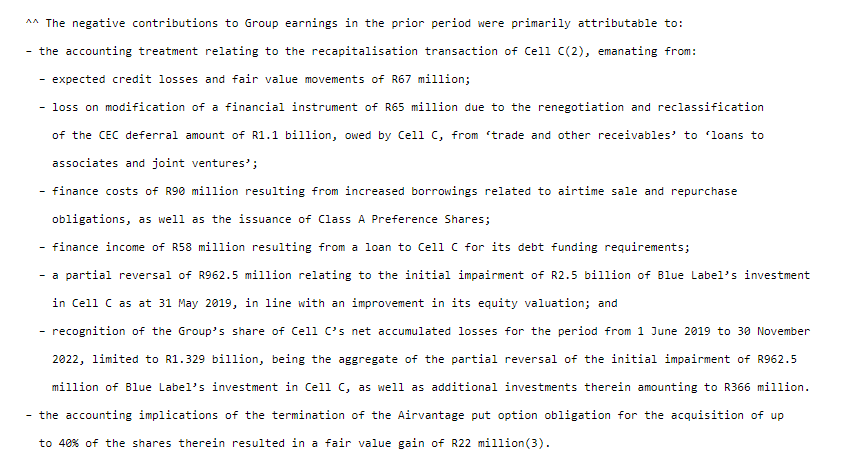

They don’t exist very often, that’s for sure. Where they do, I avoid them. If it takes this much work to properly understand the numbers (as it always does at Blue Label Telecoms), then the risks are too high for me.

There are some in the market who profess to be experts on this company. I’m certainly not one of them. What I do know is that comparable core headline earnings fell 22% and core HEPS fell 23%. This is because a business called Comm Equipment Company experienced a drop in headline earnings of R119 million at a time when the rest of the group could only grew R19 million.

Here’s a perfect example of why I just cannot bring myself to even speculate here:

Here’s the share price, which is a language I think we all understand:

Caxton suffers a single-digit decrease in HEPS (JSE: CAT)

A more difficult trading environment is to blame here

Caxton and CTP Publishers and Printers has released a trading statement for the six months to December 2023 that reflects a decrease in HEPS of between 4.1% and 8.5%. That’s not bad, but it’s a move in the wrong direction. The company has noted the usual difficulties in the trading environment, leading to a decline in overall revenues and a margin squeeze, with cost control and an increase in net finance income helping to offset the problems.

The company had cash of R1.8 billion at the end of December. This has subsequently increased to R2.17 billion.

A missed opportunity at Gold Fields (JSE: GFI)

The group didn’t capitalise on the higher gold price

Gold Fields didn’t win the hearts of investors in the year ended December 2023. Profit per share came in at $0.79 per share vs. $0.80 per share in the comparable period. Production challenges in South Africa, Ghana and Peru detracted from the result, with the Australian operation only managing a flat production performance that wasn’t enough to offset the troubles elsewhere.

Adjusted free cash flow was $367 million, down from $431 million. Net debt excluding lease liabilities increased from $310 million to $588 million.

Looking ahead, there is significant capex underway at the Salares Norte project. There’s also a significant increase in sustaining capital due to a $132 million investment in a renewable microgrid project.

Attributable production is expected to increase from 2.24M0z to between 2.33Moz and 2.43Moz. Excluding the renewables project, the all-in sustaining cost guidance is $1,350/oz – $1,400/oz. This is higher than $1,295/oz in 2023, so the gold price needs to keep helping Gold Fields for the results to look better.

A HEPS increase in perfect Harmony (JSE: HAR)

When mining goes well, it goes really well

After a period of underperformance, many investors in the gold sector might have wondered where the saying “it’s a gold mine” actually comes from – particularly when used in a positive context! Harmony Gold has just reminded the market that when the yellow metal goes to plan, things get shiny very quickly.

Of course, the mining group still needs to get the stuff out the ground, so operational execution is key. In a trading statement for the six months to December, Harmony did exactly what it needed to do to take advantage of higher gold prices. Recovered grades were up, as was gold production. As a sweetener, production of silver and uranium also increased at a time when average prices for those commodities also moved up.

Naturally, there were annoyances like higher energy costs and royalties, but these couldn’t offset the strong numbers.

HEPS will be between 937 cents and 976 cents, which is a vast increase vs. the comparable period of 293 cents. Detailed results are due on 28 February.

A major disconnect between EBITDA and cash flow at Mondi (JSE: MNP)

This is an unusual result

In most cases, EBITDA and operating cash flow at least move in the same direction. These concepts aren’t the same, despite some people using EBITDA as a proxy for operating cash flow. The big difference is net working capital movement (inventory / debtors / creditors) which is captured by operating cash flow and not by EBITDA. The usual case is that working capital would increase as EBITDA moves higher, but wouldn’t offset the benefit of higher profits. Similarly, as EBITDA moves lower, some working capital would be unlocked but it wouldn’t offset the impact of lower profits.

At Mondi, we’ve just seen the unusual scenario. Underlying EBITDA fell sharply from €1.85 billion to €1.2 billion, which is a margin contraction from 20.8% to 16.4%. Return on capital employed has diminished from 23.7% to 12.8%. But despite this, cash generated from operations increased from €1.29 billion to €1.3 billion.

The reason? A net inflow of €229 million based on lower inventory levels vs. an outflow of €419 million in the comparable year. This was enough to more than offset the impact of lower profits. If nothing else, I hope this shows you that EBITDA is a poor proxy for operating cash flow and using it in that way is a risky approach. It works in some companies, but in others the balance sheet can (and does) move sharply.

The dividend of 70 euro cents per share is consistent year-on-year. A special dividend of €1.60 per share was paid on 13 February with the net proceeds from the disposal of the Russian assets.

The nightmare continues at Pick n Pay (JSE: PIK)

Or is that Pick n Pray?

Well, the speculative exuberance around the Pick n Pay share price has been smashed back down to earth. After a strong rally from mid-January levels of R21 up to R27 in a matter of weeks, the Grim Reaper of Capital Raising visited the share price and slashed it back down to R22.

Why? Because despite how badly the market wants to believe in Sean Summers, the man can’t work miracles. As I’ve written many times, retail turnarounds are much harder than people think, even if he seems to be doing the right stuff. You have to distinguish between market exuberance (a real opportunity for traders but dangerous for investors) and a real, fundamental story.

Pick n Pay has released a sales update for the 47 weeks ended 21 January 2024. They’ve done this as part of a trading statement and news of a substantial capital raise. When group like-for-like sales reported just 2.9% growth during a period of heightened inflation, things are not looking good.

Boxer grew 17.1% over the period (and 7.3% like-for-like), which is great. Pick n Pay’s core business decreased by 0.1%, which is truly awful, especially when you remember that the excellent Clothing business (up 17.5% with like-for-like growth of 8.0%) is propping up that number. Rest of Africa was up 10.3%, taking total group sales growth to 5.3%.

Special mention must go to Pick n Pay Online, which grew 75.8%.

When trading is this bad, a retailer’s balance sheet quickly works against shareholders. Inventory piles up on the shelves, hitting the working capital cycle and overall cash generation. The retailer notes that good progress was made in recent weeks to sort out the cash generation, but the problems are there for all to see. Net debt has ballooned from R3.8 billion to R7.2 billion as at 21 January. A sale of property of R0.5 billion in February helps with this, but barely touches sides if we are honest.

Lenders have waived covenants on the debt facilities to give the company a chance to sort out the balance sheet. These are desperate times, with the group now expected to report a headline loss for the year ending 25 February, attributable “entirely” to the performance of the core Pick n Pay supermarkets business.

So, guess what? There’s a rights offer of up to R4 billion to try and fix this mess, along with an intended IPO of the Boxer business. The rights offer is expected to be in mid-2024 and the IPO towards the end of 2024. Although Pick n Pay is aiming to retain a majority stake in Boxer, the company will obviously free up capital by reducing its stake considerably.

It’s a mess.

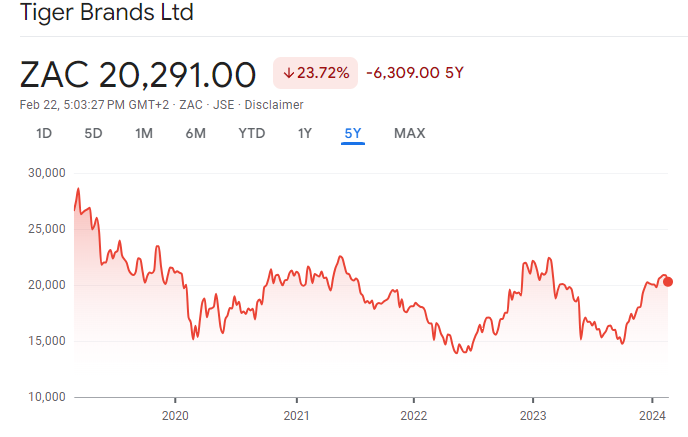

Is the Tiger Brands share price rolling over again? (JSE: TBS)

Trading conditions look incredibly difficult

The Tiger Brands share price is as volatile and dangerous as the animal that the company is named after. To me, it looks like it has run out of puff once more and could roll over from this resistance level:

The company has been significantly restructured into six business units, all reporting to the new executive management team led by Tjaart Kruger. The next restructure is focused on the shared services side of the business, with support structures moving from head office back into the different business units to improve the speed of decision making. There’s also a lot of focus being placed on rationalising SKUs (the variety of products).

In case it’s not obvious, Tiger Brands is trying to respond to a very difficult operating environment. Shockingly, prices of essentials like sugar, veggies, meat, eggs and rice are up by almost 20% according to Stats SA, which obviously puts huge pressure on consumers and their ability to spend on luxury items – where the better margins are made.

Despite promotional activity around Black Friday and the festive season, trade fell short of expectations and volumes declined. Group revenue for the four months ended January 2024 fell by 1%, with volumes down 8% and prices up 7%. There were pockets of growth in volumes (like in Snacks & Treats and in Baby), but the overall picture was firmly in the red.

The slightly silver lining is that efforts to contain costs helped to keep gross margins stable despite the drop in volumes.

If you’re hoping for a positive outlook from the company, there isn’t one. Operating income for the six months ending March will be flat or lower year-on-year, with a recovery in the second quarter dependent on improved trading ahead of the Easter period.

Little Bites

- Director dealings:

- The CEO of Mr Price (JSE: MRP) has sold every single one of the 16,908 shares received under the forfeitable share plan. The sale is worth R2.86 million. It’s usually the case that executives only sell the taxable portion, not the entire amount, so I see this as a strong sell signal.

- The CEO of Datatec (JSE: DTC) has purchased shares worth R244k.

- Joffe and Wiese are at it again, with these directors of Invicta (JSE: IVT) each buying shares worth R53k in the company.

- In an announcement dealing with the results of the voting at the AGM, Tharisa (JSE: THA) also gave further information on the investment in the Karo Platinum Project. The company has noted that the total investment for its 75% stake in Karo Mining Holdings (which in turn holds 85% in Karo Platinum) has come at a cost of $135.3 million. Once you work through the shareholdings, this implies a value for Karo Platinum of $212.3 million. The important point is that the recent rights issue by Karo Mining Holdings (in which the minority shareholder renounced its right and allowed Tharisa to move from 70% to 75%) implied a value of $457.8 million for Karo Platinum. Long story short, the company believes that the investment has created value based on longer-term sustainable PGM prices, even if current spot prices look ugly.

- The founders of Transaction Capital (JSE: TCP) have done some restructuring of their affairs to the value of R1 billion. It doesn’t change their indirect interest in the company (they are just reshuffling some cards here), but it does make me wonder if they are gearing up for a bigger corporate action after the WeBuyCars unbundling. Time will tell. In a separate update, the company announced that Global Credit Ratings (GCR) has downgraded the group’s credit ratings by a notch and has put them on Rating Watch Negative.

- With Stephen van Coller set to step down as CEO of EOH (JSE: EOH) on 31 March, Andrew Mthembu (currently independent non-executive chairman) will take the role of interim CEO for a period of up to six months while a successor is found. Considering that the announcement of van Coller’s departure came out in October 2023, why do they seem to be struggling to find a successor?