Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Afrocentric is struggling to find growth (JSE: ACT)

This isn’t an easy way to make money

AfroCentric owns a portfolio of healthcare-related enterprises that are finding it tough going at the moment. Aside from the overall lack of economic activity to drive growth, the company has had to contend with contracts with low levels of profitability. In some cases, the company has walked away from such contracts.

After all the excitement of the deal with Sanlam last year, there isn’t any excitement at all in the financials. For the six months to December 2023, revenue grew by just 1.4% and HEPS dropped by 2.4%. If there are going to be any exciting synergies with Sanlam, we aren’t seeing them yet.

At least there is an interim dividend of 11 cents per share vs. no dividend in the comparable period.

Not much to write home about at Aspen (JSE: APN)

Revenue growth hasn’t translated into profits

The six months to December 2023 were filled with interesting strategic news at Aspen, like a distribution and promotion agreement with Lilly, as well as the product purchase agreement with Viatris for Latin America and the acquisition of the Sandoz business in China.

The benefits of these initiatives will hopefully come through in the second half of the financial year, as the first half hasn’t been exciting. Although revenue increased by 10% as reported, HEPS was down 6% as reported or up 1% on a normalised basis.

The highlight was the 44% growth in operating cash flow per share, with the cash conversion rate way up from 58% to 89%. A reduction of investment in heparin inventory was the key here. They call it a permanent shift, which is good news.

Net debt has increased considerably from R22.2 billion to R27.3 billion. Although overall debt levels are comfortable, debt isn’t a cheap source of growth right now.

Shareholders will pay very close attention to the second half of the year, which is when the benefits of recent strategic initiatives are expected to be realised.

AVI: masters of operating leverage (JSE: AVI)

The beverages and snacks businesses led the charge

AVI has released results for the six months to December 2023. They reflect an increase in revenue of 7.1%, which is decent by FMCG standards in this environment. More impressively, the company achieved growth in HEPS and the interim dividend of 17.4%.

At segmental level, Entyce Beverages is the second-largest revenue contributor and also grew the most, up by 16%. Snackworks is the bigger hero though, with the largest revenue and operating profit contribution and an excellent increase in profit of 35.1% off just a 9.8% increase in revenue. It turns out that biscuits really are good for you!

Fish? Not so much. I&J saw revenue fall 5.1% and operating profit plummet by 56.0% due to poor catch rates and loss of export sales.

The company has warned that growth in the second half of the year may not be as exciting as the first half, as they are lapping a strong fourth quarter in the comparable period.

Bidvest reminds the market why it is so respected (JSE: BVT)

There’s a strong performance at trading profit level

Bidvest has released results for the six months to December 2023. Revenue grew by 8.8% and trading profit by 11.8%, showing solid operating leverage that shareholders love to see. Cash generated by operations almost doubled to R3.7 billion!

Five of the seven divisions reported double digit trading profit growth, so the group can be proud of that. Automotive took a significant knock, with trading profit down 11.4% due to oversupply of new vehicles and a resultant knock-on effect in the used market. The brand mix at McCarthy’s is problematic as Bidvest doesn’t have exposure to new brand entrants that are doing well.

These strong numbers were blunted somewhat at HEPS level, with HEPS up by 5.3% and normalised HEPS up by 6.9%. The final dividend followed suit, up 6.9%. It won’t surprise you to learn that net finance charges were to blame here, up 41.5% excluding IFRS 16 and other fair value adjustments (in other words: a pure view on the increase due to debt).

The jump in finance costs was driven by higher average gross debt (of which R3.2 billion was due to corporate actions) and an increase in average cost of funding from 5.2% to 6.1%.

Return on Invested Capital of 15.8% is down on 16.3% in the prior year but still ahead of the weighted cost of capital.

Hulamin was all about the cash in this period (JSE: HLM)

Despite normalised EBITDA dropping by 7%, cash flow from operations skyrocketed

It is critically important for companies to manage both the balance sheet and the income statement, particularly when they are serious about driving return on capital higher. If a company doesn’t focus on return metrics like those, run away as fast as you can. This is why looking at the change in working capital and the extent of capex is just as important as looking at the income statement.

In Hulamin’s numbers for the year ended December 2023, a drop in volumes and EBITDA didn’t set an encouraging scene. Thanks to a substantial effort in reducing working capital requirements and simplifying the business, cash flow from operations was 503% higher at R363 million. That’s still not a great conversion rate vs. EBITDA of R620 million, but it’s a lot better.

Capex was R311 million, so shareholders seem to get very little cash out of this thing. Investors also won’t be enthralled by the performance in HEPS, which fell by 11% as reported or 27% on a normalised basis.

MAS could have a tougher route forward than expected (JSE: MSP)

The balance sheet outlook is proving to be difficult to solve

In the six months to December 2023, MAS grew adjusted earnings per share by 6%. The tangible NAV per share was up 10% in euros. This is good stuff, so why has the share price dropped sharply in the past year?

Despite the best efforts of the company on the income statement and the management of the properties in the portfolio, the trouble lies in the EUR300 million Eurobond that was issued in 2021. The goal was to reach investment grade and refinance the debt by 2025 / 2026. Nothing ventured, nothing gained.

Sadly, it’s not going to happen due to various factors. The bond market for non-investment grade issuers has completely dried up, which means the refinancing of the debt in 2025 / 2026 will be much more difficult and more expensive than hoped.

To the company’s credit, they are trying hard to get ahead of this problem. They are raising secured debt on unencumbered properties and they suspended the dividend.

A further recent setback is that banks are viewing MAS and the joint venture with Prime Kapital as a single group from a credit perspective. This is hurting the ability to borrow for both MAS and the joint venture, due to credit exposure limits that banks place on groups.

The net result isn’t pretty. Either MAS will have to raise debt with dividend restrictions post the 2026 calendar year, or there might even be a rights issue. A sale of assets may also be needed, which takes the group even further from an investment grade rating.

When credit markets move against you, life becomes hard in property funds.

Higher earnings and cash at Merafe (JSE: MRF)

2023 was a decent year in the end

Like all local mining groups, Merafe has had to negotiate failing South African infrastructure and all the other challenges that come with being in this industry. Nonetheless, a trading statement tells us that HEPS for the year ended December 2023 increased by between 4% and 24%. That’s solid.

The other good news is that cash and cash equivalents increased by just over R50 million in the six months from June to December, now at R1.656 billion. Admittedly, a chunk of this is set aside for future environmental rehabilitation obligations.

Detailed results for the year are expected on 18 March.

Metrofile is growing far too slowly (JSE: MFL)

The bankers are getting more excitement here than shareholders

In a world of exotic cocktails and food, Metrofile is like ordering the cheese sandwich on white bread, with a glass of tap water. It will fill you, but you might die of boredom midway through eating it.

Revenue grew by 2% for the six months to December 2023 and EBITDA fell by 4%. Exciting, hey? Due to higher interest rates, HEPS sadly dropped by 13% as bankers got a proportionately larger share of the pie vs. the prior year. Net debt is up 3% to R507 million.

The interim dividend is down 22% to 7 cents per share.

In case your bull case is related to the United Arab Emirates and Oman, you should know that revenue increased 28% (yay) but operating profit fell by 48%. Oh man, indeed.

Each to their own, I guess. This one isn’t for me:

At Netcare, mental health activity remains above pre-pandemic levels (JSE: NTC)

And revenue has grown by 5% for the first quarter of the year

Netcare is participating in an investment conference this week, so the company has released a voluntary announcement for the benefit of the rest of us who aren’t invited to the cool kids party.

For the five months to 29 February 2024, total paid patient days grew 0.3%. The announcement gives all kinds of different periods unfortunately, but the crux here is that growth is coming from revenue per paid patient day. For the first quarter of the financial year, total group revenue increased by 5% and total operating costs have been “well contained” despite the inflationary environment.

It’s also worth highlighting that demand for mental health remains strong, which isn’t a shock for anyone dealing with adulting.

Raubex grows despite Beitbridge having been completed (JSE: RBX)

The company wasn’t expecting to grow against a tough base period

Thanks to an increase in tender activity, Raubex has done better than they thought they would. The order book is strong despite the macroeconomic conditions, which is great news for investors.

This is why the company expects HEPS to be between 0% and 10% higher for the year ended 29 February 2024. This may not sound like much of an achievement, but the Beitbridge Border Post Project was in the base period and not in this period. To be flat or slightly up from there is impressive.

A pot of gold at the end of the RCL Foods rainbow (JSE: RCL)

There has been a sharp recovery

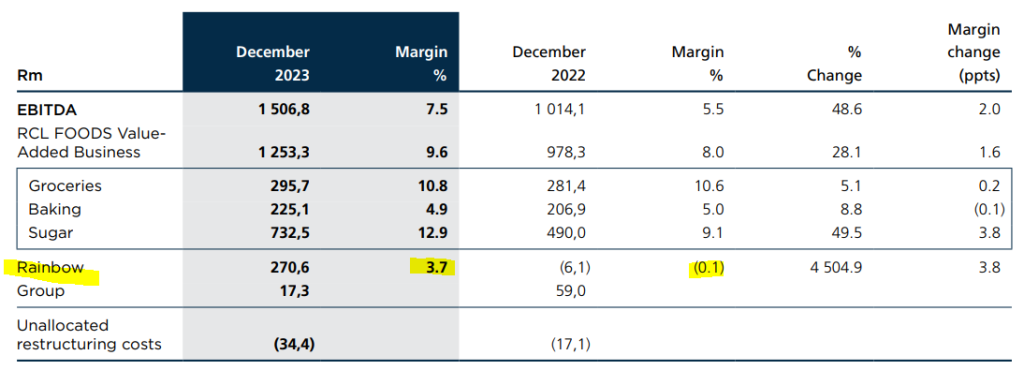

RCL Foods has released results for the six months ended December 2023 and they tell a great story. Revenue from continuing operations is up by 8.4% and EBITDA has jumped by 48.6%.

By the time we reach HEPS, we see growth of 52.6% in continuing operations and 43.3% overall. The discontinued operation in question is Vector Logistics, which was sold in August 2023.

Despite Avian Influenza in this period, Rainbow was one of the major areas of improvement for the period. It shows just how rough things were for poultry businesses in the comparable period.

Sugar also improved, with higher market prices that more than offset the impact of lower crop yields. Across the other food businesses, it looks like performance was mixed.

The Rainbow chicken business remains the lowest margin business in the group:

The big news here is that Rainbow is set for an unbundling and thus separate listing on the JSE. This will allow investors to take a pure view on either the poultry or other foods businesses. Currently, investors have to accept a very mixed exposure when buying shares in RCL Foods.

Due to the separation of Rainbow, RCL Foods has not declared an interim dividend.

Little Bites:

- Director dealings:

- The CEO of RH Bophelo (JSE: RHB) bought shares worth just under R20k.

- Canal+ has been granted an extension by the TRP until 8 April 2024 to make the mandatory offer that is required under local takeover law to the shareholders of MultiChoice (JSE: MCG).

- MC Mining (JSE: MCZ) has formally responded to the takeover bid by Goldway Capital Investment, priced at A$0.16 per share. The independent board’s advice to shareholders is to not accept the offer. There is a substantial document released to substantiate this view, which you can access at this link. In summary, the independent board sees it an opportunistic offer that is between 20% and 30% below the pricing guidance in the initial non-binding takeover proposal.

- Hyprop (JSE: HYP) announced that the acquisition of Table Bay Mall has been approved by the Competition Tribunal without any conditions being imposed on any party. The remaining condition precedent for the deal is the transfer of the property to Hyprop, anticipated to take place this month.

- Kibo Energy (JSE: KBO) has sold shares in Mast Energy Developments (MED) to the value of £29k, with the proceeds being applied to reduce the outstanding balance on the RiverFort bridge loan facility.

- Buka Investments (JSE: BKI) got off to a very slow start as a listed company, but has made some new director appointments that might be a precursor to some action.