Unlocking the world’s leading private credit managers

Harris Gorre, CFA is a Partner at Grovepoint Investment Management LLP

A swift “private credit” Google search confirms that the giants of alternative asset management, aptly named after Greek gods such as Apollo and Ares, have successfully captured the majority of Wall Street’s corporate lending business; along with its top talent and attractive double-digit returns they generate from making loans to U.S. middle-market companies.

Yet, despite private credit emerging as the fastest growing alternative asset class in the past decade, investing with leading private credit managers presents multiple challenges to investors seeking exposure to this asset class. As a result, investors remain underexposed, forgoing the diversified and asymmetric returns on offer.

However, there is a straightforward and effective approach to invest in premier private credit managers, while preserving daily liquidity and realising impressive double-digit USD returns.

Guided by the five principles below, investors can access a well-diversified and resilient portfolio portfolio of high-quality senior secured loans to private companies across the United States, managed by the world’s leading private credit managers.

1. Bigger is Better

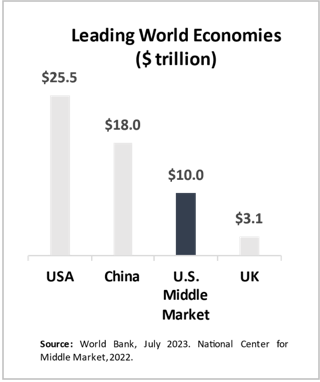

- Private credit is often defined as lending by non-bank financial institutions to middle-market companies. In the U.S. these are companies earning between $10 mn and $1 bn per annum (EBITDA1).

- There are almost 200,000 of these companies across America employing over 50 million people. In fact, 87% of companies with > $100 mn in revenue in the U.S. are private.2

- This makes the U.S. middle-market the 3rd largest economy on earth; around 3x bigger than the whole of the United Kingdom.

- The size of the U.S. market matters. The larger the market, the greater the number of high-quality corporate borrowers within sectors and across industries.

- The U.S. middle-market depth and liquidity makes it easier to construct a robust portfolio of loans to recession-resistant businesses in defensive sectors.

2. The Trend is your Friend

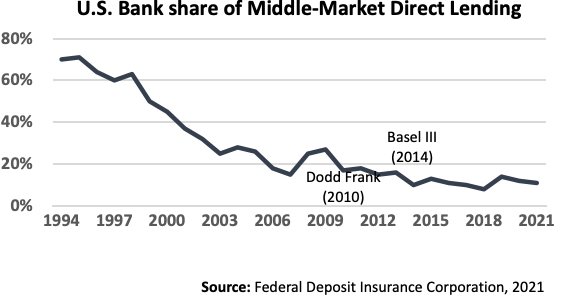

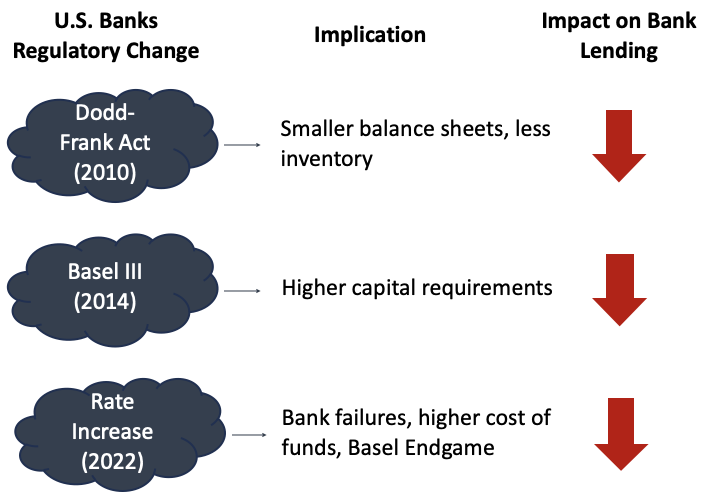

- U.S. middle-market lending is dominated by non-bank lenders.

- The migration of middle-market lending from U.S. banks started in the 1980s. By 2008, banks had lost 2/3rds of their market share to non-bank lenders and faced increasing regulatory headwinds.

- Today U.S. banks control less than 15% of the lending to middle-market companies.

The dominance of private credit managers in the U.S. is important. It means you can construct an optimally diversified portfolio of thousands of loans spread across a broad range of borrowers and sectors; while avoiding cyclical industries such as energy, hospitality, aviation and retail.

3. The Good, the Bad and the Sub-Scale

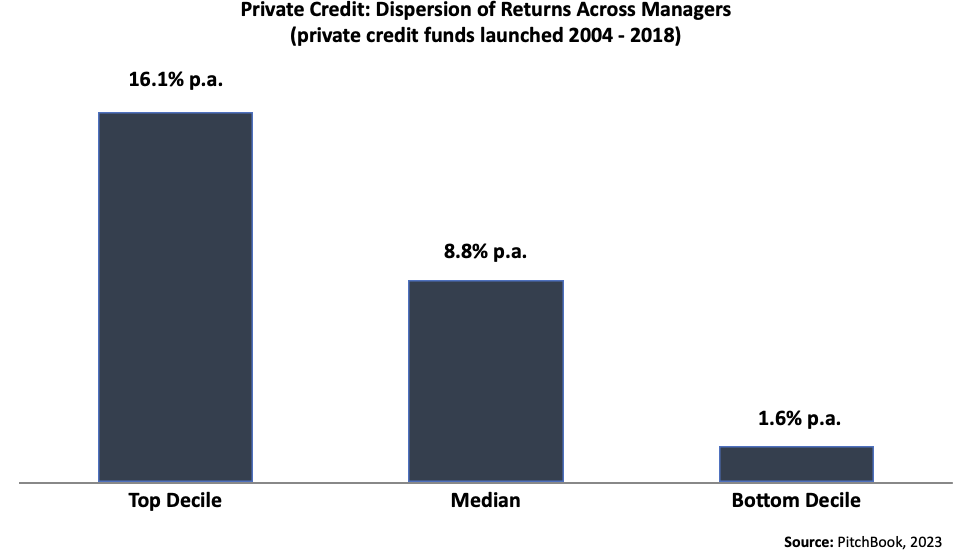

- High-quality non-bank lenders consistently generate better returns.

- Historically, credit losses have been concentrated amongst the bottom 75% of private credit managers.3

- Investing alongside high-quality managers with direct origination platforms, control of lending documentation and a deep, experienced bench of talent is fundamental to reaping outsized returns through economic cycles.

- Again size matters, as larger lenders lend to larger borrowers who default less and recover more. In addition, these lenders have more diversified loan books, reducing idiosyncratic risk.

4. Don’t Pay for Stuck Money: The Liquidity Arbitrage

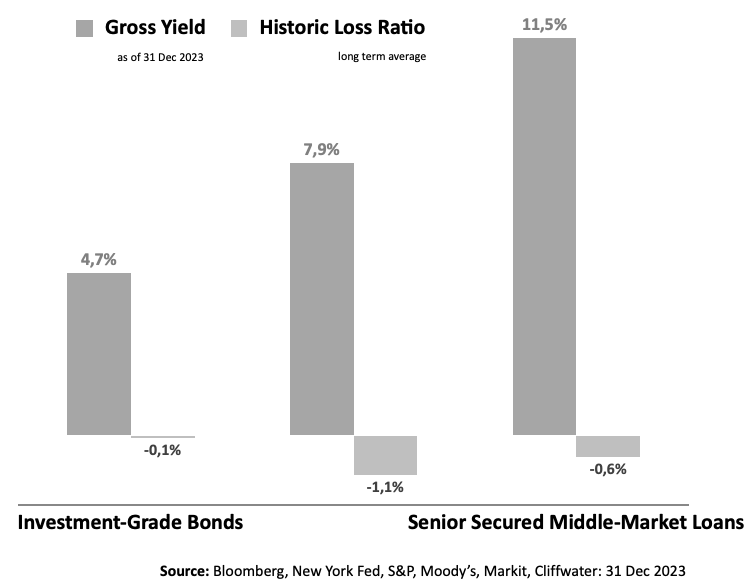

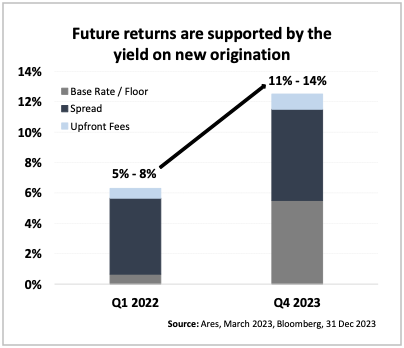

Traditionally, investors in middle-market loans receive a premium in exchange for relinquishing liquidity, i.e. investors expect a higher return for the same level of credit risk when they cannot trade their investment freely. This illiquidity premium can be as much as 4% p.a. for a similar level of credit risk.

As an example, at the end of 2023 direct lenders were originating senior secured loans at an average floating rate of 11.5% p.a. significantly more attractive than public bond markets.

- Pre-2004, the only way to access middle-market loans and capture the associated illiquidity premium was via a private credit fund that locked your money up for 5 – 7yrs+, but this started to change in 2008 when many non-bank lenders began listing private credit vehicles on the NYSE and Nasdaq4. Raising additional permanent capital from public market investors meant they could take advantage of the lending constraints banks were facing following the Great Financial Crisis (“GFC”) in 2008.

- These listed private credit vehicles shared pro rata in the loans originated by the same established direct lending teams who were managing the lock-up funds, enabling private credit managers to scale up faster and capture further market share from the banks. While non-bank lenders have had the ability to go public since the 1980s, the GFC served as a catalyst for the expansion of listed private credit vehicles.

Today there are over 130 private credit vehicles listed on the NYSE and Nasdaq. These include vehicles managed by leading credit managers such as Apollo, Ares, Bain, Barings, Blackstone, Carlyle, Golub, KKR, New Mountain, Oaktree, Owl Rock and Sixth Street.

Listed private credit vehicles now represent over 40% ($350 bn+)5 of private credit AUM.

Investing in these listed credit vehicles is significantly more attractive than investing in their illiquid private credit cousins due to the scale, diversity and liquidity of the listed market and the opportunity to invest in the same high-quality loan portfolios at a price below their fair value.6

5. Always Underwrite a Recession

- High-quality managers have historically experienced lower defaults in their loan portfolios and higher recoveries (and therefore lower realised losses) than the average middle-market lender, due to their scale, diversity, focus on senior secured lending and underwriting quality.

- Higher recovery rates result in lower realised losses whilst cash flow yields (10%+ p.a.) generated by well diversified loan portfolios have been more than sufficient to absorb losses (<0.6% p.a.).

- Large, scaled non-bank lenders can benefit from market selloffs as they are able to acquire existing loan portfolios from stressed smaller managers at discounted prices and originate new loans to high-quality borrowers at attractive all-in floating rate yields.

- Navigating through economic cycles requires steadfastly adhering to a disciplined value-oriented approach; capitalising on market dislocation to invest in high-quality private credit vehicles at discounted prices relative to their intrinsic value and crystallising gains when the market is overpaying for the yield they generate.

- Investing at a discount to the fair value of the loan portfolio not only serves to mitigate potential downside in a recession but also forms the foundation for generating superior future returns.

By integrating these guiding principles into a disciplined and active investment framework, experienced investors can construct a well-diversified portfolio of leading private credit managers; unlocking a valuable and stable source of diversified return whilst retaining daily liquidity.

Sources:

- Earnings Before Interest, Tax and Depreciation.

- Source: National Center for Middle Market, Capital IQ, 2022.

- Source: SNL Financial and SEC filings, 2009 – 2023.

- The New York Stock Exchange (“NYSE”) and the National Association of Securities Dealers Automated Quotations Stock Market (“Nasdaq”) are the two largest stock exchanges in the world with a combined market capitalisation of over $45 trillion (source: Statista 2024).

- Source: Bloomberg, 31 Dec 2023.

- Listed non-bank lenders are regulated by the Securities & Exchange Commission and are required to produce consistent, transparent and robust quarterly reports including the fair value of their loans. This determines their book value. High quality managers have historically traded at an average of 1x book value.

Editor’s note: the JSE-listed AMC that invests into the Grovepoint Investment Management private credit portfolio trades under the code JSE: GIMLPC. More information is available on the UBS website at this link.