Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Absa’s retail businesses took a major knock in 2023 (JSE: ABG)

At group level, earnings went sideways

In a year that should’ve been very strong for banks, Absa could only grow HEPS by 0.6% on an IFRS basis or 1.1% on a normalised basis that adjusts for the Barclays separation. Whichever way you cut it, it’s a disappointing outcome for Absa that is well behind what peers achieved.

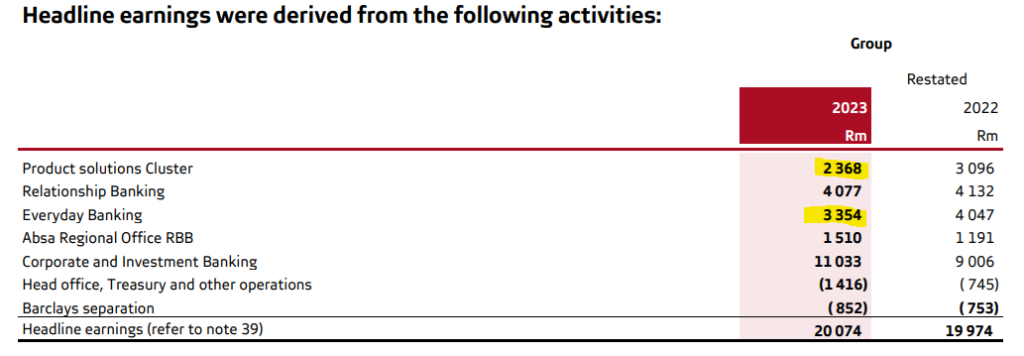

If you dig through the financials, you’ll see what the retail banking operations were the pressure point. The Product Solutions Cluster focuses on lending products (like mortgages and vehicle finance) and Everyday Banking is the retail banking solution. They both went significantly in the wrong direction, offsetting the good result achieved in Corporate and Investment Banking:

There was a substantial increase in loans written off for home loans, vehicle finance, card debts and other loans. This drove the decrease in earnings in the retail banking businesses and resulted in group return on equity decreasing from 15.3% in 2022 to 14.4% in 2023.

The Absa share price has underperformed its peers in the past year and pressure will be coming through from major shareholders for an improved performance in 2024.

EPE Capital Partners suffers a drop in NAV per share (JSE: EPE)

The ongoing pressure on the Brait share price doesn’t help

EPE Capital Partners, also called Ethos Capital, has a portfolio of unlisted and listed investments. The TL;DR over the history of this fund is that the investments tend to underperform and significant fees are paid to the managers of the fund, so shareholders end up with a disappointing outcome.

In the results for the six months to December 2023, the unlisted portfolio saw its NAV decline by 3% despite the top investments growing revenue and EBITDA by double digits. On the listed side, Brait’s share price tanked over the period and hence there was even more pressure put on the EPE NAV.

If Brait is valued based on its share price, the NAV of EPE dropped by 15% to R7.31. If Brait is valued based on its own NAV per share, then the NAV of EPE fell by 5% to R9.89. With the share price trading at R4.54 in morning trade, you can see that the market puts a fat discount on EPE regardless of the approach taken with the Brait value.

The portfolio somehow manages to have dual exposure to Nigerian telecoms, with positions in MTN Zakhele Futhi and a private company called Optasia that counts Nigeria as one of its key markets. On top of everything else that Brait etc. has to deal with, EPE has an added layer of pain from the devaluation of the naira.

Due to the substantial discount to the NAV, EPE’s strategy is to monetise the asset base and return capital to shareholders. I wouldn’t hold my breath for that to be a quick process.

Lighthouse prepares for a year of acquisitions (JSE: LTE)

The company believes that conditions are right to acquire retail malls

Lighthouse Properties has released its results for the year ended December 2023. Total distributable earnings per share came out at 1.76 EUR cents per share for the year. As the company has been doing for a while, distributions are being supplemented from retained earnings, with the total distribution for the year at 2.70 EUR cents. A scrip distribution alternative will be offered.

The loan-to-value ratio decreased from 23.84% to 14.04%, with the commentary in the announcement suggesting that it has subsequently moved higher to 27%. They are looking for further acquisitions of shopping malls in 2024, as they believe that yields on quality assets have risen and interest rates have stabilised.

The forecast distribution for 2024 is between 2.40 and 2.50 EUR cents, with some dependence on a distribution from Hammerson to help the company achieve this.

Metair has some wind in its sails again (JSE: MTA)

The unluckiest company on the JSE seems to be turning the corner

Metair really has attracted enough bad luck to last a lifetime. They’ve had an extremely tough time with all the usual South African challenges, along with natural disasters in both South Africa and Turkey! The share price has lost over half its value in the past year as a result. The 23.5% rally in the share price on Monday went a long way towards improving this!

The good news is that 2023 was much better than 2022, with the group profitable again and able to have positive conversations with lenders. It still wasn’t smooth sailing though, with improved conditions in the South African automotive components business (revenue up 45%) on one hand and a 17% decrease in battery sales volumes on the other, driven by the loss of export volumes in Mutlu Akü in Turkey as the business stopped selling to Russia and also lost a key client in the US.

Revenue growth was in the double digits for the year and EBIT margin (excluding hyperinflation and impairments) is between 6.8% and 7.8% vs. 7.6% the year before. It’s just as well that revenue growth was strong and EBIT margins were fairly steady, as net finance costs increased by more than 90%!

Headline earnings per share (HEPS) is between 128 cents and 140 cents for the year. That’s a vast improvement from a headline loss per share of 17 cents in the comparable period.

Digging deeper, the problematic Hesto business managed to agree a commercial price adjustment with key client Ford, allowing Hesto to make a profit in the second half of the year. The first half was so bad that Hesto still reported a full-year loss though. This is accounted for as an Associate and so losses are not included in the 2023 financial results, but Hesto’s performance is a consideration for debt covenant conversations with banks.

Of critical importance is that the revolving credit facility of R525 million due in April 2024 has been extended for an additional year. Lenders remain supportive and management is working on a debt restructure programme.

Before you allow yourself to believe that Metair’s luck has turned completely, I must highlight that Romanian subsidiary Rombat is under investigation by the European Commission for potentially violating EU antitrust rules between 2004 and 2017.

Remgro didn’t grow (JSE: REM)

Heineken Beverages was one of the major challenges – but not the only one

Remgro has released results for the six months to December 2023 and they reflect a substantial drop in HEPS of 35% to 45%. This is before making adjustments.

Now, some of these adjustments make sense, being once-offs related to various operations and corporate actions. I’m less convinced that the negative fair value adjustment on the Natref stock at TotalEnergies South Africa is appropriate to split out, even though that business is held for sale. This also happens to be the largest individual adjustment.

HEPS on an adjusted basis will be between 8% and 15% lower. This means that the core business went the wrong way, with the blame laid at the door of Heineken Beverages (volumes have fallen and so have margins), Community Investment Ventures Holdings (higher finance costs) and a special dividend from FirstRand in the comparative period that didn’t repeat in this period.

Volumes are still negative at RFG Holdings (JSE: RFG)

Pricing increases are taking revenue growth into the green

RFG Holdings has released a trading update for the five months ended February. Revenue was up by 5.1% thanks to price increases of 7.9%. Volumes fell by 5.2%, with the rest of the change explained by mix and forex effects.

The international vs. regional results tell very different stories. Regional revenue was up 6.7%, with price growth of 10.8% and volumes down 5.7%. International revenue was down 3.7%, with pricing 7.8% lower (but there’s a 6.8% forex offset) and volumes down 2.7%. Export volumes were unfortunately impacted by the challenges at the Cape Town port.

Long story short, consumers are under pressure (as we know) and RFG has pushed through pricing increases to make up for it. They are focused on protecting the operating margin rather than chasing sales growth at any cost. This doesn’t seem to be the strategy of everyone in the market, as RFG notes increased competitor promotional activity as a factor in the market i.e. more aggressive pricing.

The pie category has continued to buck the trend in terms of sales volumes, with the ready meals enjoying ongoing support from convenience-oriented consumers who are generally in higher income groups.

Other good news is that load shedding costs (i.e. diesel) have come down significantly.

The outlook for the business is largely positive, with the Easter period expected to support volumes. Either way, the group will continue with the focus on margins, assisted by efficiency gains from recent capital investment programmes. On the exports side, the local crop has been a success in terms of high quality fruit. RFG can only do so much though, as much will depend on the issues at the port being sorted out.

Little Bites:

- Director dealings:

- Certain directors of Quantum Foods (JSE: QFH) sold shares to cover the tax on recent phantom share rights. This isn’t unusual. What is unusual is that the purchaser (an unnamed independent third-party) entered into an agreement directly with the directors to acquire those shares at R5.30 per share, rather than waiting for them to be sold on market. The total value is R1.7 million. There’s a lot of activity around the Quantum shareholder register at the moment.

- Investment holding company Astoria (JSE: ARA) is acquiring shares in Leatt Corporation from RECM Worldwide Opportunities Prescient QI Hedge Fund at a price of $13.67 per Leatt share. The total value is $5.3 million. It will be settled through the issuance of Astoria shares at $0.738 per share and a cash payment of $840,000. This increases Astoria’s holding in Leatt from 2.3% to 8.84%. The pricing of both the Leatt and Astoria shares for the transaction is higher than the current market prices, with the Astoria shares being issued at a price close to NAV (the 30 September 2023 NAV was $0.7443 per share).

- Accelerate Property Fund (JSE: APF) is selling off assets to try and reduce debt, but that isn’t always an easy thing to execute. The deal to dispose of Cherry Lane Shopping Centre has fallen through, with terms being negotiated with a potential new purchaser. In some good news at least, the fund has sold three other properties for R43 million, with the proceeds used to reduce debt.

- Those of you who are interested in debt structuring will want to know that Grindrod Shipping (JSE: GSH) has announced a new $83 million reducing revolving credit facility. There’s also an optional reducing revolving accordion credit facility of $30 million that could be added on top. No, I’m not making any of these terms up. Yes, debt financing can get complicated. The purpose of the debt is to refinance an existing $114.1 million senior secured term loan facility.

- Shaftesbury Capital (JSE: SHC) has completed the acquisition of 25 – 31 James Street, Covent Garden for £75.1 million before costs. This is a good example of the company recycling capital, as it comes after recent disposals to the value of £145 million (achieved at an 8% premium to the balance sheet valuation of the properties).