Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Capital & Regional heading in the right direction (JSE: CRP)

Remember, these growth rates are in hard currency

Capital & Regional is a UK-focused REIT that holds a portfolio of community shopping centres. The company has released results for the year ended December 2023.

The good news is that like-for-like rental income increased 5%, helping to drive 9.7% growth in adjusted earnings per share. The further good news is that valuations moved higher, with a positive 2.6% increase. On top of this happy news, the fund acquired the Gyle shopping centre back in September in what looked like a very well-priced deal at a net initial yield of 13.5%. They expect that to rebase to 12%, which means the value of that property has significant upside potential.

The final dividend is up 7.3%, with the full-year dividend coming in 8.6% higher than the previous year.

Moving to the balance sheet, the debt maturity profile is 4.1 years with an average cost of debt of 4.25%. Around 80% is hedged for the next three years. Net loan to value has increased from 40.6% to 43.6%.

Glencore is producing in line with guidance (JSE: GLN)

It’s still early days for this financial year, though

Glencore has released its production report for the first quarter of the new financial year, with the key takeout being that guidance for the full year is unchanged.

As always with these large mining groups, there were some significant moves in individual commodities. For example, cobalt production fell 37% and nickel was up 14%. Despite some of the larger moves, guidance for the full year is still in line with previous guidance across every commodity that Glencore produces.

The all-important profitability metric is Marketing Adjusted EBIT, which is expected to be $3.0 to $3.5 billion this year. That’s ahead of the long-term range of $2.2 – $3.2 billion per year.

Harmony is on track for an excellent year (JSE: HAR)

With nine months under its belt, the company has upgraded full-year guidance

Harmony Gold is loving life at the moment, with the average rand gold price received up by 17% year-on-year for the nine months ended March 2024. Of course, the price is only one component for returns. Mines still need to get the stuff out of the ground, with Harmony taking advantage of the improved gold price by increasing gold production by 10%.

And to add to the happiness, there’s a 2% decrease in group all-in sustaining costs (AISC). To give you a sense of margins, AISC came in at R877,965/kg and the average gold price received was R1,162,048/kg.

Group operating free cash flow increased by a whopping 171%, leading to a net cash position of over R1.5 billion vs. R74 million at the end of the interim period. How’s that for a move over three months?

It’s also worth noting that uranium is a by-product of the gold extraction process at Moab Khotsong. Production increased by 28% and the average uranium price increased by 43% in dollars. Uranium revenue for the nine months was R435 million. This is very small compared to the R42.4 billion from gold over the same period, but I still found it interesting.

For the full year, production guidance has been increased to 1.55 million ounces (from 1.38 – 1.48 million ounces) and AISC is down to R920,000/kg from previous guidance of R975,000/kg. As the cherry on top, capital expenditure guidance is down to R8.6 billion from R9.5 billion.

The cash is literally raining down on Harmony, which is why the share price chart looks like this:

Volumes are up at Impala, but read carefully (JSE: IMP)

Things are tough and the group is embarking on a retrenchment programme

Impala Platinum has released a quarterly production report for the three months to March. The PGM market is very tough at the moment, where even an uptick in production isn’t enough.

Mining houses need to cut costs in response to pressure on PGM prices, otherwise they will run themselves into the ground where they found the stuff in the first place!

With nine months of the financial year now behind them, Impala Platinum can report a 15% increase in total 6E group refined and saleable production. Sales volumes were only up by 11%, though.

Deep inside the report, you’ll find a very important comment that like-for-like refined 6E production (i.e. excluding Impala Bafokeng) actually fell by 6% for the quarter (not the nine months), so the deal to acquire Royal Bafokeng has really flattered these production numbers. The nine-month view is like-for-like refined 6E production up by 1%, so the cadence is worrying i.e. the latest quarter looks worse than the preceding quarters.

The group is at least on track to meet guided parameters for the full year, so there’s no negative or positive surprise there.

From a profitability perspective, the group is facing margin pressure and has commenced a s189 process that could affect 9% of its workforce.

MTN Nigeria goes from bad to worse (JSE: MTN)

Equity is a dish best served positive – and MTN Nigeria only has a negative story to tell

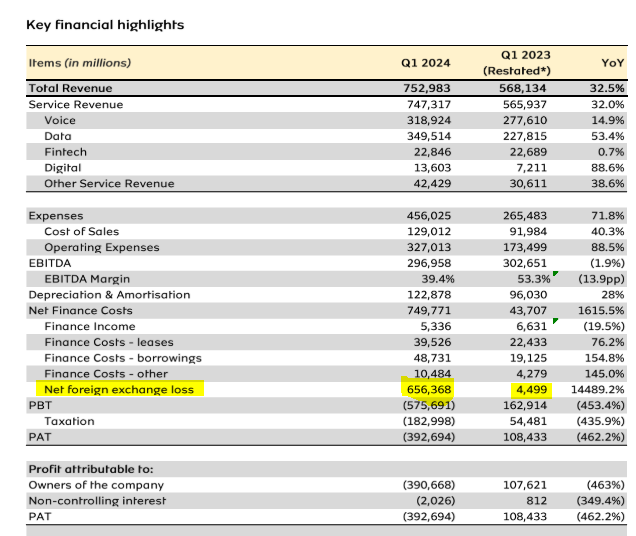

MTN is having a rough time in Nigeria and it seems to only be getting worse. Although total subscribers at MTN Nigeria grew 1.3% in the quarter ended March and service revenue increased by what looks like a very healthy 32%, EBITDA was down by 1.9%. This means huge EBITDA margin contraction by 13.9 percentage points to 39.4%.

It gets a lot worse further down the income statement, with profit after tax down 57.8% even if we adjust for net forex losses. If those losses are included, the net losses are huge and equity on the balance sheet is now negative.

In this trainwreck of a result, even free cash flow went the wrong way. It dropped 35.6%, not least of all because capital expenditure increased by 49.1%.

The macroeconomic conditions in Nigeria are making life extremely difficult, with the company noting that regulated tariff increases will be required to restore profitability. What they really need to do is show the balance sheet some love, which means lower capex and thus reduced dollar exposure, as the letters of credit that drive such severe forex losses are linked to capex. There are other initiatives underway related to profitability, including a review of tower lease contracts.

This gives you a good idea of how significant the forex losses are vs. EBITDA:

Renergen’s maintenance drove higher losses (JSE: REN)

Operational setbacks have been the story of the past year

Early-stage energy companies consume a lot of cash on their journeys. This is simply how it is, as vast capex is needed up-front to create an asset of value. There are far too many Renergen shareholders who were naïve about this, buying into the hype during the pandemic. On top of this, there have been negative surprises from operational issues that have put further dark clouds on the share price:

Driven by higher costs as well as maintenance at the LNG plant for four months, the loss attributable to ordinary shareholders increased from R26.7 million to R110.2 million. That’s a big number. Depreciation expenses were also a major part of the losses (just under R20 million), so there will be ongoing pressure on the income statement.

Phase 2 of the helium side of the business is where the real value lies and commercial operation is expected during the 2027 calendar year. Of course, a much happier story around phase 1 would go a long way towards supporting the share price.

The income statement doesn’t look great, but the efforts to build up the balance sheet in preparation for growth have been effective. There have been various funding initiatives in the past year, ranging from equity through to debt. The net asset value per share has moved higher thanks to equity injections.

We can’t say with much certainty what the next year will hold for Renergen. I’m quite sure that it won’t be boring, though!

Core earnings at WeBuyCars move higher (JSE: WBC)

The share price hasn’t seen much action post-IPO

WeBuyCars has recently incurred significant once-off costs related to the separate listing. This is why the company is reporting core HEPS as well as HEPS, with the two metrics showing completely different numbers.

It’s silly to judge the performance of the business on numbers that include the costs of the listing, or the non-cash charges related to the call options held over shares that subsequently fell away. I’m therefore ignoring HEPS, which shows a drop from positive 20 cents to a loss of between 19.7 cents and 21.7 cents for the six months to March 2024.

Instead, core HEPS is where I’m focused. That number shows an increase of 24% to 29%, coming in at between 117.5 cents and 122.3 cents. Higher volumes and average selling prices helped here, as did ongoing benefits of economies of scale.

The market didn’t give much of a response to this, with the stock trading slightly below the level at which it separately listed.

Little Bites:

- Director dealings:

- Des de Beer is back in action, buying R1.1 million worth of shares in Lighthouse Properties (JSE: LTE)

- Various entities associated with a director of Sea Harvest (JSE: SHG) bought shares in the company worth just under R200k.

- MC Mining (JSE: MCZ) released a quarterly activities report that obviously comes against the backdrop of the Goldway bid. As at 23 April, acceptances of Goldway’s bid by shareholders took that consortium to a 93.05% shareholding in MC Mining. For what it’s worth, Uitkomst achieved a 14% increase in run of mine coal for the quarter, with revenue per tonne also up by 14% in dollars. At the Makhado project, funding and development were suspended during the Goldway process and are expected to be reinitiated now that the process is complete. Separately, the company announced that shareholder Dendocept has given notice to the board of an intention to remove Andrew Mifflin as a director of the company.

- Southern Palladium (JSE: SDL) released a quarterly activities report for the three months to March. This is still a very early stage opportunity, with the company currently busy with a drill programme that is due to be completed in the third quarter of this year. The project’s estimated post-tax internal rate of return is 21%. From what I can see, that’s a dollar-based return.

- Afrimat’s (JSE: AFT) acquisition of Glenover Phosphate has become unconditional, with approval from the MPRDA having already been received and 30 June 2023 financial statements and related company documentation now completed. In the same announcement, Afrimat noted that the Lafarge acquisition closed on 22 April and integration has commenced, with a plan to complete it within 12 months.

- NEPI Rockcastle (JSE: NRP) has increased its green loan facility syndicated by the International Finance Corporation. The facility is now €58 million higher at €445 million. The facility is designed to provide for an upcoming bond maturity in November 2024, covering 89% of that bond’s principal amount in its enlarged form. The “green” element of the facility is linked to energy efficiency and emission factors.

- Kibo Energy (JSE: KBO) subsidiary Mast Energy Developments released results for the year ended December 2023. Despite loads of commentary about the different projects and where they are in the development process, the reality is that MED lost £3.5 million for the year after losing £2.7 million in the prior year.

- Efora Energy (JSE: EEL) is a lot closer to being up to date with its financials. Interim 2024 results are due to be published by the end of May, with 2023 results having been published. The transfer of ownership of the Alrode Depot has also been delayed and should close by the end of May.

- Gold Fields (JSE: GFI) announced that CFO Paul Schmidt is proceeding with early retirement. He will be replaced by Alex Dall on an interim basis (an internal promotion) with effect from 1 May 2024. Sometimes these interim promotions stick and sometimes they don’t!

- The CFO of Chrometco (JSE: CMO) – which is suspended from trading – has resigned with effect from June 2024. No replacement for Wilhelm Hölscher has been named at this stage.