Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Juicy growth at Capital Appreciation (JSE: CTA)

The dividend is up 21% in this technology group

Capital Appreciation has released a strong set of numbers, with revenue exceeding R1 billion and up 19%. That set the tone for the rest of the numbers, including a 75% increase in cash generated from operations. The terminal estate (the point-of-sale machines out there) increased by 9%.

EBITDA margin expanded by 480 basis points and HEPS was up 83%, so the numbers are all strongly in the right direction wherever you look. The full-year dividend increased by 21%.

Although acquisitions (like the R151.1 million Dariel deal) had an impact on metrics like revenue growth, the reality is that the company had the balance sheet to execute on those acquisitions. This is inevitably a better outcome for shareholders than a share-for-share deal that grows the group but dilutes existing shareholders and impacts HEPS. In the case of Dariel, the deal was structured as a cash payment of R46.9 million and an allotment of treasury shares worth R37.1 million. There will be further payments if earn-out targets are reached.

Here’s the really interesting thing though: in this period, it was the payments segment that achieved the magic, with a rather incredible scenario where an extra R38 million in revenue led to an extra R33 million in operating profit. Talk about growth dropping to the bottom line! In the software business (which includes Dariel), things are a lot trickier. Revenue was much higher (with the acquisition making a big difference here), yet operating profit actually fell from R79 million to R56.5 million.

Luckily, the pressure in the software business wasn’t enough to offset the party in payments.

Nictus has flagged a significant jump in HEPS (JSE: NCS)

But we should wait for full details of the impact of IFRS 17 on these numbers

Companies that are impacted by IFRS 17: Insurance Contracts are reporting numbers that really are difficult to compare to results that came out before this standard was implemented. We are seeing this across the financial services industry, with other companies like furniture retailer Nictus being affected as well.

It’s therefore best to wait until the release of detailed results on 28 June before jumping to conclusions about the underlying performance. For now at least, we know that HEPS for the year ended March will be between 19.24 cents and 21.56 cents, an increase of between 57.43% and 77.43%.

The share price in this tiny company is R0.95.

Ninety One is struggling to move forward (JSE: N91 | JSE: NY1)

Without strong distribution, pure asset managers are struggling with outflows

As you’ll also see in Sygnia further down, net outflows are a problem for asset managers. The groups with a strong wealth management / distribution business are still achieving net inflows as they have a sales force out there doing the hard yards. The asset managers waiting for asset allocations aren’t so lucky.

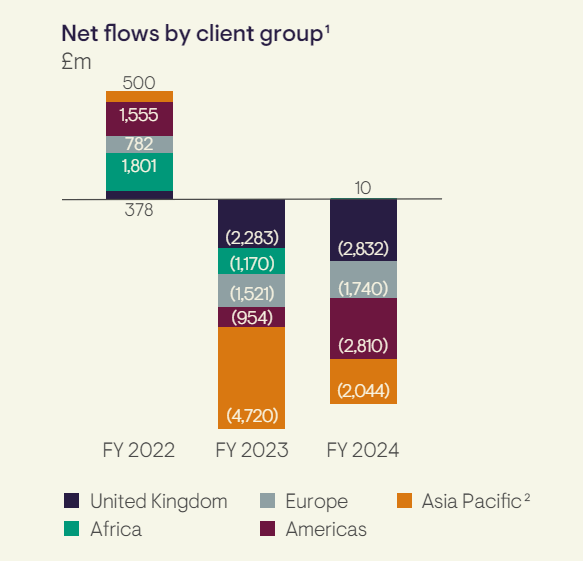

Ninety One reported a drop in assets under management of 3% for the year ended March 2024, with negative net flows of £9.4 billion. That’s at least better than the negative net flow of £10.6 billion in the comparable year. It looks worse if we consider average assets under management rather than just the end-points, with that metric down 8%. Assets under management at year-end came in at £126 billion.

Despite this, profit before tax was up 2%. Adjusted operating margin wasn’t as encouraging, down by 70 basis points to 32% as adjusted operating profit fell by 8%. That’s probably the right metric to consider, along with the the dividend per share falling by 7%.

Here’s a chart showing you what the interest rate cycles do to net flows:

Sygnia achieved decent growth in earnings (JSE: SYG)

The payout ratio has decreased though

Sygnia has released its results for the six months to March 2024. With assets under management and administration up by 7.3%, they are doing better than some other big local names in the industry. In this period, market performance more than offset the net outflows of R11.2 billion. Worryingly, the net outflows are much worse than R5.1 billion in the comparable period, so the growth in assets is being driven by volatile factors rather than a steady inflow of assets.

Institutional assets under management came in at R269.8 million at the end of March vs. R71.5 billion in retail assets.

Revenue is up 8.7% and expenses increased by 8.0%, which means there was margin expansion. Profit before tax increased by 10.2%. HEPS was up 9.7% to 100.7 cents, so the revenue growth is translating nicely into earnings growth.

The dividend hasn’t quite followed suit though, only increasing by 3.4% to 90 cents per share.

Trustco has announced the diamond resource estimate for Meya Mine (JSE: TTO)

The cautionary announcement has been withdrawn

All the way back in July 2023, Trustco announced that Sterling Global Trading would take a 70% stake in Meya Mining. The circular hasn’t been released yet as the resources report on Meya Mine was pending. This report has now been released. with Z Star Mineral Resource Consultants having prepared the estimate.

As a reminder, Trustco holds a 19.5% interest in Meya Mining with a total investment of $116 million.

The estimated value of the 1.99 million carats at Meya Mining is $763 million, of which $104 million is in the indicated category and $659 million is inferred, based on an average value of $382 per carat. The assessment was based on an area of land that is less than 5% of the combined strike lengths of the kimberlite domains within the licensed area.

Vukile feels proud of the latest financial year and with good reason (JSE: VKE)

This is one of the best REITs on the JSE right now

Vukile has released results for the year ended March 2024. Across the South African and Spanish portfolios, net operating income growth was up 5.4% and 11% respectively. There were positive rental reversions in both portfolios, with South Africa at +2.9% and Spain at +9.7%.

The loan-to-value ratio of 40.7% is at a healthy level for a REIT and they have no issues in raising both debt and equity funding, with strong support across the market.

With total funds from operations per share up 6.7% and the total dividend for the year up by 10.5%, it’s little wonder that there are investors who are happy to keep giving money to this management team.

Those who hold shares in Vukile should take note of the dividend reinvestment alternative, with that circular available here.

York Timber is acquiring additional farms (JSE: YRK)

The purchase price is R75 million

York Timber announced a deal with Stevens Lumbar Mills that will see York acquiring six properties, the standing timber thereon and the related water rights. The market value has been estimated as R75 million and the purchase price has been set at this level.

R30 million is payable up-front as a deposit, with the rest funded through the raising of debt by York. This will need to happen within 120 days of the signature date of the deal.

This is a Category 2 transaction, so there is no shareholder vote.

Little Bites:

- Director dealings:

- The CEO of Thungela (JSE: TGA) put in place a collar structure over shares worth R67.4 million. The put strike price is R134.72 and the call strike price is R183.43, with expiry in June 2026. The current price is R132, so technically the put is already in the money. He is hedging against further downside, while giving away upside above the call strike price.

- A director of ADvTECH (JSE: ADH) sold shares worth R3.8 million.

- A director of Northam Holdings (JSE: NPH) has purchased shares worth R944k.

- Aside from a sale by a director linked to share options, we also saw the company secretary of Impala Platinum (JSE: IMP) sell shares in the company worth R665k.

- A director of Collins Property Group (JSE: CPP) has bought shares worth R450k.

- As I did the other day with a similar trade by the same parties, I’m including this separately to director dealings as an institutional investor with board representation isn’t quite the same thing. Still, it’s good that Capitalworks has bought another R14.6 million worth of shares in RFG Holdings (JSE: RFG).

- Datatec (JSE: DTC) has released the circular dealing with the scrip dividend alternative for the 130 cents per share dividend. The scrip dividend is calculated with reference to the 30-day volume-weighted average price (VWAP).

- If you are interested in learning more about Santova (JSE: SNV), then you can refer to the latest analyst presentation made by the company at this link.

- The trading suspension on Oando (JSE: OAO) has been lifted now that the company has caught up on its financial reporting.

Sygnia → excuse my ignorance. How can AUM be up but net outflows worse than in the comparable period? Thank you in advance.

Hi Andrew! No ignorance at all, it’s a great question. AUM has two components – the changes in values of all the existing assets (market values going up or down) plus the net inflow / minus the net outflow. It’s like your own portfolio. The value changes every day and can go up even if you don’t put in any further money. If the markets do well enough, you can still go up even if you pulled money out!