Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Copper 360 is the best example of “if my grandmother had wheels…” (JSE: CPR)

“…she would’ve been a bicycle”

Copper 360 isn’t off to a great start as a listed company. Investors don’t enjoy surprises, especially of the negative kind. Copper 360 had a pretty terrible year ended February 2024, with much effort put into the announcement to explain why.

Too much effort, perhaps. The announcement takes us to a parallel universe where the group might have broken even, if not for *cue long list of problems*.

Although I’m not quite sure how they’ve estimated these numbers with such certainty, the announcement suggests that they would’ve managed revenue of R162 million were it not for load shedding, the three-month stoppage for the cyclone circuit installation and the poor recoveries. Unfortunately, those things all happened, so they made R38 million instead.

The group raised R490 million in capital and has been spending like mad, with R30 million now in the bank. This has included funding cash losses (R118 million), the Nama Copper acquisition (R131 million) and various capex projects.

Management is bullish on copper prices and on the year ahead in general. Hopefully they will get the company on the right track now, as markets aren’t famous for being patient with new listings that don’t perform as promised.

Gemfields has a gold project in Mozambique (JSE: GML)

You would be forgiven for not knowing this

Gemfields is known for its emerald and ruby assets. There is some other stuff in there though, like Nairoto Resources Limitada, a gold project in Mozambique. Gemfields has a 75% stake in this company. The 25% partner is the same partner that Gemfields has in Montepuez Ruby Mine.

These are very, very early days, as the company is only working towards an indicated mineral resource by the end of the year. This doesn’t mean there is any economic viability at this stage. Gemfields also notes that gold mining is not even part of the company’s long-term strategy, so the goal here would be to either sell the project or find a suitable partner when the resource is understood.

In other words, this might bring some upside optionality to Gemfields in the future, but isn’t worth putting any value on now.

Showmax is devouring capital at MultiChoice (JSE: MCG)

Canal+ is clearly playing the long game here

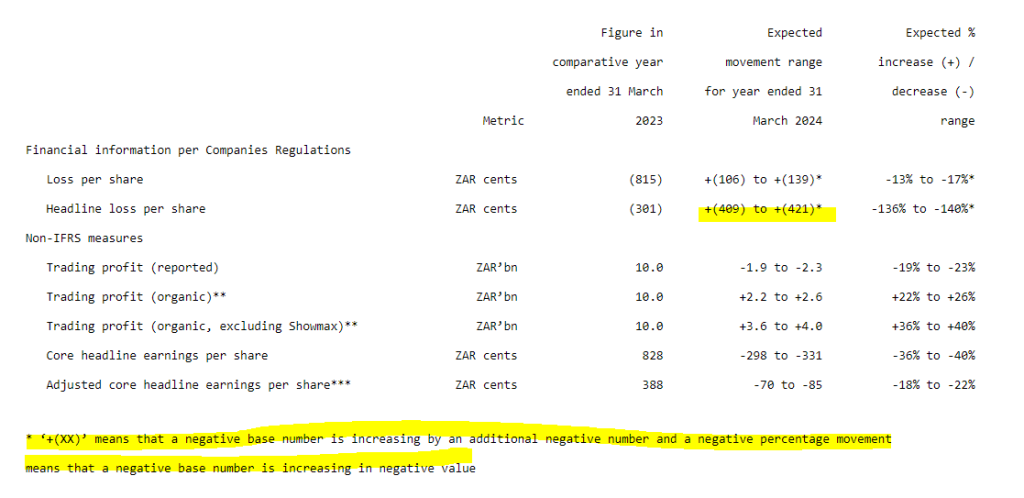

MultiChoice has released one of the most confusing trading statements that I’ve seen in my life.

The odd footnote below, along with the expected movement range that looks more like a BODMAS maths test than anything else, could’ve been entirely avoided by just having a column showing the expected range for the year ended March 2024, instead of just the expected movement. Then there would be no confusion.

I reckon there’s at least a 50% chance that whoever designed this reporting approach also designed the user interface on the DSTV App:

Once you’ve read it, re-read it and then re-read it again, you’ll see that the headline loss per share got worse. Quite a lot worse, actually. Even on their core earnings metrics, MultiChoice is in the red.

There are a few factors at play here. Aside from the weaker macroeconomic environment, there’s the depreciation of the Nigerian naira (the same problem that has given MTN a bloody nose) and the level of investment in Showmax, which is a nice way of saying that Showmax is incurring huge start-up losses as we’ve seen elsewhere in the streaming industry.

The loss per share (rather than the headline loss per share) has been impacted by a once-off impairment of IT systems of R1 billion. After fighting with the DSTV App yet again the other day as it kept freezing, I have some speculation around which systems those might be.

The metric that has moved higher is trading profit on an organic basis, which means constant currency and excluding M&A. They reference inflation-led pricing and cost optimisation as the reason for this. The foreign exchange impact then ruins that party and takes earnings into the red.

If I was a large MultiChoice shareholder, I would take the Canal+ money.

There’s another drop in earnings at Spar (JSE: SPP)

When does this tide turn?

Pick n Pay is getting all the attention at the moment as the disaster of the grocery sector, but Spar isn’t exactly showing much improvement either. In fact, for the six months to March 2024, things have only gotten worse.

Excluding Spar Poland, HEPS from continuing operations has fallen by between -13% and -3%. This implies a range of 437.9 to 488.2 cents vs. 503.3 cents in the comparable period.

Spar Poland is being shown as a discontinued operation and the company will be recognising a “material impairment” on its assets, with more details to come at the results presentation. Many South African companies have done well in Eastern Europe. Spar isn’t one of them.

Including Spar Poland, HEPS will be down by between -12% and -2%, which is actually better in terms of year-on-year movement than if Poland is excluded. The impairments come through in earnings per share (EPS) and lead to group profitability being crushed by between -98% and -88%.

The pressure on earnings in the core business has come from cost growth above turnover growth, with top-line performance being disappointing. This is particularly poor when Pick n Pay is in so much pain, as Spar should be feeding off that carcass. Of course, the IT issues at the KZN distribution centre at Spar don’t help and are still an issue. The group also notes higher interest costs as a source of downward pressure on profits.

The disastrous SAP implementation in KZN is a gift that just keeps on giving.

Little Bites:

- Director dealings:

- A director of a major subsidiary of African Rainbow Minerals (JSE: ARI) sold shares in the company worth R4.75 million.

- A prescribed officer of ADvTECH (JSE: ADH) has sold shares in the company worth R2.1 million.

- Sanlam (JSE: SLM) has confirmed to the market that Paul Hanratty has agreed to extend his term as CEO until December 2027.