After a post COVID-19 lull, mergers and acquisitions (M&A) activity on the African continent is set for an exciting new phase, as investors see opportunities to deploy capital.

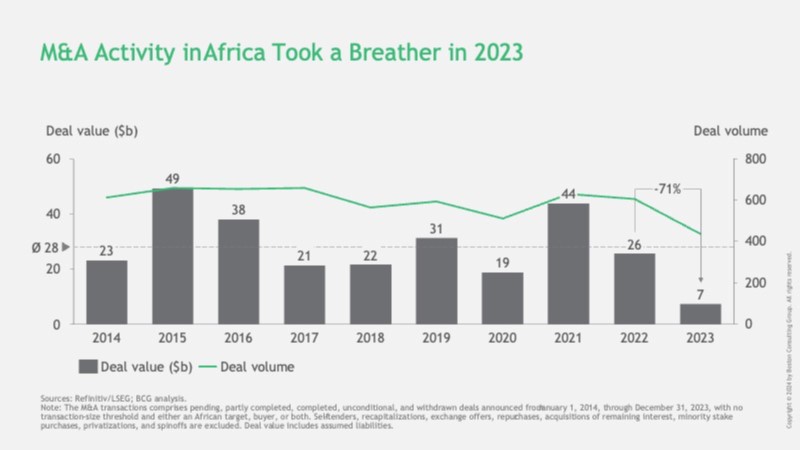

According to our research over the last 10 years, deal activity in Africa has averaged around US$28 billion in value, and there have been approximately 600 deals per year. Apart from bumper years, activity in most years fluctuated around these averages. In 2021, for example, the continent saw significant transactions by BP and Eni, which pushed the deal value up. Another exception was in 2023, when we saw only $7 billion in deal value across 440 deals – a 71% drop in deal value compared to 2022.

When looking at the geographic locations of these transactions, we observe that most deals target South African companies. But other economies like Morocco, Egypt, Nigeria and Kenya are catching up, and becoming increasingly attractive for acquirers.

We believe that there are several catalysts that may align to reverse the trend of below-average activity in recent years, and push M&A activity on the African continent to new heights.

Firstly, a look at global trends in M&A suggests that companies have strengthened their balance sheets, have excess cash on hand to invest, and are forecasting a more stable interest rate environment. While this should be seen in the context of increased geo-political uncertainty, companies may also utilise this period to look at cross-industry transactions to help them meet their digitisation and sustainability-linked goals.

The second trend is that there remains robust demand for African assets, with roughly half of the 2023 deal value being inbound activity – these are classified as non-African acquirers buying African assets. In 2023, we saw the second-highest share in the last 10 years with 57% of deal value from such deals. One connected trend is the increasing presence of Chinese buyers on the continent. Their share in deal value increased from 2% in 2014 to 7% in 2023, with a tendency to be involved in larger deals.

Sector-wise, we saw most of the transactions take place in the materials and energy and power industries, with 27% and 25% respectively in 2023. This is a shift compared to 2014, where these two sectors combined accounted for only about a quarter of aggregate African deal value.

This trend is expected to continue into 2024. Transactions in the energy and power clusters will be fuelled by major international oil companies optimising their portfolios through divestments of non-core assets, particularly in Africa. These companies, acting as the main sellers, are shifting away from non-strategic assets, driving interest not only in fossil fuels, but also in renewable energy sources and infrastructure development.

As African economies aim for energy diversification and independence, the focus on renewable resources and sustainability is increasing, indicating a move towards more self-sufficient and environmentally friendly energy production.

On the materials front, the rise of the green economy and the so-called “metals of the future” cluster – cobalt, manganese, copper and lithium – are expected to attract investor attention, especially in Africa.

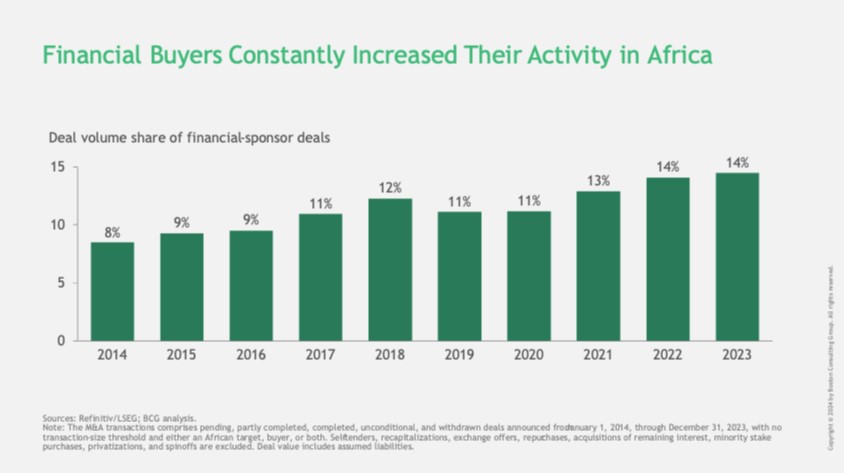

A third trend which is expected to contribute to higher M&A activity in Africa is the increasing activity of financial buyers – classic private equity investors, or a slightly newer class of financial sponsors in the form of Sovereign Wealth Funds (SWFs). With African markets maturing, these buyers have almost doubled their share of total deal-making from 8% in 2014 to 14% in 2023. One of the drivers of these transactions is the increased participation of Middle Eastern SWFs, looking to diversify their investments outside their home markets. An example is the Eastern Co, a tobacco company based in Egypt, which was acquired by UAE’s Global Investments for approximately US$625 million.

The fourth trend on the African continent is more structural, where increased optimism around deal-making is supported by game-changing initiatives like the African Continental Free Trade Area (AfCFTA), which is expected to enhance intra-African trade and M&A activity.

Should the increased M&A activity materialise through these trends, we believe that there are several opportunities for businesses to benefit. However, it’s not guaranteed that the companies which participate in deal-making create value from it. To do so, companies must follow a clear set of rules, which have proven to drive success in other regions already. Our research has shown that the following factors, among others, are pivotal for success:

• Be prepared and systematic: Have the right team, tools and processes in place to act on M&A opportunities.

• Acknowledge the risk: Doing M&A in lesser-developed economies comes with an additional risk to the already challenging odds of creating value from transactions.

• Build experience: Experience matters in M&A, as our research has shown.

• Master the art of timing: In M&A, as in many other areas of business, timing is half the battle.

• Double down on integration design and execution: The importance of execution for successful deal outcomes cannot be overstated.

Rich in mineral resources, with a youthful population and maturing financial markets, and strategically positioned between key trade routes, the African continent represents an exciting frontier market for investors. We anticipate that these trends will contribute toward a healthy M&A environment.

Historically, acquirers in Africa have created slightly more value from their deals, compared with the global average; however, the odds of creating value are, at the same time, lower. Companies that keep an eye on the trends shaping the M&A market in Africa and prepare for successful deal-making are sure to be presented with an historic opportunity.

Jens Kengelbach is Managing Director and Senior Partner; Global Head of M&A | Boston Consulting Group

This article first appeared in DealMakers AFRICA, the continent’s quarterly M&A publication.

DealMakers AFRICA is a quarterly M&A publication

www.dealmakersafrica.com