Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

The Bell is finally ringing – at R53 per share (JSE: BEL)

After years of speculation and even arguments with activist shareholders, there’s a deal

At long last, Bell Equipment is being taken private. Although the deal was only announced on Monday, Bell was up 10% on Friday. Perhaps some people just have really good crystal balls.

The Bell family holds 70.13% through IAB and another 14.82% across various family holdings, so the free float in Bell was already very low. Original attempts to take the company private at opportunistic prices were unsuccessful, with the family now stumping up R53 a share to get the deal across the line. At a huge premium of 82.3% to the 30-day VWAP, it almost feels like they’ve over-corrected on the offer price and offered too much!

The reasons for the delisting are the usual ones: limited share liquidity, constrained ability to raise capital and significant costs of remaining listed.

The offer is worth R762 million, with the offeror having obtained a bank guarantee from Investec in this respect.

Although the independent expert hasn’t opined on the fairness of the deal yet, I can’t see there being any issues at this price.

Bell traded below R5 a share in the worst of the pandemic. It has achieved elusive ten-bagger status, although I’m not sure if anyone would’ve timed it perfectly to buy at the bottom and hang on for the delisting offer! Still, a lot of people did well out of this one.

This is structured as a scheme of arrangement. If it gets the requisite number of votes, the offeror will get all the remaining shares in the company.

Murray & Roberts won a contract in Latin America (JSE: MUR)

When you’re light on good news, you have to celebrate everything

Murray & Roberts has enjoyed a 55% rally in the share price this year, benefitting from the improved sentiment on the JSE without anyone really referencing the company as a stock pick. It’s a risky choice, which might be why market commentators have stuck to the old faithfuls like Afrimat. After all, Murray & Roberts is down nearly 80% over three years.

With the company trying to execute a turnaround, any good news is celebrated. If it’s big enough, they won’t be shy to use SENS to tell you about it. This is the case in the latest update, with Cementation Americas (part of the Murray & Roberts Group) being awarded a mine construction project in Latin America worth $200 million over several years.

If this sounds like business-as-usual to you, that’s because it is. Like I said, it’s been a tough time for the group and they want to get good news into the headlines.

Northam Platinum is doing the best it can (JSE: NPH)

They can’t control PGM prices but they can control production

Northam Platinum released a voluntary production update for the year ended June 2024. It reflects a 10.3% increase in refined 4E metal production from owned operations and 10.6% including purchased material. Either way, that’s good. They exceeded their guidance thanks to outperformance at Booysendal.

PGM price weakness has been the theme lately and Northam is trying to limit the pain by being focused on internal efficiencies and cash conversion.

The share price has had a choppy ride this year and is down 8% year-to-date.

Pick n Pay has released the rights offer circular (JSE: PIK)

It feels like the market has been waiting forever for this

The market has known about Pick n Pay’s rights offer for so long that it has felt like a lifetime for the circular to be released. Although nothing has materially changed since the other announcements, it’s always worth taking a look at the circular to see what we can dig up.

The first interesting bit is the use of proceeds from the R4 billion rights offer. Apart from reducing debt making progress on the turnaround strategy, they also foresee this as being enough for incremental operational funding requirements for the rest of the 2025 financial year. This implies that the group is still absorbing cash at the moment – a good reminder that turnarounds aren’t easy.

There’s other interesting stuff, like a note that the retail business has been divided into six regions rather than three. Presumably this is to help the executives get in their cars and actually visit the stores. If I were them, I would pay particular attention to customers getting thoroughly ignored in the bakery queue for nearly ten minutes. That’s just one of my joyous experiences that I can think of in a Pick n Pay recently. They have 7,000 employees on the “frontline multi-skilling programme” which hopefully includes a module on how to sell a donut to a guy with a sugar craving.

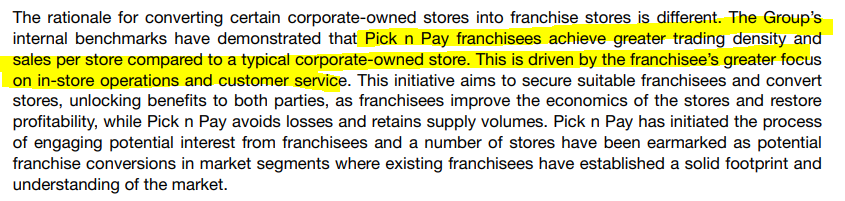

Importantly, they talk about not following a “scale-at-all-cost” approach to the store footprint, which sounds like they will have fewer stores thanks to cuts made to the long tail of sub-economic stores. That’s tough for landlords, of course. Where it makes sense, they will convert Pick n Pay stores to Boxers. Another initiative is to convert some corporate-owned stores to franchise stores.

There’s also this paragraph, which is particularly incredible when you consider that Checkers is a corporate-owned model, as is Woolworths Food. Somehow, I think this is a management problem rather than a business model problem:

Here’s a more positive data point: if load shedding continues to stay away, there’s a significant potential saving for Pick n Pay this year. They spent R698 million diesel in the year ended February 2024. Consider this amount in the context of the size of the capital raise and you’re getting a good idea of what load shedding really cost the economy last year.

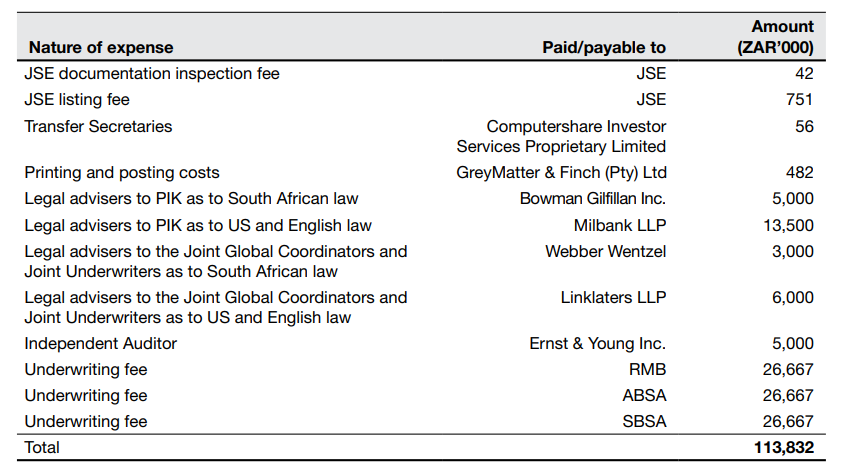

Here’s the biggest shock of all, if you’ve never seen how much money underwriters make for being willing to support a capital raise. Get ready for the costs of the rights offer, coming in at a cool R114 million:

Strategic and operational incompetence has a price. A very large price, indeed. Let’s hope that with a new management team in place, Pick n Pay will get things right.

If you would like to read the rights offer circular (and I always recommend making time for this stuff if you can), you’ll find it here.

Sappi has sold the Lanaken Mill land and assets (JSE: SAP)

Alas, it could not be saved as a mill though

In November 2023, Sappi announced that it would be reducing capacity for graphic paper in Europe. The paper industry is a cyclical game of note, but there are also underlying structural trends that can impact supply and demand. Either way, the writing was on the wall for the Sappa Lanaken mill in Belgium, with production ceasing by the end of December 2023.

Sappi has found a buyer for the asset in the form of UTB Waalwijk B.V., a Dutch company that specialises in industrial property conversions. This suggests that the property will be given a new lease on life – literally. But it probably won’t be a mill.

More importantly, the price is €50 million, of which €40 million will be paid in cash. For some reason, the announcement doesn’t indicate how the other €10 million will be paid. The transaction is expected to close in October.

Sasfin is being taken private – or is it? (JSE: SFN)

The share price was so bad that it’s barely up YTD after the take-private jump

I’ve joked more than once that Sasfin’s returns are so poor that shareholders would be much better off selling their shares and taking out a fixed deposit with the bank instead. It seems as though the family has given up on any prospects of meaningful share price growth, so they are taking it private instead alongside Women Investment Portfolio Holdings, commonly known as Wiphold.

The actual structure is interesting, with those parties subscribing for shares in Sasfin Wealth before that company makes an offer to shareholders of R30 per share in Sasfin Holdings. This is a premium of 66% to the 30-day VWAP.

They will also put together a scheme for management of Sasfin Wealth to have a 15% interest in the enlarged share capital of Sasfin Wealth. This will be funded mainly by a vendor finance scheme.

The concert parties hold 73.1% of Sasfin, so the offer is for the remaining 26.9%. There’s a real twist in the tale around this, so read on,

This is an offer rather than a scheme, so shareholders could choose to remain invested in an unlisted version of Sasfin. Personally, I would rather watch re-runs of Ireland’s last minute drop goal than have unlisted shares in Sasfin.

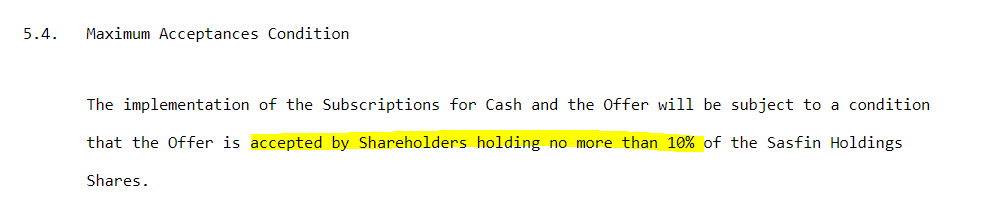

Now for the weird bit. As you read through the announcement, you get to a particularly interesting paragraph:

From my understanding of this, they will only go through with this offer if holders of no more than 10% in Sasfin accept the offer. This sounds doomed to fail, unless I’m missing something here. How can they assume that fewer than half of the non-concert party shareholder will accept the offer?

If you’re wondering if they perhaps have irrevocable undertakings from parties other than the concert parties, then you’ve been paying attention to deals. Alas, there are no other irrevocables. Only the concert parties have indicated that they won’t accept the offer from Sasfin Wealth. This is the 73.1% referenced above.

Odd.

Little Bites:

- Director dealings:

- The CEO of Stefanutti Stocks (JSE: SSK) has bought shares worth just under R3 million.

- A director of Newpark REIT (JSE: NRL) bought shares worth R1.4 million.

- A director of a major subsidiary of Lewis (JSE: LEW) sold shares worth R718k. The announcement notes that they relate to share awards but isn’t explicit on whether this is just the taxable portion.

- A director of a subsidiary of Insimbi (JSE: ISB) sold shares worth R8k.

- Clientele (JSE: CLI) must’ve cracked open the champagne yesterday, as their acquisition of 1Life Insurance is now unconditional. The deal is deemed to have closed on 1 July. They are paying for the acquisition through the issuance of Clientele shares, so I think it’s a goodie.

- Dis-Chem (JSE: DCP) is subscribing for a 50% interest in OneSpark in the US, a company that is a related party to Dis-Chem because of the relationship with the founders. The deal is for a share subscription worth R156 million, so it’s a meaningful transaction. PwC has provided an opinion that the terms of the deal are fair to Dis-Chem shareholders. If you want to read the opinion, check it out here.

- Vunani (JSE: VUN) has renewed the cautionary announcement related to the potential disposal of a minority shareholding in a subsidiary. They don’t say which subsidiary this is.