Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Put Up or Shut Up or… just extend? (JSE: CRP)

The PUSU deadline has been pushed out for both potential bidders for Capital & Regional

Capital & Regional is the person that everybody wants to ask to the dance, with NewRiver and Praxis Group both circling the company and considering a potential deal. Under UK Takeover Law, there’s a Put Up or Shut Up (PUSU) deadline by which the potential offeror must do exactly that: actually confirm that an offer is going ahead, or that an offer is not going ahead.

The idea is to avoid potential offers just lingering in the market. I must be honest though, most of these PUSU deadlines seem to frequently get extended and I’ve seen this in a few companies now.

To help Capital & Regional explore the potential transactions with both NewRiver and Praxis, the PUSU deadline for both has been extended to 12 September. For context, the NewRiver PUSU has already been extended since July. You see what I mean about how strict these deadlines seem to be?

Exxaro reminds us what a cycle looks like (JSE: EXX)

This wasn’t a good period for Exxaro’s commodities

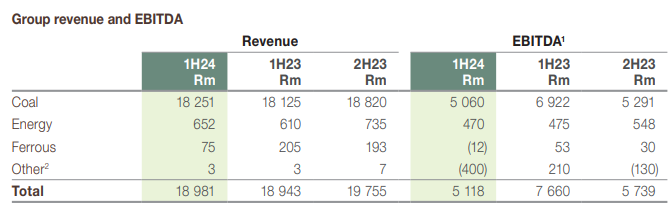

For the six months to June, Exxaro managed to increase revenue by 1%. It didn’t do much good though, as EBITDA fell 34% and HEPS was down 37%. Ouch.

The drop in profitability was most severely felt in the coal business, where a combination of lower selling prices and higher operational and distribution costs led to a decrease in EBITDA margin from 38.2% to 27.7%. Although that’s a nasty year-on-year drop in margin, it’s clearly still a lucrative business.

Exxaro’s energy business has turned out to be a very helpful underpin for profits, with revenue up vs. the prior year and EBITDA margin at a very high 79%. These are wind assets underpinned by long-term offtake agreements with Eskom. As long as the wind is blowing, they are happy.

This table gives you a sense of the size of the Energy business relative to the all-important Coal operations:

Dividends are important to Exxaro and they’ve declared an interim dividend of 796 cents per share. For reference, HEPS is 1,528 cents per share, so they are paying out just over half of profits as a dividend.

More regulatory news from Renergen (JSE: REN)

This time, it’s about the Environmental Authorisation status

The Renergen share price is having quite the week, up 39% in 5 days! The helium is working and many of the rumours have been put to bed after thorough investigations. This is all good stuff.

The latest news relates to the Environmental Authorisation, which was appealed by the Centre for Environmental Rights. The Minister dismissed 5 of their 7 grounds of appeal. This doesn’t have any impact on the timing of Phase 2, as the drilling programme is fully authorised under the Production Right granted in 2012.

Still, Renergen has some work to do based on the two grounds of appeal that were not dismissed. This means that there is still a regulatory overhang on the share price, with Renergen confident that they will satisfy the requirements for a positive outcome.

Resilient REIT managed a decent increase in the dividend (JSE: RES)

As an inflation hedge, Resilient is doing its job

Here’s one for the buy-to-let fans: results from Resilient. The interim dividend is 7.8% higher at 218.97 cents. Guidance for the full year is a dividend of 428 cents per share, which implies a forward dividend yield of 8.1%. Although this is subject to income tax like any rental, there are no other costs on this number that would usually be applicable in a buy-to-let, like paying the agents or fixing the kitchen that the tenants broke.

How does 8.1% compare to the yield on most buy-to-let opportunities that you see out there? I’m currently paying just over 7% to my landlord for my place and they are still covering costs like rates, levies and insurance.

Let’s not forget that Resilient is a liquid company and you can buy the shares and sell them with ease. Another critical point is that you are exposed to a wide property portfolio vs. just one property. And guess what? Resilient won’t phone you when the tap leaks, unlike your tenant.

Worried about missing out on the capital growth in the property? Well, Resilient’s net asset value (NAV) per share grew by 6.6%. Again, that’s after making allowances for tax etc. When you see the growth in house price indices locally, just remember that you have to pay an estate agent on the way out. Also don’t forget the transfer duty you paid on the way in.

My point is this: the local REIT sector offers numerous ways to get solid inflation-beating returns from the property market with a fraction of the risk of buy-to-let. The difference is that the share price moves every day, so you’ll see market forces playing out in real time. Believe me, if the same was true for buy-to-let, you would probably never sleep.

As a final point on these Resilient numbers, the loan-to-value ratio sits at 37%. There is far less leverage in these REITs than a bank will give you on a house, which is actually a good thing in most circumstances.

In my opinion, building a portfolio of REITs is infinitely more sensible than buy-to-let.

STADIO flags strong year-on-year growth (JSE: SDO)

There’s nothing wrong with growth in the teens – or possibly more

STADIO has released a trading statement for the six months to June and the news is good, with core HEPS up by between 14.0% and 24.3%. That’s the measure that management would like us to use. Thankfully, it’s not terribly different to the growth in HEPS of between 14.8% and 25.2%.

This comes hot on the heels of rival ADvTECH also growing in the teens, although STADIO’s growth looks higher at the top-end. Either way, life seems to be good in tertiary education, recognising that ADvTECH has other business interests as well and thus isn’t a perfect comparison for STADIO.

Standard Bank has a headache in China (JSE: SBK)

Headline earnings per share growth is disappointing thanks to ICBCS (and African currencies)

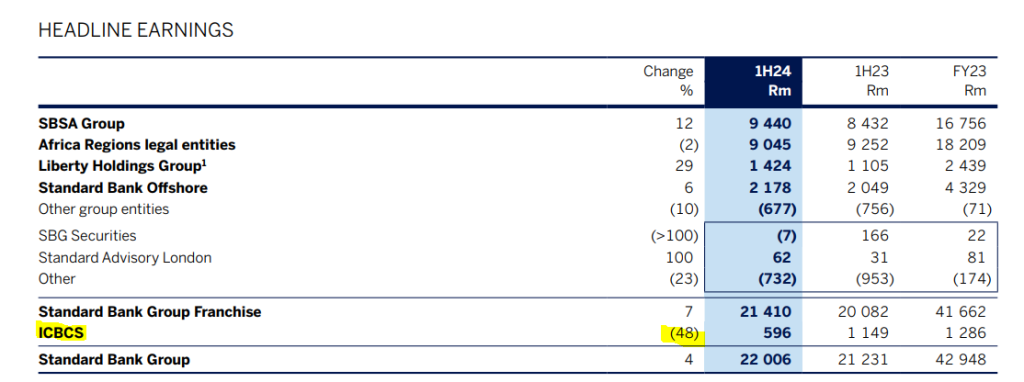

Standard Bank has been performing well recently, so I was surprised to see results come out for the six months to June with HEPS growth of just 4%. That doesn’t sound like the sort of numbers they have been producing in South Africa and Africa.

Indeed, it didn’t take long to find the problem: ICBCS, the investment in China. This is what my little guy would refer to as an “owie”:

To be fair, headline earnings growth was only 7% before ICBCS, so we certainly can’t put all the blame on the investment in China. Note that Africa Regions fell by 2%, with strong performance in local currency in the subsidiaries being ruined by the weakness of many of those currencies.

A Bloomberg article came out during the day which noted that Standard Bank has put plans to sell the Chinese joint venture on ice. They’ve been talking about it with ICBC since 2022, but the timing isn’t right for a transaction. The Chinese narrative is poor at the moment, so it seems that Standard Bank is stuck with this headache.

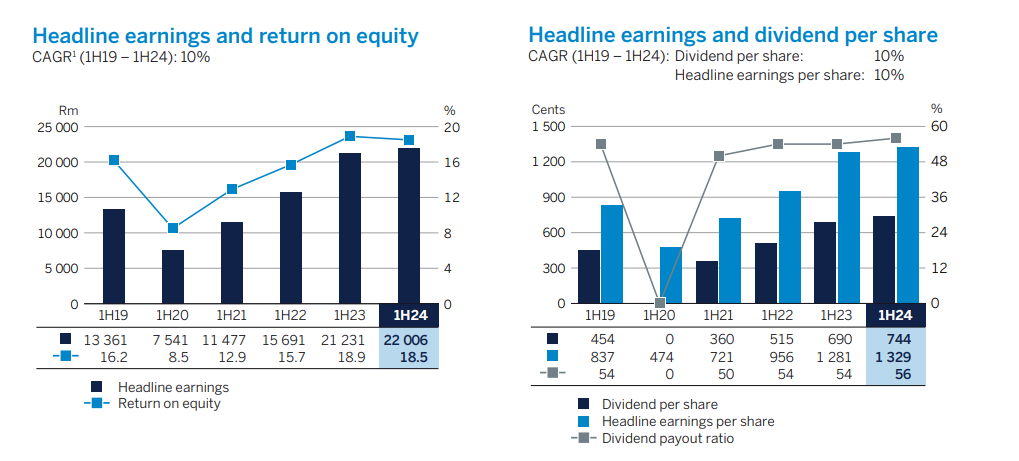

Return on Equity of 18.5% is still a solid number, but is down from 18.9% in the comparable period. Still, this chart shows that the post-pandemic period has been really good for banking (as we know), but there are signs of earnings growth slowing down:

You might have noticed that the dividend payout ratio has moved higher in the latest period. This is why the dividend per share is up 8% despite HEPS only being up 4%.

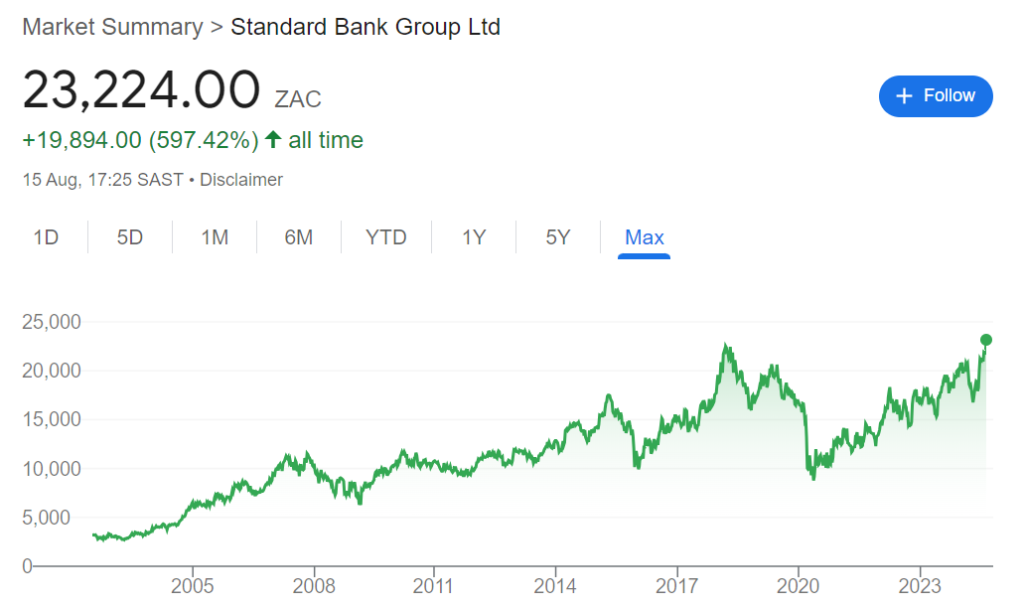

The net asset value is 5% higher at R145.64. I feel like the market read a completely different announcement to me today, based on this price action in the shares:

On a longer term view, I’m even more convinced that the banking share price growth story is going to run out of road soon, not least of all with interest rates surely coming down in the near future:

Standard Bank is complex because of the exposure to Africa and China, so it’s not easy to guess where the performance might go. One thing I actively avoid though is buying shares at all-time highs when there is this much uncertainty.

Little Bites:

- Director dealings:

- An associate of a director of Emira Property Fund (JSE: EMI) has sold shares worth R2.2 million.

- A family trust linked to a director of CMH (JSE: CMH) has sold shares worth R1.54 million.

- Associates of a director of Goldrush Holdings (JSE: GRSP) (previously RECM & Calibre) bought shares worth R207.5k.

- An associate of a director of Acsion (JSE: ACS) has bought shares worth R139k.

- Not a director dealing in the traditional sense, but worth noting as these structures can go wrong and end up putting a huge overhang on a share price. Associates related to the McCormick family have pledged Exemplar REITail (JSE: EXP) shares worth R1.61 billion to Investec Bank as security for a debt facility. This is just a reboot of a previous deal and is nothing new, but it shows you how listed shares are used to raise further capital.

- Brikor (JSE: BIK) has been talking about a delisting from the JSE, but this plan has been shelved while the company figures out the termination of the Brikor Share Incentive Scheme Trust. This is causing delays to the bank funding for the bank guarantee that is necessary to execute the delisting. For now, plans to delist have been indefinitely deferred.

Buy to let is OK if the return rental is covering your mortgage and all other fees. After all, you could be left with an asset that someone else has paid for. although with agents are being greedy by charging high ‘finders’ fees in addition to high management fees. of+-12% it does make it difficult

It unfortunately takes many years at the moment for rentals to exceed mortgage payments, so there’s a lot of chipping in along the way that could’ve been invested differently!