Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Accelerate looks to finalise the Fourways Mall management deal (JSE: APF)

This will hopefully improve performance at what has been a problematic property

If some of the GNU-inspired sentiment can filter into Joburg and specifically Fourways, then perhaps Accelerate will finally achieve a decent outcome with Fourways Mall. Sadly, the mall has thus far proven to be far too ambitious, with Accelerate having built the largest super-regional centre in the country when nobody was asking them to do it.

To try and get things right at the mall, they are bringing in expert independent management. Back in December 2023, they announced that heads of agreement had been achieved with Flanagan & Gerard (F&G) regarding their potential appointment as the asset and property manager for the mall. They have now announced the detailed terms to appoint F&G and Luvon (which seems to be a company closely related to F&G) to that role.

The deal lasts for five years unless there is an event of default, or Accelerate and Fourways Mall co-owner Azrapart sell their shares in the mall. The fees payable over that period are 1% of gross monthly collections for the previous month, plus an asset management fee of 1.75% and a leasing fee of 0.5%, also calculated on collections. That’s 3.25% of collections, so these property managers need to add a great deal of value.

The managers will also earn 2.5% on the total cost incurred on each capital project, so they earn fees for managing capex as well.

If you can believe it, there’s also an upside participation fee. There’s a complicated formula to work it out, but we can look to the breach clauses to get an idea of how high it might be. If the agreement is terminated in year 5 (i.e. close to when it should be up for renewal), the minimum upside participation fee would be R150 million. The fee is either payable in cash or with shares in Fourways Mall.

On top of this, the manager will also have a call option to acquire a share of up to 15% in Fourways Mall after payment of the participation fee.

It sounds like a pretty sweet deal to me for the property manager, which shows how much trouble Accelerate is actually in with Fourways Mall. Sadly when egos get in the way (like the desire to own the biggest mall in the country), it’s quite easy for things to go wrong.

A circular is being prepared for shareholders with full details, so shareholders will have a chance to vote on the intended transaction.

NEPI Rockcastle looks as solid as ever (JSE: NRP)

The reputation as one of the best REITs on the local market has been earned

NEPI Rockcastle has released results for the six months to June. They reflect ongoing strong performance in the Central and Eastern European markets that NEPI has focused on, with one of the key drivers of performance being stronger sales for tenants within the retail portfolio. This allows NEPI to keep putting up base rentals as tenants want to be in those spaces, with the added benefit of turnover-based rentals as well.

All of this has contributed to net operating income (NOI) increasing by 13.5%, helped greatly by property operating expenses dropping by 3.3% thanks to energy efficiencies. We find ourselves in an environment of expensive debt, so this could only translate into growth in distributable earnings per share of 5.6%. Another major reason for the modest increase in HEPS relative to NOI is the increase in number of shares in issue, a feature of property funds that offer scrip dividend alternatives where shareholders can elect to receive shares rather than cash.

The payout ratio is 90%, so most of the earnings go to shareholders as dividends. This is because the balance sheet is in great shape, with a loan-to-value ratio of 32.2%. That’s in the sweet spot for where a REIT should be when interest rates are relatively high.

For the full year, distributable earnings per share guidance has been upgraded. After initially expecting growth of 4%, they are now expecting 5.5% – essentially a continuation of the performance in the first half of the year.

No final dividend at Sasol (JSE: SOL)

The focus is on reducing debt levels in the group

Sasol has released results for the year ended June. Although there was improvement in the second half of the year, the approach of recognising substantial impairments in this period has been accompanied by the disappearance of the final dividend. The new management team is giving themselves the cleanest possible slate to work off, including on the balance sheet.

The distinction between operating profit and EBIT (Earnings Before Interest and Taxes) is very important here. The former excludes the impairments and the latter is net of impairments. When the impairments came to R74.9 billion, that’s a rather large difference.

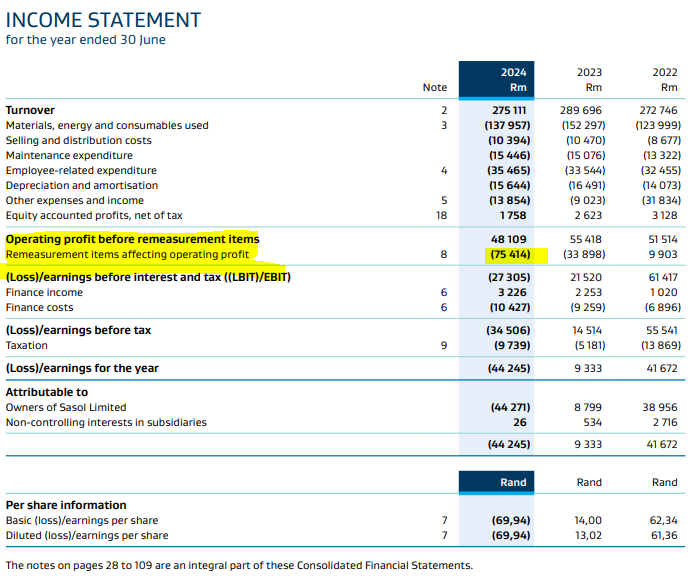

Here’s what that looks like on the income statement, showing that the huge swing into losses really has been driven by impairments, rather than any kind of catastrophe in the operating profit line, which fell by 13.2% to R48.1 billion:

You’ll notice that there’s a small difference between the remeasurement items of R75.4 billion and the impairments of R74.9 billion. This is because there are a few other things in there other than impairments.

You might also have noticed the significant distortion in the tax rate this year. Even if we ignore the impairments, a drop in operating profits should’ve led to a lower tax amount vs. last year, rather than the tax expense almost doubling. There are a whole bunch of complications in the tax that aren’t reversed out in the headline earnings calculation, contributing to HEPS falling so severely even though operating profit really didn’t do that badly.

So, speaking of HEPS, that metric has fallen by a rather ugly 66% to R18.19. That’s a long way down from R53.75 in FY23 and R47.58 in FY22. Finance costs didn’t help here, increasing from R9.2 billion to R10.4 billion at a time when operating profits went backwards. This is a perfect example of how financial leverage takes a percentage move in operating profit and amplifies it into a larger move in net profit.

Sasol’s dividend policy is now to pay 30% of free cash flow as a dividend, but only if net debt (excluding leases) is below $4.0 billion. They are currently on $4.1 billion, so they are using that as the basis for there to be no final dividend for this period. They will look to reduce debt and thus finance costs, which will help HEPS going forward.

I must also point out that the previous dividend policy was based on HEPS rather than free cash flow, so they’ve made a substantial change here. Free cash flow is net of capex, so a period of heavy investment by Sasol would negatively impact dividends. This is probably a more sensible approach anyway.

The market didn’t like it, with dividend-focused investors running for the hills. Sasol closed 6.5% lower for the day.

To make sure you have access to full details and because Sasol values the Ghost Mail investor community, the company has placed its results in Ghost Mail here.

Little Bites:

- Director dealings:

- A family trust linked to the founding family at Famous Brands (JSE: FBR) has sold shares in the company worth R11.1 million.

- An associate of a director of Telkom (JSE: TKG) bought shares in the company worth R61k. Telkom’s share price has been largely ignored in the GNU-phoria period and this could be one to watch.

- The minor child of a director of OUTsurance Group (JSE: OUT) bought shares worth R100. Not only must you start ’em young, but you must do so with small amounts! The same director is also on the board of WeBuyCars (JSE: WBC) and the minor child popped R100 into those shares as well. Nothing like a balanced portfolio.

- Is there more deal activity on the horizon at Trematon Capital (JSE: TMT)? There could well be, with the company releasing a cautionary announcement about a potential disposal of one of the investments in the group. Remember, the company recently announced the disposal of 60% in GenEx to a Middle East-based investor. They’ve been busy at Trematon!

- I’m becoming immensely tired of Kibo Energy (JSE: KBO) using SENS as a free public relations platform. SENS isn’t there for general business-as-usual announcements. The latest such announcement is that Kibo is refurbishing another genset. Perhaps next week they will let us know what they are ordering for the office lunch.