Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

BHP is such a good example of how mining cycles play out (JSE: BHG)

The bumper profits of 2022 are now a distant memory

Mining cycles are wild things. We can see this quite clearly at BHP, where diluted headline earnings fell from $22.2 billion in 2022 to $13 billion in 2023 and then $9.9 billion in 2024. That’s quite the drop, which is why mining cycles are only for those with strong stomachs.

The shape for EBITDA is similar other than in the latest year, with underlying EBITDA decreasing from $40.6 billion to $28 billion and then up to $29 billion in the latest period. You can see that the EBITDA vs. headline earnings disconnect happened in 2024. One of the reasons for the gap is that net debt has increased from $333 million in 2022 to $9.1 billion in 2024, at a time when interest rates are much higher. Remember, EBITDA is a measure of earnings before interest costs – in fact, that’s where the first part of the acronym comes from!

Looking at free cash flow for total operations, this dropped from $25 billion in 2022 to $5.6 billion in 2023 and then increased to $11.9 billion in 2024. In a capex-heavy business model, free cash flow tends to have far more volatility than earnings.

In a group as diversified as BHP, we need to look deeper to see what’s really going on in the major commodities produced by the group.

In the copper operations, we find a promising story of EBITDA up by 29% and underlying return on capital employed of 13%. They expect to deliver 4% growth in production in the coming year after two years of 9% growth.

In iron ore, EBITDA was up 13% and return on capital employed was a meaty 61%. This is the joy of owning the lowest cost major iron ore producer globally in the form of Western Australia Iron Ore.

Coal EBITDA was down 54% but is thankfully a smaller part of the group. Return on capital employed was 19%, which is still decent.

In terms of outlook, BHP flags major uncertainty around China – no surprise there. They also note India as a bright spot for commodities, with significant growth there.

Brimstone’s intrinsic NAV has gone backwards since December (JSE: BRT)

In an investment holding company, this is the key metric

Investment holding companies tend to recognise some investments as associates and others as subsidiaries, leading to all kinds of weirdness in the accounting. I prefer to look past all of that and focus on net asset value (NAV) per share, as this tells you whether the investment portfolio went up or down in value.

Looking on a per share basis is also important as it takes into account any share repurchasing activity, which is value accretive when the share price trades below NAV – as it literally always does. It’s therefore good to see that Brimstone reduced debt and executed share repurchases in this period.

Still, the intrinsic NAV per share fell 5.7% from December 2023 to June 2024, coming in at R11.436 per share. Brimstone trades at R5.70, so there’s the discount I was talking about. The biggest problem has been Sea Harvest, where the share price has been under pressure. You’ll find the results from that company further down, as Sea Harvest is also listed.

Master Drilling has flat profits – but watch those impairments (JSE: MDI)

You can’t always ignore the stuff in EPS rather than HEPS

The most common difference between Earnings Per Share (EPS) and Headline Earnings Per Share (HEPS) is that EPS is net of impairments and HEPS is not. An impairment is based on an assessment of the value that can still be derived from an asset. If that value is lower than the carrying amount on the balance sheet, an impairment or write-down must be recognised.

Sometimes, impairments aren’t very important. They often relate to assets that probably should’ve already been impaired a while ago. At Master Drilling though, the impairments in this period caught my eye as they relate to reverse circulation and mobile tunnelboring equipment – assets that are important sources of revenue. Due to uncertainty in the broader market, they’ve recognised a vast impairment in this period of $13.3 million.

Above all else, this is a reminder of the technological and market risks facing Master Drilling. If these impairments become a regular feature at the company, then it negatively impacts the business case. With 55% of capex on expansion and 45% on sustaining the existing fleet, they are constantly adding to the equipment and taking a view on what the demand for it might be.

The company reports in US dollars and revenue is up 17.3% in that currency, so it was a strong period aside from the impairments. Alas, increases in operating expenses ate up pretty much all the uplift in gross profit, with higher finance costs adding to the pain. Measured in US dollars, HEPS fell by 3.2%. Measured in rand, HEPS fell only 0.5%.

To add to the difficulties in interpreting this result, net cash from operating activities more than doubled from $12.2 million to $27.7 million. Master Drilling doesn’t pay an interim dividend, so we will have to wait for the full year results to see how the cash picture translates into distributions to shareholders.

Some signs of life at Pick n Pay (JSE: PIK)

Oddly, the franchise stores are now underperforming corporate-owned stores

Pick n Pay has raised capital from the market and now needs to deliver the turnaround strategy. They have their work cut out for them, especially with a gorilla like Shoprite in the room. Still, there are some signs of improvement coming through.

You won’t see much good news in the 26 weeks to 25 August unfortunately, with a trading statement noting that HEPS will be at least 20% lower for the period. The benefit to the balance sheet of the rights issue will only start to be felt in the second half of the year, as the capital was raised recently. This is why net finance charges are R180 million higher year-on-year. As expected, Boxer has grown headline earnings for the period and the troubles at Pick n Pay have more than offset that growth.

One of the problems is that gross margin is under pressure, as they’ve had to be aggressive on price to win shoppers back and compete against the likes of Shoprite. The diesel savings from lack of load shedding have been reinvested in price. I’ve written a few times this year that Eskom gave Pick n Pay a get-out-of-jail card this year. Had load shedding still been in place, I genuinely am not sure how they would save this thing.

To deliver a better full year result, they are expecting a much better performance from Pick n Pay. In the 21 weeks to 21 July 2024, they could only manage like-for-like growth in PnP SA Supermarkets of 2.0%. This excludes standalone clothing stores. Company-owned supermarkets grew 3.6% and franchise supermarkets were down 0.8%, a surprising underperformance from the franchise business. These are still really poor numbers, especially vs. a weak base. Boxer grew 13.5% overall and 9.5% on a like-for-like basis, showing us what a successful retail format can do.

In case you’re curious, standalone clothing stores grew 10.3% overall but only 0.7% on a like-for-like basis.

I think that a turnaround of Pick n Pay, if it ever really happens, will be harder and take longer than most people expect. It’s extremely tough to get this right.

Redefine has made the capital markets day presentation available (JSE: RDF)

If you’re interested in the property sector, this is a great document to work through

I always enjoy it when a listed company hosts a capital markets day and makes the presentation available to everyone. The Redefine presentation is incredibly detailed and tells the story of the evolution of the portfolio over the past few years.

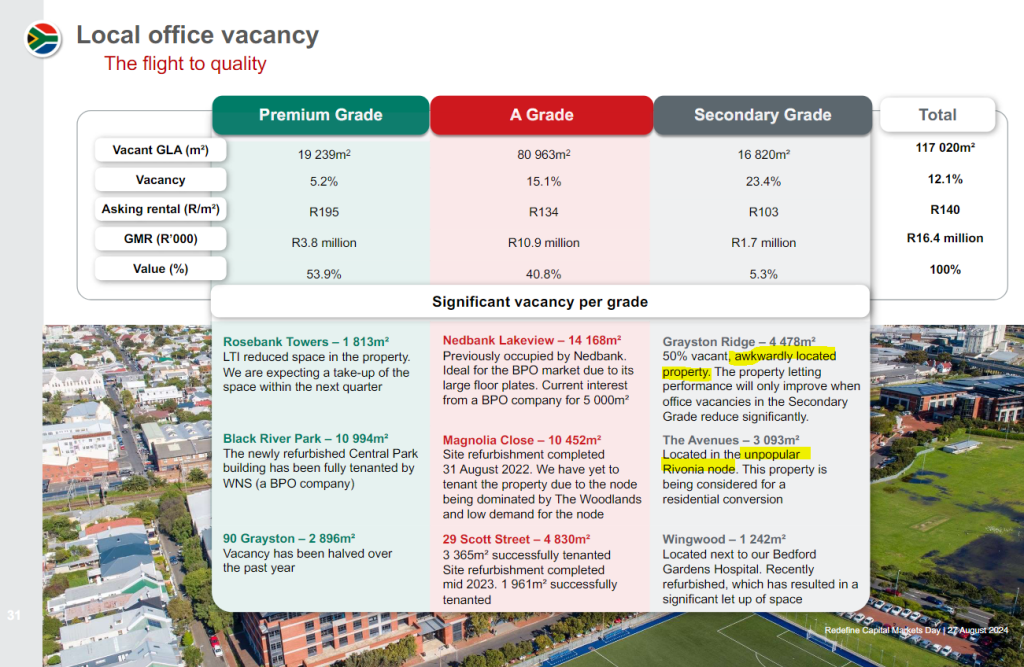

It also has gems like this slide, which surely wins an honesty award (and gives great insight into the office market):

If you can make the time to just flick through the presentation, I guarantee you’ll learn something new. You’ll find it here.

Sasfin has managed to pull off the acceptances condition (JSE: SFN)

The biggest hurdle to the deal is now out the way

The offer of R30 per share to Sasfin shareholders came with an unusual condition that holders of no more than 10% of shares in Sasfin can accept the offer in order for it to be valid. In other words, holders of 90% need to agree to hold the shares into a private environment.

Sasfin managed to get it right, with irrevocable undertakings from holders of more than 90% of shares that they will not accept the offer, thereby meeting the condition and allowing the deal to continue.

The next step is that Unitas and Wipfin as the take-private partners will subscribe for shares in Sasfin Wealth. This will allow Sasfin Wealth to fund the offer being made to shareholders in Sasfin.

A circular will be distributed to shareholders in due course.

Higher finance costs and taxes drag Sea Harvest lower (JSE: SHG)

Also, the international revenue mix is considerably higher

Sea Harvest has released results for the six months to June 2024. Revenue was only 3% higher, so that’s not a great start. International revenue is now 53% of the total, up significantly from 45% in the comparable period.

Thankfully, gross profit was up 22% as gross margin moved from 24% to 29%. Operating profit was up 23%, yet earnings before interest and tax (EBIT) was only 6% higher.

We then get to the uncomfortable numbers, dragged down by higher net finance costs (up from R104 million to R128 million) and taxes (up from R48.5 million to R60.7 million). This resulted in attributable profit after tax dropping by 17% and headline earnings decreasing by 32%.

To add to the negative move for shareholders, Sea Harvest has more shares in issue than before and hence HEPS fell by 36%. Not a great outcome at all.

Looking ahead, the acquisition of 100% of Terrasan’s pelagics business and 63.07% of Terrasan’s abalone business closed on 14 May, so that should be a major contributor to the coming year provided things improve in the abalone market in particular. They need it, as catch volumes in the hake business in South Africa have been under pressure, leading to the relatively higher contribution from international sources than before.

The share price is down 15.9% over the past year.

Stor-Age still has a growth story to tell (JSE: SSS)

If only the valuation wasn’t so demanding

Stor-Age is a solid REIT and the market knows it, which is why it trades on a yield of just 8.4%. On such a fully priced yield (remember that a low yield means a higher share price), there hasn’t been much share price growth for investors. Over three years, the price is only up 2%!

There’s not much growth in the mature side of the business, but things are still in the green. In the owned portfolio, occupancies are up 2.8% year-on-year for the four months to July. Although the South African portfolio has seen occupancies fall since March i.e. a year-to-date view, this is largely due to seasonality and they expect things to pick up after winter. This is why the year-on-year view is so important. In the UK, occupancies were up 4.7% year-on-year vs. 2.3% in South Africa, so they are growing quickly in that market.

We do need to dig deeper though, as there are other important metrics. In same-store occupancy in the UK joint venture portfolio for example, occupancies are down 1.2% year-on-year. They have huge room for ongoing expansion of the footprint though, as we can see in the total growth in occupancies in the UK joint venture portfolio of 13.7%.

All of these occupancy growth rates are based on square metres i.e. actual metres occupied, not occupancy as a percentage of total space.

Of critical importance is the growth in rental rates. This is the other part of the growth algorithm along with the amount of occupied space. They have achieved 8.4% growth year-on-year in South Africa and 1.9% in the UK on the same basis. You can see how inflation has started calming down in the UK.

Another crucial part of the investment thesis is that the acquisition and development pipeline remains extensive.

In South Africa, they recently acquired Extra Attic in Airport Industria, Cape Town for R73 million. The developments of the Kramerville and Century City properties were recently completed. In Sunningdale in Cape Town, they are enjoying the explosive growth in the area and the property that was completed in 2021 has delivered a predictably strong performance. To squeeze more juice out of the area, they’ve agreed with Garden Cities to acquire another hectare of land adjacent to the existing property. Development on that land in only in the planning phase at this stage.

In the UK, there are two major developments underway with the joint venture partners. Interestingly, Stor-Age reduced its shareholding in one of the developments by selling shares and using the proceeds to fund the proportionate share of the development. In other words, they opted not to send further capital to the UK to fund the development.

In further news on the balance sheet and dividend strategy, Stor-Age has received strong shareholder support to reduce the dividend payout ratio from 100% to between 90% and 95% of distributable income.

I would love to hold shares in Stor-Age again, but not at these yields. It’s literally priced for perfection and that’s why total returns over the past three years have been underwhelming. Great company, wrong price for me.

WBHO expects an improvement in HEPS (JSE: WBO)

The trading statement is light on details, but at least earnings are up

Construction group WBHO has released a trading statement for the year ended June. The great news is that HEPS is up by between 10% and 20% for continuing operations, coming in at between R18.73 and R20.44 per share. For total operations, it’s up by between 25% and 35% at a range of R18.94 to R20.45.

They haven’t given any further details at this stage, other than confirmation that results are due on 10 September.

Little Bites:

- Director dealings:

- Stephen Koseff has sold more shares in Investec (JSE: INL | JSE: INP), this time to the value of £544k.

- An associate of a director of Brait (JSE: BAT) bought shares in the company worth nearly R2.2 million. Separately, Titan Premier Investments (the vehicle linked to Christo Wiese) bought shares worth just over R2 million.

- Andre van der Veer (not Andre van der Veen of A2X fame as I initially thought) and his wife bought shares in NEPI Rockcastle (JSE: NRP) worth R368k.

- A non-executive director of Hammerson (JSE: HMN) bought shares worth £8.5k.

- The family trust of a director of a major subsidiary of RFG Foods (JSE: RFG) sold shares in the company worth R37k.

- Vodacom’s (JSE: VOD) court battle around the Please Call Me matter continues, with the Constitutional Court agreeing to hear the company’s application for leave to appeal in the matter in tandem with its appeal against the Supreme Court of Appeal judgment. It all comes back to the amount that should be paid to Kenneth Nkosana Makate, with the Vodacom CEO having offered R47 million and Makate fighting for more in court.

- Lighthouse Properties (JSE: LTE) has confirmed that the scrip distribution reference price is a 3% discount to the spot price on 26 August, so they are providing a small incentive to shareholders who choose to receive shares rather than cash.

- Insimbi Industrial Holdings (JSE: ISB) released a trading statement noting that HEPS will be down by at least 20%. That’s the bare minimum disclosure required by the JSE, so it’s anyone’s guess how bad it could be. This is for the six months to August, so the period isn’t even over yet. Buckle up!

- There’s a significant recovery at Workforce Holdings (JSE: WKF), where HEPS has jumped from 1.7 cents to between 12.43 cents and 12.77 cents for the six months to June. We don’t need to bother with noting the percentage move on a jump like that! It’s more important to go back and compare this to previous years. Sure enough, HEPS for the six months to June 2022 was 14.6 cents, so this performance is still not a full recovery to previous levels after a terrible time in 2023.

- Jubilee Metals (JSE: JBL) has secured a private power purchase agreement in Zambia. The counterparty is independent solar and hydro power producer Lunsemfwa Hydro Power Company, with the deal designed to meet the total power needs of Roan and Sable. There’s also room for expansion, with discounted rates locked in for a further 10MW of solar power if Jubilee needs it. Roan has previously been impacted by power shortages, so they are taking advantage of a decision by the Zambian government to allow the private sector to provide power.

- Southern Palladium (JSE: SDL) has announced that the combined UG2 and Merensky Reef Mineral Resource is now 35% up from the previous estimate. Two separate independent consultants have audited the mineral resources data. The pre-feasibility study is underway and scheduled for release in Q4 of this year.

- Vunani (JSE: VUN) renewed its cautionary announcement regarding the potential disposal of a minority shareholding in a subsidiary. They haven’t indicated which subsidiary and there’s still no guarantee that a deal will go ahead.

- There’s truly never a dull moment at Trustco (JSE: TTO), with the latest being the discovery of an “exceptional diamond” by Meya Mining, in which Trustco has a 19.5% interest. Long story short, they found a 391.45 carat diamond, which isn’t the biggest ever found in the region (that honour belongs to a 770-carat diamond found in 1945), but is certainly a large and very economically helpful diamond. Trustco flags that in its valuation of the asset going forward, they may look to take into account the number of exceptional finds in the area. Like I said: never a dull moment.

- Reinet Investments (JSE: RNI) announced that the proposed dividend of €0.35 per share was approved by shareholders. The exchange rate to rand will be announced in due course.